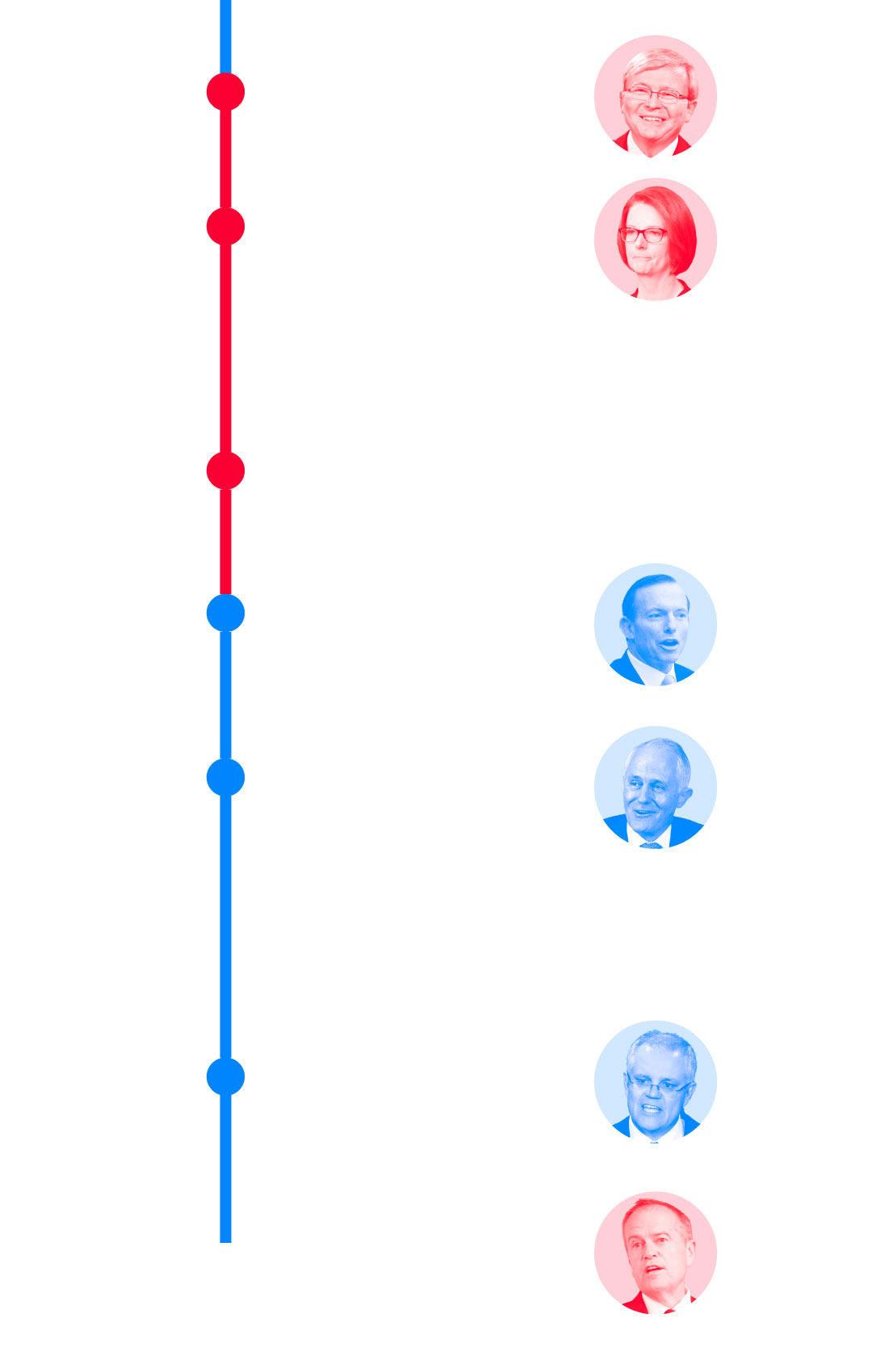

The Australian Election And Its Impact On Asset Prices

Table of Contents

Impact on the Australian Dollar (AUD)

Pre-Election Volatility

The period leading up to an Australian election is often characterized by increased Australian dollar volatility. Uncertainty surrounding potential policy changes from different political parties fuels speculation in the currency markets. Opinion polls, policy announcements, and even unexpected events can trigger significant fluctuations in the AUD's value against other major currencies.

- Historical Examples: The 2019 election saw a period of heightened election uncertainty, resulting in notable AUD fluctuations in the weeks leading up to the vote. Similar patterns have been observed in previous elections.

- Factors driving pre-election AUD volatility include:

- Shifting public opinion reflected in polls.

- Announcements of major policy proposals by competing parties.

- Speculation about potential coalition governments and their likely policies.

- Global economic factors impacting investor confidence in the Australian economy.

Post-Election Market Reaction

The AUD exchange rate often reacts swiftly to election results. A decisive victory for one party may lead to greater market certainty and potentially strengthen the AUD, while a hung parliament or a surprise outcome can trigger increased volatility. The nature of the winning party's economic policies significantly impacts the AUD's performance.

- Potential Scenarios:

- A conservative government focused on fiscal responsibility might boost investor confidence, strengthening the AUD.

- A labor government prioritizing social programs and increased spending could potentially weaken the AUD, depending on market reaction to their fiscal policies.

- Government policies impacting the AUD include:

- Monetary policy decisions made by the Reserve Bank of Australia.

- Fiscal policy decisions relating to government spending and taxation.

- Trade policies influencing exports and imports.

Effects on the Australian Stock Market (ASX)

Sector-Specific Impacts

Different sectors of the ASX performance are differentially affected by government policies. For example, mining companies may benefit from policies promoting resource extraction, while banks might be impacted by regulatory changes. Technology companies could see opportunities or challenges depending on the government’s approach to innovation and technological development.

