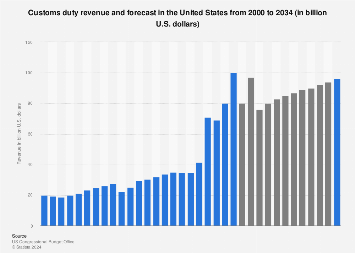

U.S. Customs Duty Collections Hit Record $16.3 Billion In April

Table of Contents

- Factors Contributing to Record U.S. Customs Duty Collections

- Increased Import Volume

- Higher Tariffs and Duties on Certain Goods

- Improved Enforcement and CBP Efficiency

- Implications of Record U.S. Customs Duty Revenue

- Impact on the U.S. Budget and National Debt

- Effects on U.S. Businesses and Consumers

- Future Outlook for U.S. Customs Duty Collections

- Predicting Future Trends

- Challenges and Opportunities for U.S. Customs and Border Protection

- Conclusion

Factors Contributing to Record U.S. Customs Duty Collections

Several factors converged to propel U.S. Customs duty collections to this record high. Understanding these elements is crucial for navigating the evolving landscape of international trade and import duty regulations.

Increased Import Volume

A significant driver of the record-breaking revenue is a substantial increase in import volume. Consumers and businesses alike are importing more goods, leading to higher overall duty collections.

- Strong growth in electronics imports: The demand for consumer electronics continues to be robust, driving a significant portion of the increased import volume.

- Increased imports of consumer goods: A booming retail sector fueled by post-pandemic consumer spending has contributed substantially to higher import volumes across various consumer goods categories.

- Economic Factors: A relatively strong U.S. dollar and increased global supply chain stability have also contributed to the higher import volume. Data from the U.S. Census Bureau (source needed - replace with actual source) shows a [insert percentage]% increase in total imports compared to April 2023.

Higher Tariffs and Duties on Certain Goods

Existing tariffs, particularly those implemented as part of previous trade policy decisions, significantly contributed to the increased revenue. Furthermore, any recent tariff adjustments on specific goods further amplified the effect.

- Increased tariffs on certain steel and aluminum imports: Tariffs imposed on these materials have directly increased the import duty paid on products utilizing these inputs.

- Continued tariffs on goods from specific countries: Pre-existing tariffs on imports from certain nations, due to ongoing trade disputes, continue to impact the amount of import duty collected. (Link to relevant trade policy announcements/legislation here)

- Impact of Trade Wars: The ongoing complexities of global trade relationships, including periods of trade friction, inevitably affect the import duty landscape and contribute to fluctuating revenue streams.

Improved Enforcement and CBP Efficiency

Enhanced customs procedures and strengthened enforcement efforts by U.S. Customs and Border Protection (CBP) have undoubtedly played a role in maximizing duty collections.

- Advanced technology for customs processing: Improved technology and automated systems have streamlined processes, resulting in quicker and more accurate duty assessments.

- Improved risk assessment models: CBP's enhanced ability to identify high-risk shipments has led to more effective targeting of potential undervaluation or misclassification of goods.

- Increased scrutiny on import declarations: More rigorous scrutiny of import documentation ensures greater accuracy in duty calculations and minimizes evasion.

Implications of Record U.S. Customs Duty Revenue

The record-breaking revenue from U.S. Customs duty collections has profound implications for various sectors of the U.S. economy.

Impact on the U.S. Budget and National Debt

The increased revenue has a positive impact on the federal budget, potentially offsetting some of the national debt.

- Significant Revenue Increase: The $16.3 billion represents a [insert percentage]% increase compared to April of the previous year (source needed – replace with actual source).

- Potential for Government Spending: This increased revenue stream could potentially provide additional funding for various government programs and initiatives.

- Fiscal Policy Implications: The influx of revenue has significant implications for broader fiscal policy discussions and debates surrounding government spending.

Effects on U.S. Businesses and Consumers

While the increased revenue is beneficial for the government, higher customs duties impact importers, businesses, and ultimately, consumers.

- Increased import costs for businesses: Higher import duties translate to increased costs for businesses that rely on imported goods, potentially squeezing profit margins.

- Potential inflationary pressures: Increased import costs can be passed on to consumers through higher prices for goods and services, potentially contributing to inflationary pressures.

- Impact on Competitiveness: Higher import duties can reduce the competitiveness of some U.S. businesses compared to foreign competitors with lower import costs.

Future Outlook for U.S. Customs Duty Collections

Predicting future trends in U.S. Customs duty revenue requires careful consideration of numerous economic and policy factors.

Predicting Future Trends

The sustainability of this record revenue level depends on several evolving factors.

- Global Economic Growth: Global economic conditions significantly influence import demand and, consequently, Customs duty collections.

- Changes in Trade Policy: Future changes in tariffs, trade agreements, and trade relationships could dramatically affect import duty revenue.

- Technological Advancements: Technological advancements in customs processing and enforcement will continue to shape collection efficiency.

Challenges and Opportunities for U.S. Customs and Border Protection

CBP faces significant challenges in managing the increased trade volumes and ensuring efficient duty collection.

- Need for Enhanced Technology: Continued investment in advanced technology and automation is essential to manage the growing volume of imports.

- Increased Staffing and Training: Adequate staffing and specialized training for CBP personnel are crucial to maintain efficient operations.

- Supply Chain Disruptions: Ongoing global supply chain disruptions pose challenges to consistent and predictable duty collection.

Conclusion

The record-breaking $16.3 billion in U.S. Customs duty collections in April 2024 highlights the complexity of international trade and its impact on the U.S. economy. Increased import volume, higher tariffs, and improved CBP efficiency are key contributing factors. This surge in revenue has significant implications for the U.S. budget, businesses, and consumers. However, the sustainability of this high level of revenue remains uncertain, dependent on various economic and policy factors. Staying informed about changes in U.S. Customs duty and import duty regulations is critical for businesses and individuals alike. Resources such as the CBP website and relevant trade associations offer valuable information to understand and manage customs duty obligations. Continuously monitoring U.S. Customs duty collections and their impact on the national economy is essential for navigating this dynamic landscape of global trade.

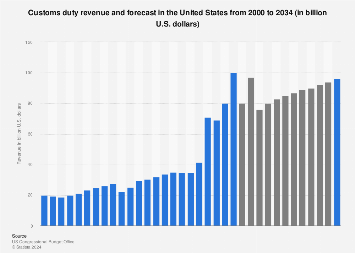

Partynextdoors Apology To Tory Lanez Diss Track Fallout Explained

Partynextdoors Apology To Tory Lanez Diss Track Fallout Explained

Is Epic City Development On Hold Abbotts Warning And The Facts

Is Epic City Development On Hold Abbotts Warning And The Facts

Sheffield United Lucky Escape Red Card Incident Against Leeds United Analyzed

Sheffield United Lucky Escape Red Card Incident Against Leeds United Analyzed

Elsbeth Season 2 Episode 18 A Pivotal Character Murder Stuns Viewers

Elsbeth Season 2 Episode 18 A Pivotal Character Murder Stuns Viewers

Slobodna Dalmacija Di Capriojeva Nova Slika Tesko Ga Je Prepoznati

Slobodna Dalmacija Di Capriojeva Nova Slika Tesko Ga Je Prepoznati