Sasol (SOL) Investor Concerns Following Strategy Update

Table of Contents

Debt Levels and Financial Stability of Sasol (SOL)

Sasol's substantial debt burden remains a significant concern for investors. The company's high debt-to-equity ratio and credit ratings reflect this financial vulnerability. The recent strategy update outlines plans for debt reduction and financial restructuring, but the success of these initiatives remains to be seen. Crucially, the effectiveness of these measures will depend on various factors, including prevailing market conditions and the company's ability to execute its plans effectively.

- Key figures illustrating debt levels: Sasol's latest financial reports should be consulted for precise figures, but generally, a high debt-to-equity ratio suggests a higher financial risk.

- Analysis of debt maturity profile: Understanding when debts are due is crucial in assessing short-term liquidity risks and long-term solvency. A large proportion of short-term debt increases vulnerability.

- Potential impact of interest rate changes on debt servicing: Rising interest rates significantly increase the cost of servicing Sasol's debt, potentially impacting profitability and cash flow.

- Comparison with competitor debt levels: Analyzing Sasol's debt levels relative to its competitors provides valuable context and helps assess the severity of its financial situation. This requires a comparative analysis of debt-to-equity ratios and other relevant financial metrics. The benchmark should be similar companies operating in the energy and chemical sectors.

Impact of the Energy Transition on Sasol (SOL)'s Future

The global shift away from fossil fuels presents a significant challenge to Sasol's core business. The company's heavy reliance on coal and other fossil fuels exposes it to substantial risks associated with increasing environmental regulations and shifting consumer preferences. The strategy update emphasizes diversification into cleaner energy sources, but the scale and speed of this transition are key questions for investors. The success of this transition will heavily rely on several factors, including the feasibility of the transition plan and the level of investor confidence in the strategy.

- Sasol's current investments in renewable energy: Analyzing the scale and nature of Sasol's investments in renewable energy will provide an indication of its commitment to the energy transition.

- Analysis of the long-term viability of its core business: A thorough assessment of the long-term demand for Sasol's traditional products is essential in understanding the risks associated with its current business model.

- Potential regulatory changes impacting the company's operations: Understanding the evolving regulatory landscape concerning emissions and fossil fuels is crucial in projecting the future impact on Sasol's operations and profitability.

- Competitive landscape within the energy transition: Analyzing the competitive landscape in the renewable energy sector will help determine Sasol's competitive advantage and its ability to successfully navigate the energy transition. This includes assessing the competitive landscape and market share of Sasol in the renewables sector.

Concerns Regarding Sasol (SOL)'s Operational Efficiency and Profitability

Sasol's operational efficiency and profitability margins have been subject to scrutiny. The strategy update proposes various measures to improve efficiency and reduce costs, but concerns persist regarding the company's ability to effectively implement these changes and achieve sustainable improvements. Market volatility and supply chain disruptions will continue to be significant factors impacting operational performance. Investors will closely monitor key performance indicators to gauge the company's success in this area.

- Key performance indicators (KPIs) reflecting operational efficiency: KPIs like operating margins, return on assets (ROA), and production efficiency metrics should be closely monitored.

- Analysis of profit margins compared to competitors: Benchmarking Sasol's profitability against its competitors helps gauge its relative performance and identify areas for improvement.

- Discussion of cost-cutting measures proposed in the strategy: A detailed analysis of the proposed cost-cutting measures will help investors assess their potential impact on profitability and the feasibility of their implementation.

- Assessment of the company's pricing power: Analyzing Sasol's pricing power within the market will provide valuable insights into its ability to mitigate the impact of input cost increases and maintain profitability.

Management's Execution of the New Strategy and Investor Confidence in Sasol (SOL)

The success of Sasol's new strategy hinges on the effectiveness of its management team. Investor confidence will be significantly influenced by the management team's ability to execute the strategy and deliver on its promises. Evaluating the management's track record, experience, and expertise is crucial in assessing the likelihood of achieving the projected growth targets.

- Management's experience and expertise: Analyzing the background and experience of the management team provides insights into their capacity to lead Sasol through this critical period.

- Analysis of past strategic initiatives and their success: Examining the outcomes of previous strategic initiatives will help investors evaluate the management's ability to successfully implement strategic changes.

