Significant Increase In Gas Prices: Up Nearly 20 Cents Per Gallon

Table of Contents

Reasons Behind the Significant Gas Price Increase

Several interconnected factors contribute to this substantial gas price increase. Understanding these underlying causes is crucial to navigating the current economic climate and anticipating future fuel price fluctuations.

Increased Global Demand

The global demand for oil is significantly higher than anticipated, putting immense pressure on prices. This increased demand stems from several key factors:

- Rising global economic activity: As economies recover from the pandemic, the demand for energy, including gasoline, has surged. This increased economic activity translates directly into higher fuel consumption.

- Post-pandemic recovery: Increased travel, both domestic and international, has boosted the demand for gasoline and other petroleum products. More people are driving, flying, and shipping goods, leading to a sharp increase in oil consumption.

- Increased travel: The resurgence in tourism and business travel has significantly impacted oil consumption worldwide.

According to the International Energy Agency (IEA), global oil demand reached [Insert Statistic on Oil Consumption] barrels per day in [Insert Month/Year], exceeding pre-pandemic levels. Regions like Asia, particularly China and India, are experiencing strong economic growth, further driving up global oil consumption.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical events play a significant role in shaping global oil supply and, subsequently, gas prices. Uncertainties in various regions cause disruptions to the flow of oil, leading to price volatility.

- [Specific Geopolitical Event 1]: [Explain the impact of this event on oil production and distribution. Example: The ongoing conflict in [Country] has significantly disrupted oil exports, reducing the global supply and impacting prices.]

- [Specific Geopolitical Event 2]: [Explain the impact of this event on oil production and distribution. Example: Sanctions imposed on [Country] have limited its oil exports, further tightening the global supply.]

- OPEC+ Influence: The Organization of the Petroleum Exporting Countries (OPEC+) plays a crucial role in influencing global oil production and prices through its production quotas and agreements. Changes in these quotas can significantly impact the global supply and, consequently, gas prices.

These geopolitical factors create uncertainty in the oil market, leading to speculative trading and price increases.

Refinery Capacity Constraints

Reduced refinery capacity contributes significantly to gas price hikes. Several factors are at play:

- Refinery maintenance: Scheduled and unscheduled maintenance at refineries can temporarily reduce their output capacity, impacting the available supply of gasoline.

- Refinery closures: The closure of some refineries due to various reasons (economic, environmental, etc.) further limits the refining capacity, leading to higher prices.

- Limited capacity expansions: The lack of significant investments in new refinery capacity in recent years has constrained the ability to meet the growing demand for gasoline.

These capacity constraints exacerbate the impact of increased demand and geopolitical instability, leading to higher prices at the pump.

Impact of the Gas Price Increase on Consumers and the Economy

The significant increase in gas prices has a ripple effect across the entire economy, impacting consumers and businesses alike.

Increased Transportation Costs

Higher gas prices directly translate to increased transportation costs for both individuals and businesses.

- Increased commuting costs: Individuals face higher commuting expenses, reducing disposable income and potentially impacting their spending habits.

- Higher shipping costs: Businesses face increased costs for transporting goods, which can lead to higher prices for consumers.

- Impact on logistics industries: The logistics sector, heavily reliant on fuel, experiences significant cost pressures, impacting their profitability and potentially causing delays in shipping.

This increase in transportation costs contributes significantly to the inflationary pressure throughout the economy.

Inflationary Pressure

The rise in gas prices is a significant contributor to overall inflation. The increased cost of transportation affects the prices of almost all goods and services.

- Increased prices of goods and services: Higher transportation costs are passed on to consumers through increased prices for groceries, clothing, and other essential goods and services.

- Impact on consumer spending: Higher prices reduce consumer purchasing power, potentially slowing down economic growth.

- Correlation with inflation rates: Data shows a strong correlation between rising gas prices and higher inflation rates.

Government Response and Potential Solutions

Governments are exploring various measures to mitigate the impact of the gas price increase.

- Government subsidies: Some governments may offer subsidies to reduce the burden on consumers.

- Tax breaks: Temporary tax cuts on gasoline can provide some relief.

- Investment in renewable energy: Long-term solutions involve investing in renewable energy sources to reduce dependence on fossil fuels.

