Selling Stakes In Elon Musk's Private Ventures: A Lucrative Side Hustle

Table of Contents

Understanding the Landscape of Elon Musk's Private Ventures

Elon Musk's entrepreneurial endeavors have captivated the world. Companies like SpaceX, pioneering space exploration and reusable rockets; The Boring Company, aiming to revolutionize tunnel construction; Neuralink, focused on brain-computer interfaces; and Tesla, though publicly traded, initially a private venture showcasing disruptive technology, all represent potentially lucrative investment opportunities. However, securing "stakes"—equity ownership—in these private companies presents significant challenges. These aren't your average stock market purchases.

The concept of "stakes" refers to ownership shares in a privately held company. Unlike publicly traded companies whose shares are readily available on exchanges, private company stakes are typically less liquid and require different investment strategies. Accessing these investments is difficult due to several factors:

- Limited public information on valuations and financial performance: Private companies aren't obligated to disclose detailed financial information to the public, making valuation challenging.

- High minimum investment thresholds often required: Investing in these ventures typically demands substantial capital, often beyond the reach of the average investor.

- Sophisticated investor networks needed for access: Connections within high-net-worth circles and angel investor networks are often necessary to even access investment opportunities.

- Regulatory complexities and legal considerations: Navigating the legal framework surrounding private equity investments requires expertise and careful attention to detail.

Identifying Potential Avenues for Investment

Acquiring stakes in Elon Musk's private ventures isn't a straightforward process. Several avenues exist, each with its own set of requirements and complexities:

- Secondary Market Transactions: This involves purchasing existing shares from current investors willing to sell. Finding such opportunities requires extensive networking and a thorough understanding of the secondary market for private equity.

- Private Placements: These are direct investments offered by the company itself, usually to a select group of accredited investors. Accessing private placements often depends on existing relationships and a strong investment profile.

Successfully navigating these avenues requires leveraging several resources:

- Networking with high-net-worth individuals and angel investors: Building relationships within these circles can provide access to exclusive investment opportunities.

- Utilizing online investment platforms specializing in private equity: Certain platforms connect accredited investors with private company offerings, although vetting these platforms is crucial.

- Seeking guidance from experienced financial advisors and legal professionals: Expert advice is essential for navigating the complexities of private equity investments and ensuring compliance with regulations.

- Thoroughly researching the financial health and future potential of the chosen venture: Due diligence is paramount; understanding the company's business model, market position, and competitive landscape is crucial for informed decision-making.

Assessing the Risks and Rewards

Investing in private companies, particularly those associated with high-growth, high-risk ventures like Elon Musk's, carries inherent risks:

- High risk of losing the entire investment: The potential for failure is a significant consideration. Private companies are inherently more vulnerable than established public companies.

- Illiquidity – difficulty selling stakes quickly: Unlike publicly traded stocks, selling stakes in private companies can be difficult and time-consuming.

- Lack of reliable financial information for accurate valuation: The limited transparency of private companies makes accurate valuation challenging, increasing uncertainty.

However, the potential rewards can be substantial:

- Potential for massive returns if the venture achieves significant growth: If a company like SpaceX or Neuralink achieves its ambitious goals, the returns for early investors could be astronomical.

Effective risk management is key:

- Diversification: Spreading investments across different assets mitigates the risk associated with any single investment.

- Thorough due diligence: Careful research minimizes the chances of investing in a failing venture.

Legal and Ethical Considerations

Investing in private companies demands awareness of legal and ethical implications:

- Compliance with securities laws and regulations: Understanding and adhering to relevant securities laws is crucial to avoid legal repercussions.

- Avoiding insider trading and conflicts of interest: Maintaining ethical standards and avoiding any actions that could be construed as insider trading is paramount.

- Adherence to ethical investment principles: Responsible investing practices are essential, considering environmental, social, and governance (ESG) factors.

