Understanding The Low Demand For 10-Year Mortgages In Canada

Table of Contents

Higher Interest Rate Risk Associated with 10-Year Mortgages

One of the primary reasons for the low demand for 10-year mortgages in Canada is the significantly higher interest rate risk. Locking into a fixed interest rate for a decade exposes borrowers to the potential for substantial increases in the Bank of Canada's key interest rate. This risk is amplified by the inherent unpredictability of the Canadian and global economies.

- Fluctuations in the Bank of Canada's interest rate policy: The Bank of Canada adjusts its benchmark interest rate to manage inflation and economic growth. These adjustments directly influence mortgage rates offered by lenders. A series of rate hikes during the 10-year term could lead to drastically increased monthly payments.

- Impact of global economic uncertainty on Canadian mortgage rates: Global economic events, such as recessions or geopolitical instability, can significantly impact Canadian interest rates, creating further uncertainty for those locked into a long-term mortgage.

- Difficulty in predicting long-term interest rate trends: Accurately forecasting interest rates ten years into the future is virtually impossible. Economic models can only offer probabilities, not certainties.

- Potential for refinancing challenges if rates rise significantly: If interest rates rise substantially during the 10-year term, refinancing might not be a viable option. Borrowers may find themselves locked into unfavourable terms with higher payments than anticipated.

For example, consider a borrower who takes out a $500,000 mortgage at a 5% interest rate for 10 years. If interest rates rise to 7% midway through the term, their monthly payments could increase significantly, putting a strain on their household budget. This scenario underscores the substantial financial risk associated with long-term fixed-rate mortgages in Canada.

Prepayment Penalties and Flexibility Concerns

Another significant deterrent to 10-year mortgages is the substantial prepayment penalties involved. These penalties are considerably higher than those associated with shorter-term mortgages like 5-year or even 1-year terms. This lack of flexibility poses a considerable risk for borrowers.

- Comparison of prepayment penalties across different mortgage terms: Prepayment penalties are typically calculated based on the interest rate differential between the existing mortgage and the prevailing market rate. For a 10-year mortgage, this penalty can be very substantial if the mortgage is broken early.

- Lack of flexibility in responding to changing financial circumstances: Life throws curveballs. Job loss, unexpected medical expenses, or other unforeseen circumstances might necessitate breaking a mortgage early. The high prepayment penalties associated with a 10-year mortgage can create a significant financial hardship.

- The potential for significant financial losses if a borrower needs to break their mortgage early: Breaking a 10-year mortgage early could result in tens of thousands of dollars in penalties, making it a financially risky proposition.

- Alternative options like porting a mortgage to a new home: While porting a mortgage is possible, it's not always seamless and might not completely eliminate prepayment penalties, especially with a longer term like 10 years.

It's crucial to carefully consider long-term life plans and financial stability before committing to a 10-year mortgage. The lack of flexibility can be a significant drawback for many Canadians.

The Preference for Shorter-Term Mortgages and Rate Adjustments

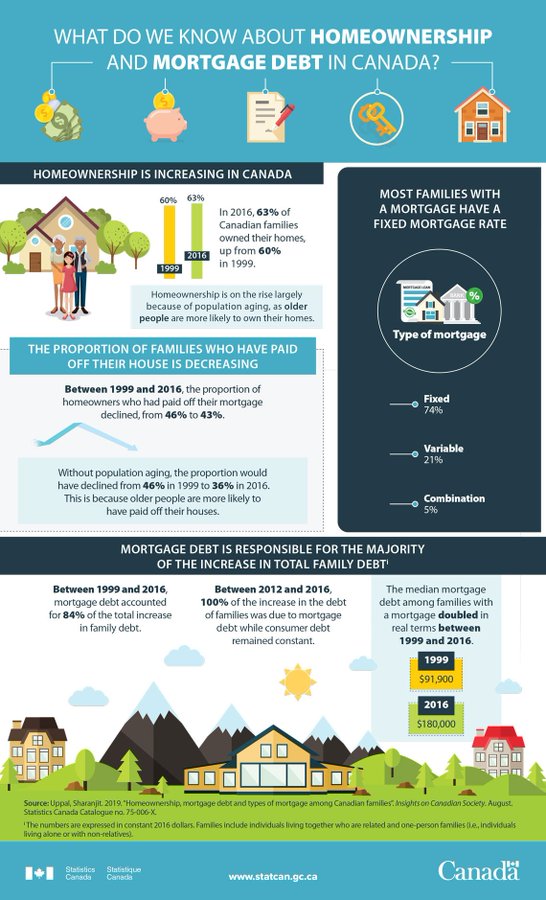

The increasing popularity of shorter-term mortgages, particularly 5-year terms, reflects a preference for greater flexibility and reduced interest rate risk. Canadians are increasingly opting for the ability to renegotiate their interest rates every few years.

