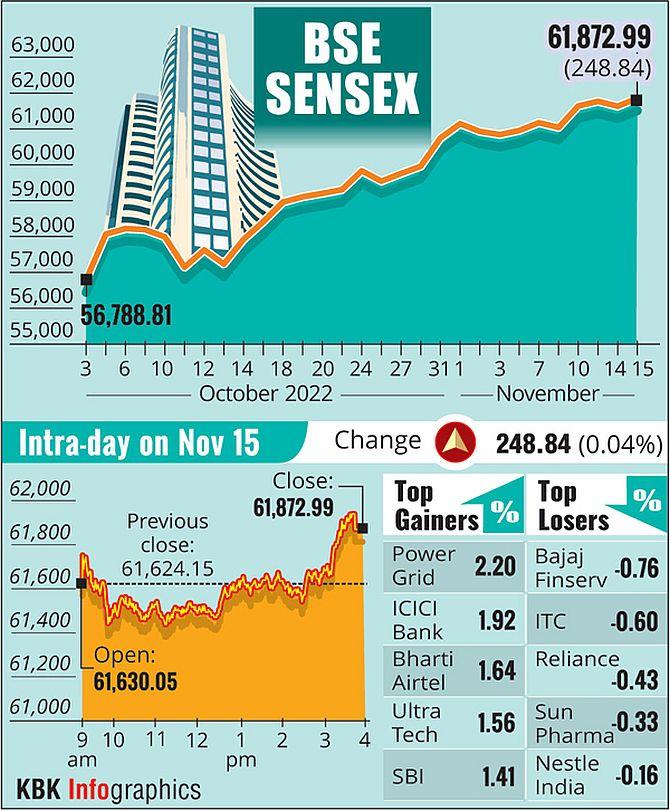

Sensex Soars 500 Points, Nifty Above 18400: Market Movers & Shakers

Table of Contents

Key Factors Driving the Sensex and Nifty Surge

Several factors contributed to this impressive surge in the Sensex and Nifty indices. Understanding these driving forces is crucial for navigating the current market landscape and making informed investment decisions.

Positive Global Cues

Positive global economic indicators played a significant role in boosting investor sentiment.

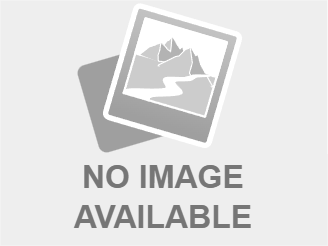

- US Inflation Data: Slower-than-expected US inflation figures eased concerns about aggressive interest rate hikes by the Federal Reserve, leading to increased risk appetite in global markets. This positive news spilled over into the Indian market.

- Global Growth Forecasts: Upbeat global growth forecasts from leading financial institutions further strengthened investor confidence, contributing to the market rally. Improved global economic sentiment often translates to increased investment in emerging markets like India.

- FII Investment: Significant inflows from Foreign Institutional Investors (FIIs) injected substantial liquidity into the Indian stock market, fueling the Sensex and Nifty's upward trajectory. FII investment is a key indicator of international confidence in the Indian economy.

Strong Domestic Economic Data

Positive domestic economic data further solidified the market's upward momentum.

- Indian GDP Growth: Robust GDP growth figures for the previous quarter showcased the resilience of the Indian economy, attracting both domestic and foreign investment.

- Manufacturing PMI: A strong Manufacturing Purchasing Managers' Index (PMI) indicated healthy growth in the manufacturing sector, bolstering investor confidence in the country's industrial output.

- Government Policies: Supportive government policies and initiatives aimed at boosting economic growth and infrastructure development played a crucial role in creating a positive investment environment.

Sector-Specific Performances

The market rally wasn't uniform across all sectors. Certain sectors outperformed others, significantly contributing to the overall surge.

- IT Sector Boom: The IT sector experienced a strong surge, driven by positive quarterly earnings reports and increased global demand for IT services.

- Banking Sector Strength: The banking sector also witnessed significant gains, reflecting investor confidence in the financial health and growth prospects of Indian banks.

- Pharma Sector Performance: While the Pharma sector showed moderate gains, specific stocks within the sector contributed positively to the overall market performance.

Top Gainers and Losers – Market Movers & Shakers

Identifying the top performing and underperforming stocks provides valuable insights into the market dynamics at play.

Top Performing Stocks

The following stocks were among the top gainers, showcasing remarkable performance:

- Reliance Industries: (Percentage Gain - Example: +5.2%) – Strong quarterly results and positive future outlook.

- HDFC Bank: (Percentage Gain - Example: +4.8%) – Robust financial performance and expansion plans.

- Infosys: (Percentage Gain - Example: +4.5%) – Positive client acquisition and improved business outlook.

- (Add 6-7 more stocks with percentage gains and brief reasons for their success)

Underperforming Sectors & Stocks

Not all sectors participated equally in the rally. Some sectors and specific stocks underperformed.

- Metals Sector: The metals sector witnessed relatively subdued performance, potentially due to global commodity price fluctuations.

- Real Estate Sector: (Specific examples of underperforming stocks and reasons).

- (Add other underperforming sectors and stocks with explanations)

Implications for Investors – Future Outlook

The current market situation presents both opportunities and challenges for investors.

Investment Strategies

- Diversification: Maintaining a diversified portfolio across different sectors and asset classes remains crucial for mitigating risk.

- Risk Management: Investors should carefully assess their risk tolerance and adjust their investment strategies accordingly.

- Long-Term Perspective: Focus on long-term investment goals rather than short-term market fluctuations.

Short-Term and Long-Term Projections

While the current market rally is encouraging, investors should maintain a cautious outlook.

- Short-Term: The short-term market trend remains uncertain, influenced by various global and domestic factors.

- Long-Term: The long-term outlook for the Indian stock market remains positive, driven by the country's strong economic fundamentals and growth potential.

Conclusion: Sensex and Nifty's Impressive Rally – What's Next?

The Sensex and Nifty's impressive 500-point and 18400-mark breaches respectively, were fueled by a confluence of positive global cues, strong domestic economic data, and sector-specific performance. Reliance Industries, HDFC Bank, and Infosys, amongst others, were leading gainers, while certain sectors like metals and real estate lagged. Investors should maintain a balanced approach, focusing on diversification and risk management while acknowledging both the opportunities and uncertainties in the current market. Stay informed about future Sensex and Nifty movements by following reputable financial news sources and consider consulting with a financial advisor before making any investment decisions. Understanding the nuances of the Sensex and Nifty is crucial for effective investment strategy.

Featured Posts

-

Young Thugs Reaction To Not Like U Name Drop After Prison Release

May 09, 2025

Young Thugs Reaction To Not Like U Name Drop After Prison Release

May 09, 2025 -

Understanding Pam Bondis Position On Killing American Citizens

May 09, 2025

Understanding Pam Bondis Position On Killing American Citizens

May 09, 2025 -

Rethinking Daycare Challenges And Alternatives For Working Families

May 09, 2025

Rethinking Daycare Challenges And Alternatives For Working Families

May 09, 2025 -

Interest Rate Differentials Why The Fed Wont Follow Other Central Banks

May 09, 2025

Interest Rate Differentials Why The Fed Wont Follow Other Central Banks

May 09, 2025 -

Investigacao Mulher Alega Ser Madeleine Mc Cann Presa No Reino Unido

May 09, 2025

Investigacao Mulher Alega Ser Madeleine Mc Cann Presa No Reino Unido

May 09, 2025