Should I Buy Palantir Stock Now? Evaluating The 40% Growth Forecast For 2025

Table of Contents

Palantir's Current Market Position and Competitive Landscape

Palantir Technologies, a leading data analytics company, occupies a unique position in the market. Its success hinges on its ability to navigate both the government and commercial sectors.

Dominating the Government and Defense Sectors

Palantir has established itself as a major player in government and defense contracts. Its Gotham platform provides critical data integration and analysis capabilities for national security agencies worldwide.

- Key Government Clients: Numerous US government agencies, as well as international defense organizations. Specific naming requires further research and is avoided to remain impartial.

- Market Share: While precise figures are difficult to obtain due to the nature of government contracts, Palantir commands a significant share of the market for advanced data analytics solutions within the defense and intelligence sectors.

- Potential for Future Contract Wins: The ongoing need for sophisticated data analytics within national security agencies ensures a continued pipeline of potential contract wins for Palantir. The company's strong reputation and proven track record contribute to this potential.

The stability and predictability of government contracts offer a degree of security not always found in the volatile commercial market. Long-term contracts provide a solid foundation for revenue projections and financial planning for Palantir.

Expanding into the Commercial Market

While Palantir's roots lie in government contracts, its commercial ambitions are growing. Its Foundry platform aims to bring the power of its data analytics capabilities to private sector businesses.

- Key Commercial Clients: Palantir is gradually building a portfolio of clients in various industries, including finance, healthcare, and manufacturing. Again, specific names are omitted for neutrality.

- Success Stories: While specific details of commercial successes are often kept confidential, Palantir highlights case studies demonstrating the value of its platform in improving operational efficiency and driving better business decisions.

- Challenges: Penetrating the competitive commercial market is challenging. Competitors such as Databricks and Snowflake offer alternative data analytics solutions, creating a fiercely contested landscape.

- Comparative Analysis: Compared to cloud-based competitors, Palantir often emphasizes its on-premise and hybrid deployment capabilities, catering to clients with stringent data security requirements.

The success of Palantir's commercial expansion will significantly impact its overall revenue projections and is crucial to achieving the projected 40% growth.

Analyzing the 40% Growth Forecast for 2025

The 40% growth forecast for Palantir by 2025 is a bold prediction, but several factors contribute to its plausibility.

Factors Contributing to the Projected Growth

Several factors underpin the projected growth:

- Increasing Adoption of Foundry: Palantir's flagship platform, Foundry, is witnessing increased adoption across both government and commercial clients.

- Expansion into New Markets: Palantir is actively pursuing new markets, such as healthcare and finance, which represent significant growth opportunities.

- Product Innovation: Continued investment in research and development is leading to product enhancements and new offerings that cater to evolving client needs.

- Strong Revenue Growth Projections: Analyst reports suggest a positive trajectory for Palantir's revenue, supporting the 40% growth forecast.

It is crucial to acknowledge that this forecast is based on assumptions, and achieving this target is not guaranteed. Economic conditions and competitive pressures could significantly influence Palantir's actual growth.

Potential Risks and Challenges

Several challenges could impede Palantir's growth:

- Competition: Intense competition from established tech giants and agile startups could eat into Palantir's market share.

- Economic Downturns: Economic downturns could lead to reduced spending on data analytics solutions, impacting Palantir's revenue.

- Dependence on Large Contracts: Over-reliance on large government contracts creates vulnerability to contract delays or cancellations.

- Regulatory Scrutiny: Increased regulatory scrutiny could impact Palantir's operations, particularly in data privacy and security.

- Stock Market Volatility: The overall performance of the stock market can significantly influence Palantir's stock price regardless of the company's internal performance.

Understanding these potential headwinds is crucial for making an informed investment decision.

Valuation and Investment Considerations

Before considering a Palantir stock investment, it's crucial to assess its valuation and align it with your investment strategy.

Palantir Stock Price and Valuation Metrics

- Current Stock Price: The current Palantir stock price is subject to constant fluctuation and requires real-time information from financial sources.

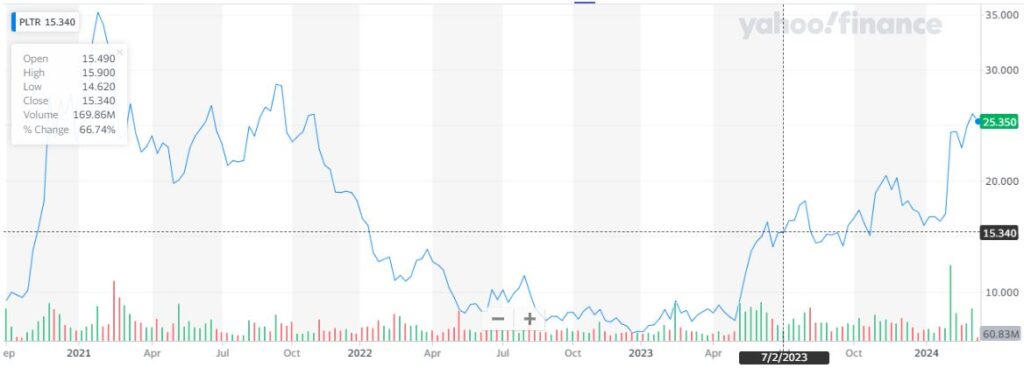

- Historical Performance: Past stock performance is not indicative of future results, but analyzing historical trends can provide context.

- P/E Ratio and Other Metrics: Evaluating Palantir's P/E ratio (Price-to-Earnings) and other relevant valuation metrics in comparison to industry peers is crucial.

- Discounted Cash Flow Analysis: A more in-depth valuation might involve discounted cash flow analysis to project future earnings and determine a fair stock price.

