Shein's London IPO: Delayed Due To US Tariff Concerns

Table of Contents

Shein, the ultra-fast fashion giant, has reportedly delayed its highly anticipated London initial public offering (IPO). This delay, a significant event for the fast fashion industry, is primarily attributed to growing concerns surrounding potential US tariffs, significantly impacting the company's financial projections and investor confidence. This article will delve into the reasons behind this postponement and analyze its implications for Shein's future, examining the potential impact on Shein stock and the broader fast fashion market.

The Looming Threat of US Tariffs

The delay of the Shein IPO highlights the increasing pressure on fast-fashion brands like Shein. This pressure stems from multiple sources, creating a perfect storm impacting its planned London listing.

Increased Scrutiny of Fast Fashion

Fast fashion's business model, built on speed and low prices, has come under intense scrutiny. Consumers are increasingly aware of the ethical and environmental implications of this model, demanding greater transparency and accountability from brands. This increased awareness has led to:

- Increased consumer awareness of ethical concerns: Consumers are more discerning, choosing brands aligned with their values regarding fair labor practices and environmental sustainability. This shift in consumer preference puts pressure on companies like Shein to demonstrate ethical sourcing and responsible manufacturing.

- Government investigations into Shein's supply chain: Regulatory bodies in various countries, including the US, are investigating Shein's supply chain practices to ensure compliance with labor laws and environmental regulations. These investigations can lead to fines and reputational damage, further complicating the IPO process.

- Potential for increased import duties on goods from China: A significant portion of Shein's products are manufactured in China. The potential for increased import duties from the US significantly impacts profitability, making a London IPO, with its reliance on the US market, a riskier proposition.

Quantifying the Tariff Impact

The potential financial burden of increased US tariffs on Shein is substantial. Even a modest percentage increase in import costs could significantly impact the company's profitability and valuation.

- Estimated percentage increase in import costs: Depending on the specific tariffs imposed, import costs could increase by a significant percentage, potentially eating into already tight profit margins.

- Impact on Shein's profit margins: Increased import costs directly reduce profit margins, making the company less attractive to investors. The valuation of the Shein IPO will be directly influenced by these reduced margins.

- Potential for price increases for consumers: To offset the increased costs, Shein might be forced to raise prices, potentially impacting sales and consumer demand. This is a delicate balancing act, as price increases could alienate its price-sensitive customer base.

Alternative IPO Strategies for Shein

Given the challenges posed by US tariffs, Shein is exploring alternative strategies for its IPO.

Exploring Other Market Options

Shein might consider pursuing an IPO in a different market less influenced by US trade policy. Asia, specifically markets like Hong Kong, offer potential alternatives.

- Advantages and disadvantages of different market options: Each market has its advantages and disadvantages regarding regulatory frameworks, investor appetite, and access to capital.

- Regulatory landscape in alternative markets: Shein would need to carefully evaluate the regulatory landscape in any alternative market to ensure compliance and a smooth IPO process.

- Potential investor interest in those markets: Investor interest varies across markets. Shein needs to assess the level of investor appetite for a fast-fashion IPO in its chosen alternative location.

Delaying the IPO for Strategic Advantage

The delay could also be a strategic move, allowing Shein to address underlying concerns before going public.

- Time to improve supply chain transparency: The delay offers Shein the time to enhance its supply chain transparency, showcasing its commitment to ethical sourcing and sustainable practices.

- Opportunities to strengthen ethical sourcing practices: Shein can use this time to implement improvements in its sourcing and manufacturing processes to mitigate ethical concerns and regulatory risks.

- Time to refine its business model for long-term sustainability: The delay provides an opportunity to refine its business model, focusing on long-term sustainability and mitigating its environmental impact.

Impact on Investors and the Fashion Industry

The Shein IPO delay sends ripples through the investor community and the broader fashion industry.

Investor Sentiment and Market Reaction

The delay has negatively impacted investor confidence in Shein and the fast-fashion sector.

- Stock market reactions to the news: The news of the delay likely led to a negative reaction from the market, affecting the perception of similar companies and potentially influencing their valuations.

- Impact on investor confidence in the fast-fashion sector: The delay raises concerns about the long-term viability and profitability of fast-fashion businesses, potentially impacting the valuations of similar companies considering IPOs.

- Potential for revised valuations of similar companies: Investors might re-evaluate the valuations of other fast-fashion brands considering an IPO, leading to potentially lower valuations.

Long-Term Implications for Shein's Growth

The delay has long-term implications for Shein's growth and overall strategy.