Conclusion

Investing in stakes of Elon Musk's private ventures presents a unique, high-risk, high-reward opportunity. Success requires significant capital, a robust network, thorough due diligence, and expert guidance. The challenges are considerable, but the potential rewards can be substantial. While accessing these investments is challenging, understanding the landscape and strategic approaches discussed in this article provides a crucial first step. Start researching potential avenues for acquiring stakes in Elon Musk's private ventures and consider consulting with financial professionals to explore this potentially lucrative side hustle. Remember to always conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Mission Impossible Dead Reckoning Tom Cruises Stunts Will Amaze

Apr 26, 2025

Mission Impossible Dead Reckoning Tom Cruises Stunts Will Amaze

Apr 26, 2025 -

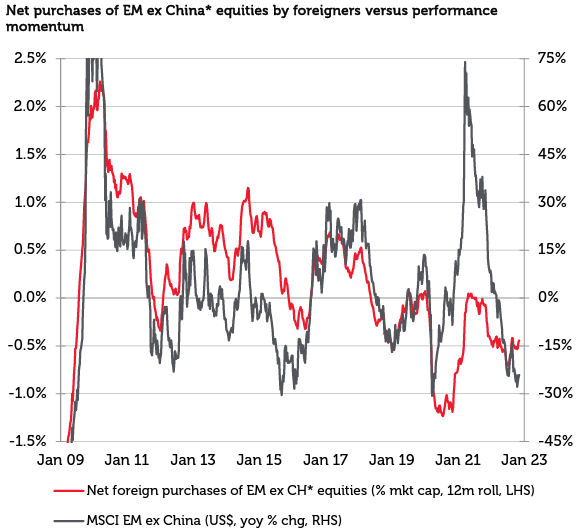

