GPB Capital Ponzi Scheme: Founder David Gentile Receives 7-Year Sentence

Table of Contents

The Scale of the GPB Capital Ponzi Scheme

The GPB Capital Ponzi scheme represents a staggering example of investment fraud, resulting in billions of dollars in investor losses. This massive financial crime impacted thousands of victims across the United States, highlighting the widespread reach and devastating consequences of such schemes. The fraudulent activities involved misrepresentation of investments and financial performance, painting a rosy picture that masked the reality of the failing enterprise.

- Billions of dollars in investor losses: The exact figure continues to be determined, but the losses amount to billions, devastating the financial lives of countless individuals and families.

- Thousands of victims across the US: The scheme ensnared investors from various backgrounds and locations, underscoring the indiscriminate nature of such fraudulent operations.

- Misrepresentation of investments and financial performance: Gentile and his associates employed deceptive tactics to inflate the perceived value and performance of the investments.

- Use of high-pressure sales tactics: Aggressive sales techniques were used to pressure investors into committing significant sums of money.

- Complex web of affiliated entities obscuring the fraud: The GPB Capital structure was deliberately convoluted, making it difficult to uncover the fraudulent activities and trace the flow of funds.

David Gentile's Role and Conviction

David Gentile, the founder of GPB Capital, played a central role in orchestrating this massive Ponzi scheme. His conviction on charges related to securities fraud, wire fraud, and conspiracy signifies a significant victory for investor protection efforts. The evidence presented during the trial irrefutably demonstrated Gentile's involvement in the fraudulent activities, leading to his seven-year prison sentence.

- Key roles played by Gentile in the fraudulent activities: Gentile was directly involved in the deceptive practices that fueled the scheme.

- Specific charges leveled against him: The charges included securities fraud, wire fraud, and conspiracy to commit securities fraud and wire fraud, reflecting the multifaceted nature of his criminal actions.

- Details of the sentencing and any additional penalties: In addition to the seven-year prison sentence, Gentile likely faced substantial financial penalties, including fines and restitution to victims.

- Mention of any co-conspirators and their legal outcomes: While Gentile's conviction is a significant development, the investigation and prosecution of other individuals involved in the scheme are ongoing.

Impact on Investors and the Investment Landscape

The GPB Capital Ponzi scheme had a catastrophic impact on investors who lost significant portions of their savings, often their life savings. This devastating financial blow was compounded by the emotional toll of betrayal and the lengthy process of attempting to recoup lost funds. The SEC's ongoing investigation and efforts to recover assets for victims, while crucial, highlight the significant challenges involved in such cases.

- The emotional and financial toll on victims: The psychological impact on victims extends beyond the immediate financial losses, creating long-term stress and hardship.

- Ongoing efforts by the SEC and receiver to recover assets: The Securities and Exchange Commission (SEC) is actively working to recover assets and return them to the defrauded investors.

- Increased scrutiny of alternative investment vehicles: The case has led to heightened scrutiny and increased regulatory oversight of alternative investments.

- Potential for legislative changes to improve investor protection: The GPB Capital case may prompt legislative changes designed to enhance investor protection and prevent similar schemes in the future.

Lessons Learned and Future Implications

The GPB Capital Ponzi scheme serves as a cautionary tale, emphasizing the critical importance of due diligence and investor awareness. Protecting yourself from investment fraud requires vigilance and a proactive approach. Before investing, always verify claims independently and seek professional financial advice.

- Importance of verifying investment claims independently: Never rely solely on information provided by the investment firm. Conduct your own thorough research.

- Need for thorough due diligence before investing: Investigate the investment, the company, and the individuals involved. Check for any red flags or warnings.

- Red flags to look out for in potentially fraudulent schemes: Be wary of unusually high returns, guaranteed profits, pressure to invest quickly, and lack of transparency.

- Resources available to investors seeking information and protection: Utilize resources such as the SEC website and reputable financial advisors to gather information and protect your investments.

Conclusion

The GPB Capital Ponzi scheme and David Gentile's seven-year sentence highlight the devastating consequences of investment fraud and the urgent need for investor protection. The scale of the scheme, the impact on thousands of victims, and the complexities of recovering lost funds underscore the importance of vigilance. Understanding the intricacies of the GPB Capital Ponzi scheme and David Gentile's sentencing should serve as a crucial reminder to all investors to practice vigilance and due diligence to avoid becoming victims of similar investment frauds. Before making any investment decisions, always conduct thorough research, seek professional financial advice, and remember that if an investment opportunity seems too good to be true, it probably is.

