Analysis Of Apple Stock (AAPL): Important Price Levels And Trends

Table of Contents

Historical Performance of Apple Stock (AAPL)

Long-Term Trends:

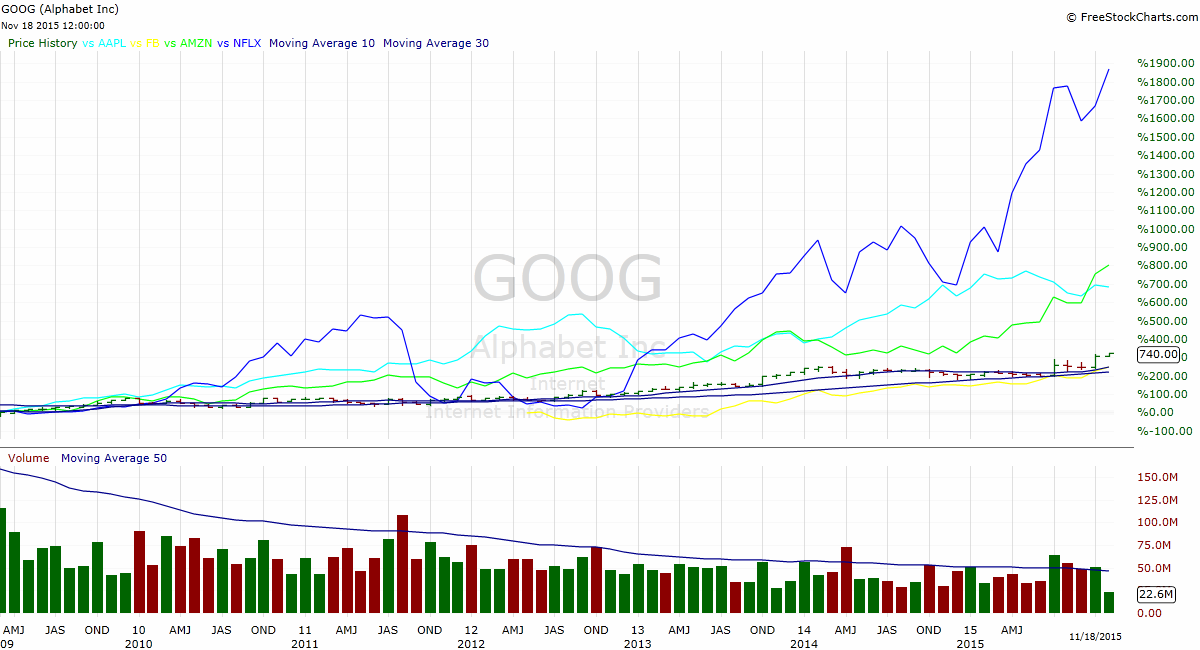

Apple's stock performance over the past two decades reveals a remarkable growth story. Examining the AAPL stock chart across 5, 10, and 20-year periods showcases periods of explosive growth punctuated by market corrections.

- 20-Year Trend: AAPL experienced dramatic growth, fueled by the iPhone's launch and subsequent expansion into services.

- 10-Year Trend: This period showcases the maturation of the iPhone and the expansion into new markets like wearables and services.

- 5-Year Trend: This shorter term highlights the ongoing growth and diversification of Apple's revenue streams.

(Insert a chart or graph visualizing AAPL's stock performance over the past 5, 10, and 20 years.)

Keywords: AAPL stock chart, Apple stock history, long-term Apple stock performance.

Short-Term Volatility:

Recent price fluctuations in Apple stock (AAPL) demonstrate its susceptibility to short-term market volatility. Understanding these short-term Apple stock trends is vital for active traders.

- Product Releases: New iPhone releases typically generate excitement and can lead to short-term price increases.

- Financial Reports: Quarterly earnings reports significantly influence the AAPL daily price, with positive surprises driving upward momentum and negative surprises leading to drops.

- Economic Factors: Broader economic conditions, such as inflation and interest rate changes, also impact Apple stock volatility.

Keywords: Apple stock volatility, AAPL daily price, short-term Apple stock trends.

Identifying Key Support and Resistance Levels for AAPL

Support Levels:

Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Analyzing the AAPL stock chart reveals several key support levels.

- $150: This level has historically provided strong support, acting as a floor for significant price drops.

- $130: This level represents a slightly weaker support but still significant in preventing substantial declines.

(Insert a chart highlighting the support levels on the AAPL stock chart.)

Keywords: AAPL support levels, Apple stock support, technical analysis Apple.

Resistance Levels:

Resistance levels represent price points where selling pressure is expected to outweigh buying pressure, preventing further price increases. Identifying these levels is crucial for determining potential price ceilings.

- $180: This price point has historically acted as a strong resistance level, hindering significant price rallies.

- $200: This level presents a higher resistance that, if broken, could indicate a sustained upward trend.

(Insert a chart highlighting the resistance levels on the AAPL stock chart.)

Keywords: AAPL resistance levels, Apple stock resistance, Apple stock chart analysis.

Technical Indicators for Apple Stock (AAPL)

Moving Averages:

Moving averages, such as the 50-day and 200-day, smooth out price fluctuations and can help identify trends.