Closure Of Emerging Markets Fund Leads To Point72 Trader Exits

Apr 26, 2025

Closure Of Emerging Markets Fund Leads To Point72 Trader Exits

Apr 26, 2025 -

King Announces Early Start To Birthday Celebrations

Apr 26, 2025

King Announces Early Start To Birthday Celebrations

Apr 26, 2025 -

Ai Regulation Showdown Europe Stands Firm Against Trump Administration Pressure

Apr 26, 2025

Ai Regulation Showdown Europe Stands Firm Against Trump Administration Pressure

Apr 26, 2025 -

Unlock Spring Essential Lente Words And Phrases

Apr 26, 2025

Unlock Spring Essential Lente Words And Phrases

Apr 26, 2025

Latest Posts

-

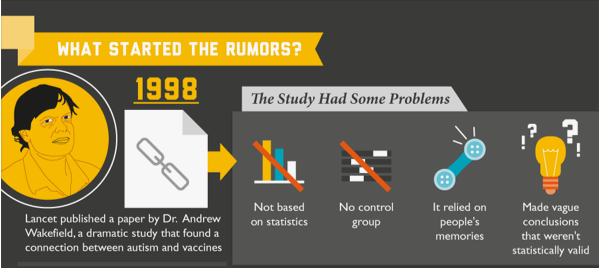

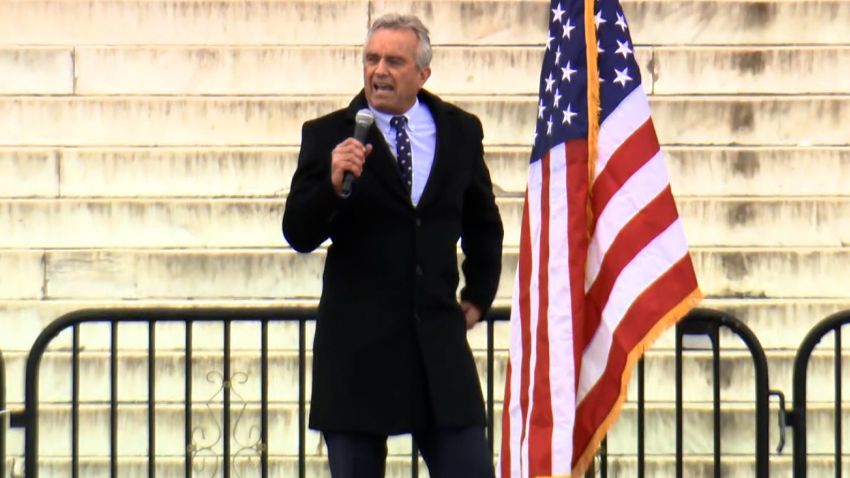

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025 -

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

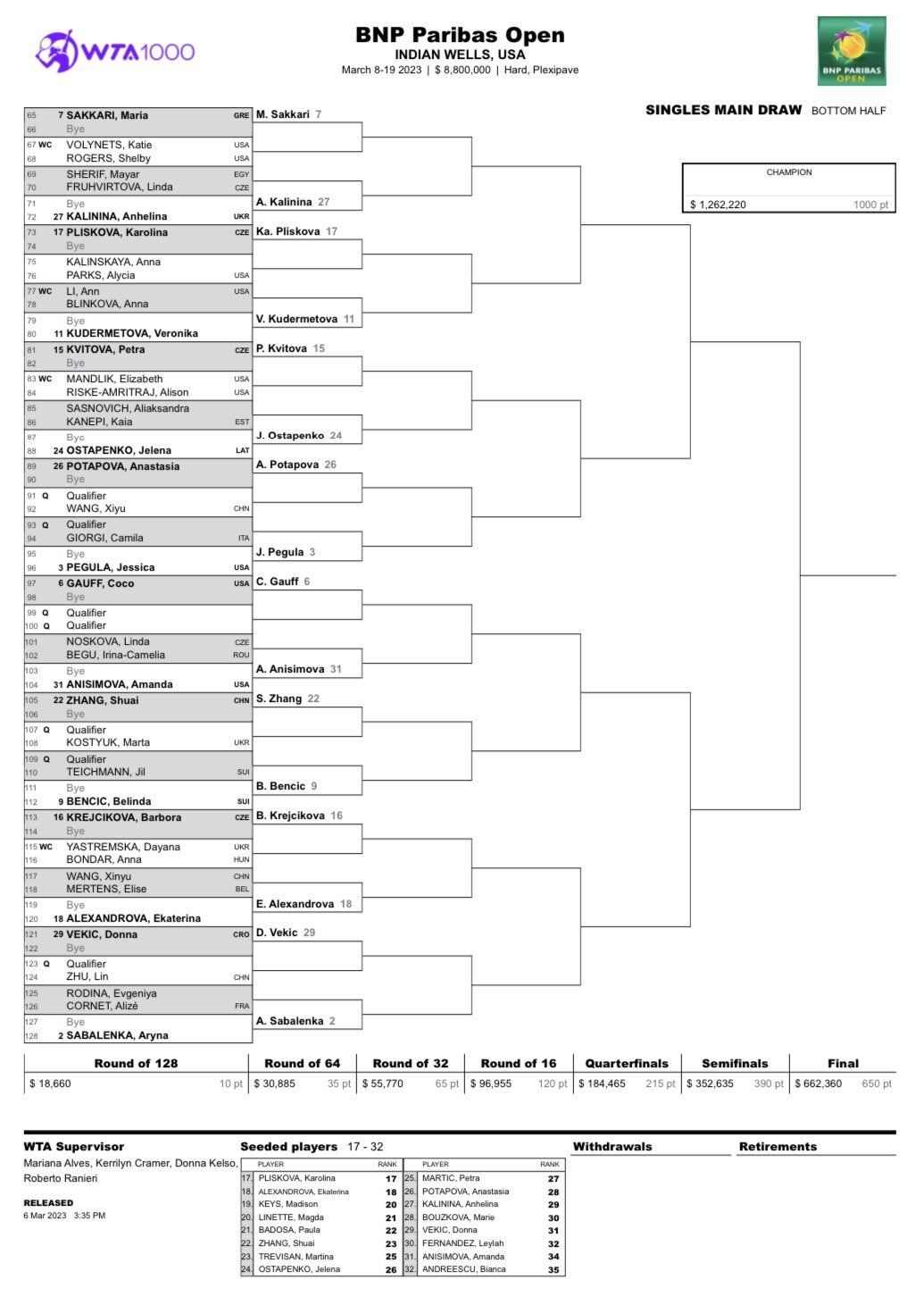

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025 -

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025