- Opportunity to renegotiate interest rates every 5 years based on market conditions: Shorter-term mortgages allow borrowers to capitalize on potentially lower interest rates when their term expires. This can significantly reduce the overall interest paid over the life of the mortgage.

- Reduced risk exposure to fluctuating interest rates: By opting for a shorter term, borrowers limit their exposure to potentially rising interest rates.

- Greater flexibility in managing mortgage payments: Shorter terms offer greater flexibility to adjust mortgage payments if financial circumstances change.

- Potential for lower overall interest paid over the life of the mortgage (if rates decrease): If interest rates fall during the life of the mortgage, borrowers with shorter terms can renegotiate their rates and secure a lower interest rate for their next term.

Statistics from the Canadian Mortgage and Housing Corporation (CMHC) consistently show that the majority of new mortgages are for shorter terms, reflecting this market trend. The 5-year term currently dominates the Canadian mortgage market.

The Role of Consumer Behaviour and Risk Aversion

The shift towards shorter-term mortgages is also driven by consumer behaviour and a general aversion to risk.

- Risk aversion among Canadian homeowners: Many Canadian homeowners are risk-averse and prefer the predictability of shorter-term mortgages.

- Preference for predictability and financial control: Shorter terms provide a greater sense of control over monthly payments and reduce the uncertainty associated with long-term interest rate fluctuations.

- Influence of financial advisors recommending shorter-term options: Financial advisors often recommend shorter-term mortgages due to the inherent risks associated with longer terms.

- Impact of recent economic uncertainty on consumer sentiment: The recent economic uncertainty has further fueled this preference for shorter-term, more manageable mortgage options.

Conclusion

This article has explored the key factors contributing to the low demand for 10-year mortgages in Canada, highlighting the higher interest rate risk, significant prepayment penalties, and the growing preference for shorter-term mortgages offering greater flexibility. The Canadian mortgage market shows a clear trend towards shorter-term options due to consumer behaviour and market dynamics. Before committing to a 10-year mortgage, carefully weigh the risks and benefits. Consider your financial goals, risk tolerance, and long-term plans. Understanding the implications of choosing a 10-year mortgage versus a shorter-term option is crucial for making informed decisions about your Canadian home financing. Speak with a mortgage broker to explore options best suited to your individual circumstances and navigate the complexities of Canadian 10-year mortgages.

Featured Posts

-

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The January 6th Allegations

May 06, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The January 6th Allegations

