SSE's £3 Billion Spending Cut: Impact Of Slowing Growth

Table of Contents

- Analyzing the Drivers of SSE's £3 Billion Spending Reduction

- The Implications for Renewable Energy Development in the UK

- Job Losses and Economic Ripple Effects of SSE's Spending Cuts

- Market Response and Future Investment Strategies for SSE

- Conclusion: Understanding the Long-Term Effects of SSE's £3 Billion Spending Cut

Analyzing the Drivers of SSE's £3 Billion Spending Reduction

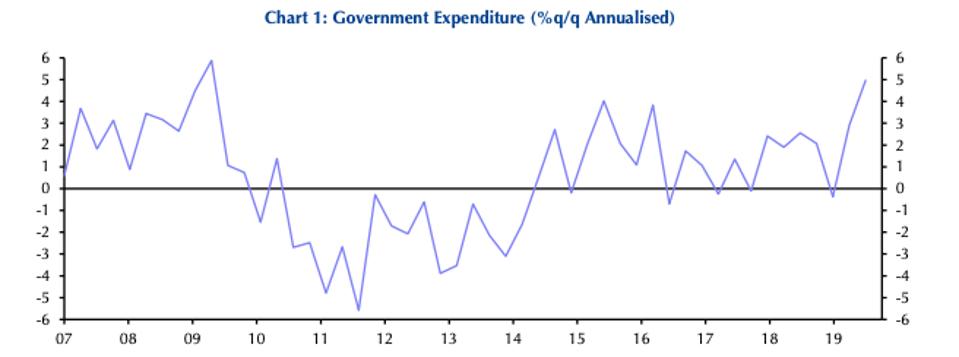

Several factors have contributed to SSE's decision to slash its capital expenditure by £3 billion. The primary driver is undoubtedly the slowing economic growth impacting the UK and globally. This slowdown translates into reduced energy demand and increased uncertainty about future revenue streams, making large-scale investments riskier.

- Economic Slowdown: The current economic climate, characterized by high inflation and interest rates, has significantly impacted consumer spending and business investment, leading to decreased energy demand forecasts.

- Increased Energy Costs: Soaring energy costs, particularly for fossil fuels, have increased the overall cost of energy production, squeezing profit margins and making new investments less attractive. This has forced a re-evaluation of project viability and profitability.

- Regulatory Uncertainty: Changes in government policy and regulations, including those surrounding renewable energy subsidies and carbon pricing, create uncertainty for energy companies planning long-term investments. This uncertainty makes it difficult to accurately assess the return on investment for large-scale projects.

- Market Competition: Increased competition within the UK energy market further complicates the investment landscape. Companies are under pressure to maintain profitability, forcing them to prioritize projects with the highest return and cut back on less lucrative ventures.

- Specific Project Delays/Cancellations: While SSE hasn't explicitly named all affected projects, it's expected that several large-scale renewable energy and grid infrastructure developments have been delayed or cancelled as a direct result of this spending cut.

The Implications for Renewable Energy Development in the UK

SSE's reduced investment significantly impacts the UK's renewable energy ambitions. The company is a major player in the development of wind and solar energy projects, and the £3 billion cut will likely lead to delays and cancellations of crucial projects.

- Impact on Renewable Energy Portfolio: SSE's portfolio includes several large-scale onshore and offshore wind farms, as well as solar power projects. The spending cut will inevitably affect the timeline and feasibility of these projects.

- Project Delays and Cancellations: Delays or cancellations could hinder the UK's progress towards its net-zero targets and compromise its ambition to become a global leader in renewable energy.

- Broader Implications for Climate Goals: The reduction in investment could have far-reaching consequences for the UK's ability to meet its climate change commitments and transition to a low-carbon economy. The delay in crucial renewable energy projects will directly affect the nation's progress towards its net-zero targets.

Job Losses and Economic Ripple Effects of SSE's Spending Cuts

The £3 billion spending cut will undoubtedly have a significant impact on employment and the wider economy. Reduced investment translates into fewer job opportunities in the energy sector and related supply chains.

- Potential Job Losses: The cut will directly affect jobs in engineering, construction, and project management roles associated with the cancelled or delayed projects. Indirect job losses are also likely to occur in related industries.

- Economic Impact on Supply Chains: The reduced investment will have a ripple effect on businesses supplying goods and services to SSE and the wider energy sector, leading to potential supply chain disruptions and economic hardship for local communities.

- Impact on Government Revenue and Public Services: Lower investment will likely reduce tax revenue for the government, potentially impacting public services and infrastructure projects.

Market Response and Future Investment Strategies for SSE

The market reacted negatively to SSE's announcement, with the share price experiencing a temporary dip, reflecting investor concerns about the company's future prospects. However, the long-term effects remain uncertain.

