Should You Invest In Palantir Stock Before May 5th? Analysis And Predictions

Table of Contents

Palantir's Recent Performance and Financial Health

Understanding Palantir's recent financial performance is crucial for any investment decision. Examining key metrics provides a clearer picture of its current financial health and potential for future growth.

Revenue Growth and Profitability

Palantir's recent financial reports reveal a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus. Analyzing year-over-year growth, profitability trends, and changes in operating margins is vital.

- Year-over-Year Growth: Examine the percentage increase in revenue from one year to the next. Consistent, strong growth indicates a healthy and expanding business.

- Profitability Trends: Assess the trends in net income and operating margins. Are they improving, declining, or remaining stagnant? This reveals the company's ability to translate revenue into profit.

- Significant Changes: Note any significant changes in financial performance, such as unexpected jumps or drops. Investigating the reasons behind these changes is crucial for a comprehensive analysis. Analyzing Palantir financials requires considering all these factors to understand the overall picture.

Key Contracts and Government Partnerships

Palantir's substantial government contracts and partnerships are a significant driver of its revenue. These relationships provide stability and long-term growth potential. Analyzing the details of these partnerships helps understand future revenue streams.

- Important Clients and Contracts: Identifying Palantir's key clients, particularly government agencies, and understanding the terms of their contracts is critical. Long-term contracts provide revenue predictability.

- Long-Term Implications: Assess the long-term implications of these partnerships. Are these contracts renewable? Do they lead to further opportunities? This provides insight into the sustainable nature of Palantir's revenue streams. Understanding Palantir clients and the nature of their partnership agreements is essential for evaluating the stability of the business.

Market Analysis and Future Predictions

Analyzing market trends and future predictions is critical for assessing the potential return on a Palantir investment. Understanding the competitive landscape and considering analyst opinions helps determine the risks and rewards.

Industry Trends and Competition

Palantir operates in the rapidly evolving big data analytics and government technology sectors. Analyzing industry trends and competition is paramount.

- Key Competitors: Identify Palantir's main competitors and assess their strengths and weaknesses. This analysis will help determine Palantir's competitive advantage.

- Emerging Technologies: Evaluate emerging technologies and their potential impact on Palantir's business model. Are there disruptive technologies that could threaten Palantir's position?

- Potential Threats: Identify potential threats to Palantir's growth, such as increased competition or regulatory changes. Assessing these threats helps gauge the risk associated with investing in Palantir stock. Understanding the competitive landscape of the big data analytics and government technology sectors is crucial for evaluating the long-term prospects of a Palantir investment.

Analyst Ratings and Price Targets

Consulting reputable financial analysts' reports provides valuable insights into market sentiment and price predictions for Palantir stock.

- Reputable Sources: Refer to reports from well-known and respected financial analysis firms.

- Consensus Among Analysts: Look for a consensus among analysts regarding Palantir's future price performance. This provides a general sense of market expectations.

- Price Targets: Note the various price targets set by analysts. These provide a range of potential outcomes for Palantir's stock price. Examining analyst ratings and price targets provides a valuable perspective on market expectations for Palantir stock.

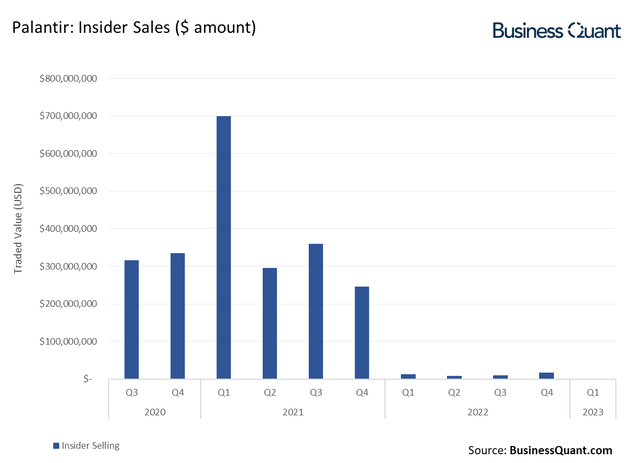

Potential Risks and Uncertainties

Investing in Palantir stock, like any investment, carries inherent risks. Identifying these risks is crucial for making informed decisions.

- Market Volatility: Palantir's stock price can be volatile, subject to market fluctuations and broader economic conditions.

- Competition: Increased competition from other companies offering similar services could impact Palantir's market share and profitability.

- Dependence on Government Contracts: Palantir's reliance on government contracts exposes it to potential risks associated with changes in government policy or budget cuts. A thorough Palantir risk assessment is crucial before investing.