- Comparison of projected growth targets with industry benchmarks: Comparing Sasol's projected growth targets with industry benchmarks helps to assess the realism and achievability of these goals.

- Potential risks and challenges in implementing the new strategy: Identifying potential risks and challenges in implementing the new strategy helps investors anticipate potential setbacks and assess the robustness of the plan.

Conclusion: Addressing the Future of Sasol (SOL) and its Investors

In conclusion, several key Sasol (SOL) investor concerns remain, revolving around debt levels, the energy transition, operational efficiency, and management's execution of the new strategy. The strategy update offers a roadmap for addressing these challenges, but its success hinges on the company's ability to effectively manage its debt, navigate the energy transition, improve operational efficiency, and execute its plans. The short-term and long-term prospects of Sasol depend heavily on the successful implementation of this strategy. While potential for future growth and value creation exists, careful monitoring of the company's performance and continued analysis of relevant factors are crucial. To stay informed about developments relating to Sasol (SOL) investor concerns, we recommend subscribing to reputable financial news sources and, if necessary, consulting with a qualified financial advisor.

Featured Posts

-

Connolly Loses Appeal Over Racist Social Media Post

May 21, 2025

Connolly Loses Appeal Over Racist Social Media Post

May 21, 2025 -

Restauration Du Patrimoine Breton Plouzane Et Clisson Beneficiaires De La Mission Patrimoine 2025

May 21, 2025

Restauration Du Patrimoine Breton Plouzane Et Clisson Beneficiaires De La Mission Patrimoine 2025

