Predicting Future Stock Performance: Will These 2 Stocks Beat Palantir In 3 Years?

Table of Contents

Understanding Palantir's Current Market Position and Future Projections

Palantir, a prominent player in big data analytics and government contracting, enjoys a strong market position. However, predicting its future requires careful consideration of its strengths and weaknesses.

Palantir's Strengths:

- Revenue Growth: Palantir has shown consistent revenue growth, fueled by increased demand for its data analytics platforms.

- Market Share: The company holds a significant market share in the government and commercial sectors, particularly in data analytics for national security and intelligence.

- Key Partnerships: Strategic partnerships with leading technology companies and government agencies provide access to valuable resources and expanding markets.

- Technological Innovation: Palantir continuously invests in research and development, ensuring its technology remains at the forefront of the industry.

- Expansion into New Sectors: The company is actively expanding into new sectors, aiming to diversify its revenue streams and reduce dependence on any single market.

Palantir's Weaknesses and Risks:

- Competition from Established Tech Giants: Intense competition from established tech giants like Amazon Web Services and Microsoft Azure poses a significant challenge.

- Regulatory Hurdles: Navigating the complex regulatory landscape, particularly in government contracting, involves inherent risks and potential delays.

- Potential for Slower-than-Expected Growth: The rapid growth experienced in recent years may not be sustainable, leading to potential disappointment for investors.

Stock #1: Snowflake – A Deep Dive into its Potential

Snowflake, a cloud-based data warehousing and analytics company, presents a compelling alternative.

Snowflake's Business Model and Competitive Landscape:

- Key Products/Services: Snowflake provides a cloud-based data warehouse offering scalability, security, and ease of use.

- Market Share: Snowflake is rapidly gaining market share in the cloud data warehousing market, benefiting from the shift towards cloud-based solutions.

- Growth Strategy: Snowflake's aggressive growth strategy focuses on expanding its customer base, developing new features, and leveraging strategic partnerships.

- Financial Performance: Snowflake's financial performance has demonstrated impressive revenue growth and increasing profitability.

Snowflake's Growth Prospects and Outperformance Potential:

- Projected Revenue Growth: Analysts predict continued strong revenue growth for Snowflake, driven by increasing cloud adoption and demand for data analytics solutions.

- Market Expansion: Snowflake is expanding its reach into various industries and geographical markets, offering significant growth potential.

- Technological Innovation: The company invests significantly in R&D, staying ahead of competitors in terms of technology and functionality.

- Management Team: Snowflake boasts a strong and experienced management team with a proven track record in the technology sector.

Risks and Challenges for Snowflake:

- Competition: Competition from established cloud providers like AWS, Azure, and Google Cloud Platform remains fierce.

- Economic Downturn Impact: An economic slowdown could potentially reduce demand for cloud-based solutions, impacting Snowflake's growth.

Stock #2: CrowdStrike – Another Contender for Outperformance

CrowdStrike, a cybersecurity company specializing in endpoint protection, offers another potential contender.

CrowdStrike's Business Model and Competitive Landscape:

- Key Products/Services: CrowdStrike provides cloud-based endpoint protection, threat intelligence, and incident response services.

- Market Share: CrowdStrike is rapidly gaining market share in the cybersecurity market, fueled by the increasing demand for robust security solutions.

- Growth Strategy: CrowdStrike's growth strategy emphasizes expanding its product offerings, targeting new customer segments, and leveraging strategic partnerships.

- Financial Performance: The company's financial performance demonstrates solid revenue growth and improving profitability.

CrowdStrike's Growth Prospects and Outperformance Potential:

- Projected Revenue Growth: Analysts project continued strong revenue growth for CrowdStrike, driven by increasing demand for cybersecurity services.

- Market Expansion: CrowdStrike is expanding into new markets and geographic regions, targeting both large enterprises and small and medium-sized businesses (SMBs).

- Technological Innovation: The company invests heavily in R&D to maintain its leading position in the cybersecurity landscape.

- Management Team: CrowdStrike's leadership team comprises experienced professionals with a proven track record in the cybersecurity industry.