- Strategic oil reserves: Releasing strategic oil reserves can temporarily increase the supply and ease price pressures.

However, the effectiveness of these measures varies, and long-term solutions are crucial to address the underlying issue of fuel price volatility.

Conclusion

The significant increase in gas prices is a result of a complex interplay of factors, including increased global demand, geopolitical instability, and refinery capacity constraints. This surge in fuel prices has a substantial impact on consumers, businesses, and the overall economy, leading to higher transportation costs and contributing to inflationary pressures. To mitigate the impact, consumers should monitor gas price trends and explore fuel-efficient alternatives, such as carpooling, public transportation, and fuel-efficient vehicles. Understanding gas price fluctuations and preparing for potential future gas price increases are crucial in today's economic climate. Stay informed and adapt your strategies to navigate this challenging period.

Featured Posts

-

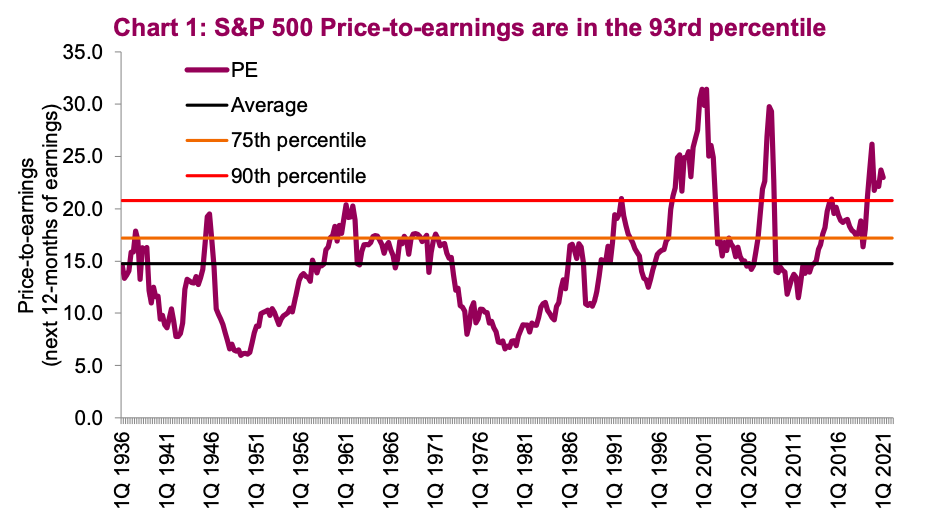

Understanding Stock Market Valuations Bof As Perspective For Investors

May 22, 2025

Understanding Stock Market Valuations Bof As Perspective For Investors

May 22, 2025 -

Sydney Sweeney Life After The Housemaid And Echo Valley

May 22, 2025

Sydney Sweeney Life After The Housemaid And Echo Valley