Featured Posts

-

Analyzing Conor Mc Gregors Media Appearances On Fox News

May 11, 2025

Analyzing Conor Mc Gregors Media Appearances On Fox News

May 11, 2025 -

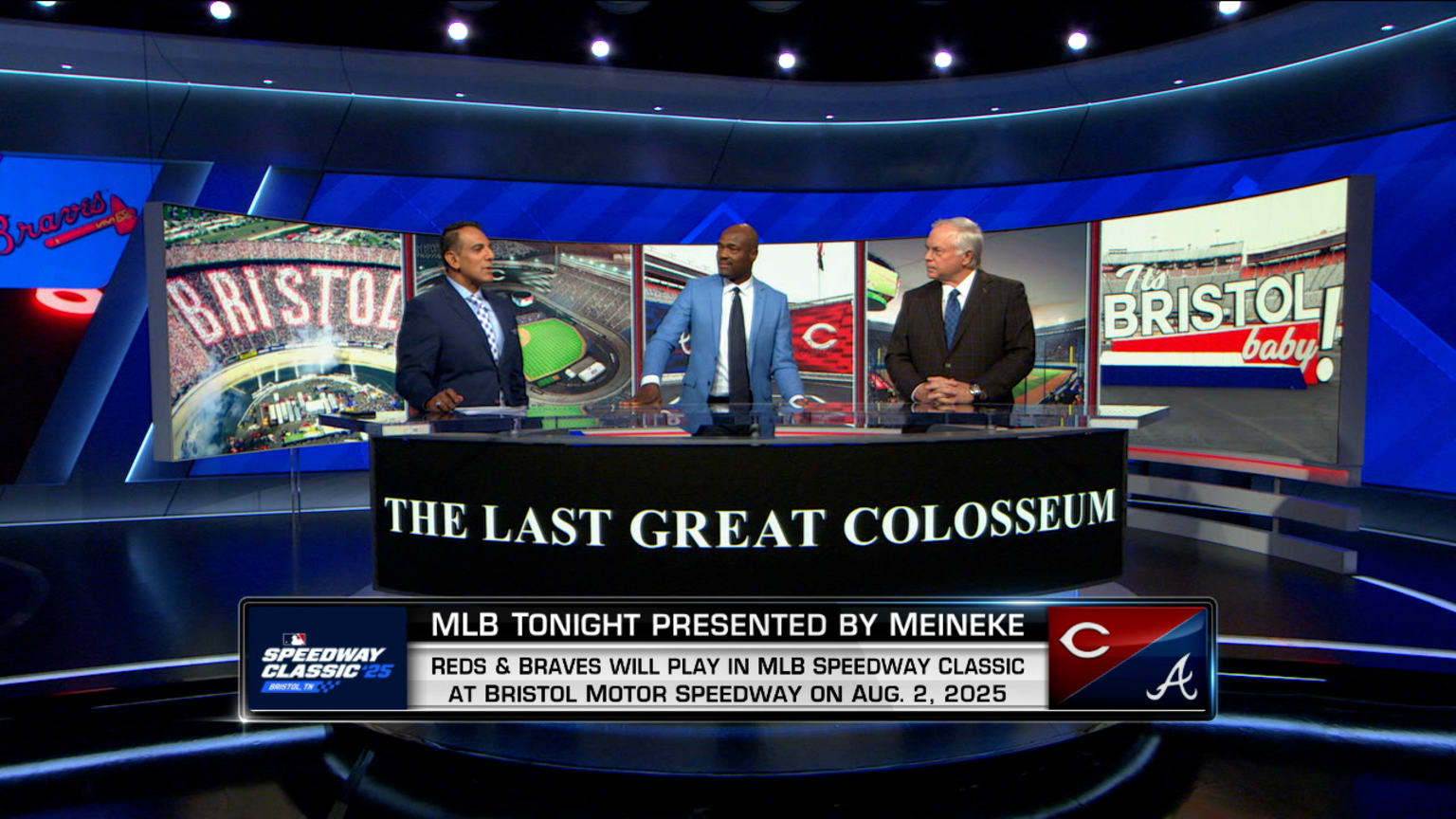

Manfred On Fan Interest Bristols Mlb Speedway Classic

May 11, 2025

Manfred On Fan Interest Bristols Mlb Speedway Classic

May 11, 2025 -

Aaron Judge 1 000 Games And Counting Towards Cooperstown

May 11, 2025

Aaron Judge 1 000 Games And Counting Towards Cooperstown

May 11, 2025 -

Did Appearing On Teen Mom Ruin Farrah Abrahams Life

May 11, 2025

Did Appearing On Teen Mom Ruin Farrah Abrahams Life

May 11, 2025 -

Zurich Classic Mc Ilroy And Lowry To Play Together

May 11, 2025

Zurich Classic Mc Ilroy And Lowry To Play Together

May 11, 2025