Factors to Consider Before Investing in Palantir Stock Before May 5th

Before committing to a Palantir investment, carefully consider your personal financial situation and investment goals.

Your Investment Goals and Risk Tolerance

Aligning investment decisions with your personal financial goals and risk tolerance is paramount.

- Investment Strategies: Consider whether a short-term or long-term investment strategy aligns best with your objectives.

- Risk Profiles: Understand your personal risk tolerance and choose investments accordingly. Palantir, given its growth potential and inherent risks, may not be suitable for all investors. Choosing an appropriate investment strategy and understanding your risk tolerance are crucial for making informed investment decisions.

Diversification and Portfolio Management

Diversification is key to mitigating risk in any investment portfolio.

- Balanced Portfolio: Consider how Palantir fits into a well-diversified portfolio. Avoid putting all your eggs in one basket.

- Asset Allocation: Ensure that your investment strategy includes a balanced allocation of assets across various sectors to reduce overall risk. Proper portfolio diversification is essential for mitigating investment risks.

Conclusion: Should You Invest in Palantir Stock Before May 5th? A Final Verdict

Whether or not to invest in Palantir stock before May 5th depends on a thorough assessment of its financial health, market position, and your personal risk tolerance. While Palantir exhibits significant growth potential, particularly in its government partnerships and big data analytics capabilities, it also faces risks including market volatility and competition. Remember to conduct comprehensive research and consider your investment goals and risk tolerance before making any decisions. Consult a financial advisor if needed. For more information, visit Palantir's investor relations page [link to Palantir investor relations page]. Make informed decisions regarding your Palantir stock investment before May 5th.

Featured Posts

-

Did Wynne Evanss Actions Lead To Katya Jones Quitting Strictly

May 09, 2025

Did Wynne Evanss Actions Lead To Katya Jones Quitting Strictly

May 09, 2025 -

Crise A La Cite De La Gastronomie De Dijon Le Point De Vue De La Ville Concernant Epicure

May 09, 2025

Crise A La Cite De La Gastronomie De Dijon Le Point De Vue De La Ville Concernant Epicure

May 09, 2025 -

Millions Made From Office365 Hacks Executive Inboxes Targeted

May 09, 2025

Millions Made From Office365 Hacks Executive Inboxes Targeted

May 09, 2025 -

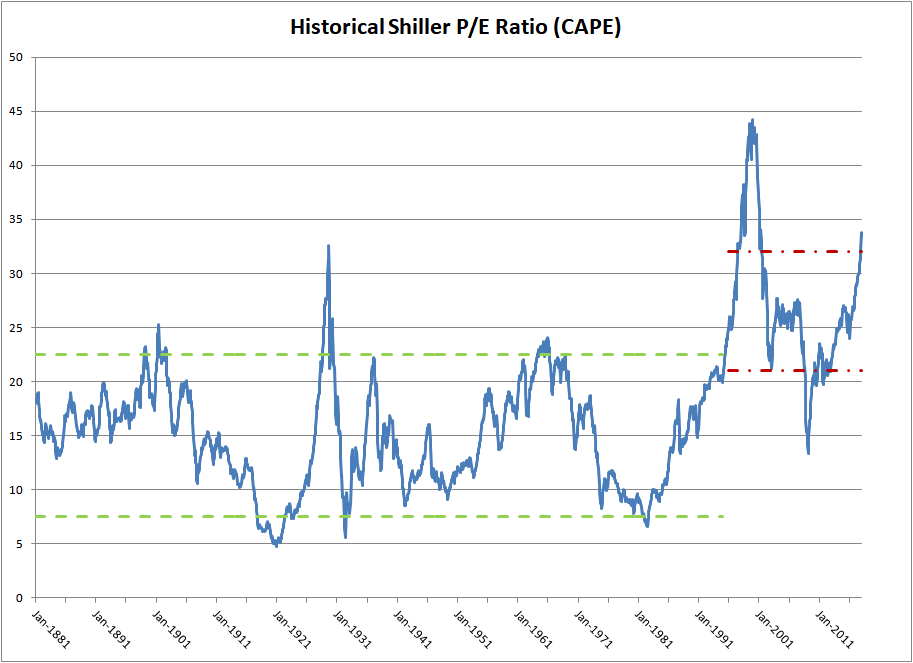

Ignoring The Noise Bof As Analysis Of Current Stock Market Valuations

May 09, 2025

Ignoring The Noise Bof As Analysis Of Current Stock Market Valuations

May 09, 2025 -

Oilers Vs Kings Expert Predictions And Betting Picks For Game 1 Of The Playoffs

May 09, 2025

Oilers Vs Kings Expert Predictions And Betting Picks For Game 1 Of The Playoffs

May 09, 2025