Federal Reserve's Stance: A Deep Dive Into Why Rate Cuts Are Delayed

Table of Contents

Persistent Inflation as a Primary Obstacle

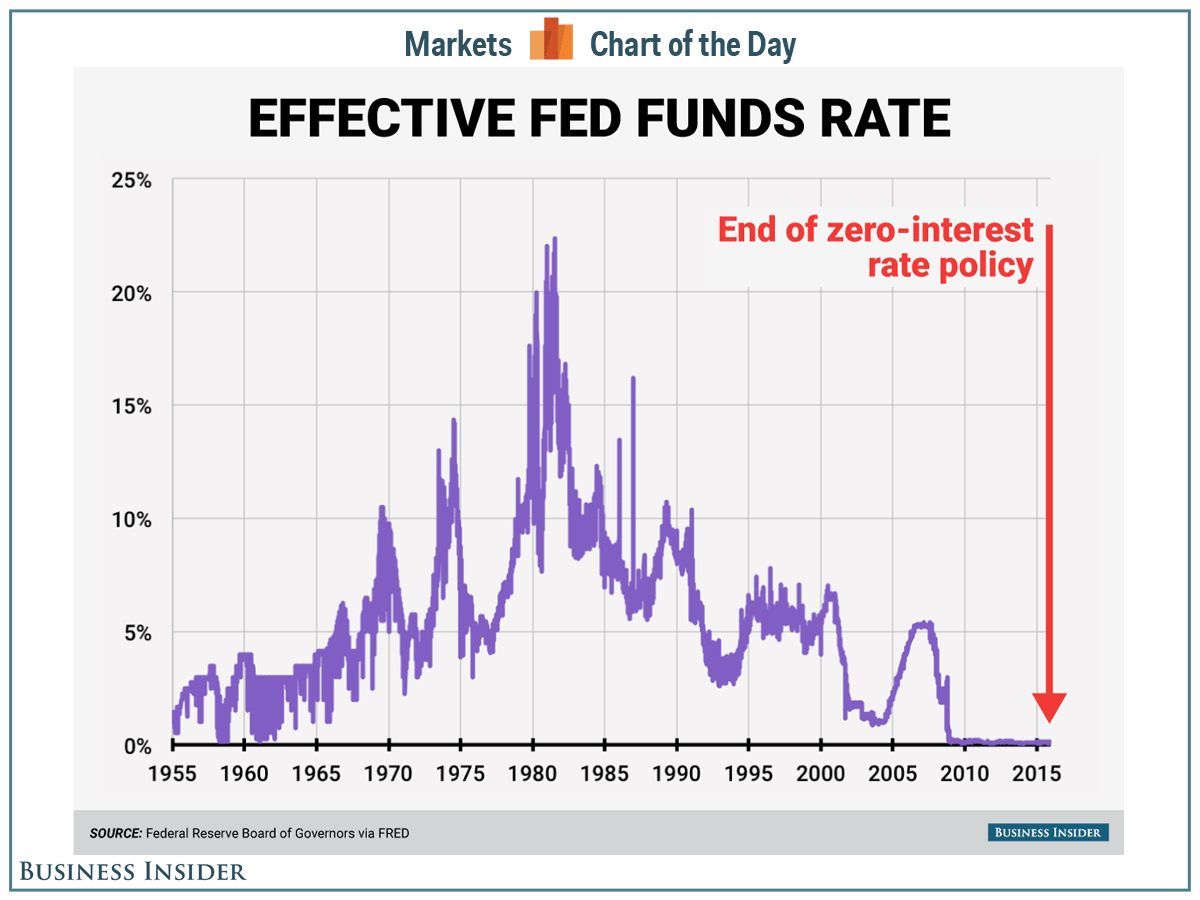

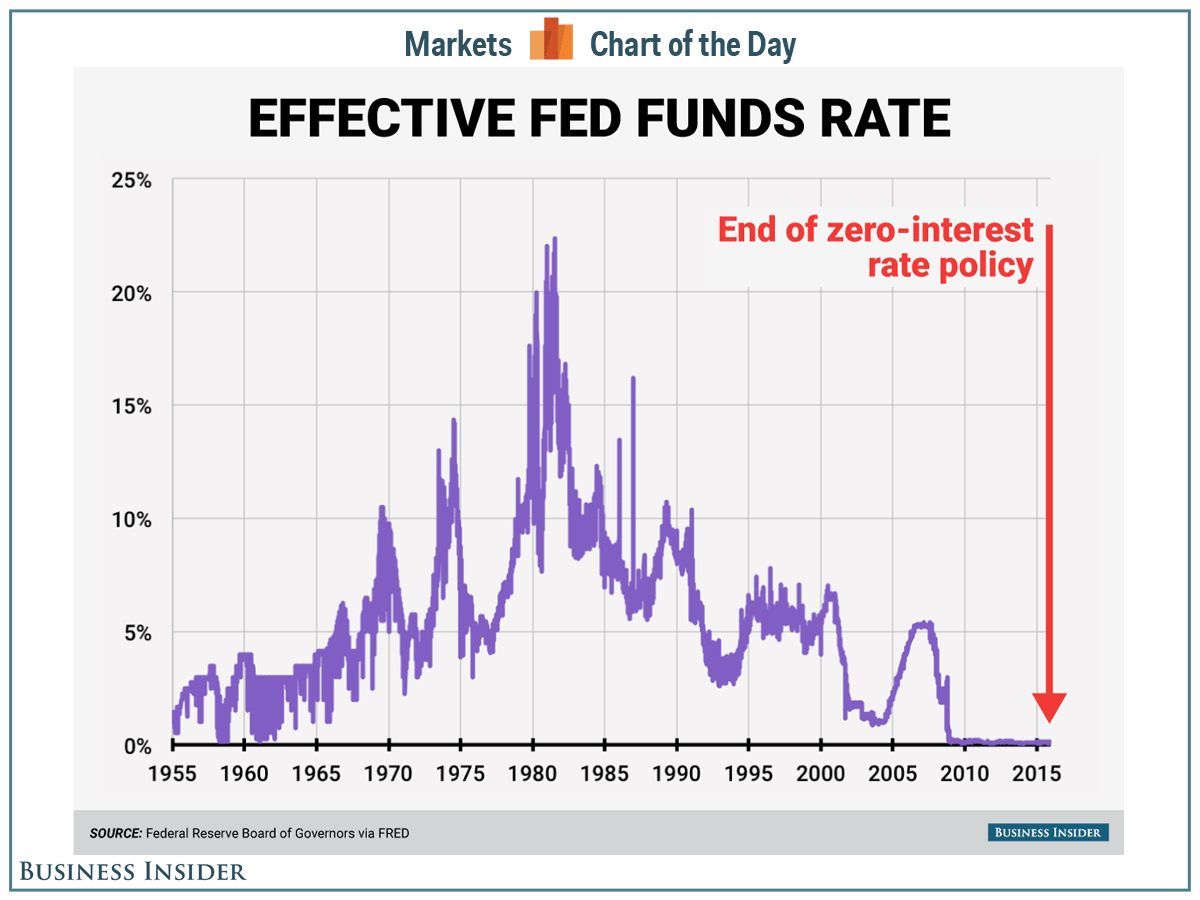

High inflation remains the primary obstacle preventing the Federal Reserve from implementing rate cuts. The ongoing challenge of bringing inflation down to the target level significantly impacts their decision-making process. The Federal Reserve’s mandate is primarily focused on price stability.

- Current Inflation Rate: The current inflation rate, as measured by the Consumer Price Index (CPI) and Producer Price Index (PPI), continues to exceed the Federal Reserve's target of 2%. This persistent inflation, even if showing signs of slowing, remains a significant concern.

- Contributing Factors: Several factors contribute to this persistent inflation, including lingering supply chain disruptions, robust wage growth, and elevated energy prices. "Sticky inflation," where prices remain high even as demand cools, is also a factor. Core inflation, which excludes volatile food and energy prices, also needs to show consistent deceleration before the Fed considers significant rate cuts.

- Cautious Approach: High inflation necessitates a cautious approach to rate cuts. Premature reductions in interest rates could reignite inflationary pressures, potentially leading to a more painful and prolonged fight against inflation later.

Strong Labor Market and Wage Growth

A robust labor market and rising wages present another challenge to the Federal Reserve's monetary policy strategy. While positive for employment, these factors also contribute to inflationary pressures.

- Unemployment Figures: The unemployment rate remains low, indicating a tight labor market. This strong employment environment empowers workers to negotiate higher wages, potentially fueling a wage-price spiral.

- Impact of Wage Growth: Significant wage growth, while a positive sign for workers, can exacerbate inflationary pressures if it outpaces productivity gains. This puts upward pressure on prices as businesses pass increased labor costs onto consumers.

- Wage-Price Spiral Risk: The Federal Reserve is closely monitoring the potential for a wage-price spiral – a self-reinforcing cycle where rising wages lead to higher prices, which in turn lead to further wage demands. Such a spiral can make inflation incredibly difficult to control.

Uncertainty Surrounding Economic Outlook

The complexities and uncertainties surrounding the future economic outlook require the Federal Reserve to proceed cautiously and assess risks carefully before adjusting interest rates.

- Recession Risk: Concerns persist about a potential economic slowdown or even a recession. The Federal Reserve must weigh the risks of triggering a recession by maintaining tight monetary policy against the risks of allowing inflation to become entrenched.

