Infineon (IFX) Sales Guidance Misses Estimates Amid Trump Tariff Uncertainty

Table of Contents

Infineon's Disappointing Sales Figures

Infineon's latest sales guidance reveals a significant shortfall compared to previous quarters and market forecasts. This represents a considerable blow to investor confidence and raises concerns about the company's short-term prospects.

Detailed Breakdown of the Missed Estimates

Let's examine the specifics. (Insert chart/graph here showing comparison of actual vs. expected sales figures for the relevant quarter. Include data points for revenue, profitability, and earnings per share). For example, Infineon reported a [insert percentage]% decrease in sales compared to the previous quarter, significantly missing the consensus analyst estimate of a [insert percentage]% increase. This translated to a [insert specific number] shortfall in revenue, impacting profitability by [insert specific number or percentage].

- Quantifiable Shortfall: The sales guidance missed expectations by [insert specific numerical value or percentage].

- Affected Product Segments: The automotive segment, which is typically a strong performer for Infineon, experienced the most significant decline in sales, likely due to [insert reason, e.g., supply chain disruptions]. The industrial power control segment also faced headwinds.

- Impact on Revenue and Profitability: The missed guidance resulted in a [insert percentage]% decrease in overall revenue and a [insert percentage]% decline in profitability compared to the previous quarter.

The Role of Trump-Era Tariffs in the Sales Miss

The lingering effects of Trump-era tariffs played a significant role in Infineon's disappointing financial performance. These tariffs created ripple effects throughout the global semiconductor supply chain.

Impact on Supply Chains

Tariffs imposed on various components and materials used in Infineon's production processes increased manufacturing costs. This directly impacted their ability to maintain profitability margins.

- Specific Tariffs: Tariffs on [insert specific components or materials] directly affected Infineon's production costs.

- Mechanism of Impact: Increased import costs led to higher production costs, forcing Infineon to either absorb the increased expenses, lowering profit margins, or raise prices, impacting sales volume.

- Sources: [Cite relevant sources and reports, e.g., official government documents, industry reports].

Effect on Global Demand

Tariffs contributed to uncertainty in the global economy, negatively impacting demand for Infineon's products in certain key markets. This further exacerbated the sales shortfall.

- Reduced Consumer Spending: Increased prices due to tariffs might have reduced consumer spending on products incorporating Infineon's components.

- Weakened Global Trade: Tariffs led to weakened international trade, diminishing demand for semiconductors globally.

Infineon's Response and Future Outlook

Infineon has responded to the missed sales guidance with a combination of cost-cutting measures and strategic adjustments.

Company Statements and Actions

In their official statement, Infineon management acknowledged the challenges presented by the current macroeconomic environment and the lingering effects of past trade policies. They announced plans to [insert specific actions taken, e.g., streamline operations, reduce capital expenditure].

- Key Management Quotes: "[Insert quotes from Infineon's management regarding the sales guidance miss and their response strategy]."

- Cost-Cutting Measures: Infineon implemented [insert specific cost-cutting measures, e.g., workforce reductions, operational efficiency improvements].

- Strategic Adjustments: The company is focusing on [insert strategic adjustments, e.g., diversification into new markets, development of new technologies].

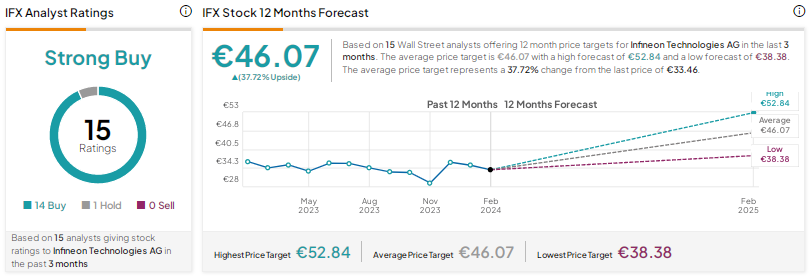

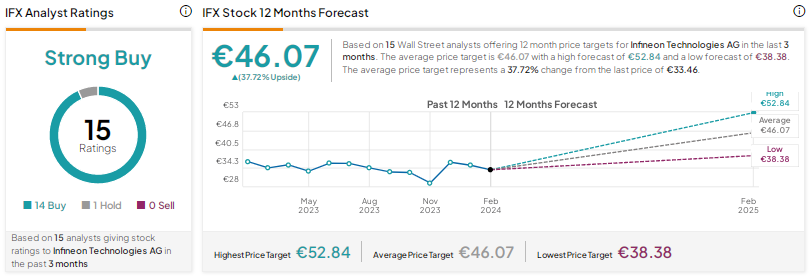

Analyst Predictions and Market Reactions

Analyst reactions to Infineon's performance have been mixed, with some expressing concern about the continued impact of global uncertainties, while others maintain a positive long-term outlook. The stock price experienced [insert percentage]% change following the announcement of the sales guidance.

