Shein's London IPO: The Fallout From US Tariffs

Table of Contents

H2: The Impact of US Tariffs on Shein's Profitability

The imposition of US tariffs has significantly impacted Shein's profitability, forcing the company to re-evaluate its strategies.

H3: Increased Production Costs

US tariffs significantly increase the cost of importing Shein's goods into the American market. This directly impacts profit margins, potentially forcing price increases or reduced profitability. To maintain competitiveness, Shein may need to explore alternative sourcing strategies or manufacturing locations to mitigate these costs. This is a complex issue requiring careful consideration of various factors.

- Increased shipping costs: Tariffs add a substantial layer of expense to the already complex logistics of global apparel trade.

- Higher import duties: These directly reduce the profit margin on each item sold in the US.

- Potential for reduced consumer demand due to higher prices: Passing increased costs onto the consumer could negatively affect sales volume.

H3: Diversification Strategies

In response to the challenges posed by US tariffs, Shein is likely to intensify its diversification strategies. This involves reducing its reliance on the US market and expanding into other regions.

- Increased investment in European logistics: Establishing robust infrastructure in Europe is crucial for efficient distribution.

- Marketing campaigns targeting new markets: Shein will need to tailor its marketing strategies to resonate with consumers in different regions.

- Potential partnerships with European retailers: Collaborating with established European brands could provide access to new markets and customer bases. This could involve joint ventures or licensing agreements.

H2: Shein's London IPO: A Strategic Response?

The decision to pursue a London IPO rather than a US listing may be a strategic response to the challenges presented by US tariffs and regulatory scrutiny.

H3: Avoiding US Regulatory Scrutiny

A London IPO could offer Shein a way to sidestep increased scrutiny from US regulators concerning its labor practices and environmental impact. European regulatory environments might be perceived as less stringent, offering a more favorable IPO landscape.

- Reduced regulatory burden: Listing in London could minimize compliance costs and potential legal challenges related to labor and environmental concerns.

- Access to a broader investor base: The London Stock Exchange offers access to a diverse range of investors, potentially leading to a higher valuation.

- Potential for higher valuation in a different market: Market conditions and investor sentiment can vary significantly between different stock exchanges.

H3: Access to European Capital Markets

London's established financial markets provide access to a significant pool of capital, crucial for Shein's ambitious growth plans and expansion strategies.

- Greater access to funding for expansion: Securing capital through a London IPO will be vital for further global expansion.

- Increased brand recognition in Europe: A London listing will raise Shein's profile and increase brand awareness among European investors.

- Opportunities for strategic acquisitions: Access to capital could facilitate acquisitions of other fashion brands or technology companies.

H2: The Broader Implications for the Fast Fashion Industry

Shein's strategic moves have profound implications for the broader fast-fashion industry and global trade.

H3: The Future of Global Trade in Apparel

Shein's experience highlights the complexities of global trade and the impact of protectionist policies on international businesses. Other fast-fashion brands may face similar challenges, prompting adjustments to their sourcing and distribution strategies.

- Increased regionalization of production: Companies may shift production closer to their target markets to reduce reliance on long supply chains.

- Growth in domestic apparel manufacturing: Tariffs may encourage a resurgence of domestic apparel manufacturing in certain countries.

- Potential for higher prices for consumers: Increased costs associated with tariffs and reshoring could lead to higher prices for consumers.

H3: Sustainability Concerns and Ethical Sourcing

The US tariffs and Shein's response raise questions about the sustainability and ethical sourcing practices within the fast-fashion industry. The debate on environmental impact and fair labor practices will likely intensify.

- Increased focus on sustainable materials: Consumers are increasingly demanding eco-friendly options, pushing brands to adopt sustainable practices.

- Improved labor standards: Greater transparency and accountability are needed to ensure fair labor practices throughout the supply chain.

- Growth in eco-conscious consumerism: Ethical concerns are driving consumer demand for sustainably produced apparel.

3. Conclusion:

Shein's potential London IPO, heavily influenced by the fallout from US tariffs, presents a significant case study in global business strategy and the challenges of navigating complex international trade regulations. The impact extends beyond Shein itself, affecting the entire fast-fashion landscape and prompting a reconsideration of sourcing, manufacturing, and ethical considerations. To stay updated on the latest developments and understand the ongoing implications of this significant move, keep following news and analysis on Shein's London IPO and the wider ramifications of US tariffs on the fast-fashion industry. Understanding the impact of Shein's London IPO strategy, considering the US tariff fallout, is crucial for anyone involved in the global fashion market.