- Geopolitical Risks and Global Economic Conditions: Geopolitical events and instability in global economic conditions add further complexity to the outlook. These external factors can significantly influence inflation and economic growth, making it challenging to predict the future trajectory of the economy.

- Data-Dependent Policy: The Federal Reserve emphasizes a data-dependent policy approach. They are closely monitoring incoming economic data, including GDP growth, inflation reports, and employment figures, to inform their decisions. This careful approach highlights their commitment to making informed decisions based on the most current economic conditions.

The Importance of Data-Driven Decision Making

It is crucial to understand that the Federal Reserve's actions are not solely based on market expectations or political pressures. Instead, their decisions are driven by a rigorous analysis of incoming economic data. This data-driven approach ensures that monetary policy is tailored to the specific circumstances of the economy.

Potential Future Scenarios and Timing of Rate Cuts

Several scenarios could trigger a shift in the Federal Reserve's stance and lead to rate cuts.

- Conditions for a Shift: A sustained decline in inflation, particularly in core inflation, coupled with signs of weakening economic growth, could lead the Federal Reserve to ease monetary policy. A significant increase in unemployment might also prompt a shift.

- Potential Timelines: The timing of rate cuts remains uncertain, varying depending on the pace of inflation decline and the overall economic outlook. Some predict rate cuts towards the end of 2024 or even into 2025, while others believe a shift could occur earlier, depending on the data.

- Gradual vs. Aggressive Cuts: The Federal Reserve might opt for gradual rate cuts to carefully assess the impact of each adjustment on the economy. However, depending on the severity of a potential economic downturn, more aggressive rate cuts could be considered.

Conclusion: Understanding the Federal Reserve's Stance on Delayed Rate Cuts

In summary, the delay in rate cuts stems from the persistent challenge of high inflation, the strength of the labor market, and significant uncertainty surrounding the future economic outlook. The Federal Reserve's data-driven approach underscores their commitment to price stability and their careful consideration of all relevant economic factors. They are prioritizing a measured response to avoid exacerbating existing challenges.

To stay informed about the Federal Reserve's policy decisions and their impact on interest rates, it's vital to follow the Federal Reserve's official website and reputable financial news sources for updates. Closely monitoring key economic indicators will allow you to better understand the Federal Reserve's stance and future interest rate decisions and the evolving landscape of monetary policy updates. Understanding the Federal Reserve policy is crucial for navigating the complexities of the current economic climate.

Featured Posts

-

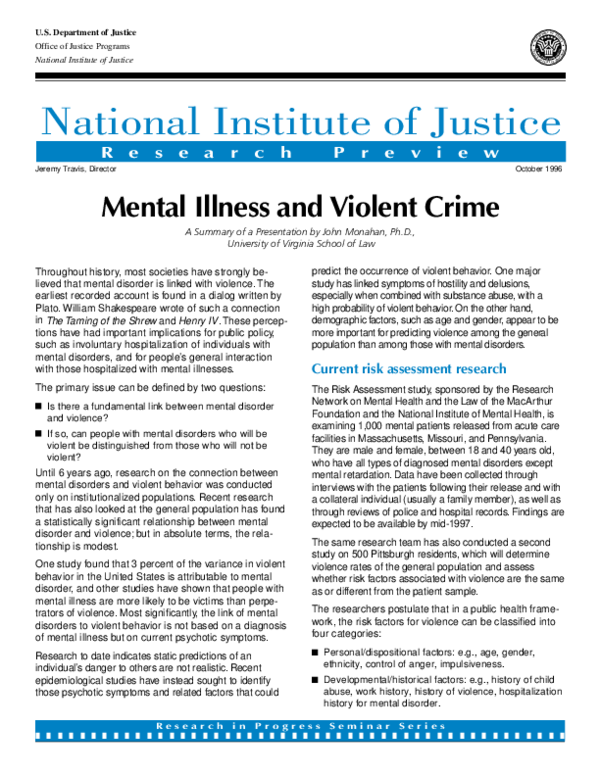

Reframing The Narrative Mental Illness And Violent Crime

May 10, 2025

Reframing The Narrative Mental Illness And Violent Crime

May 10, 2025 -

Unprovoked Racist Attack Woman Stabs Man To Death

May 10, 2025

Unprovoked Racist Attack Woman Stabs Man To Death

May 10, 2025 -

Figmas Ai Advancements Redefining Design Workflows

May 10, 2025

Figmas Ai Advancements Redefining Design Workflows

May 10, 2025 -

Samuel Dickson A Canadian Industrialist And Lumber Baron

May 10, 2025

Samuel Dickson A Canadian Industrialist And Lumber Baron

May 10, 2025 -

Regulatory Reform Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Reform Sought By Indian Insurers For Bond Forwards

May 10, 2025