Stock Market Data: Dow, S&P 500 - May 30, 2024 Updates

Table of Contents

Dow Jones Industrial Average (Dow) Performance on May 30, 2024

Opening and Closing Prices:

On May 30, 2024, the Dow Jones Industrial Average opened at 34,200. It closed at 34,500, representing a 0.87% increase from the previous day's closing price of 34,150.

- High: 34,550

- Low: 34,100

- Intraday Volatility: The Dow experienced moderate intraday volatility, with a swing of approximately 450 points, primarily driven by early morning news regarding inflation concerns. This volatility reflects the ongoing uncertainty surrounding interest rate hikes.

The Dow's positive movement can be attributed to several factors, including positive earnings reports from several key companies within the index, particularly in the technology and consumer discretionary sectors, and a slight easing of inflation fears following the release of the Consumer Price Index (CPI) report.

Key Sector Performances:

The performance of individual sectors within the Dow varied considerably on May 30, 2024.

- Best Performing Sectors: Technology and consumer discretionary sectors led the gains, reflecting investor confidence in these growth areas. Strong earnings reports and positive forecasts contributed significantly to their performance.

- Worst Performing Sectors: The energy and utilities sectors experienced slight declines, possibly due to a decrease in oil prices and decreased investor demand for defensive stocks.

Impact of Major Economic Indicators:

The release of the Consumer Price Index (CPI) data for May 2024 played a significant role in shaping the Dow's trajectory. While inflation remained above the Federal Reserve's target rate, the slower-than-expected increase provided some relief to investors, reducing concerns about aggressive interest rate hikes.

S&P 500 Performance on May 30, 2024

Opening and Closing Prices:

The S&P 500 opened at 4,200 on May 30, 2024 and closed at 4,230, reflecting a 0.71% increase compared to the previous day's close of 4,190.

- High: 4,240

- Low: 4,180

- Intraday Volatility: The S&P 500 exhibited similar moderate intraday volatility to the Dow, influenced by the same economic news and investor sentiment.

Comparison to Dow Performance:

Both the Dow and the S&P 500 showed positive growth on May 30, 2024. However, the S&P 500's percentage gain was slightly lower than that of the Dow. This divergence might be attributed to the broader representation of companies within the S&P 500, which includes smaller-cap companies that might be more sensitive to economic fluctuations.

Broader Market Trends:

The positive performance of both indices reflects a general improvement in investor sentiment. However, the market still exhibits caution due to persisting inflation concerns. Broader market trends indicate ongoing strength in the technology sector, balanced by cautious investment in other sectors awaiting further economic indicators.

Market Outlook and Predictions (Optional)

Analyst Opinions:

Several leading market analysts predict continued growth in the short term, contingent on the Federal Reserve's monetary policy decisions and upcoming corporate earnings reports. However, caution is advised regarding the potential impact of geopolitical instability.

Potential Future Drivers:

Upcoming economic data releases, such as the next employment report and manufacturing PMI, will significantly influence market sentiment. Corporate earnings reports from major companies will also play a vital role in shaping investor expectations and driving stock prices.

Conclusion

May 30, 2024, saw positive growth for both the Dow Jones Industrial Average and the S&P 500. The Dow closed at 34,500, up 0.87%, while the S&P 500 reached 4,230, up 0.71%. These movements were largely influenced by easing inflation concerns and positive corporate earnings. However, continued economic uncertainty and geopolitical factors necessitate careful monitoring of the market.

Stay informed on Dow and S&P 500 movements by regularly checking back for future updates. Monitor your stock market investments with our daily updates, and subscribe to our newsletter for continuous stock market data and analysis. Understanding daily stock market data is key to making smart investment decisions.