Determining whether Palantir is currently overvalued or undervalued requires comprehensive financial analysis.

Investment Strategies and Risk Tolerance

Palantir stock is best suited for investors with a higher risk tolerance.

- Long-Term vs. Short-Term Investment: A long-term investment horizon is generally recommended for Palantir due to its growth potential, but also inherent volatility.

- Diversification: Diversification is essential to mitigate risk. Palantir shouldn't represent a significant portion of any investment portfolio.

- Risk Assessment: Investors need to honestly assess their risk tolerance before investing in Palantir stock.

- Investment Amounts: Investment amounts should always be proportionate to individual financial situations and risk tolerance. It's never advisable to invest more than one can afford to lose.

Conclusion

The 40% growth forecast for Palantir stock by 2025 presents a compelling investment opportunity, but it's crucial to weigh the potential rewards against the inherent risks. While Palantir's strong presence in the government sector and expanding commercial reach are positive indicators, factors like competition and economic uncertainty need careful consideration. Ultimately, the decision of whether to buy Palantir stock now depends on your individual investment goals, risk tolerance, and a thorough analysis of the company's financial performance and future prospects. Conduct your own thorough research before investing and consider seeking advice from a qualified financial advisor. Remember, this article is for informational purposes only and does not constitute financial advice. Carefully consider whether investing in Palantir stock is right for you. Before making any decisions regarding your Palantir investment, always consult a financial professional.

Featured Posts

-

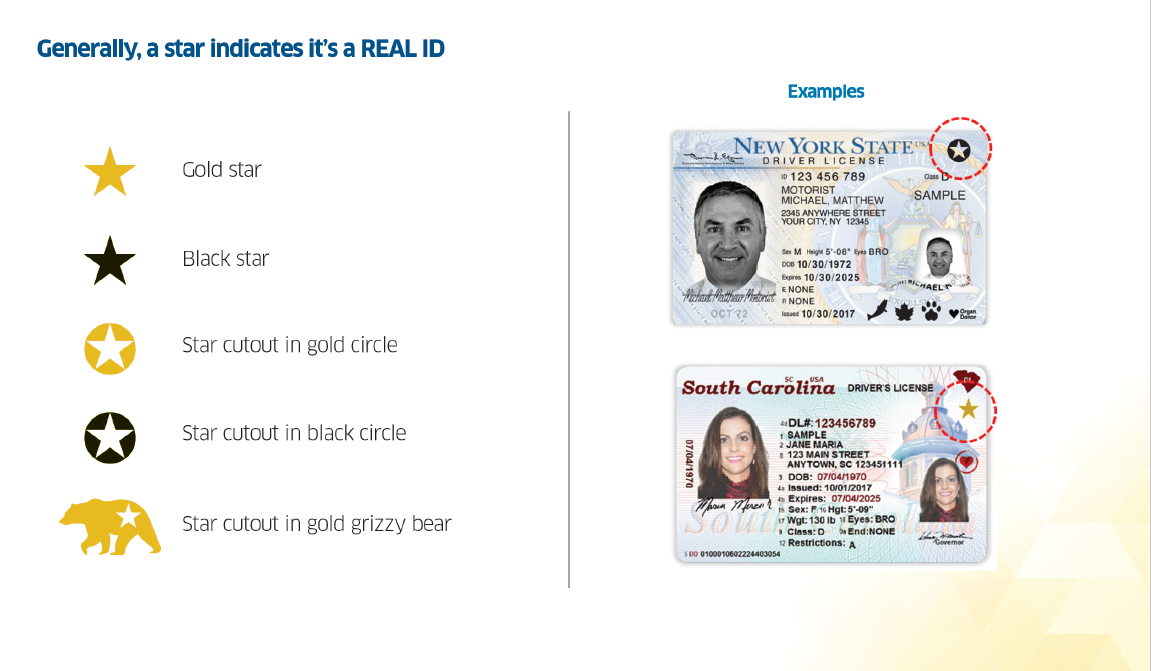

Real Id Deadline Essential Information For Summer Travelers

May 09, 2025

Real Id Deadline Essential Information For Summer Travelers

May 09, 2025 -

Understanding The Recent Increase In Bitcoin Mining Hash Rate

May 09, 2025

Understanding The Recent Increase In Bitcoin Mining Hash Rate

May 09, 2025 -

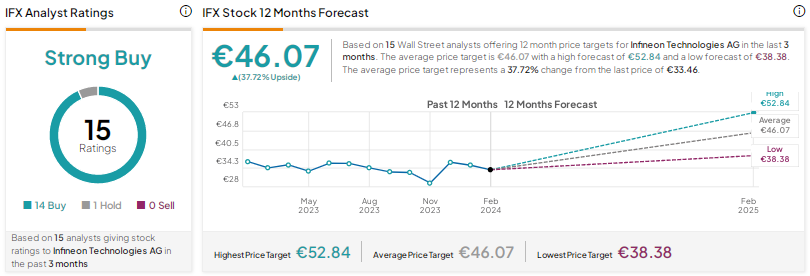

Infineon Ifx Sales Guidance Misses Estimates Amid Trump Tariff Uncertainty

May 09, 2025

Infineon Ifx Sales Guidance Misses Estimates Amid Trump Tariff Uncertainty

May 09, 2025 -

Cite De La Gastronomie De Dijon La Ville Et Le Soutien A Epicure

May 09, 2025

Cite De La Gastronomie De Dijon La Ville Et Le Soutien A Epicure

May 09, 2025 -

Edmonton Unlimiteds Global Impact Strategy Focus On Tech And Innovation

May 09, 2025

Edmonton Unlimiteds Global Impact Strategy Focus On Tech And Innovation

May 09, 2025