S&P 500 Jumps Over 3%: US-China Trade Truce Fuels Rally

Table of Contents

The US-China Trade Truce: A Detailed Look

The recent market surge is directly attributable to positive developments in the ongoing US-China trade negotiations. While a comprehensive agreement hasn't been finalized, promising signs of a potential truce significantly impacted investor sentiment.

Key Provisions of the Trade Agreement (or Potential Agreement):

While specifics may vary depending on the final agreement, reports suggest key concessions from both sides. The US might see a reduction in tariffs on certain Chinese goods, while China could commit to increased purchases of US agricultural products and other goods. The details of intellectual property protections and technology transfer remain crucial aspects under negotiation. The exact terms will influence the long-term impact on market stability and growth.

Market Sentiment Shift:

The news triggered a palpable shift in market sentiment. Initial pessimism, fueled by prolonged trade tensions and uncertainty, gave way to cautious optimism. Analyst comments reflected this change, with many praising the potential for reduced trade friction and its positive implications for global economic growth. The dramatic increase in trading volume further illustrated the heightened investor interest and confidence.

- Increased investor confidence fueled a significant buying spree.

- Reduced market uncertainty led to decreased volatility in the short term.

- Positive outlook for affected sectors, particularly technology and manufacturing, drove stock prices higher.

Long-Term Implications of the Trade Deal:

The long-term effects of a US-China trade deal are complex and multifaceted.

- Impact on supply chains: Reduced tariffs could lead to more efficient and cost-effective global supply chains.

- Potential for increased economic growth: A trade truce could unlock significant economic growth potential for both nations and the global economy.

- Reduction in tariffs: Lower tariffs will reduce the cost of goods, benefiting consumers and businesses alike.

- Potential for future trade disputes: While a truce is positive, the possibility of future trade disagreements cannot be entirely ruled out.

Sector-Specific Performance Following the News

The market rally wasn't uniform across all sectors. Some experienced significantly greater gains than others.

Winning Sectors:

Technology and manufacturing were among the sectors that saw the most substantial gains. Companies heavily reliant on global trade benefited immensely from the reduced uncertainty.

- Examples: Several tech giants saw double-digit percentage increases in their stock prices. Manufacturing companies dependent on Chinese components experienced a significant boost in investor confidence.

- Reasons: Reduced tariffs on imported components and increased consumer demand fueled this growth.

Lagging Sectors:

Sectors less directly impacted by US-China trade relations experienced less dramatic changes or even minor declines. This highlights the sector-specific nature of the market reaction.

Analyzing Volatility:

Market volatility, as measured by the VIX index, experienced a noticeable decrease following the announcement, indicating reduced investor anxiety. However, it's crucial to monitor volatility levels in the coming weeks and months as the details of any trade agreement are finalized. Charts and graphs comparing volatility before, during, and after the news would provide valuable visual insights.

Expert Opinions and Market Analysis

Understanding the market reaction requires considering expert opinions and broader market analyses.

Analyst Predictions:

Leading financial analysts offered a range of opinions. Some remain cautiously optimistic, highlighting the potential for sustained growth, while others warn against overreacting and emphasize the need to monitor further developments closely.

Impact on Interest Rates and the Dollar:

The trade truce’s impact on interest rates and the US dollar is a complex issue. Lower trade uncertainty might lead to moderate changes in both, but the extent of these changes will depend on many other factors.

Comparison to Previous Market Reactions:

Comparing this rally to previous market reactions to trade-related news reveals both similarities and differences. Past experiences show that market optimism can be short-lived if negotiations stall or unforeseen challenges arise.

Conclusion: Navigating the S&P 500's Future After the Trade Truce

The US-China trade truce significantly impacted the S&P 500, leading to a substantial market rally. While this positive development offers a welcome respite from prolonged trade tensions, it's crucial for investors to remain vigilant and monitor ongoing developments. The long-term implications will depend on the final details of any agreement, as well as broader economic and geopolitical factors. Staying informed about further negotiations and potential shifts in market sentiment is essential for navigating the complexities of the S&P 500's future. For further insights into S&P 500 performance and its sensitivity to global trade dynamics, we encourage you to explore reputable financial news sources and analysis tools. Understanding the interplay between global trade and the S&P 500 is crucial for informed investment decisions.

Featured Posts

-

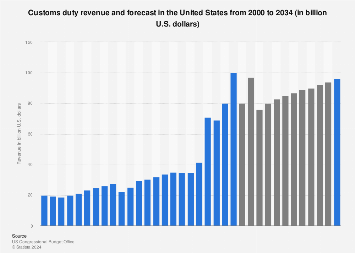

U S Customs Duty Collections Hit Record 16 3 Billion In April

May 13, 2025

U S Customs Duty Collections Hit Record 16 3 Billion In April

May 13, 2025 -

Governor Abbott Directs Texas Rangers To Probe Plano Islamic Center Development Plan

May 13, 2025

Governor Abbott Directs Texas Rangers To Probe Plano Islamic Center Development Plan

May 13, 2025 -

Ver Atalanta Vs Lecce En Vivo Partido De La Serie A Fecha 34

May 13, 2025

Ver Atalanta Vs Lecce En Vivo Partido De La Serie A Fecha 34

May 13, 2025 -

Doom Eternal Dark Ages Location Unveiled On Ps 5

May 13, 2025

Doom Eternal Dark Ages Location Unveiled On Ps 5

May 13, 2025 -

Unending Nightmare The Ordeal Of Families With Hostages In Gaza

May 13, 2025

Unending Nightmare The Ordeal Of Families With Hostages In Gaza

May 13, 2025