- Share Price and Investor Confidence: The immediate market reaction highlighted investor anxieties about the impact of the spending cut on SSE's long-term growth and profitability. However, the market's response is likely to evolve as SSE's new strategy unfolds.

- Future Investment Plans and Strategies: SSE will need to carefully manage its resources and prioritize investments in projects with the highest potential returns. This will require a reassessment of its existing portfolio and a focus on cost-effective strategies.

- Long-Term Effects on Competitiveness and Market Position: The spending cut could affect SSE's competitiveness in the long term, particularly if competitors continue to invest heavily in renewable energy projects. Its market share and future growth will be dependent upon its ability to adapt to the changing energy landscape.

Conclusion: Understanding the Long-Term Effects of SSE's £3 Billion Spending Cut

SSE's £3 billion spending cut is a significant event with far-reaching consequences for the UK energy sector and the economy. The decision reflects the challenges of slowing growth, increased energy costs, and regulatory uncertainty. The reduction in investment will impact renewable energy development, potentially jeopardizing the UK's climate goals, and lead to job losses and economic disruption. While the long-term effects remain to be seen, SSE's future strategy will be crucial in determining its competitiveness and market position. Stay informed about the ongoing developments at SSE and the wider impact of slowing growth on the energy sector by following our blog for future updates.

Canada Vs Mexico Los Memes Mas Epicos De La Liga De Naciones Concacaf

Canada Vs Mexico Los Memes Mas Epicos De La Liga De Naciones Concacaf

Betaalverkeer In Nederland Van Bankrekening Tot Tikkie

Betaalverkeer In Nederland Van Bankrekening Tot Tikkie

Netflix Un Serial Nou Cu O Distributie Care Aspira La Oscar

Netflix Un Serial Nou Cu O Distributie Care Aspira La Oscar

Saskatchewan Political Panel And The Federal Election A Detailed Analysis

Saskatchewan Political Panel And The Federal Election A Detailed Analysis

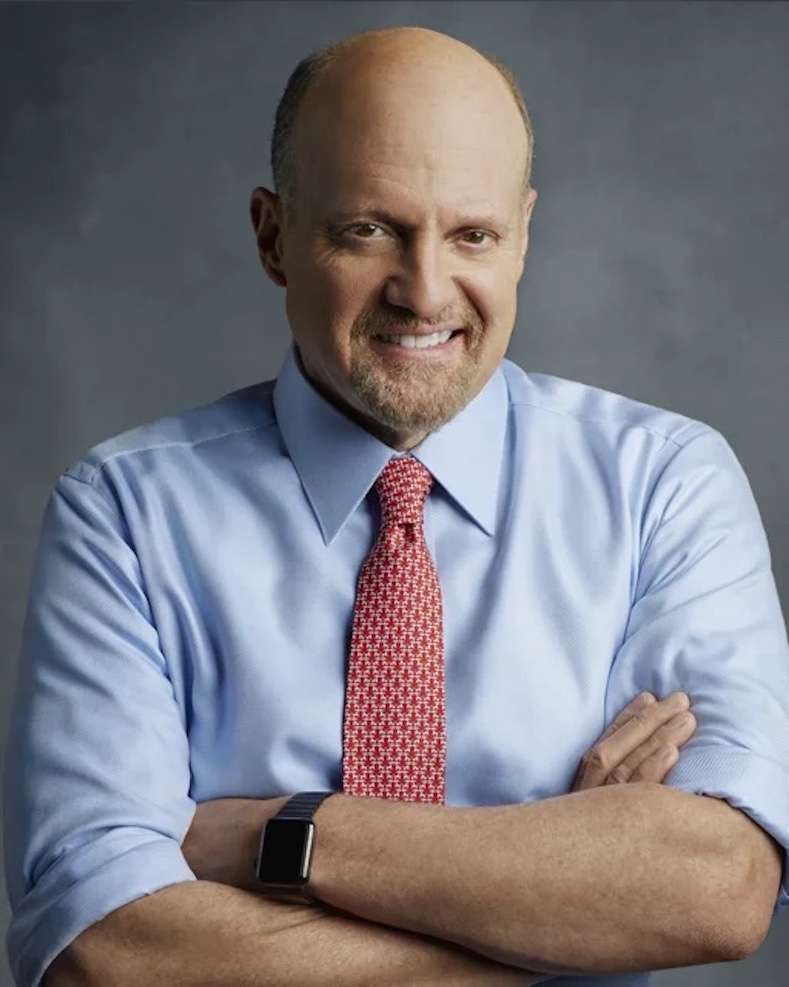

Core Weave Crwv A Deep Dive Into Jim Cramers Assessment And The Open Ai Factor

Core Weave Crwv A Deep Dive Into Jim Cramers Assessment And The Open Ai Factor