Solid U.S. Job Growth Continues: April Employment Report Shows 177,000 Jobs Added, Unemployment At 4.2%

Table of Contents

Deep Dive into the April Jobs Report: Key Findings

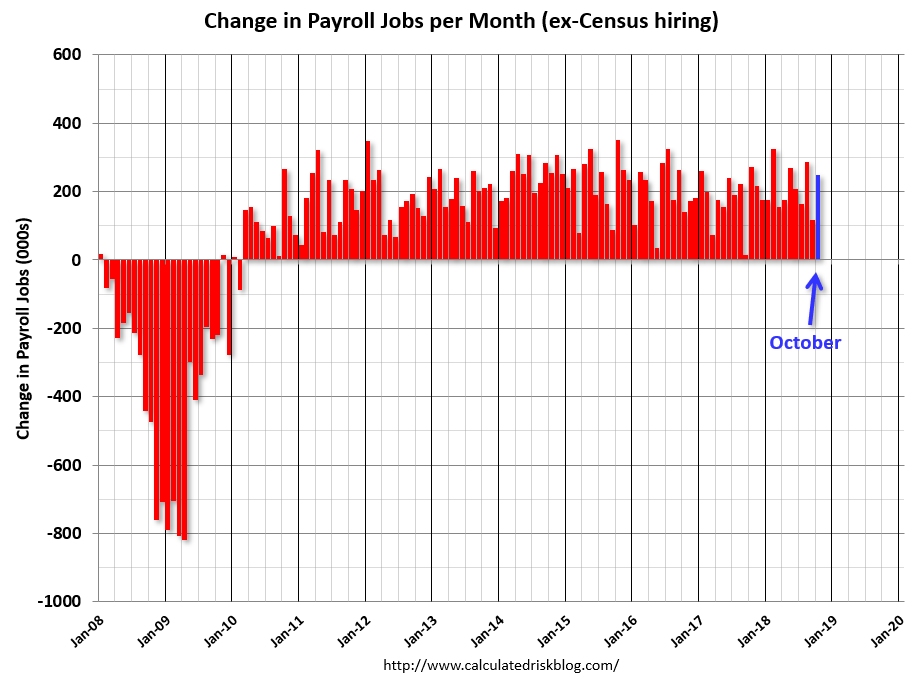

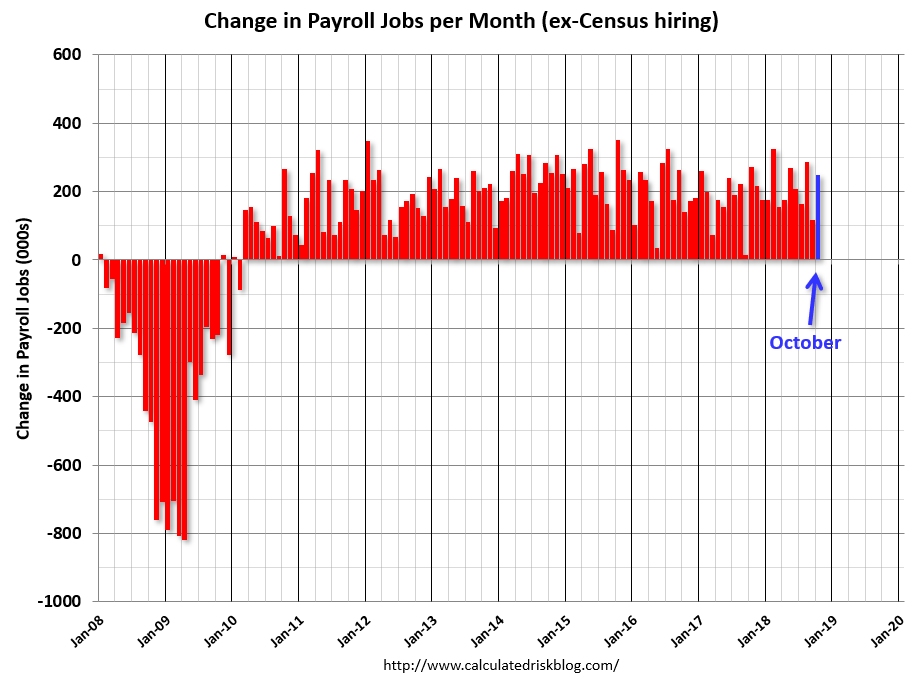

The April jobs report revealed a net increase of 177,000 jobs, a figure that, while positive, fell slightly below the expectations of many economists. Compared to the robust job growth seen in previous months, this represents a moderation in the pace of job creation. However, it's crucial to consider this within the broader context of the economic landscape.

-

Job Growth by Sector: The leisure and hospitality sector continued to show strength, adding a significant number of jobs. Professional and business services also contributed substantially to overall job growth, reflecting continued expansion in these key areas. Manufacturing, while showing growth, saw a more modest increase. The robust performance in service-sector employment points to a continuing recovery and increasing consumer confidence.

