Ryanair's Growth Outlook Dampened By Tariff Conflicts; Buyback Plan Unveiled

Table of Contents

Impact of Tariff Conflicts on Ryanair's Operations

The current global trade landscape presents significant challenges for Ryanair's operations. Several tariff conflicts are directly impacting the airline's ability to maintain its ambitious growth trajectory. These include:

-

Brexit-related trade barriers: The lingering effects of Brexit continue to create uncertainty and added administrative burdens for Ryanair's flights between the UK and the EU. These complexities lead to increased operational costs and potentially reduced flight frequency on certain routes. This directly affects passenger numbers and overall profitability.

-

Potential US-EU trade disputes: Any escalation of trade tensions between the US and the EU could further impact fuel prices, a major cost component for airlines. Increased fuel costs, driven by tariffs or sanctions, directly translate to higher operating expenses for Ryanair, potentially squeezing profit margins.

-

Aviation-specific tariffs: The imposition of tariffs on specific aviation-related goods or services could add to the financial pressure on the airline. This might include tariffs on aircraft parts or maintenance services, leading to increased operational costs.

Ryanair is attempting to mitigate these challenges through various strategies:

-

Route adjustments: The airline might adjust its route network, focusing on less-affected regions or routes with higher profitability. This involves careful analysis of passenger demand and cost-benefit considerations.

-

Hedging strategies: To minimize the impact of fluctuating fuel prices, Ryanair employs hedging strategies, such as purchasing fuel contracts in advance at fixed prices. However, the effectiveness of these strategies depends largely on the accuracy of future price predictions.

The combined effect of these tariff-related challenges has undoubtedly resulted in reduced passenger numbers on some routes and increased pressure on Ryanair's profitability, thereby directly affecting its growth outlook.

Ryanair's Share Buyback Plan: A Strategic Response

In response to these challenges, Ryanair has announced a significant share buyback program. The details of this plan include:

-

Size and scope: The buyback program involves a substantial investment in repurchasing its own shares, signaling a commitment to its shareholders. The exact amount varies according to market conditions and Ryanair’s financial standing.

-

Rationale: The primary rationale behind this buyback is to demonstrate confidence in Ryanair's long-term prospects. It is seen as a way to boost investor confidence and potentially support the stock price amidst the external headwinds. By reducing the number of outstanding shares, the company aims to increase the earnings per share (EPS), thereby potentially attracting more investors.

-

Impact on stock price and investor sentiment: The buyback program is expected to positively influence investor sentiment and potentially increase the stock price. However, the actual impact depends on numerous factors, including broader market conditions and investor perceptions of the airline's future performance.

Compared to previous strategies, this buyback signifies a strong commitment to shareholders' returns, although the long-term sustainability of this strategy amidst persistent economic challenges remains to be seen. Whether it is a sustainable long-term strategy remains a matter of ongoing observation.

Analysis of Ryanair's Future Growth Prospects

Despite the challenges, Ryanair still possesses several strengths that could fuel future growth:

-

Market share: Ryanair maintains a dominant market share in the European low-cost carrier market, giving it a strong competitive advantage. Its established brand recognition and extensive route network offer significant resilience.

-

Competitive landscape: While competition exists within the low-cost airline sector, Ryanair's scale and operational efficiency often enable it to weather economic storms better than smaller competitors.

-

Expansion plans: Despite the headwinds, Ryanair may still pursue expansion into new markets or explore diversification strategies, focusing on resilient routes or new revenue streams (e.g., ancillary services).

However, the long-term sustainability of Ryanair's low-cost business model is subject to ongoing review in the current climate. The persistent pressure of tariff conflicts and increased fuel costs necessitates a dynamic approach to route planning and cost management to secure sustainable growth.

Conclusion:

Ryanair's growth outlook is undeniably challenged by ongoing tariff conflicts impacting both fuel prices and international travel. The airline’s substantial share buyback plan is a strategic attempt to reinforce investor confidence. The long-term impact of these external factors remains uncertain, however. Careful monitoring of the situation and its effect on Ryanair’s future performance is crucial.

Call to Action: Stay informed about Ryanair's performance and the evolving landscape of the European aviation industry to better understand the long-term effects of tariff conflicts and the success of the buyback plan. Continue to monitor Ryanair’s stock and related news for crucial updates on its growth outlook and future strategies.

Featured Posts

-

Burnham And Highbridge History Unveiled Photo Archive Opens

May 20, 2025

Burnham And Highbridge History Unveiled Photo Archive Opens

May 20, 2025 -

Delving Into The Psychology Of Agatha Christies Poirot

May 20, 2025

Delving Into The Psychology Of Agatha Christies Poirot

May 20, 2025 -

How Winter Weather Advisories Affect School Decisions

May 20, 2025

How Winter Weather Advisories Affect School Decisions

May 20, 2025 -

Market Analysis D Wave Quantum Qbts Stocks Unexpected Rise This Week

May 20, 2025

Market Analysis D Wave Quantum Qbts Stocks Unexpected Rise This Week

May 20, 2025 -

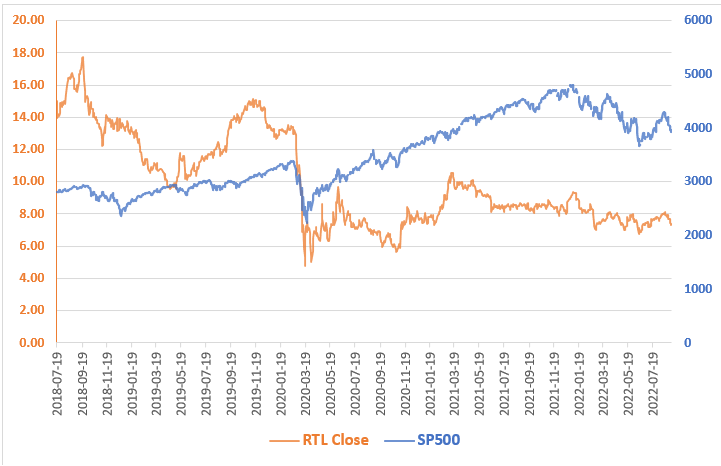

Is Rtl Group Poised For Streaming Success Examining Financial Projections

May 20, 2025

Is Rtl Group Poised For Streaming Success Examining Financial Projections

May 20, 2025

Latest Posts

-

Kroyz Azoyl Ston Teliko Champions League I Symvoli Toy Giakoymaki

May 20, 2025

Kroyz Azoyl Ston Teliko Champions League I Symvoli Toy Giakoymaki

May 20, 2025 -

Prokrisi Kroyz Azoyl O Giakoymakis Ston Teliko Champions League

May 20, 2025

Prokrisi Kroyz Azoyl O Giakoymakis Ston Teliko Champions League

May 20, 2025 -

Eyresi Efimereyontos Giatroy Stin Patra 10 And 11 Maioy

May 20, 2025

Eyresi Efimereyontos Giatroy Stin Patra 10 And 11 Maioy

May 20, 2025 -

Patra Efimereyontes Iatroi Savvatokyriako 10 11 Maioy

May 20, 2025

Patra Efimereyontes Iatroi Savvatokyriako 10 11 Maioy

May 20, 2025 -

Efimeries Giatron Patra 10 11 Maioy Breite Ton Giatro Sas

May 20, 2025

Efimeries Giatron Patra 10 11 Maioy Breite Ton Giatro Sas

May 20, 2025