Risks and Challenges for CrowdStrike:

- Competition: Competition from established cybersecurity vendors like Symantec and McAfee remains intense.

- Evolving Threat Landscape: The ever-evolving cybersecurity threat landscape necessitates constant adaptation and innovation, posing a significant challenge.

Comparative Analysis: Snowflake vs. CrowdStrike vs. Palantir

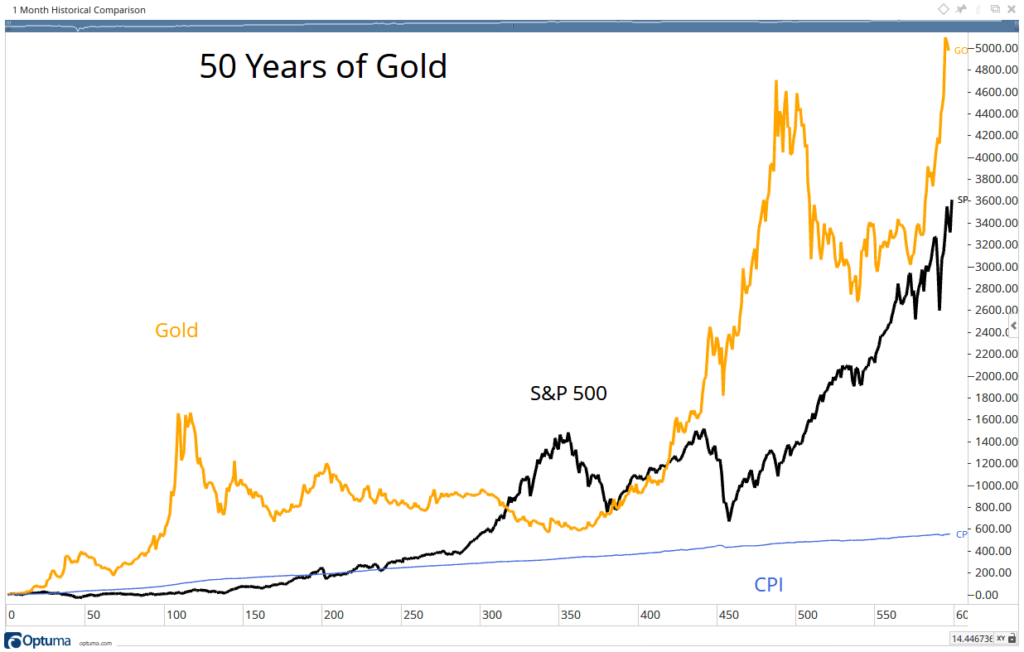

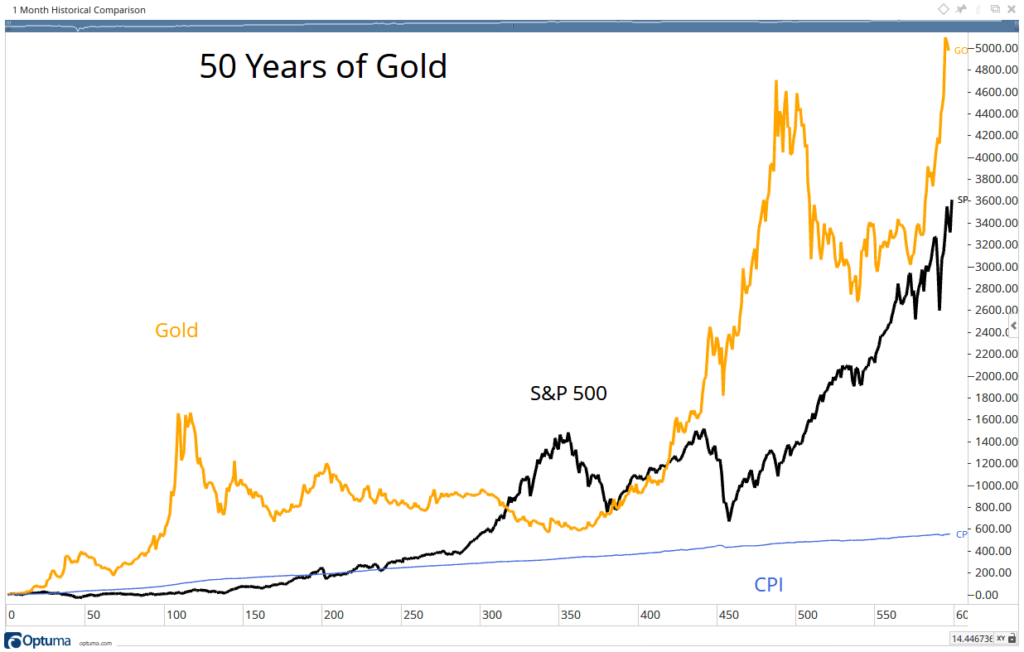

A detailed comparison of key financial metrics, revenue growth projections, and market valuations is crucial. Visualizations such as charts and graphs will provide a clear picture of each company's relative strengths and weaknesses. A summary table highlighting key strengths and weaknesses will help investors compare these three stocks. (Note: Due to the dynamic nature of the stock market, specific numerical data would need to be added here based on current market information.)

Conclusion

Predicting future stock performance is inherently complex. While Snowflake and CrowdStrike present strong potential for growth and may even surpass Palantir's performance over the next three years, several factors could influence their trajectory. Thorough due diligence, careful