Stock Market Prediction: Identifying Superior Alternatives To Palantir

Table of Contents

Understanding the Risks Associated with Palantir

Palantir, while a technologically advanced company, presents inherent risks for investors seeking robust stock market prediction strategies. Understanding these risks is paramount before committing significant capital.

Volatility and Market Dependence

Palantir stock (PLTR) has demonstrated considerable volatility. Its price is heavily influenced by market sentiment and its dependence on specific government contracts. This creates uncertainty for investors.

- Recent Price Volatility: Palantir's stock price has experienced significant ups and downs, showcasing its sensitivity to market fluctuations and news cycles. This volatility can lead to substantial losses if not carefully managed.

- Reliance on Specific Sectors: A large portion of Palantir's revenue comes from government contracts, particularly within the defense and intelligence sectors. Changes in government spending or policy could significantly impact the company's revenue streams.

- Potential for Reduced Revenue Streams: The competitive landscape for data analytics and government contracts is constantly evolving. Palantir faces competition from established players and new entrants, posing a risk to future revenue growth.

Keyword integration: Palantir stock, Palantir investment risk, stock market volatility, PLTR stock price

Limited Diversification

Concentrating a significant portion of your investment portfolio in a single stock, especially one as volatile as Palantir, is a high-risk strategy. Diversification is key to mitigating risk and maximizing long-term returns.

- Illustrative Examples of Portfolio Diversification: A diversified portfolio might include a mix of stocks across different sectors (technology, healthcare, energy, etc.), bonds, and other asset classes like real estate. This spread reduces the impact of any single investment's underperformance.

- Explanation of Risk Mitigation through Diversification: Diversification spreads risk across multiple investments. If one investment performs poorly, others can potentially offset those losses, leading to a more stable overall portfolio performance.

Keyword integration: Portfolio diversification, risk management, investment strategy, diversified portfolio

Exploring Superior Alternatives for Stock Market Prediction

Instead of relying solely on Palantir for stock market prediction, consider these superior alternatives offering increased diversification and potentially better risk-adjusted returns.

Diversified ETFs

Exchange Traded Funds (ETFs) provide a simple and effective way to diversify your investments across various sectors and market caps. They offer broad market exposure with relatively low fees.

- Examples of Successful ETFs: Consider broad market ETFs like the SPDR S&P 500 ETF Trust (SPY) or sector-specific ETFs focusing on technology, healthcare, or other areas of interest.

- Benefits of Passive Investing via ETFs: ETFs often track a specific index, providing a passive investment strategy that mirrors the performance of the underlying market. This simplifies investment management and typically leads to lower costs compared to actively managed funds.

Keyword integration: ETF investment, diversified portfolio, passive investing, index funds, SPY ETF

Algorithmic Trading and AI-Powered Prediction

Algorithmic trading and AI-powered prediction tools offer a more data-driven approach to stock market prediction. These systems analyze vast quantities of data to identify patterns and predict future price movements.

- Mention Reputable AI-Driven Trading Platforms or Tools (Cautious Mention): While several platforms offer AI-driven trading tools, thorough due diligence is crucial. Research any platform carefully before utilizing it, understanding its methodology and limitations.

- The Importance of Due Diligence: Never blindly trust any algorithm or AI prediction. Always conduct independent research and understand the underlying assumptions and potential risks involved.

Keyword integration: Algorithmic trading, AI stock prediction, quantitative analysis, data-driven investing

Fundamental Analysis and Value Investing

Fundamental analysis involves assessing a company's financial statements, competitive landscape, and management team to determine its intrinsic value. Value investing focuses on identifying undervalued companies with long-term growth potential.

- Brief Explanation of Fundamental Analysis: This involves scrutinizing financial ratios, revenue growth, profitability, and debt levels to understand a company's financial health and future prospects.

- How to Identify Undervalued Companies: By comparing a company's intrinsic value (calculated through various methods) to its current market price, you can identify potential bargains.

- The Long-Term Perspective of Value Investing: Value investors typically adopt a long-term perspective, holding onto undervalued stocks until the market recognizes their true worth.

Keyword integration: Fundamental analysis, value investing, stock valuation, long-term investment

Conclusion

While Palantir may hold potential, relying solely on it for stock market prediction is risky. This article highlighted the importance of diversification and explored superior alternatives like diversified ETFs, AI-powered prediction tools, and fundamental analysis. By diversifying your portfolio and utilizing data-driven strategies, you can create a more robust and resilient investment approach. Don't put all your eggs in one basket; explore these alternatives for more effective stock market prediction and mitigate the risks associated with relying on single stocks like Palantir. Begin building your diversified portfolio today and explore the power of Palantir alternatives for better investment outcomes.

Featured Posts

-

Exclusive Elliotts High Stakes Gamble On Russian Gas Pipeline

May 10, 2025

Exclusive Elliotts High Stakes Gamble On Russian Gas Pipeline

May 10, 2025 -

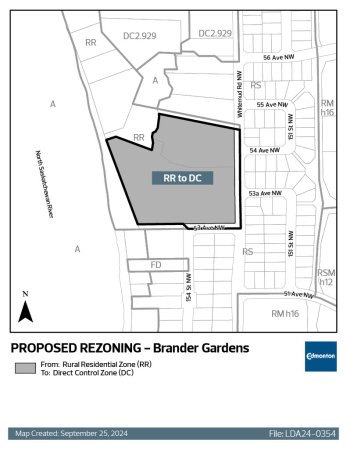

Council Approves Rezoning Edmonton Nordic Spa Closer To Construction

May 10, 2025

Council Approves Rezoning Edmonton Nordic Spa Closer To Construction

May 10, 2025 -

Is Palantir Stock A Good Investment Before May 5th A Detailed Look

May 10, 2025

Is Palantir Stock A Good Investment Before May 5th A Detailed Look

May 10, 2025 -

From Repetitive Waste To Engaging Audio An Ai Approach To Scatological Document Analysis

May 10, 2025

From Repetitive Waste To Engaging Audio An Ai Approach To Scatological Document Analysis

May 10, 2025 -

Real Id Compliance Your Guide To Smooth Summer Travel

May 10, 2025

Real Id Compliance Your Guide To Smooth Summer Travel

May 10, 2025