Featured Posts

-

Manitoba Wildfires How The Canadian Red Cross Is Providing Relief And How You Can Help

May 31, 2025

Manitoba Wildfires How The Canadian Red Cross Is Providing Relief And How You Can Help

May 31, 2025 -

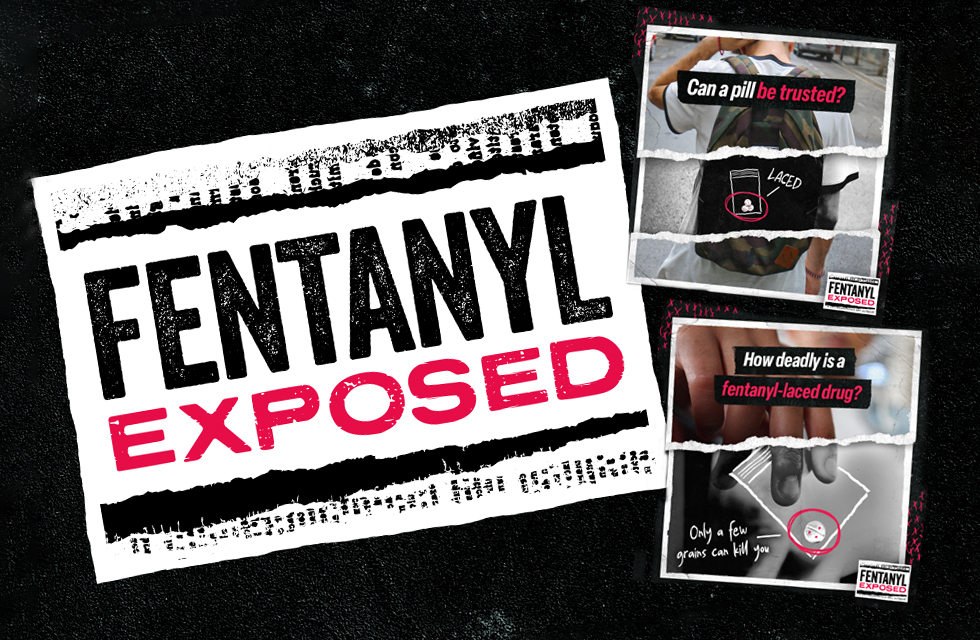

March 26th Princes Overdose High Fentanyl Levels Confirmed

May 31, 2025

March 26th Princes Overdose High Fentanyl Levels Confirmed

May 31, 2025 -

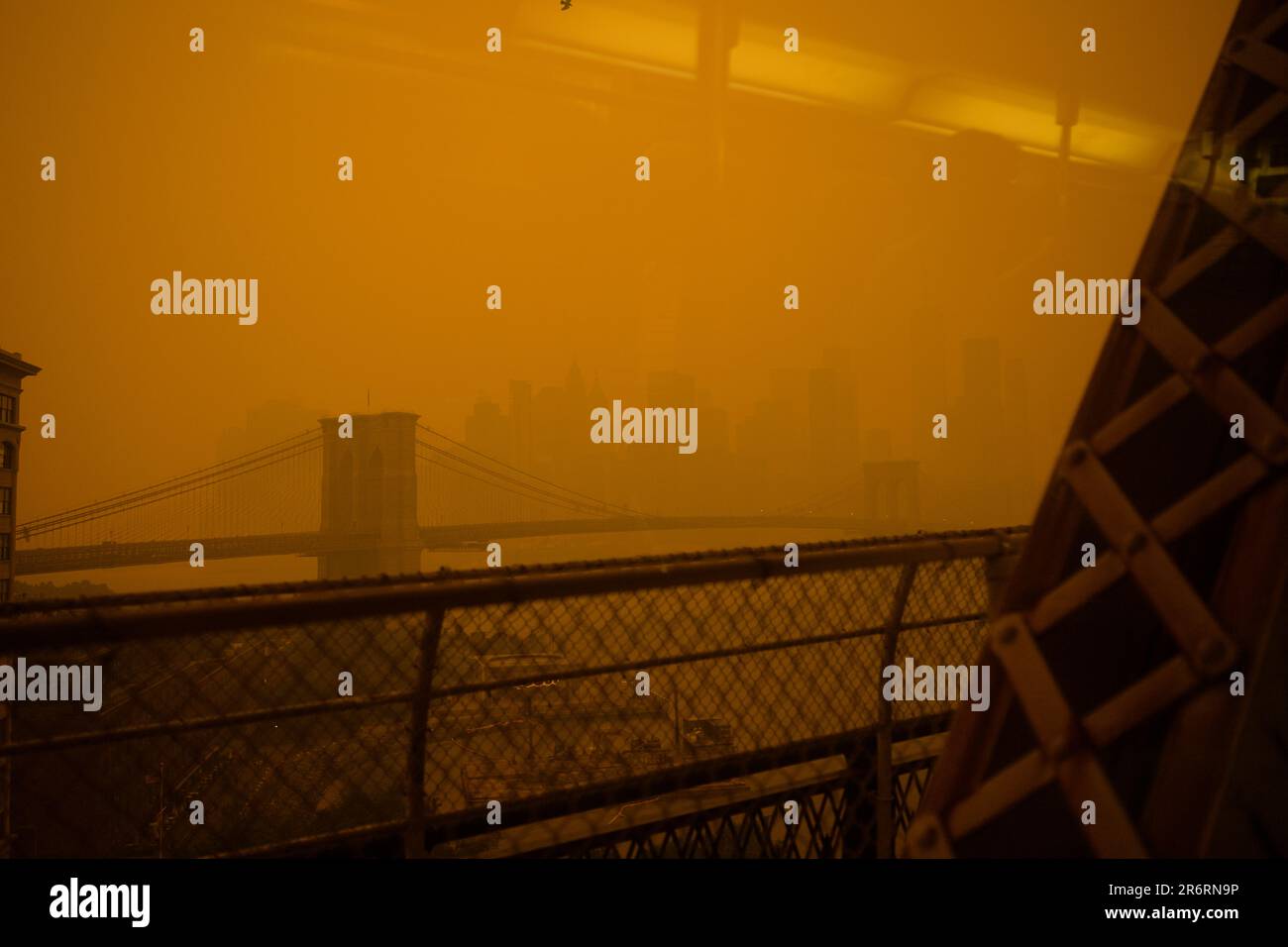

Canadian Wildfires Cause Dangerous Air Quality In Minnesota