May 22, 2025 -

Groeiend Autobezit Stuwt Occasionverkoop Bij Abn Amro

May 22, 2025

Groeiend Autobezit Stuwt Occasionverkoop Bij Abn Amro

May 22, 2025 -

Is Ai Mode The Future Of Google Search A Deep Dive

May 22, 2025

Is Ai Mode The Future Of Google Search A Deep Dive

May 22, 2025 -

Confirmation John Lithgow And Jimmy Smits Back For Dexter Resurrection

May 22, 2025

Confirmation John Lithgow And Jimmy Smits Back For Dexter Resurrection

May 22, 2025

Latest Posts

-

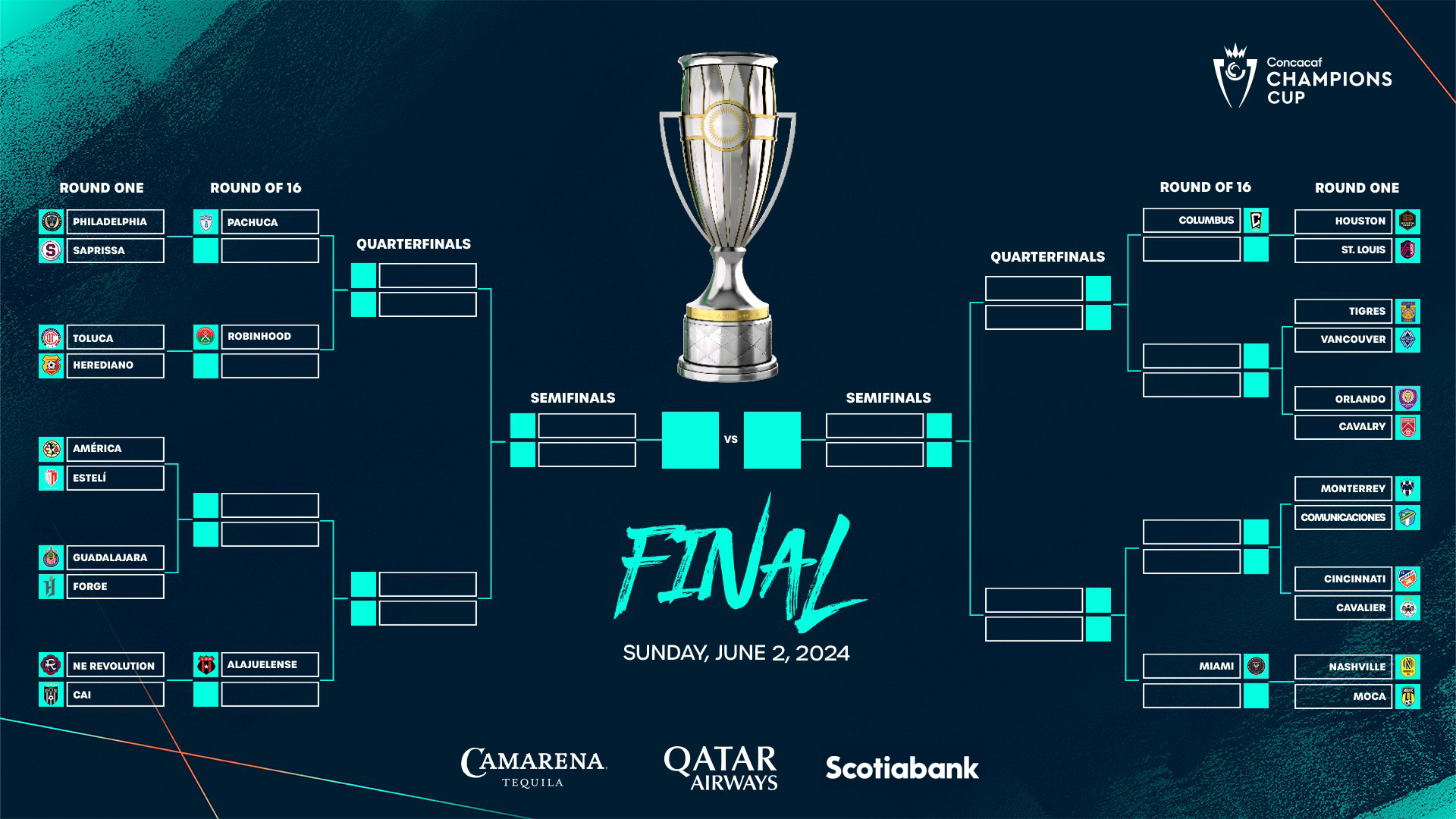

Los Memes Mas Chistosos Del Canada Vs Mexico En La Liga De Naciones Concacaf

May 22, 2025

Los Memes Mas Chistosos Del Canada Vs Mexico En La Liga De Naciones Concacaf

May 22, 2025 -

Liga De Naciones Concacaf Diversion Garantizada Con Los Memes De Canada Vs Mexico

May 22, 2025

Liga De Naciones Concacaf Diversion Garantizada Con Los Memes De Canada Vs Mexico

May 22, 2025 -

Canada Vs Mexico Los Memes Mas Epicos De La Liga De Naciones Concacaf

May 22, 2025

Canada Vs Mexico Los Memes Mas Epicos De La Liga De Naciones Concacaf

May 22, 2025 -

Memes Canada Vs Mexico Liga De Naciones Concacaf Los Mas Graciosos

May 22, 2025

Memes Canada Vs Mexico Liga De Naciones Concacaf Los Mas Graciosos

May 22, 2025 -

Los Mejores Memes Canada Vs Mexico Liga De Naciones Concacaf

May 22, 2025

Los Mejores Memes Canada Vs Mexico Liga De Naciones Concacaf

May 22, 2025