Stock Market Analysis: Navigating Trump's Tariff Threats And UK Trade Developments

Table of Contents

Trump's Tariff Threats and their Impact on Stock Market Volatility

Understanding the Impact of Tariffs

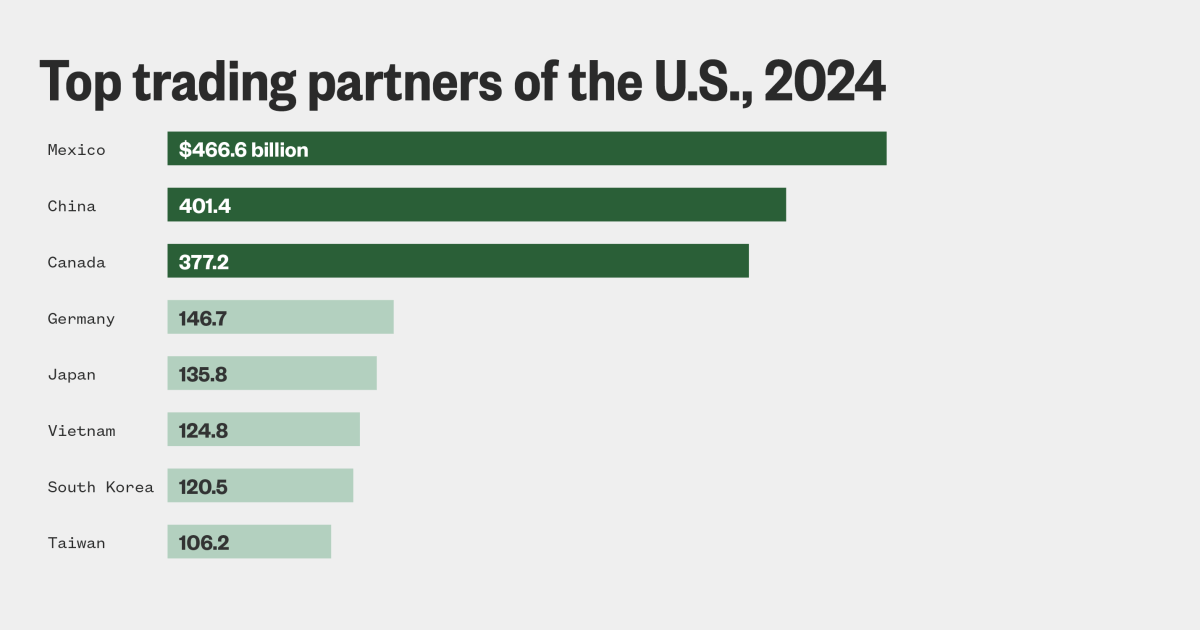

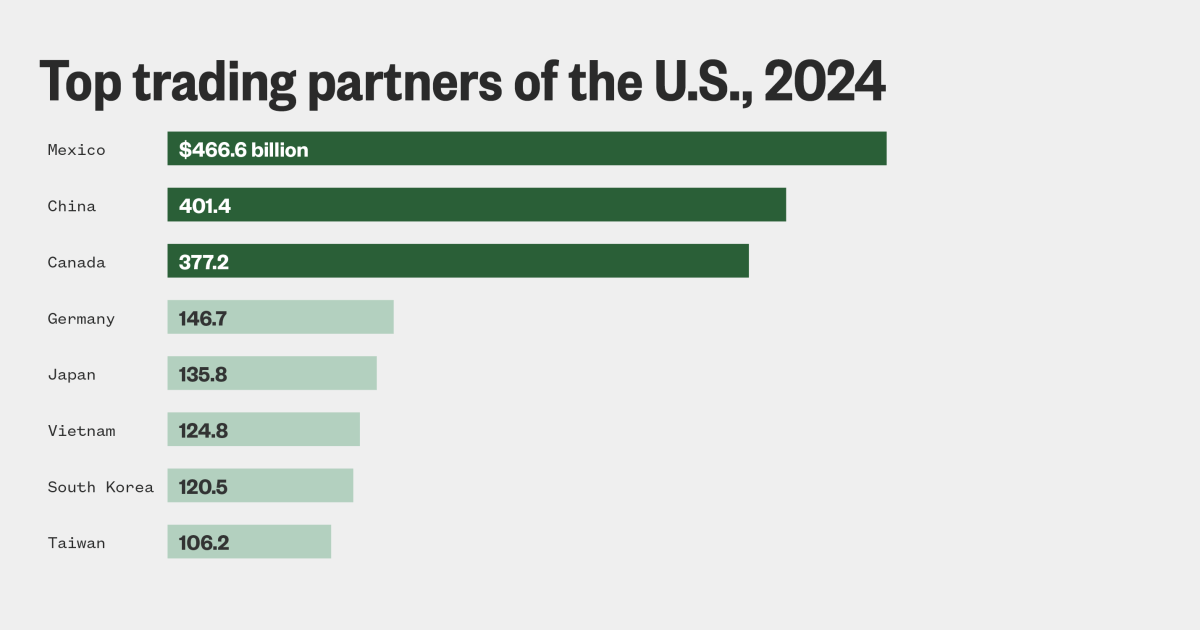

Tariffs, essentially taxes on imported goods, significantly impact the stock market. By increasing the cost of imported goods, tariffs lead to higher prices for consumers. This, in turn, can reduce consumer spending, negatively impacting company profits and ultimately, stock prices. The effect isn't uniform across all sectors; some are more vulnerable than others. For example, manufacturing and agriculture sectors heavily reliant on imported materials or exporting goods face significant challenges.

