Ignoring The Noise: BofA's Analysis Of Current Stock Market Valuations

Table of Contents

BofA's Core Valuation Methodology

BofA employs a multi-faceted approach to valuing stocks, combining quantitative and qualitative factors. Their methodology isn't solely reliant on any single metric, instead integrating several key valuation techniques to paint a holistic picture. This robust approach to stock market analysis allows for a more nuanced understanding of market trends.

-

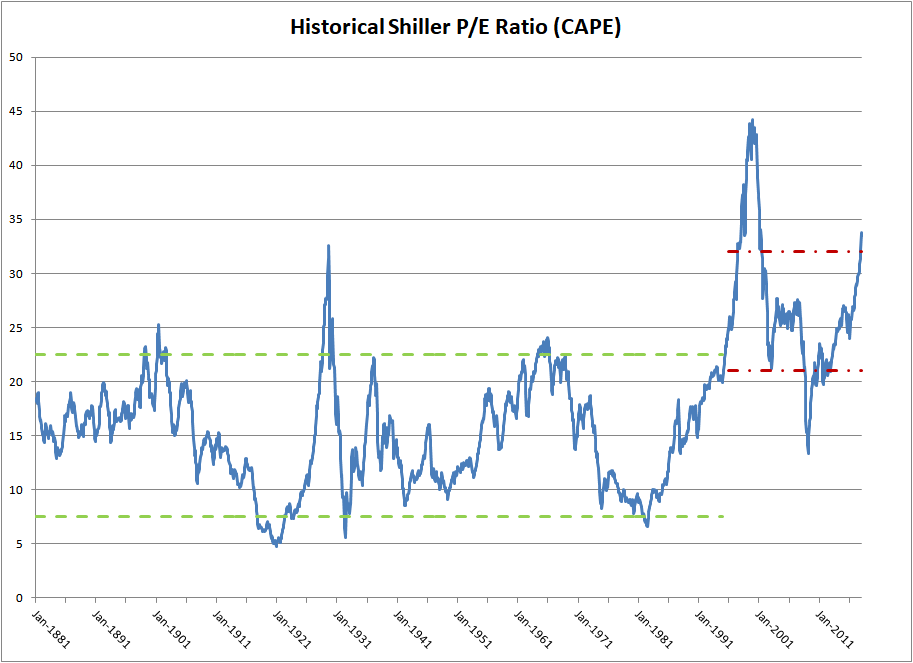

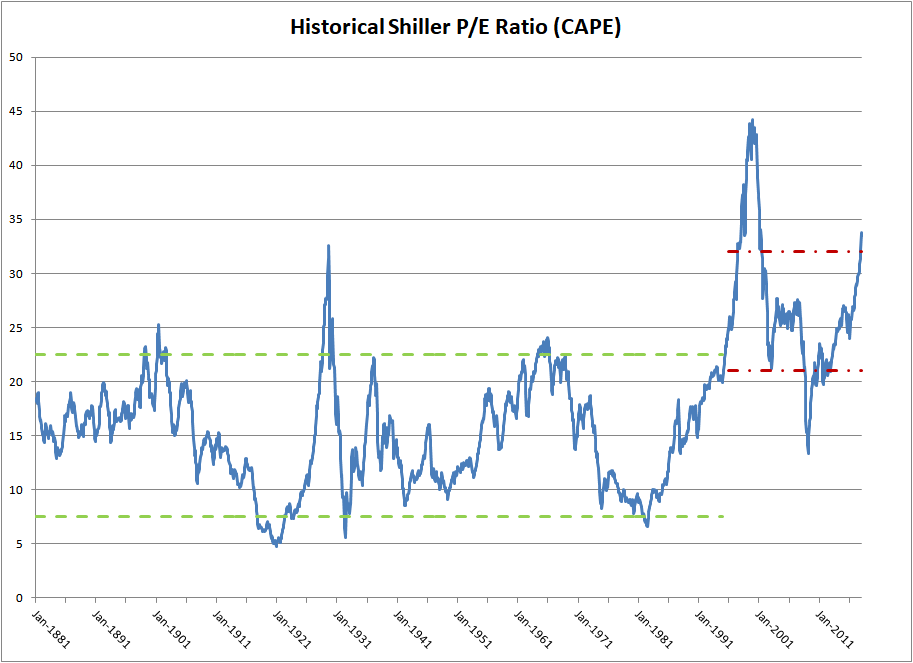

Key Metrics and their Usage: BofA utilizes a range of metrics including the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), Price-to-Book ratio (P/B), and discounted cash flow (DCF) analysis. The P/E ratio, for example, is used to compare a company's stock price to its earnings per share, providing an indication of how much investors are willing to pay for each dollar of earnings. BofA adjusts these metrics based on sector-specific factors and long-term growth prospects.

-

Unique Aspects of BofA's Model: A distinctive feature of BofA's valuation model is its incorporation of macroeconomic factors and geopolitical risks. Their analysis isn't solely focused on individual company performance; it also considers the broader economic landscape and potential disruptions. This comprehensive approach allows them to account for systemic risks that may impact valuations.