consideration of risks, and a diversified investment strategy are crucial. This analysis offers a starting point, but it's imperative to conduct your own in-depth research before making any investment decisions. Remember, the art of predicting future stock performance demands constant monitoring and adaptation. Consider consulting a financial advisor for personalized guidance.

Featured Posts

-

Wireless Mesh Network Market To Expand At A 9 8 Cagr Market Size And Trends

May 09, 2025

Wireless Mesh Network Market To Expand At A 9 8 Cagr Market Size And Trends

May 09, 2025 -

Fast Flying Farce Takes Flight At St Albert Dinner Theatre

May 09, 2025

Fast Flying Farce Takes Flight At St Albert Dinner Theatre

May 09, 2025 -

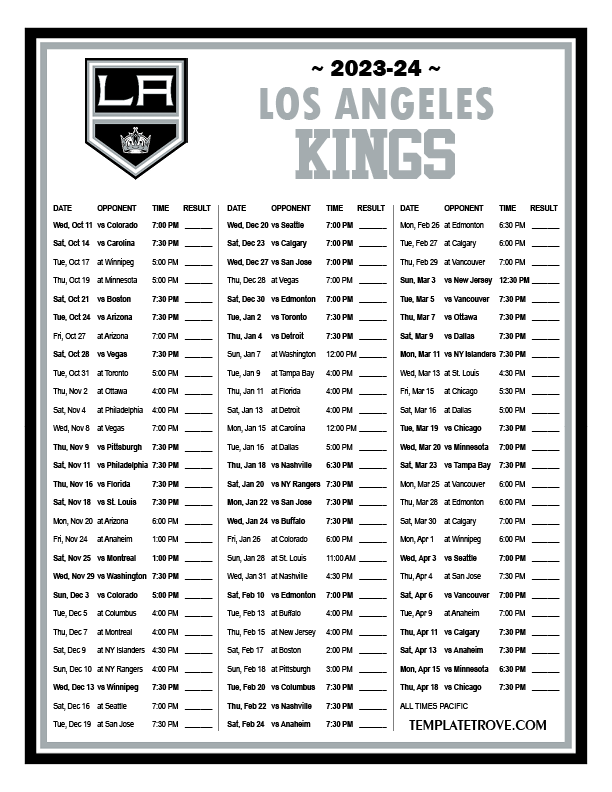

Edmonton Oilers Projected To Win Against Los Angeles Kings A Betting Analysis

May 09, 2025

Edmonton Oilers Projected To Win Against Los Angeles Kings A Betting Analysis

May 09, 2025 -

Inter Milan Target Matthijs De Ligt Loan With Option To Buy

May 09, 2025

Inter Milan Target Matthijs De Ligt Loan With Option To Buy

May 09, 2025 -

Stivn King Na Netflix Ochakvan Rimeyk

May 09, 2025

Stivn King Na Netflix Ochakvan Rimeyk

May 09, 2025