- 50-Day Moving Average: A short-term indicator that can signal short-term trends. Crossovers with the 200-day MA can be significant.

- 200-Day Moving Average: A long-term indicator that can help confirm longer-term trends.

(Insert a chart illustrating the 50-day and 200-day moving averages on the AAPL stock chart.)

Keywords: AAPL moving averages, Apple stock technical indicators, Apple stock chart patterns.

Relative Strength Index (RSI):

The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- RSI above 70: Generally considered overbought, suggesting a potential price correction.

- RSI below 30: Generally considered oversold, suggesting a potential price rebound.

(Insert a chart showing the RSI indicator for AAPL.)

Keywords: AAPL RSI, Apple stock RSI, Apple stock overbought/oversold.

Future Predictions and Outlook for Apple Stock (AAPL)

Factors Influencing Future Performance:

Several factors will shape Apple's future performance and AAPL stock price.

- Innovation: Continued innovation in hardware and software is crucial for maintaining market share and driving growth.

- Competition: Intense competition from companies like Samsung and other tech giants poses a challenge.

- Economic Conditions: Global economic uncertainty can impact consumer spending and Apple's sales.

Keywords: Apple stock forecast, AAPL future price, Apple stock prediction.

Potential Price Targets:

Based on the analysis, potential price targets for AAPL in the near future could range from $170 to $210, depending on various factors. However, these are merely speculative estimations, and it's important to note that unforeseen events can significantly impact actual prices.

(Disclaimer: This is speculative analysis and not financial advice. Investors should conduct their own thorough research before making any investment decisions.)

Keywords: Apple stock price target, AAPL price target 2024, Apple stock potential.

Conclusion: Analysis of Apple Stock (AAPL): Key Takeaways and Call to Action

This analysis of Apple stock (AAPL) highlighted key price levels, historical trends, and technical indicators that provide insights into potential future price movements. While we’ve identified potential support and resistance levels and discussed various factors influencing AAPL's trajectory, remember that the stock market is inherently unpredictable.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own due diligence before making investment decisions.)

Stay informed about the dynamic world of Apple stock (AAPL) by regularly reviewing market analysis and financial news. Conduct thorough research and consider consulting with a financial advisor before making any investment decisions related to AAPL stock trading or Apple stock investment. Understanding these nuances is key to successful investing in AAPL stock.

Featured Posts

-

Apple Stock Decline Impact Of Announced Tariffs

May 25, 2025

Apple Stock Decline Impact Of Announced Tariffs

May 25, 2025 -

10 Let Evrovideniya Chto Stalo S Triumfatorami

May 25, 2025

10 Let Evrovideniya Chto Stalo S Triumfatorami

May 25, 2025 -

Apple Q2 Earnings Loom As Stock Price Falls

May 25, 2025

Apple Q2 Earnings Loom As Stock Price Falls

May 25, 2025 -

Trumps Tariffs Trigger 2 Drop In Amsterdam Stock Exchange

May 25, 2025

Trumps Tariffs Trigger 2 Drop In Amsterdam Stock Exchange

May 25, 2025 -

Ferrari Opens Flagship Bangkok Facility A New Era Begins

May 25, 2025

Ferrari Opens Flagship Bangkok Facility A New Era Begins

May 25, 2025

Latest Posts

-

Climate Change And The Rise Of Deadly Fungi A Growing Concern

May 25, 2025

Climate Change And The Rise Of Deadly Fungi A Growing Concern

May 25, 2025 -

Nippon U S Steel Deal Moves Forward After Trumps Approval

May 25, 2025

Nippon U S Steel Deal Moves Forward After Trumps Approval

May 25, 2025 -

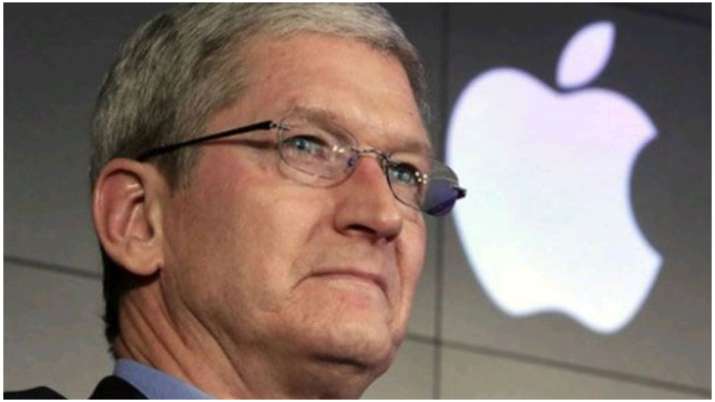

Apple Ceo Tim Cooks Tumultuous Year A Series Of Setbacks

May 25, 2025

Apple Ceo Tim Cooks Tumultuous Year A Series Of Setbacks

May 25, 2025 -

Container Ship Grounding Cnn Coverage Of Front Lawn Incident

May 25, 2025

Container Ship Grounding Cnn Coverage Of Front Lawn Incident

May 25, 2025 -

The History And Demise Of Black Lives Matter Plaza In Washington D C

May 25, 2025

The History And Demise Of Black Lives Matter Plaza In Washington D C

May 25, 2025