Closure Of Emerging Markets Fund Leads To Point72 Trader Exits

Table of Contents

The Closure of Point72's Emerging Markets Fund

Point72 Asset Management's decision to shutter its emerging markets fund marks a significant shift in its investment strategy. While the precise reasons remain undisclosed, several factors likely contributed to this closure.

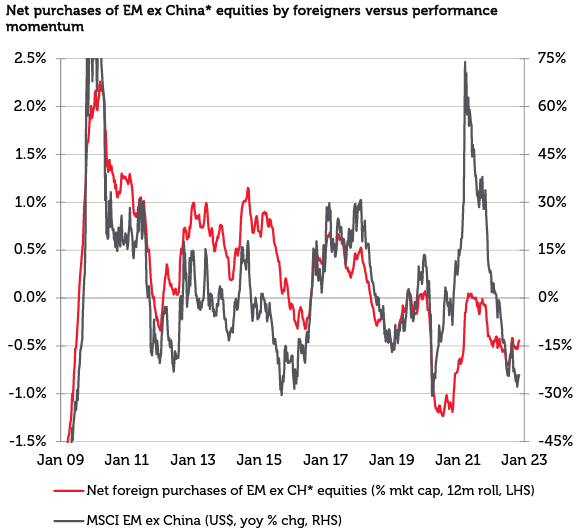

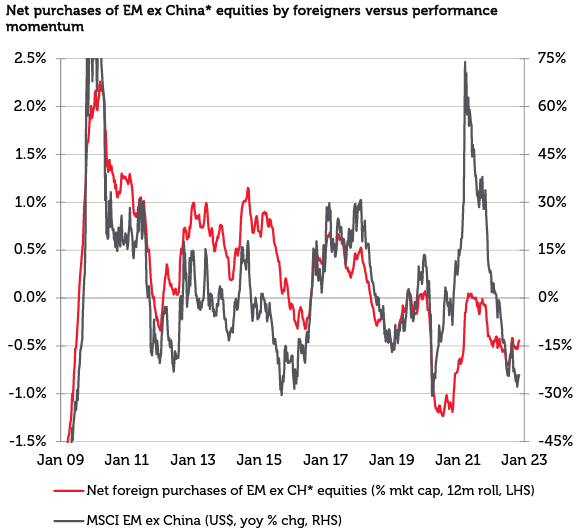

- Underperformance: The fund may have consistently underperformed benchmarks, failing to meet internal targets despite the inherent volatility and opportunities within emerging markets.

- Market Conditions: Geopolitical instability, macroeconomic headwinds, and currency fluctuations in various emerging economies could have created a challenging investment environment, leading to decreased returns.

- Strategic Realignment: Point72 might be realigning its portfolio to focus on other asset classes deemed more lucrative or less risky in the current climate. This could involve shifting resources to areas like technology, private equity, or other developed market sectors.

The fund's size and specific investment history haven't been publicly disclosed in detail, adding to the speculation surrounding the closure. While Point72 has yet to release an official statement comprehensively explaining the decision, the move signals a cautious approach towards emerging markets, at least in the short term. This closure has significant implications for the broader emerging markets investment landscape, potentially affecting investor sentiment and future investment flows into these regions.

Key Trader Exits and Their Significance

The closure of the emerging markets fund has been accompanied by a significant exodus of key traders and portfolio managers from Point72. This talent drain raises concerns about the firm's future capabilities within this asset class.

- Experienced Professionals Depart: Several high-profile traders, possessing extensive expertise in navigating the complexities of emerging market investments, have resigned from Point72 following the fund closure.

- Impact on Point72's Performance: The departure of these individuals represents a considerable loss of institutional knowledge and experience, potentially impacting Point72's future performance in emerging markets, should they choose to re-enter the space.

- Recruitment Challenges for Competitors: These experienced professionals are likely to be highly sought after by competing hedge funds and asset management firms. Their recruitment will strengthen the capabilities of rival organizations, intensifying competition in the field. Their departure also impacts the overall talent pool within emerging markets investing.

The exact destinations of these departing traders remain largely unknown, but their moves will undoubtedly reshape the competitive landscape within the industry.