Featured Posts

-

Ufc 313 Alex Pereiras Heavyweight Future And The Jon Jones Super Fight

May 04, 2025

Ufc 313 Alex Pereiras Heavyweight Future And The Jon Jones Super Fight

May 04, 2025 -

Ufc Des Moines Expert Fight Predictions And Analysis

May 04, 2025

Ufc Des Moines Expert Fight Predictions And Analysis

May 04, 2025 -

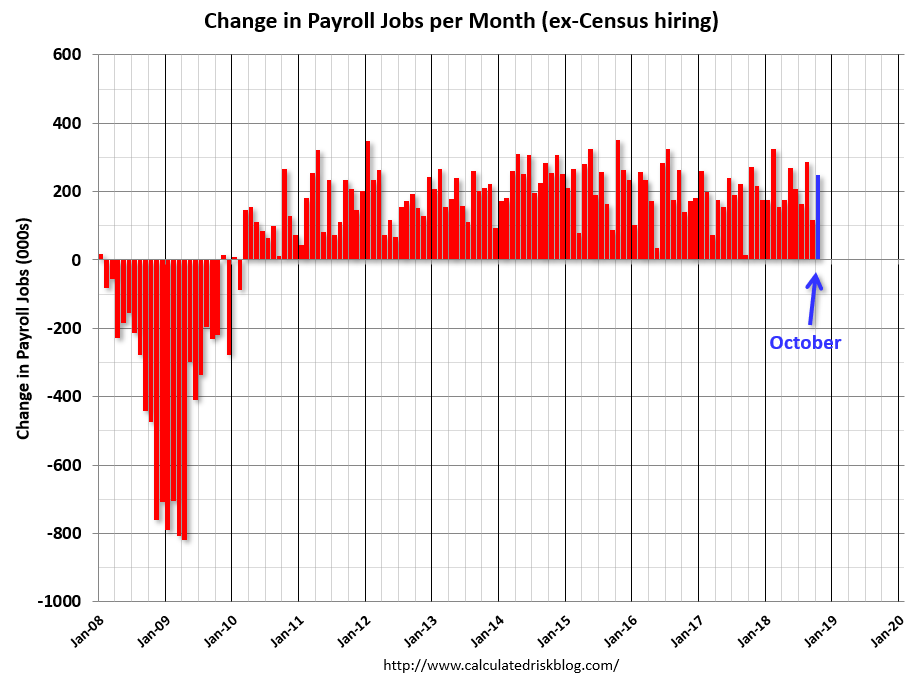

Solid U S Job Growth Continues April Employment Report Shows 177 000 Jobs Added Unemployment At 4 2

May 04, 2025

Solid U S Job Growth Continues April Employment Report Shows 177 000 Jobs Added Unemployment At 4 2

May 04, 2025 -

Germanys Eurovision Hopes Dented By Tynnas Voice

May 04, 2025

Germanys Eurovision Hopes Dented By Tynnas Voice

May 04, 2025 -

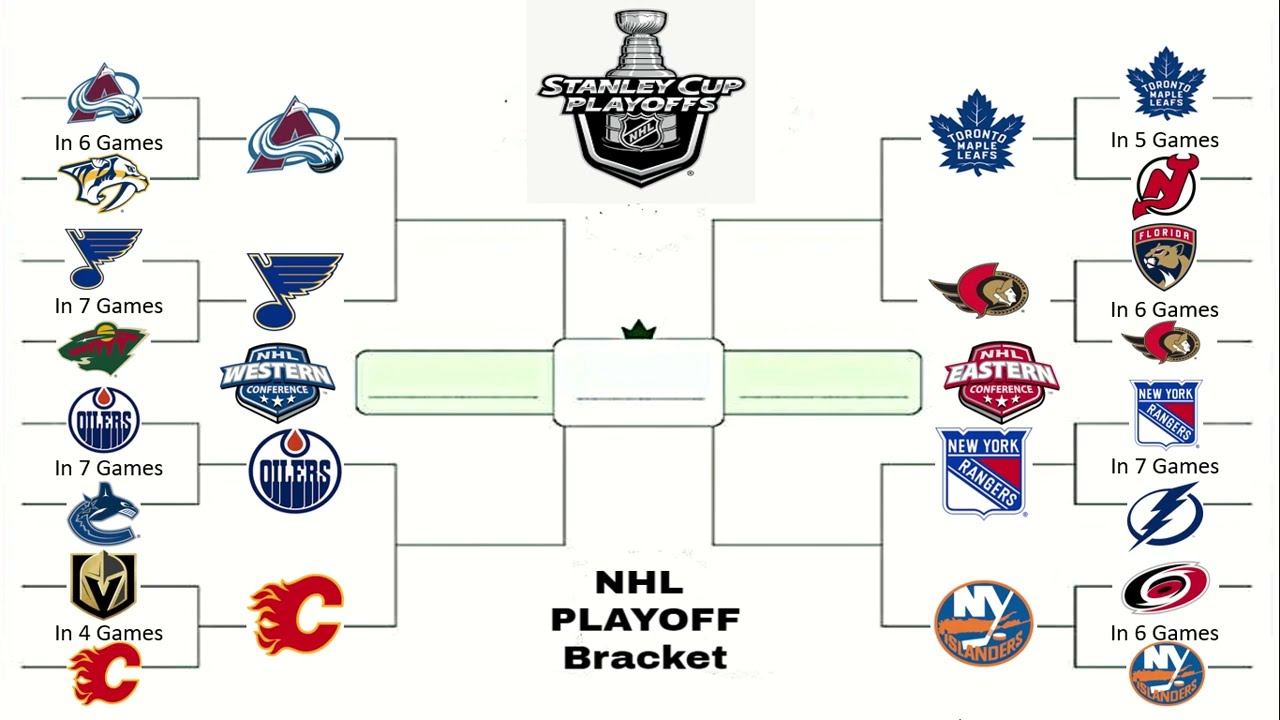

Decoding The First Round Your Guide To The Nhl Stanley Cup Playoffs

May 04, 2025

Decoding The First Round Your Guide To The Nhl Stanley Cup Playoffs

May 04, 2025