The imposition of tariffs creates uncertainty in the market. Businesses struggle to plan for the future when import costs are unpredictable. This uncertainty leads to increased volatility, making it difficult for investors to accurately assess risk and potential returns.

- Increased import costs lead to higher prices for consumers. This reduces purchasing power and dampens consumer confidence.

- Reduced consumer spending can negatively impact company profits. Companies may see decreased sales and reduced earnings.

- Certain sectors are more vulnerable than others to tariff-related disruptions. Those heavily reliant on international trade are disproportionately affected.

- Market uncertainty surrounding tariffs contributes to increased volatility. This makes accurate stock market forecasting more challenging.

Historical examples, such as the steel and aluminum tariffs imposed during the Trump administration, demonstrate the market's immediate reaction to such policies. Stock prices of affected companies often fell sharply, reflecting investor concerns about reduced profitability.

Strategies for mitigating tariff-related risks

Navigating the turbulent waters of tariff-induced volatility requires a strategic approach. Diversification is key. Spreading investments across different sectors and geographical regions reduces exposure to any single sector affected by tariffs. Focusing on fundamental analysis to identify companies with strong balance sheets and diverse revenue streams is also crucial. These companies are better positioned to weather economic storms.

Risk management tools, such as hedging strategies using options or futures contracts, can help mitigate potential losses. Staying informed about upcoming tariff announcements and their potential impact is also essential for proactive decision-making.

- Diversify your portfolio across different sectors and geographies. This helps reduce the impact of any single event.

- Focus on companies with strong balance sheets and diverse revenue streams. These companies are generally more resilient to economic shocks.

- Consider using options or futures contracts to hedge against market risks. This can help protect against potential losses.

- Stay informed about upcoming tariff announcements and their potential impact. Proactive monitoring allows for timely adjustments to investment strategies.

UK Trade Developments Post-Brexit and their Global Stock Market Implications

Analyzing the impact of Brexit on UK and global markets

Brexit, the UK's withdrawal from the European Union, has had a profound and multifaceted impact on both the UK and global stock markets. The short-term effects included increased uncertainty, leading to initial market declines. The long-term impacts, however, remain dependent on future trade deals, economic policies, and the overall adaptation of the UK economy.

Brexit has also disrupted global supply chains, affecting various sectors. The UK's economic performance plays a significant role in the health of the global economy, impacting everything from manufacturing to finance. Uncertainty regarding future trade agreements continues to cause volatility in the market.

- Increased uncertainty led to initial market declines. Investors reacted negatively to the uncertainty surrounding the post-Brexit landscape.

- Long-term impacts depend on future trade deals and economic policy. The success of Brexit will significantly influence market performance.

- Global supply chains have been disrupted, affecting various sectors. Businesses have had to adapt to new trade routes and regulations.

- The UK's economic performance significantly impacts global markets. The UK is a major player in the global economy.

Investment opportunities in the post-Brexit landscape

While Brexit presented challenges, it also created new investment opportunities. Certain sectors, particularly those focused on new trade agreements or domestic markets, may experience growth. Companies adapting to new regulations and trade relationships may also offer attractive investment opportunities. International diversification remains crucial to mitigate Brexit-related risks.

- Certain sectors may experience growth due to shifts in trade patterns. New trade agreements may open up opportunities for certain industries.

- Companies adapting to new regulations may present attractive investment opportunities. Companies demonstrating adaptability can thrive in changing conditions.

- International diversification is crucial to mitigate Brexit-related risks. Spreading investments across different markets minimizes exposure.

- Thorough due diligence is essential when investing in a volatile market. Careful research and risk assessment are vital.

Conclusion

This stock market analysis highlights the significant impact of both Trump's tariff policies and UK trade developments on global market stability. Understanding these geopolitical factors is crucial for effective investment strategies. By carefully considering the risks and opportunities presented, investors can navigate this complex landscape and potentially maximize returns. Remember to conduct thorough research and consider professional financial advice before making any investment decisions related to stock market analysis. Stay informed about ongoing developments in international trade and continue your stock market analysis to make well-informed investment choices.

Featured Posts

-

Boston Celtics Player Forgoes Nba Award Campaign

May 11, 2025

Boston Celtics Player Forgoes Nba Award Campaign

May 11, 2025 -

Omada Health Files For Us Ipo A Look At The Andreessen Horowitz Backed Digital Health Company

May 11, 2025

Omada Health Files For Us Ipo A Look At The Andreessen Horowitz Backed Digital Health Company

May 11, 2025 -

From Bellator Loss To Ufc Star Manon Fiorots Unstoppable Rise

May 11, 2025

From Bellator Loss To Ufc Star Manon Fiorots Unstoppable Rise

May 11, 2025 -

Covid 19 Test Fraud Lab Owner Pleads Guilty

May 11, 2025

Covid 19 Test Fraud Lab Owner Pleads Guilty

May 11, 2025 -

Gpb Capital Ponzi Scheme Founder David Gentile Receives 7 Year Sentence

May 11, 2025

Gpb Capital Ponzi Scheme Founder David Gentile Receives 7 Year Sentence

May 11, 2025