CoreWeave (CRWV): A Deep Dive Into Jim Cramer's Assessment And The OpenAI Factor

Table of Contents

Jim Cramer's Assessment of CoreWeave (CRWV): A Critical Analysis

Jim Cramer, the renowned host of CNBC's "Mad Money," has frequently weighed in on various tech stocks. While specific quotes require referencing his recent shows and articles (which should be done for a fully up-to-date analysis), a general understanding of his sentiment is crucial. Was his assessment bullish, bearish, or neutral?

Analyzing Cramer's reasoning requires examining the specific factors he highlighted. Did he focus on CRWV's revenue growth, its market share within the AI cloud computing sector, or its relationship with OpenAI? Understanding his rationale helps determine the validity and potential impact of his opinion. His assessment likely influenced CRWV's stock price and investor sentiment, potentially creating short-term volatility.

- Specific quotes from Jim Cramer regarding CoreWeave (CRWV): [Insert actual quotes here, citing sources.]

- Potential biases or conflicts of interest to consider: [Analyze potential conflicts. Does Cramer hold any CRWV stock? Does he have business relationships that could influence his opinion?]

- Comparison to Cramer's assessment of other similar companies: [Compare his assessment of CRWV to his views on competitors like AWS, Google Cloud, or Microsoft Azure. This provides context and reveals potential biases.]

The OpenAI Factor: CoreWeave's (CRWV) Strategic Partnership and Growth Potential

CoreWeave's relationship with OpenAI is a cornerstone of its success. While the precise nature of their collaboration may not be fully public, it's clear that CoreWeave provides significant computing resources for OpenAI's demanding AI models. This relationship directly contributes to CoreWeave's revenue streams and solidifies its position within the rapidly expanding AI cloud computing market. The potential for future collaborations is immense, implying long-term growth.

- Specific details about the CoreWeave (CRWV) - OpenAI collaboration: [Find and include details of their partnership. Is it a direct contract, a preferred provider status, or something else?]

- Analysis of the market demand for AI-focused cloud computing: The demand for high-performance computing infrastructure for AI applications is experiencing exponential growth, benefiting companies like CoreWeave.

- Discussion of potential risks and challenges associated with this reliance on OpenAI: Over-reliance on a single partner poses risks. Changes in OpenAI's strategy or the emergence of competitors could impact CoreWeave's revenue.

CoreWeave (CRWV) Financial Performance and Future Outlook

Analyzing CoreWeave's financial performance involves examining key metrics: revenue growth, profitability, and operating margins. These metrics should be compared against its competitors in the AI cloud computing space. Future growth hinges on securing additional large clients, expanding its infrastructure, and maintaining its technological edge. Reputable financial analysts' forecasts will provide valuable insights into its projected trajectory.

- Key financial figures for CoreWeave (CRWV): [Insert relevant financial data, including revenue, profits, and growth rates from the most recent financial reports.]

- Comparison to competitors in the AI cloud computing space: [How does CRWV's performance compare to AWS, Google Cloud, Microsoft Azure, and other relevant players? This reveals competitive positioning.]

- Analysis of the company’s competitive advantages and disadvantages: [Identify CoreWeave's strengths and weaknesses – specialized infrastructure, pricing models, customer service, etc.]

Investing in CoreWeave (CRWV): Risks and Rewards

Investing in CoreWeave (CRWV) presents both significant opportunities and potential risks. Market volatility in the tech sector is a key consideration. Competition is fierce, and dependence on OpenAI introduces a specific risk factor. However, the potential rewards are substantial given the rapid expansion of the AI cloud computing market and CoreWeave's strategic positioning.

- Summary of the potential risks associated with CRWV: Market volatility, competition, dependence on OpenAI, technological disruption.

- Summary of the potential rewards associated with CRWV: High growth potential in a booming market, strong partnerships, potential for market leadership.

- Recommendations for investors based on the analysis: [Provide a balanced assessment, recommending a cautious approach with thorough due diligence.]

Conclusion: CoreWeave (CRWV): A Verdict on its Future

This analysis examined CoreWeave (CRWV), incorporating Jim Cramer's insights and the crucial role of OpenAI. While the financial performance and future outlook are promising, the risks inherent in the tech sector and specific dependencies require careful consideration. The company's strategic partnership with OpenAI positions it for significant growth within the AI cloud computing market. However, prospective investors must conduct comprehensive due diligence before committing capital. Learn more about CoreWeave (CRWV) and invest wisely in CoreWeave (CRWV) after thorough research.

Featured Posts

-

The Goldbergs Exploring The Shows Humor And Heart

May 22, 2025

The Goldbergs Exploring The Shows Humor And Heart

May 22, 2025 -

Pahalgam Terror Attack Switzerlands Condemnation And Call For Peace

May 22, 2025

Pahalgam Terror Attack Switzerlands Condemnation And Call For Peace

May 22, 2025 -

Diversification A Moncoutant Sur Sevre L Heritage De Clisson

May 22, 2025

Diversification A Moncoutant Sur Sevre L Heritage De Clisson

May 22, 2025 -

Racial Hatred Tweet Ex Tory Councillors Wifes Appeal Delayed

May 22, 2025

Racial Hatred Tweet Ex Tory Councillors Wifes Appeal Delayed

May 22, 2025 -

Aims Group And World Trading Tournament Wtt Announce Official Partnership

May 22, 2025

Aims Group And World Trading Tournament Wtt Announce Official Partnership

May 22, 2025

Latest Posts

-

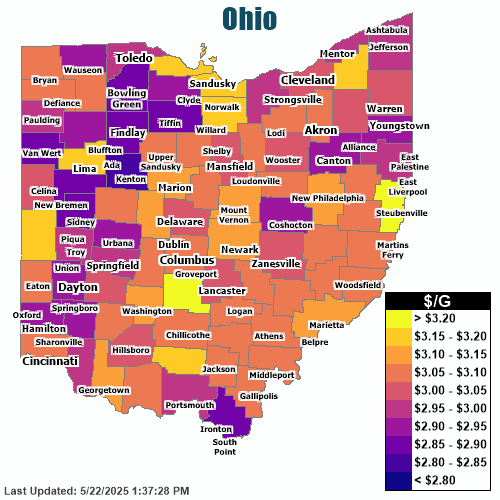

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025 -

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025 -

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025 -

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025 -

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025