- Range of Analyst Price Targets: Analyst price targets range from [insert lowest price target] to [insert highest price target], reflecting the uncertainty surrounding Infineon's future prospects.

Broader Implications for the Semiconductor Industry

Infineon's struggles are not entirely isolated. Other semiconductor companies have also faced headwinds due to geopolitical uncertainties and fluctuating global demand.

Industry-Wide Challenges

The semiconductor industry faces several common challenges, including: supply chain disruptions, escalating component costs, and fluctuating global demand.

- Affected Companies: Other semiconductor manufacturers like [mention other relevant companies] have also experienced challenges due to similar factors.

- Industry Consolidation: The current climate might lead to further consolidation within the semiconductor industry as companies seek to improve efficiency and resilience.

- Technological Advancements: Investment in technological advancements and diversification of supply chains could help the industry mitigate future risks.

Potential Long-Term Effects

The long-term impact of these challenges could reshape the semiconductor industry landscape. Companies that can effectively manage their supply chains and adapt to changing market conditions are likely to thrive.

- Increased Regionalization: Companies might focus on diversifying their manufacturing locations to reduce reliance on single regions.

- Focus on Innovation: Investment in cutting-edge technologies and innovative solutions will be crucial for maintaining competitiveness.

Conclusion

Infineon's missed sales guidance highlights the ongoing challenges faced by the semiconductor industry, with the lingering effects of Trump-era tariffs playing a significant role. The company's response and future outlook remain uncertain, but understanding Infineon (IFX) sales performance and the impact of trade policies is critical for investors. To stay informed about future developments regarding Infineon (IFX) sales guidance and the semiconductor industry, subscribe to our updates, follow company news, and continue to read insightful analyses on related topics.

Featured Posts

-

Family Support For Dakota Johnson At Materialist Los Angeles Premiere

May 09, 2025

Family Support For Dakota Johnson At Materialist Los Angeles Premiere

May 09, 2025 -

Nyt Strands Today April 4 2025 Clues Hints And Solutions

May 09, 2025

Nyt Strands Today April 4 2025 Clues Hints And Solutions

May 09, 2025 -

Kas Nutiko Dakota Johnson Ir Skandalas Del Kraujingu Plintu Nuotrauku

May 09, 2025

Kas Nutiko Dakota Johnson Ir Skandalas Del Kraujingu Plintu Nuotrauku

May 09, 2025 -

April 9 Nyt Strands Solutions Complete Guide To Game 402

May 09, 2025

April 9 Nyt Strands Solutions Complete Guide To Game 402

May 09, 2025 -

Global Power Shift India Overtakes Uk France And Russia

May 09, 2025

Global Power Shift India Overtakes Uk France And Russia

May 09, 2025

Latest Posts

-

Stricter Uk Visa Rules Addressing Concerns Of Visa Fraud

May 09, 2025

Stricter Uk Visa Rules Addressing Concerns Of Visa Fraud

May 09, 2025 -

Report Uk Plans To Restrict Visas For Certain Nationalities

May 09, 2025

Report Uk Plans To Restrict Visas For Certain Nationalities

May 09, 2025 -

Uk Government Tightens Visa Rules Impact On Work And Student Visas

May 09, 2025

Uk Government Tightens Visa Rules Impact On Work And Student Visas

May 09, 2025 -

Uk Visa Restrictions Report Highlights Potential Nationality Bans

May 09, 2025

Uk Visa Restrictions Report Highlights Potential Nationality Bans

May 09, 2025 -

New Uk Visa Regulations Aimed At Curbing Visa Misuse

May 09, 2025

New Uk Visa Regulations Aimed At Curbing Visa Misuse

May 09, 2025