Should You Invest In Palantir Stock Today? A Detailed Look At PLTR

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates primarily through two platforms: Gotham and Foundry. Gotham caters to government agencies, providing them with advanced data analytics capabilities for intelligence, defense, and security applications. Foundry, on the other hand, serves commercial clients, offering a platform for data integration, analysis, and decision-making across various industries. Palantir's revenue model is primarily subscription-based, with additional revenue generated from professional services, including consulting and implementation support. This blend creates a recurring revenue stream that contributes to the overall stability of the company.

Palantir's client base includes a mix of government agencies and large corporations, with a significant portion of its revenue historically coming from government contracts. This reliance on government contracts is a double-edged sword, as we'll discuss later.

- Key government contracts and their impact on revenue: Large, long-term contracts with agencies like the CIA and other intelligence communities have been crucial to Palantir's historical growth. However, the renewal of these contracts and the securing of new ones are important factors to consider.

- Growth in commercial sector adoption: Palantir is actively pursuing growth in the commercial sector, aiming to diversify its revenue streams and reduce reliance on government contracts. Success in this area will be critical for long-term growth.

- Recurring revenue streams and their sustainability: The subscription-based nature of Palantir's offerings ensures a predictable flow of revenue. However, maintaining customer retention and securing new subscriptions will be vital for sustaining these streams.

- Potential for new revenue streams (e.g., expansion into new markets): Palantir continues to explore new markets and applications for its technology, which could lead to significant revenue growth in the future. This includes expanding into areas like healthcare and finance.

Financial Performance and Growth Prospects

Analyzing Palantir's financial performance requires looking at key metrics like revenue, earnings, profitability, and valuation. While Palantir has shown significant year-over-year revenue growth in recent years, profitability remains a key focus for the company. Its valuation is also a subject of considerable debate, with some analysts pointing to its high growth potential while others express concerns about its current valuation relative to its earnings.

- Year-over-year revenue growth: Tracking this metric provides a clear picture of Palantir's overall performance and growth trajectory.

- Profitability margins and their trajectory: The improvement (or lack thereof) in profitability margins indicates the company's efficiency and ability to translate revenue into profit.

- Debt levels and financial health: Analyzing Palantir's debt levels gives an understanding of its financial stability and risk profile.

- Analyst ratings and price targets: A review of analyst ratings and price targets provides insights into market sentiment and future expectations for the PLTR stock price.