-

Wage Growth and Inflation: Average hourly earnings showed a modest increase, a development that economists are carefully monitoring. While wage growth is generally positive for workers, it also contributes to inflationary pressures. This delicate balance between wage increases and inflation is a key factor shaping the Federal Reserve’s monetary policy decisions. Increased consumer spending, fueled by wage growth, can further contribute to inflation if supply chains remain constrained.

-

Key Statistics Summary:

- Total Nonfarm Payroll Employment: Increased by 177,000 jobs.

- Unemployment Rate: Remained at 4.2%.

- Average Hourly Earnings: Increased modestly, contributing to inflationary concerns.

- Labor Force Participation Rate: Showed only slight changes, indicating a largely stable labor force.

Unemployment Rate Remains Low at 4.2%: What Does It Mean?

The persistent low unemployment rate of 4.2% signifies a tight labor market. This suggests that employers are struggling to find qualified workers to fill available positions. Understanding the different types of unemployment helps contextualize this statistic.

-

Types of Unemployment: Frictional unemployment (individuals between jobs), structural unemployment (mismatch between skills and available jobs), and cyclical unemployment (due to economic downturns) all contribute to the overall unemployment rate. The current low rate suggests that cyclical unemployment is low, a positive sign for the economy.

-

Labor Force Participation Rate: Analyzing the labor force participation rate and the employment-to-population ratio provides a fuller picture of labor market dynamics. These figures, while showing only minor fluctuations in April, offer valuable insights into the overall health of the workforce. A rising participation rate could indicate greater confidence in the job market, while a stagnant rate might suggest underlying challenges.

-

Implications of Low Unemployment:

- Increased Wage Pressure: The scarcity of workers can lead to upward pressure on wages.

- Potential for Inflation: Higher wages can contribute to increased inflation.

- Challenges for Businesses: Finding and retaining employees becomes more difficult.

Challenges and Future Outlook for U.S. Job Growth

While the April employment report showcased continued job growth, several challenges could impact future performance.

-

Headwinds to Job Growth: Persistent inflationary pressures, ongoing supply chain disruptions, and increasing geopolitical uncertainty all pose significant risks to sustained job creation. These factors can dampen consumer spending, hinder business investment, and lead to economic uncertainty.

-

Federal Reserve Actions: The Federal Reserve's monetary policy, particularly interest rate hikes aimed at curbing inflation, could have a dampening effect on economic growth and, consequently, job creation. This delicate balancing act between controlling inflation and maintaining economic expansion is a major focus for policymakers.

-

Job Market Outlook: Forecasts for job growth in the coming months are varied, reflecting the uncertainty in the global economic landscape. While many economists predict continued, albeit slower, job growth, the potential impact of the aforementioned challenges remains a key factor affecting future predictions.

-

Key Risks and Opportunities:

- Risk: A significant economic slowdown could lead to a decline in job creation.

- Opportunity: Continued investment in key sectors, coupled with effective workforce development programs, could support sustained job growth.

Solid U.S. Job Growth – Looking Ahead

The April employment report reveals a picture of continued, but moderating, job growth in the U.S. economy. The addition of 177,000 jobs and the 4.2% unemployment rate reflect a relatively healthy labor market. However, challenges remain, including inflation, supply chain issues, and geopolitical uncertainty. The Federal Reserve's actions will play a crucial role in shaping the future of U.S. job growth. Staying informed about upcoming U.S. employment data and economic news is critical for understanding the evolving job market trends. Stay updated on the latest U.S. job growth trends by subscribing to our newsletter! Learn more about the impact of the April employment report on the U.S. economy by reading our other articles.

Featured Posts

-

Record Breaking Heat Pump Launched At Utrecht Wastewater Treatment Plant

May 04, 2025

Record Breaking Heat Pump Launched At Utrecht Wastewater Treatment Plant

May 04, 2025 -

Governo Bayrou La Strategia Per Contrastare L Ascesa Di Le Pen

May 04, 2025

Governo Bayrou La Strategia Per Contrastare L Ascesa Di Le Pen

May 04, 2025 -

Narco Subs And Potent Cocaine Understanding The Drivers Of The Global Epidemic

May 04, 2025

Narco Subs And Potent Cocaine Understanding The Drivers Of The Global Epidemic

May 04, 2025 -

Noche De Combates Ufc Y Canelo Se Enfrentan En Mexico

May 04, 2025

Noche De Combates Ufc Y Canelo Se Enfrentan En Mexico

May 04, 2025 -

Rewatching The Gta Vi Trailer What We Know So Far

May 04, 2025

Rewatching The Gta Vi Trailer What We Know So Far

May 04, 2025