May 21, 2025 -

Uk News Tory Politicians Wifes Jail Term Confirmed For Migrant Remarks

May 21, 2025

Uk News Tory Politicians Wifes Jail Term Confirmed For Migrant Remarks

May 21, 2025 -

Exploring The Versatility Of Cassis Blackcurrant From Jams To Desserts

May 21, 2025

Exploring The Versatility Of Cassis Blackcurrant From Jams To Desserts

May 21, 2025 -

3 Njwm Yndmwn Lawl Mrt Lmntkhb Amryka Tht Qyadt Almdrb Bwtshytynw

May 21, 2025

3 Njwm Yndmwn Lawl Mrt Lmntkhb Amryka Tht Qyadt Almdrb Bwtshytynw

May 21, 2025

Latest Posts

-

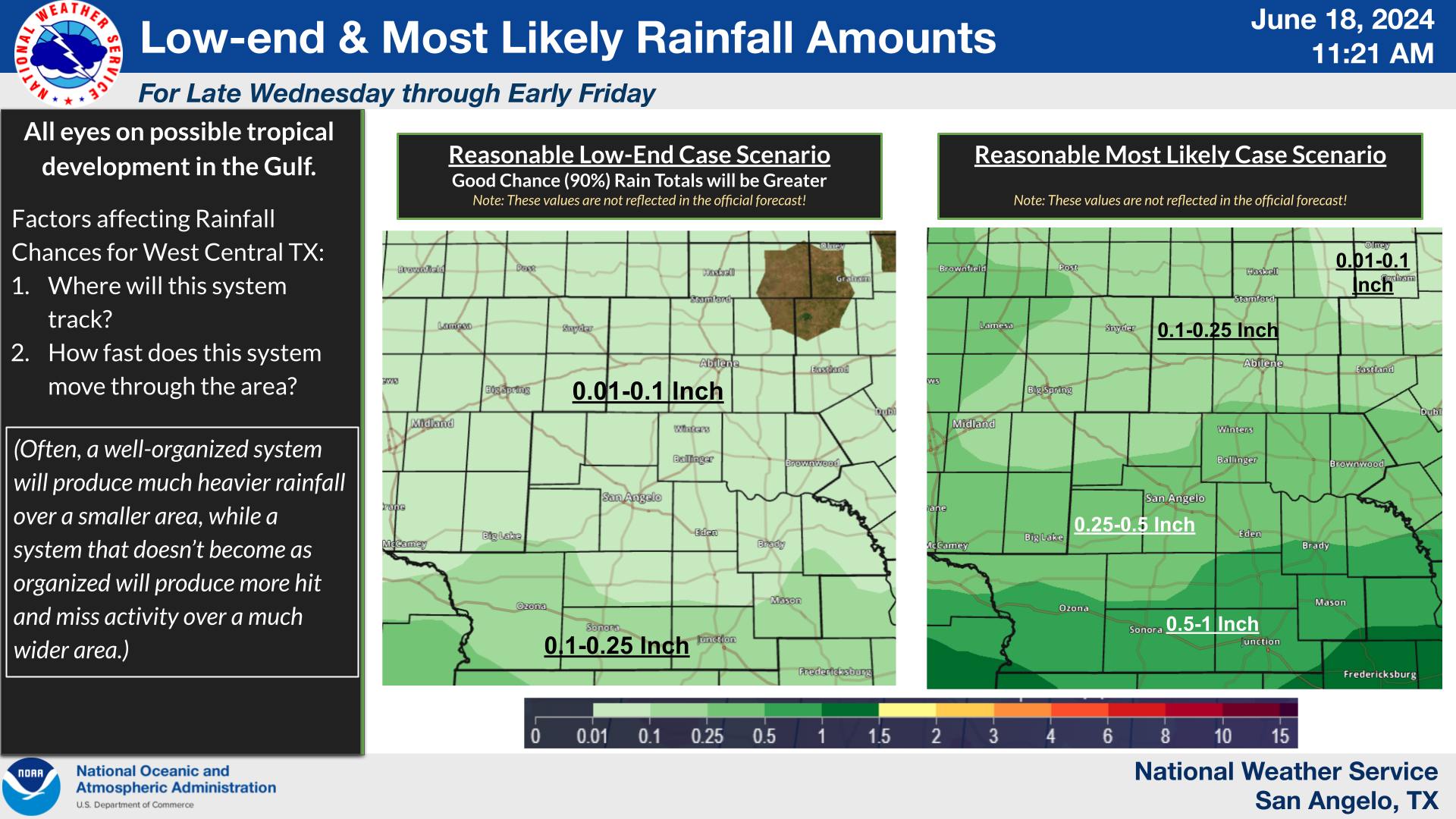

Wintry Mix Of Rain And Snow What To Expect

May 21, 2025

Wintry Mix Of Rain And Snow What To Expect

May 21, 2025 -

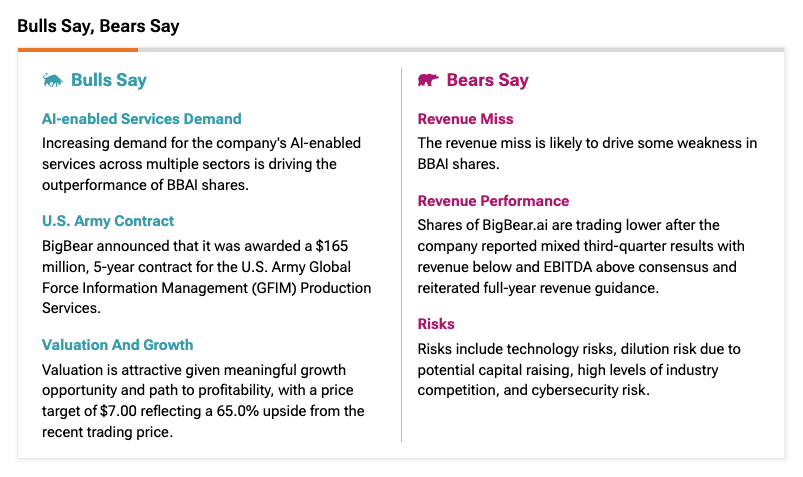

Analyzing Big Bear Ai Stock Is It Worth Buying

May 21, 2025

Analyzing Big Bear Ai Stock Is It Worth Buying

May 21, 2025 -

Big Bear Ai Stock Investment Analysis And Outlook

May 21, 2025

Big Bear Ai Stock Investment Analysis And Outlook

May 21, 2025 -

Big Bear Ai Stock Buy Or Sell

May 21, 2025

Big Bear Ai Stock Buy Or Sell

May 21, 2025 -

Drier Weather On The Horizon Tips For Coping With Reduced Rainfall

May 21, 2025

Drier Weather On The Horizon Tips For Coping With Reduced Rainfall

May 21, 2025