How To Interpret The Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net worth of a single share in an exchange-traded fund (ETF). For the Amundi MSCI All Country World UCITS ETF USD Acc, the NAV reflects the current market value of all the underlying assets it holds, mirroring the performance of the MSCI All Country World Index. It's a critical indicator of your investment's performance and overall health.

- Definition: NAV is calculated by subtracting an ETF's total liabilities (expenses like management fees and operational costs) from its total assets (the market value of all its holdings), then dividing by the total number of outstanding shares.

- Relevance to Amundi MSCI All Country World UCITS ETF USD Acc: This ETF tracks a broad global index, meaning its NAV directly reflects the collective performance of a vast range of international companies. A rising NAV suggests positive performance, while a falling NAV signals potential underperformance.

- Key Components:

- Assets: This encompasses the market value of all stocks, bonds, and other securities included in the ETF's portfolio. The daily fluctuations in the prices of these underlying assets directly influence the NAV.

- Liabilities: These are the ETF's expenses, including management fees charged by Amundi, administrative costs, and other operational expenses. These liabilities reduce the overall value available to shareholders.

How is the NAV of Amundi MSCI All Country World UCITS ETF USD Acc Calculated?

The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is calculated daily, providing investors with a daily snapshot of their investment's value. This calculation process is transparent and adheres to strict industry standards.

- Daily Calculation: Typically, the NAV is calculated at the close of the primary market for the underlying assets.

- Underlying Asset Valuation: The market value of each asset in the ETF's portfolio is determined using its closing market price on the relevant exchange. This ensures the NAV reflects the most up-to-date market conditions.

- Currency Conversion: Because the ETF is denominated in US Dollars (USD), any assets priced in other currencies are converted to USD using the prevailing exchange rates at the close of the market.

- Transparency: Amundi, as the ETF provider, makes the daily NAV publicly available. You can usually find this information on their official website or through major financial data providers like Bloomberg or Yahoo Finance. This transparency ensures accountability and allows investors to easily track their investment's progress.

Interpreting NAV Fluctuations

Understanding the factors that influence NAV fluctuations is vital for making sound investment decisions. Changes in NAV are rarely isolated events; they reflect broader market movements and global events.

- Market Influences: The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc closely follows the performance of the MSCI All Country World Index. A rising index generally leads to a higher NAV, and conversely, a falling index typically results in a lower NAV.

- Impact of Global Events: Global economic news (e.g., interest rate changes, inflation data), geopolitical events (e.g., wars, political instability), and overall market sentiment can significantly impact the NAV. Unexpected events can cause sudden and dramatic shifts.