- Examples of Past Impacts: Past elections have shown the impact of specific policy announcements on certain ASX-listed companies. Changes to mining royalties or environmental regulations, for instance, can directly impact mining stocks.

- Potential Sectoral Impacts:

- Mining: Changes in resource taxes or environmental regulations.

- Banking: Alterations to lending regulations or financial oversight.

- Technology: Government support for innovation and technological advancement.

Investor Sentiment and Market Volatility

Election results significantly influence investor sentiment and subsequently, market volatility. Uncertainty surrounding policy changes can lead to investors adopting a "wait-and-see" approach, potentially causing market dips. Conversely, a clear mandate and a stable government can boost investor confidence, leading to market growth.

- Factors affecting investor confidence include:

- Clarity and stability of the government's economic policies.

- The government's perceived competence in managing the economy.

- Global economic conditions and their impact on the Australian economy.

- The level of political uncertainty in the post-election period.

Influence on the Australian Property Market

Housing Policy and Property Prices

Government housing policy plays a pivotal role in shaping Australian property market trends. Policies impacting lending regulations, tax incentives for property investors, and social housing initiatives directly influence property prices and housing affordability.

- Comparison of Policy Approaches:

- Tax incentives for property investors can stimulate demand and drive up prices.

- Stricter lending regulations can cool the market and curb price increases.

- Increased investment in social housing can indirectly influence the private market.

Investment Implications

The Australian property market is significantly influenced by election outcomes. Understanding the potential policy shifts is vital for investors to make informed decisions. The election can present both opportunities and risks depending on the specific policies adopted by the new government.

- Navigating the Market:

- Research the proposed housing policies of different parties before the election.

- Assess the potential impact of various policy changes on your investment strategy.

- Diversify your investments to mitigate risk.

- Consult with financial professionals to create a personalized investment plan.

Conclusion: Navigating the Australian Election's Impact on Asset Prices

The Australian election and its impact on asset prices are inextricably linked. Election outcomes influence the AUD exchange rate, ASX performance, and the Australian property market through various policy changes and shifts in investor sentiment. Understanding these impacts is crucial for navigating the financial landscape. To effectively manage your portfolio, stay informed about the key policy proposals of the competing parties, monitor market reactions to election results, and consider seeking professional financial advice. Stay informed about the Australian election and its impact on asset prices and consult with financial professionals for personalized guidance. By carefully considering these factors, investors can make informed decisions and position themselves for success in the post-election market.

Featured Posts

-

Newark Airport Staffing Shortage Causes Impacts And Potential Solutions

May 06, 2025

Newark Airport Staffing Shortage Causes Impacts And Potential Solutions

May 06, 2025 -

The Everything App A Head To Head Comparison Of Altman And Musks Visions

May 06, 2025

The Everything App A Head To Head Comparison Of Altman And Musks Visions

May 06, 2025 -

The Carney Era A New Phase Of Economic Transformation

May 06, 2025

The Carney Era A New Phase Of Economic Transformation

May 06, 2025 -

Chris Pratts Honest Opinion Of Patrick Schwarzeneggers Full Frontal

May 06, 2025

Chris Pratts Honest Opinion Of Patrick Schwarzeneggers Full Frontal

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Role Hard Work And Nepotism Debate

May 06, 2025

Patrick Schwarzeneggers White Lotus Role Hard Work And Nepotism Debate

May 06, 2025

Latest Posts

-

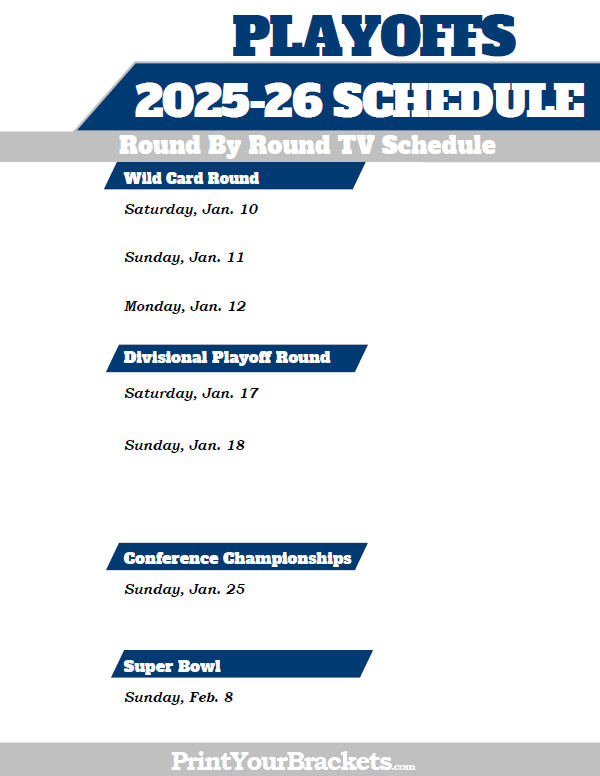

Nba Playoffs Game 1 Knicks Vs Celtics Winning Prediction And Best Bets

May 06, 2025

Nba Playoffs Game 1 Knicks Vs Celtics Winning Prediction And Best Bets

May 06, 2025 -

Celtics Vs Knicks Playoff Game 1 Predictions And Betting Analysis

May 06, 2025

Celtics Vs Knicks Playoff Game 1 Predictions And Betting Analysis

May 06, 2025 -

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For The Nba Playoffs

May 06, 2025

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For The Nba Playoffs

May 06, 2025 -

Celtics Vs Heat Tipoff Time Tv Channel And Live Stream February 10

May 06, 2025

Celtics Vs Heat Tipoff Time Tv Channel And Live Stream February 10

May 06, 2025 -

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025