May 06, 2025 -

Gigi Hadid And Bradley Cooper Instagram Official At Her 30th Birthday Party

May 06, 2025

Gigi Hadid And Bradley Cooper Instagram Official At Her 30th Birthday Party

May 06, 2025 -

Hos Kokmayan Ueruenler Itibari Nasil Korursunuz

May 06, 2025

Hos Kokmayan Ueruenler Itibari Nasil Korursunuz

May 06, 2025 -

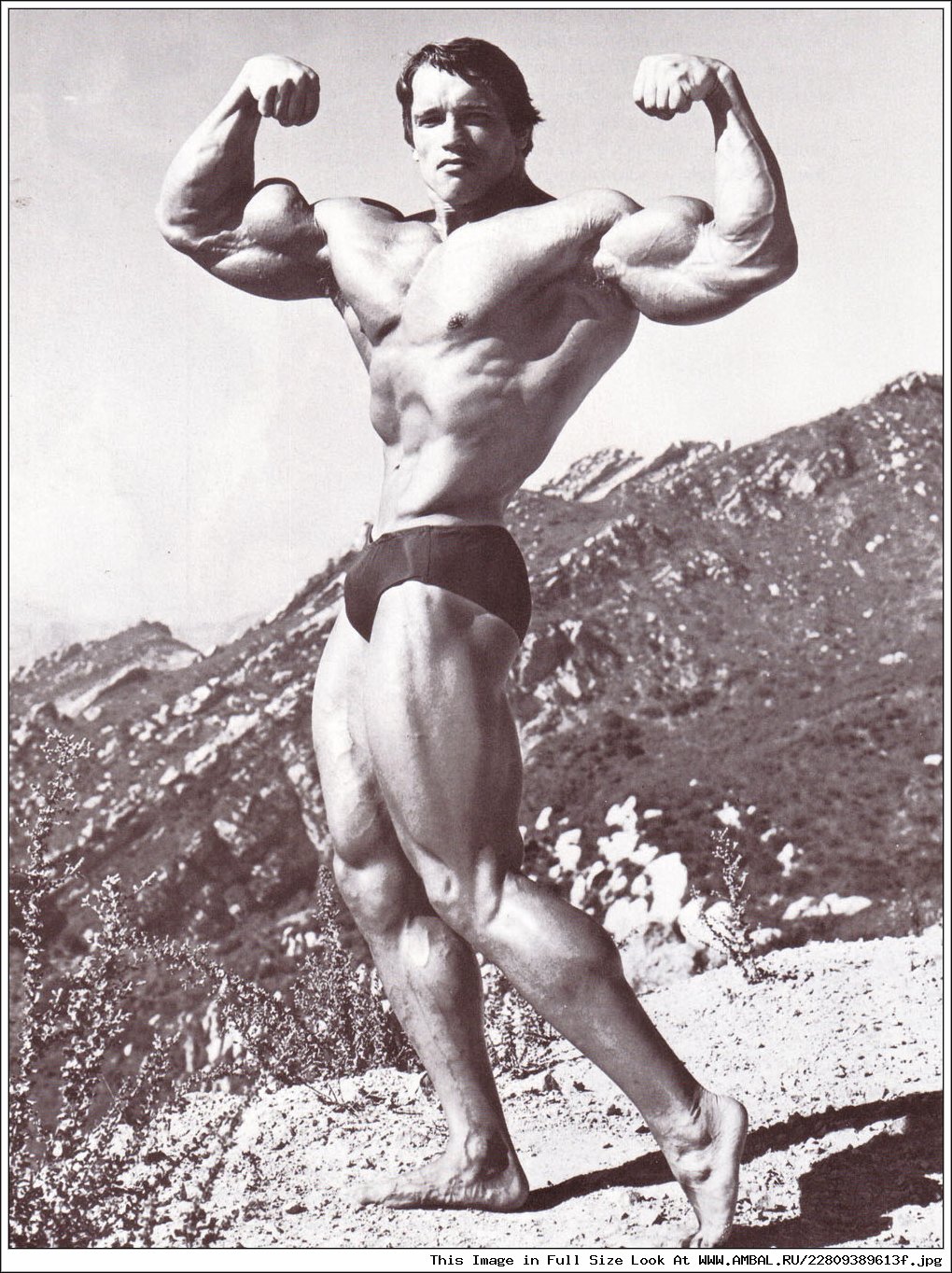

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

Zamowienie Na Trotyl Z Polski Implikacje Dla Bezpieczenstwa

May 06, 2025

Zamowienie Na Trotyl Z Polski Implikacje Dla Bezpieczenstwa

May 06, 2025

Latest Posts

-

Polska I Eksport Trotylu Rzut Oka Na Duze Zamowienie

May 06, 2025

Polska I Eksport Trotylu Rzut Oka Na Duze Zamowienie

May 06, 2025 -

Zamowienie Na Trotyl Z Polski Implikacje Dla Bezpieczenstwa

May 06, 2025

Zamowienie Na Trotyl Z Polski Implikacje Dla Bezpieczenstwa

May 06, 2025 -

Analyzing The Popularity Of Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025

Analyzing The Popularity Of Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025 -

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025 -

Rather Be Alone Exploring The Success Of Leon Thomas And Halle Baileys Collaboration

May 06, 2025

Rather Be Alone Exploring The Success Of Leon Thomas And Halle Baileys Collaboration

May 06, 2025