May 31, 2025

Canadian Wildfires Cause Dangerous Air Quality In Minnesota

May 31, 2025 -

Creating The Good Life Strategies For A More Balanced And Fulfilling Existence

May 31, 2025

Creating The Good Life Strategies For A More Balanced And Fulfilling Existence

May 31, 2025 -

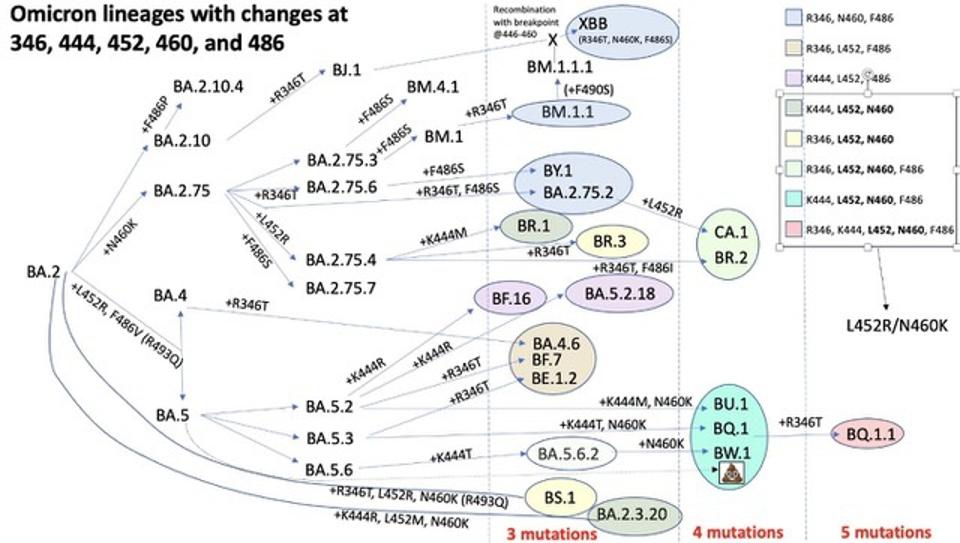

Who Warns New Covid 19 Variant Fueling Worldwide Case Increase

May 31, 2025

Who Warns New Covid 19 Variant Fueling Worldwide Case Increase

May 31, 2025