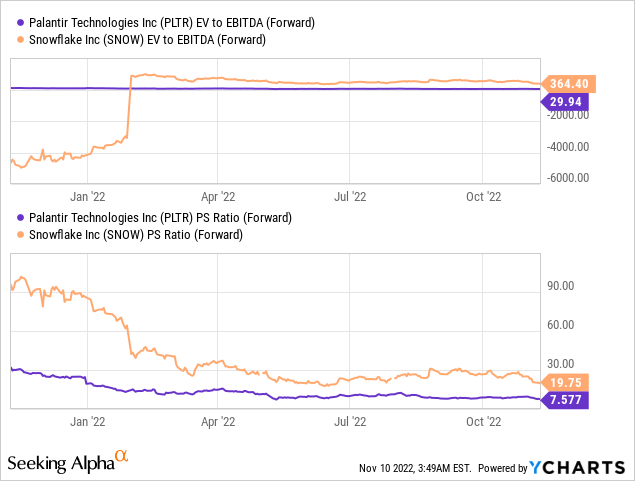

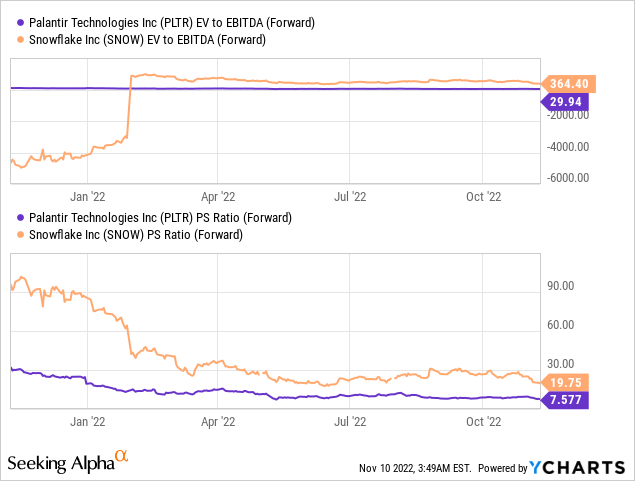

- Comparison to competitors in the big data analytics market: Comparing Palantir's performance and valuation to competitors like Databricks and Snowflake helps to establish a benchmark and identify potential strengths and weaknesses.

Risks and Challenges Facing Palantir

Investing in Palantir stock (PLTR stock) carries several inherent risks. Understanding these risks is crucial for any potential investor.

- Dependence on government contracts: A significant portion of Palantir's revenue comes from government contracts, making the company susceptible to changes in government spending and procurement policies.

- Competition from established tech giants: Palantir faces stiff competition from established tech giants like Microsoft, Google, and Amazon, which have significant resources and established market positions in the data analytics space.

- Data security and privacy concerns: As a company dealing with sensitive data, Palantir faces ongoing challenges related to data security and privacy, which can impact its reputation and future business opportunities.

- Potential for changes in government regulations: Changes in government regulations concerning data privacy and security could significantly impact Palantir's operations and revenue streams.

- Economic downturn impact: In times of economic downturn, both government and commercial clients may reduce spending on data analytics software, negatively affecting Palantir's revenue.

Should You Invest in Palantir Stock? A Balanced Perspective

The decision of whether to invest in Palantir stock requires careful consideration of the potential benefits and risks.

- Pros of investing in PLTR: Palantir possesses strong technology, operates in a large and growing market (big data analytics), and has shown impressive revenue growth. Its future potential is significant, particularly as it expands its commercial client base.

- Cons of investing in PLTR: Concerns remain about its valuation, dependence on government contracts, and the competitive landscape it operates within. The company’s path to consistent profitability is also a significant consideration.

- Consideration for risk tolerance and investment goals: Potential investors should carefully assess their risk tolerance and investment goals before making any decisions about investing in Palantir stock. This isn't a low-risk investment.

Conclusion: Making Your Decision on Palantir Stock (PLTR)

Palantir Technologies presents a compelling but complex investment opportunity. While its innovative technology and large addressable market offer significant growth potential, risks related to government contract dependence, competition, and valuation must be carefully considered. The analysis suggests a cautious approach. Before investing in Palantir stock (PLTR), conduct your own thorough due diligence. Consider your risk tolerance and investment goals. Learn more about Palantir Technologies and its future prospects. Remember, this information is for educational purposes only and does not constitute financial advice. Always seek professional guidance before making any investment decisions related to Palantir stock, PLTR stock, or any other security.

Featured Posts

-

Liga Chempionov 2024 2025 Prognoz Na Polufinaly I Final Raspisanie I Tv Translyatsii

May 09, 2025

Liga Chempionov 2024 2025 Prognoz Na Polufinaly I Final Raspisanie I Tv Translyatsii

May 09, 2025 -

Municipales 2026 A Dijon Les Ecologistes Preparent Leur Strategie

May 09, 2025

Municipales 2026 A Dijon Les Ecologistes Preparent Leur Strategie

May 09, 2025 -

Olly Murs To Headline Music Festival At A Beautiful Castle Near Manchester

May 09, 2025

Olly Murs To Headline Music Festival At A Beautiful Castle Near Manchester

May 09, 2025 -

Predicting Future Stock Performance Will These 2 Stocks Beat Palantir In 3 Years

May 09, 2025

Predicting Future Stock Performance Will These 2 Stocks Beat Palantir In 3 Years

May 09, 2025 -

Western Manitoba Under Snowfall Warning Heavy Snow Expected

May 09, 2025

Western Manitoba Under Snowfall Warning Heavy Snow Expected

May 09, 2025