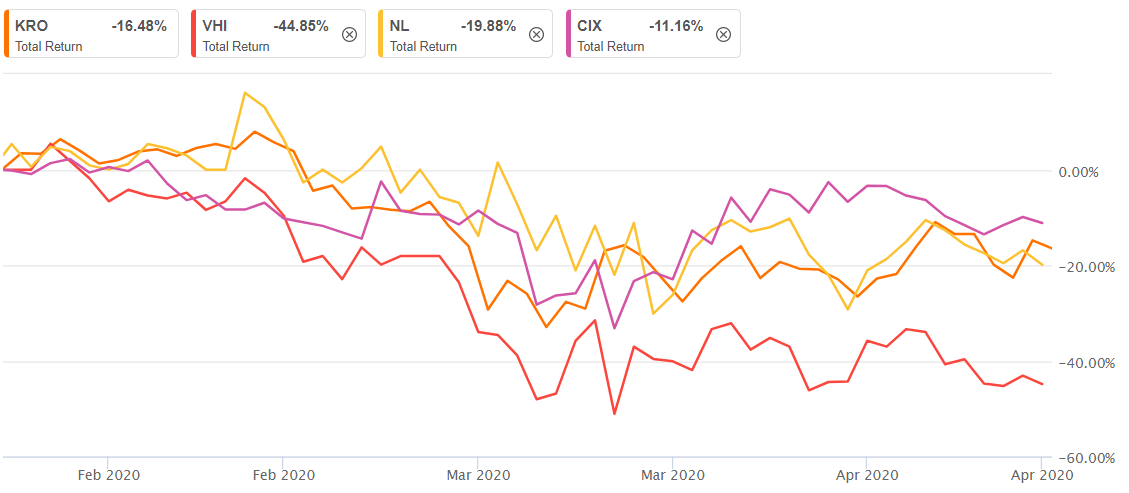

- Analyzing Trends: Instead of focusing on daily fluctuations, analyze the NAV over longer periods (weeks, months, or years) to identify trends and assess the ETF's long-term performance. Charts and graphs can greatly assist in visualizing these trends.

- Comparing to Benchmark: Regularly compare the ETF's NAV performance against the MSCI All Country World Index benchmark to evaluate its tracking accuracy. A close correlation indicates the ETF is effectively replicating the index.

Using NAV for Investment Decisions

While NAV is a valuable tool, it shouldn't be the sole determinant for buy or sell decisions. However, it provides crucial context within a broader investment strategy.

- Buy and Sell Signals (with caution): A significant and sustained drop in NAV might present a buying opportunity for long-term investors, while a substantial rise might signal a potential time to consider partial profit-taking. However, this requires careful consideration of market conditions and your personal risk tolerance.

- Portfolio Rebalancing: Monitoring the NAV allows for effective portfolio rebalancing. If a significant portion of your portfolio is invested in this ETF and its NAV grows substantially, you might choose to rebalance by shifting funds to other asset classes.

- Performance Evaluation: The NAV is a key metric to gauge the performance of your investment in the Amundi MSCI All Country World UCITS ETF USD Acc over time. By tracking its performance against your initial investment, you can assess its return on investment.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is fundamental for informed investment decisions. By mastering how it's calculated and interpreting its fluctuations within the context of market trends and global events, you can better manage your portfolio and achieve your investment goals. Regularly reviewing the NAV, analyzing its long-term trends, and comparing it to the benchmark index will provide valuable insights into your investment's performance. Remember to consult a financial advisor for personalized advice before making any investment decisions based on NAV. Start interpreting the Amundi MSCI All Country World UCITS ETF USD Acc's Net Asset Value (NAV) today and make smarter investment choices!

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist What You Need To Know

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist What You Need To Know

May 25, 2025 -

Kyle Walker And The Mysterious Milan Night Out Following Wifes Departure

May 25, 2025

Kyle Walker And The Mysterious Milan Night Out Following Wifes Departure

May 25, 2025 -

News Corps Undervalued Assets A Comprehensive Analysis

May 25, 2025

News Corps Undervalued Assets A Comprehensive Analysis

May 25, 2025 -

Escape To The Country Financing Your Rural Dream

May 25, 2025

Escape To The Country Financing Your Rural Dream

May 25, 2025 -

Faiz Indirimi Kararindan Sonra Avrupa Borsalarinin Performansi

May 25, 2025

Faiz Indirimi Kararindan Sonra Avrupa Borsalarinin Performansi

May 25, 2025

Latest Posts

-

La Strategie De La Chine Pour Etouffer Les Voix Dissidentes En France

May 25, 2025

La Strategie De La Chine Pour Etouffer Les Voix Dissidentes En France

May 25, 2025 -

Discrepancies Revealed Ex French Pm And Macrons Policy Differences

May 25, 2025

Discrepancies Revealed Ex French Pm And Macrons Policy Differences

May 25, 2025 -

Le Silence Impose Comment La Chine Muselle Les Dissidents En France

May 25, 2025

Le Silence Impose Comment La Chine Muselle Les Dissidents En France

May 25, 2025 -

2 Drop In Lvmh Shares Following Disappointing Q1 Sales Figures

May 25, 2025

2 Drop In Lvmh Shares Following Disappointing Q1 Sales Figures

May 25, 2025 -

Proposed French Law Banning Hijabs In Public For Under 15s

May 25, 2025

Proposed French Law Banning Hijabs In Public For Under 15s

May 25, 2025