Impact on Investor Confidence

The closure of the fund and the subsequent trader exits have undoubtedly impacted investor confidence in Point72's ability to generate returns within emerging markets.

- Shifting Investor Strategies: Point72's clients might reassess their allocation to the firm, potentially shifting investments towards other asset managers or strategies deemed less risky.

- Broader Market Sentiment: The events at Point72 might amplify broader concerns about the risks associated with emerging market investments, leading to a more cautious approach from other investors.

- Effects on the Hedge Fund Industry: This situation could serve as a cautionary tale for other hedge funds with significant exposure to emerging markets, prompting them to re-evaluate their risk management strategies and investment approaches.

Future Outlook for Point72 and Emerging Markets Investment

The future direction of Point72’s involvement in emerging markets remains uncertain.

- Strategic Re-evaluation: Point72 is likely to conduct a thorough reassessment of its investment strategies for emerging markets, potentially considering a different approach or a phased re-entry into the sector.

- Market Opportunities and Risks: Emerging markets still present significant opportunities for long-term growth, but they also carry considerable risks. Political instability, economic volatility, and regulatory changes are all factors that need to be carefully considered.

- Predictions and Investment Trends: Predicting the future of emerging market investments is challenging. However, a careful study of macroeconomic trends and geopolitical events will guide future investment decisions.

Conclusion

The closure of Point72's emerging markets fund and the subsequent departure of key traders mark a pivotal moment in the firm's history and highlight the inherent challenges and risks associated with emerging market investments. The impact on investor confidence and the broader hedge fund industry remains to be seen. However, one thing is clear: these events underscore the dynamic and often unpredictable nature of the financial markets. Stay informed about the evolving situation at Point72 and the dynamic landscape of emerging market investments. Follow [your website/publication] for ongoing updates on Point72, emerging markets fund performance, and key personnel changes within the hedge fund industry. Understanding these shifts is crucial for making informed investment decisions in the volatile world of emerging markets.

Featured Posts

-

Fugro And Damen Partner To Bolster Royal Netherlands Navy Capabilities

Apr 26, 2025

Fugro And Damen Partner To Bolster Royal Netherlands Navy Capabilities

Apr 26, 2025 -

Todays Nyt Spelling Bee 337 Feb 3rd Hints Answers And Tips

Apr 26, 2025

Todays Nyt Spelling Bee 337 Feb 3rd Hints Answers And Tips

Apr 26, 2025 -

Galerie Le Labo Du 8 Decouvrez L Exposition Photographique De Pierre Terrasson

Apr 26, 2025

Galerie Le Labo Du 8 Decouvrez L Exposition Photographique De Pierre Terrasson

Apr 26, 2025 -

Quem E Benson Boone Descubra O Hitmaker De Beautiful Thing E Astro Do Lollapalooza

Apr 26, 2025

Quem E Benson Boone Descubra O Hitmaker De Beautiful Thing E Astro Do Lollapalooza

Apr 26, 2025 -

Nyt Spelling Bee Solution February 3rd Puzzle 337 Hints And Strategies

Apr 26, 2025

Nyt Spelling Bee Solution February 3rd Puzzle 337 Hints And Strategies

Apr 26, 2025

Latest Posts

-

Jannik Sinners Doping Case Concludes

Apr 27, 2025

Jannik Sinners Doping Case Concludes

Apr 27, 2025 -

Us Open 2024 Svitolinas Straight Sets Win Against Kalinskaya

Apr 27, 2025

Us Open 2024 Svitolinas Straight Sets Win Against Kalinskaya

Apr 27, 2025 -

Svitolina Cruises Past Kalinskaya In Us Open Opener

Apr 27, 2025

Svitolina Cruises Past Kalinskaya In Us Open Opener

Apr 27, 2025 -

Pegula Triumphs Epic Comeback Against Collins At Charleston Open

Apr 27, 2025

Pegula Triumphs Epic Comeback Against Collins At Charleston Open

Apr 27, 2025 -

Elina Svitolina Dominates Anna Kalinskaya In Us Open First Round

Apr 27, 2025

Elina Svitolina Dominates Anna Kalinskaya In Us Open First Round

Apr 27, 2025