-

Adjustments for Market Conditions: BofA's models incorporate adjustments for current market conditions, such as interest rate sensitivity and inflation expectations. For instance, rising interest rates can significantly impact the present value of future cash flows, leading to adjustments in DCF valuations and overall stock market analysis. This sensitivity analysis is crucial for accurate valuation in a dynamic market.

BofA's Assessment of Current Market Overvaluation/Undervaluation

BofA's recent reports ( Note: Insert specific report date and link here if available ) offer a detailed assessment of current market valuations. (Insert BofA's overall conclusion here, e.g., "BofA concludes that the market is currently slightly overvalued, particularly in certain sectors."). This conclusion is not a blanket statement, however, and nuance is crucial.

-

Specific Sectors/Asset Classes: (Insert specific sectors BofA highlights as overvalued or undervalued, e.g., "BofA flags technology and consumer discretionary sectors as potentially overvalued, while certain energy and utility stocks appear undervalued based on their current earnings and future projections.") This granular analysis provides actionable insights for investors.

-

Supporting Data and Rationale: (Insert specific data points and reasoning used by BofA to support their conclusions, referencing specific metrics and industry trends. E.g., "Their analysis points to elevated P/E ratios in the technology sector compared to historical averages and projected earnings growth, supporting their overvaluation assessment.")

-

Comparison with Other Analysts: (Include a brief comparison with the views of other prominent analysts, if available. E.g., "This contrasts somewhat with Goldman Sachs' view, which suggests a more moderate overvaluation.") Providing context from different analysts' perspectives helps paint a more complete picture of the situation.

Key Risks and Opportunities Identified by BofA

BofA's analysis identifies several key risks and opportunities shaping current stock market valuations. Understanding these factors is essential for informed investment decisions.

-

Inflation's Impact: Persistent inflation poses a significant risk to valuations by eroding corporate profits and impacting consumer spending. BofA's analysis likely addresses the impact of inflation on discounted cash flow models and the resulting implications for stock prices.

-

Recessionary Pressures: The possibility of a recession significantly influences BofA's outlook. Their analysis likely incorporates recessionary scenarios, assessing their impact on corporate earnings and market valuations.

-

Sector-Specific Opportunities: (Mention specific sectors BofA identifies as offering potential opportunities, e.g., "BofA highlights the energy sector, which could benefit from sustained high energy prices.") This identification of opportunities requires diligent stock market analysis.

-

Geopolitical Factors: Geopolitical events, such as the war in Ukraine and rising tensions in other regions, impact market sentiment and valuations. BofA's analysis likely incorporates these external factors into their overall assessment.

Investment Implications Based on BofA's Analysis

BofA's analysis translates into several practical investment implications. These implications offer guidance, but not specific financial advice.

-

Portfolio Adjustments: Based on BofA's assessment, investors may consider adjusting their portfolios. This might involve sector rotation (shifting investments from overvalued to undervalued sectors) or altering their overall asset allocation strategy.

-

Defensive vs. Growth Strategies: Given the current economic uncertainty, BofA's analysis likely provides insights into the merits of defensive versus growth investing strategies. Defensive strategies focus on stability, while growth strategies aim for higher returns but come with increased risk.

-

Specific Investment Opportunities: (Mention specific investment opportunities highlighted by BofA, if any. This requires specific details from the BofA report.) This offers investors specific potential avenues for investing based on the analysis.

Conclusion

This analysis of BofA's perspective on current stock market valuations offers crucial insights for navigating the complex investment landscape. By understanding BofA's methodology, their assessment of market conditions, and their identification of key risks and opportunities, investors can make more informed decisions. Remember that this is just one perspective, and independent research is always recommended.

Call to Action: Stay informed about stock market valuations by regularly reviewing expert analysis, like BofA's reports, to make well-informed investment choices. Don't let the noise drown out the valuable insights that can help you manage your portfolio effectively. Further research into BofA's market analysis and other expert opinions will provide a more comprehensive understanding of current stock market valuations. Remember that BofA market analysis, while insightful, should be part of a broader research strategy for navigating the complexities of stock market valuations.

Featured Posts

-

The I Control You Moment Jack Doohan And Briatores Power Struggle On Netflix

May 09, 2025

The I Control You Moment Jack Doohan And Briatores Power Struggle On Netflix

May 09, 2025 -

Brekelmans En India Een Strategische Partnerschap

May 09, 2025

Brekelmans En India Een Strategische Partnerschap

May 09, 2025 -

The Imminent Arrival Of Young Thugs Back Outside Album

May 09, 2025

The Imminent Arrival Of Young Thugs Back Outside Album

May 09, 2025 -

110 Potential The Black Rock Etf Attracting Billionaire Investors

May 09, 2025

110 Potential The Black Rock Etf Attracting Billionaire Investors

May 09, 2025 -

Lidery Frantsii Velikobritanii Germanii I Polshi Ne Posetyat Kiev 9 Maya

May 09, 2025

Lidery Frantsii Velikobritanii Germanii I Polshi Ne Posetyat Kiev 9 Maya

May 09, 2025