- Potential for slower growth in the US market: The ongoing uncertainty around US tariffs could lead to slower growth in the crucial US market.

- Need for increased investment in ethical and sustainable practices: Shein needs to demonstrate a significant investment in ethical and sustainable practices to regain investor and consumer confidence.

- Long-term implications for Shein's brand reputation: How Shein navigates these challenges will significantly impact its long-term brand reputation and its ability to attract and retain customers and investors.

Conclusion:

Shein's delayed London IPO highlights the significant challenges faced by fast-fashion companies navigating increasing regulatory scrutiny and global trade complexities. The threat of US tariffs has undoubtedly played a crucial role in this decision. While the delay presents challenges, it also offers Shein an opportunity to address underlying concerns and build a more sustainable and resilient business model. The ultimate success of Shein's future IPO will depend on its ability to effectively manage these issues and regain investor confidence. Stay updated on further developments regarding the Shein IPO and its strategic response to these significant hurdles.

Featured Posts

-

March 23rd Celtics Vs Trail Blazers Game Time Tv Channel And Live Stream Info

May 06, 2025

March 23rd Celtics Vs Trail Blazers Game Time Tv Channel And Live Stream Info

May 06, 2025 -

Rising Waters Threaten Venice Exploring A Bold New Solution

May 06, 2025

Rising Waters Threaten Venice Exploring A Bold New Solution

May 06, 2025 -

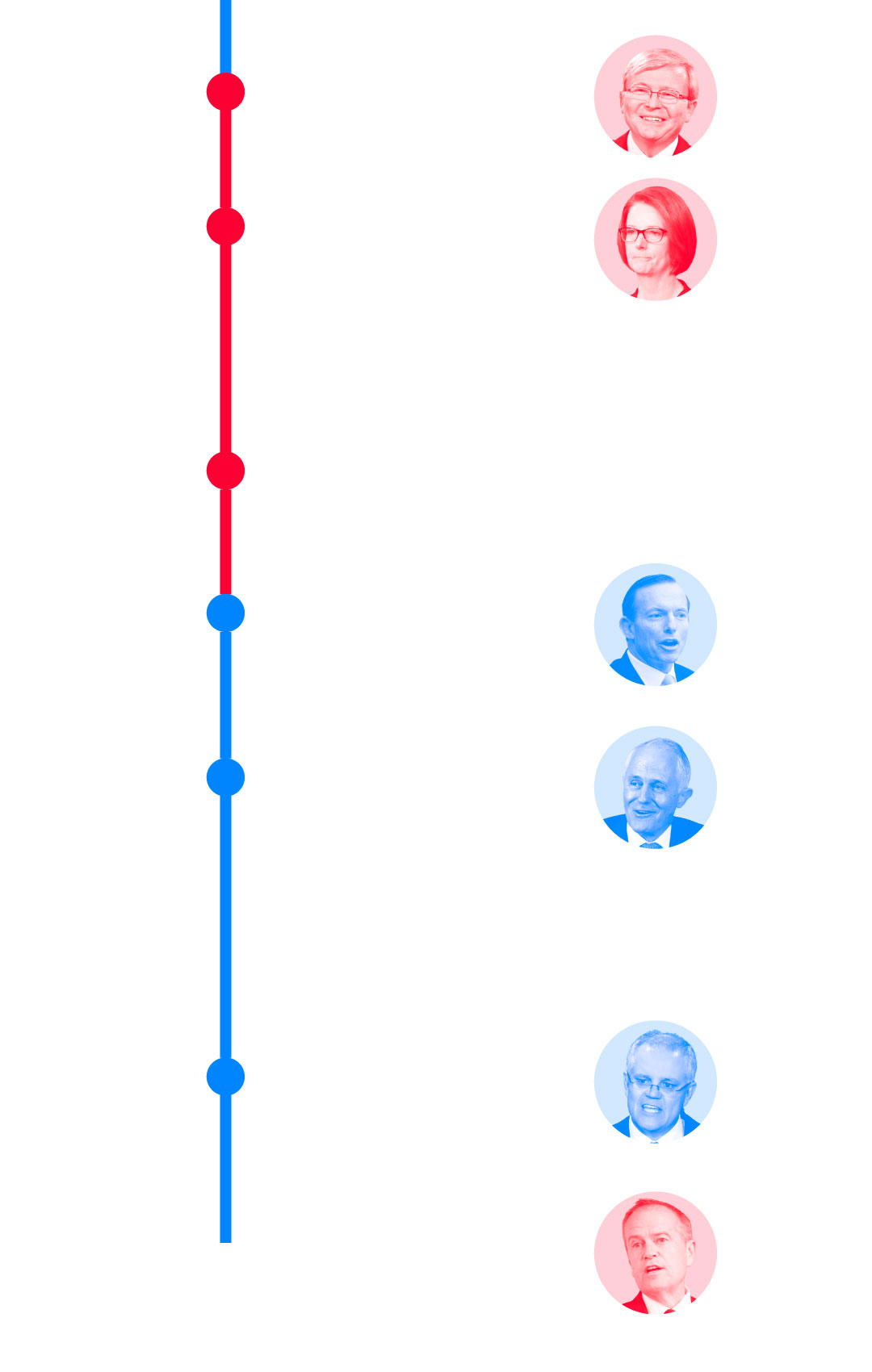

The Australian Election And Its Impact On Asset Prices

May 06, 2025

The Australian Election And Its Impact On Asset Prices

May 06, 2025 -

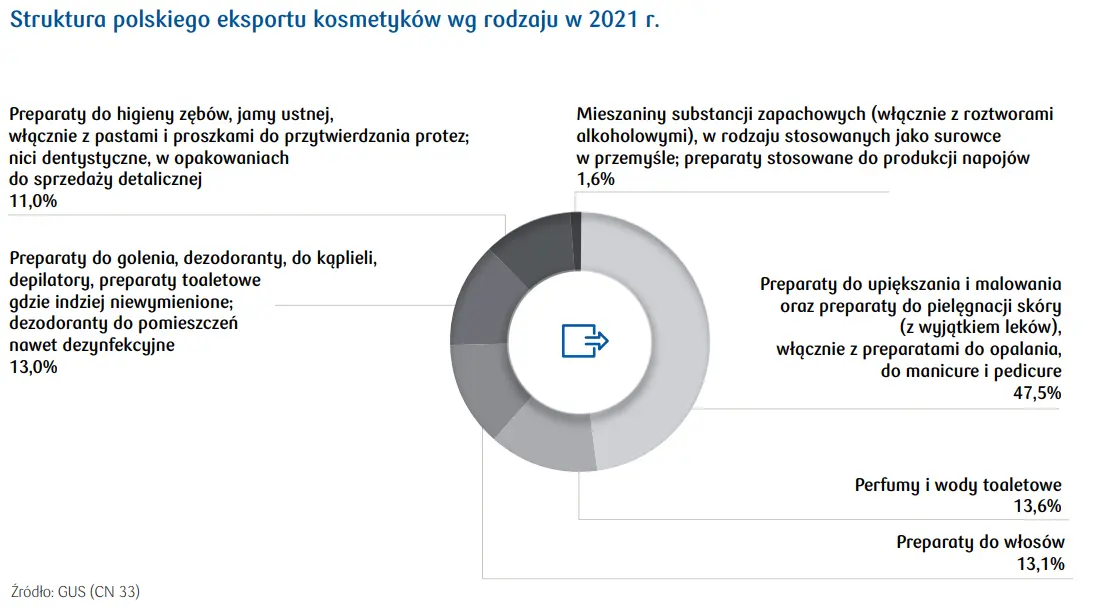

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025 -

Analysis Of Ddgs Dont Take My Son Diss Track Aimed At Halle Bailey

May 06, 2025

Analysis Of Ddgs Dont Take My Son Diss Track Aimed At Halle Bailey

May 06, 2025

Latest Posts

-

The Rather Be Alone Collaboration Understanding Leon Thomas And Halle Baileys Creative Process

May 06, 2025

The Rather Be Alone Collaboration Understanding Leon Thomas And Halle Baileys Creative Process

May 06, 2025 -

Halle Bailey Targeted In Ddgs Take My Son Diss Track

May 06, 2025

Halle Bailey Targeted In Ddgs Take My Son Diss Track

May 06, 2025 -

Halle Bailey Targeted In Ddgs Latest Diss Track Take My Son

May 06, 2025

Halle Bailey Targeted In Ddgs Latest Diss Track Take My Son

May 06, 2025 -

Analyzing Rather Be Alone The Musical Partnership Of Leon Thomas And Halle Bailey

May 06, 2025

Analyzing Rather Be Alone The Musical Partnership Of Leon Thomas And Halle Bailey

May 06, 2025 -

Rather Be Alone Exploring The Collaboration Between Leon Thomas And Halle Bailey

May 06, 2025

Rather Be Alone Exploring The Collaboration Between Leon Thomas And Halle Bailey

May 06, 2025