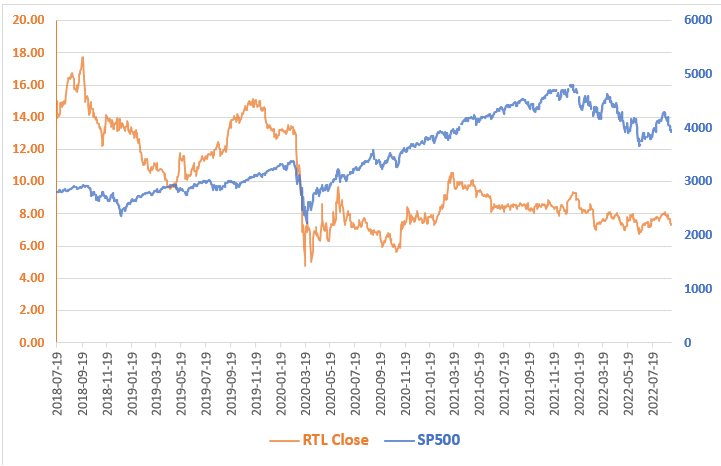

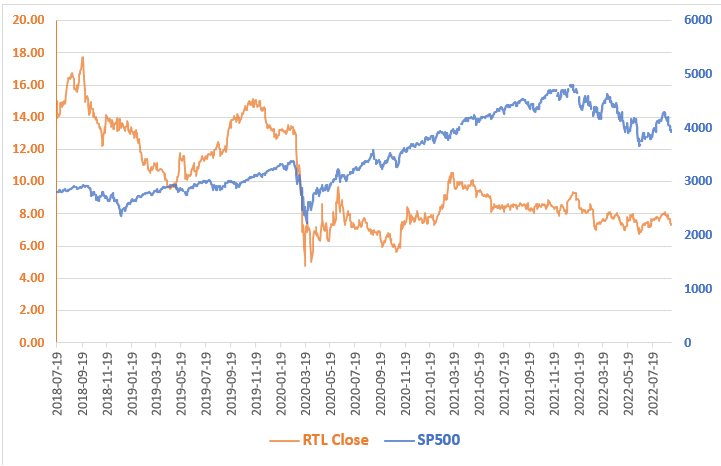

Is RTL Group Poised For Streaming Success? Examining Financial Projections

Table of Contents

RTL Group's Streaming Strategy and Market Position

RTL Group's streaming ambitions are largely centered around RTL+, its flagship streaming platform, along with other ventures like Videoland in the Netherlands. Understanding its market position and strategic moves is vital to assessing its future success.

Analysis of RTL+ and other streaming platforms

RTL+'s performance hinges on several factors: its market share, subscriber growth, the quality and breadth of its content library, and the competitive pressures it faces.

- Competitive Landscape: RTL+ competes with established giants like Netflix, Disney+, and Amazon Prime Video, each possessing vast content libraries and significant subscriber bases. This intense competition necessitates a strong content strategy and effective marketing.

- Content Strategy: RTL+'s success depends on its ability to offer compelling and diverse content that resonates with its target audience. This includes original productions, exclusive licensing deals, and a curated selection of popular movies and shows. A weakness in content could significantly hinder subscriber growth.

- Subscriber Acquisition Costs: Acquiring new subscribers is costly. RTL+ needs to balance its marketing spend with the lifetime value of each subscriber to ensure profitability. High customer acquisition costs (CAC) can impact the overall financial health of the streaming service.

Geographic expansion and international strategies

RTL Group's international reach and expansion plans are crucial for long-term growth. The success of Videoland in the Netherlands offers a valuable case study for future expansion.

- Videoland's Success: Analyzing Videoland's market penetration, subscriber numbers, and revenue generation in the Netherlands can provide insights into RTL Group's ability to replicate this success in other markets.

- Expansion into Underserved Markets: Identifying and targeting underserved markets with tailored content could provide significant growth opportunities. This requires careful market research and culturally relevant programming.

- Partnerships and Acquisitions: Strategic partnerships and acquisitions can accelerate international expansion, providing access to new content libraries, technologies, and distribution networks.

Financial Projections and Key Performance Indicators (KPIs)

Examining RTL Group's financial projections and key performance indicators provides a clearer picture of its financial health and the trajectory of its streaming services.

Revenue projections and growth forecasts

RTL Group regularly publishes financial reports offering insights into the projected revenue and growth of its streaming platforms. This data is crucial for evaluating the long-term viability of its streaming strategy.

- Revenue Streams: Analyzing anticipated revenue streams—subscription fees, advertising revenue, and any other potential income sources—provides a comprehensive understanding of RTL+'s financial model.

- Projected Profitability: Identifying projected timelines for profitability is critical. A sustainable business model requires achieving profitability within a reasonable timeframe. Investors and analysts closely monitor these projections.

- Financial Report Analysis: A thorough analysis of RTL Group's financial reports, including revenue figures, operating costs, and net income, is essential to assess the financial health of its streaming ventures.

Key performance indicators (KPIs) and their analysis

Analyzing key performance indicators (KPIs) is essential to track the effectiveness of RTL Group's streaming strategy. These metrics offer a granular view of performance.

- ARPU (Average Revenue Per User): A rising ARPU indicates increased revenue generation from existing subscribers, potentially through higher subscription tiers or add-on services.

- Churn Rate: A high churn rate suggests subscribers are canceling their subscriptions, indicating potential issues with content, pricing, or customer service. A low churn rate is vital for long-term sustainability.

- Customer Acquisition Cost (CAC): This KPI measures the cost of acquiring a new subscriber. A high CAC can negatively impact profitability, necessitating optimization of marketing and acquisition strategies.

- Content Production Costs: The cost of producing original content significantly impacts profitability. Careful budgeting and efficient production processes are vital to maintain healthy margins.

Challenges and Risks to RTL Group's Streaming Ambitions

Despite its potential, RTL Group faces several challenges and risks in its pursuit of streaming success.

Competition from established streaming giants

The streaming market is intensely competitive. RTL+ needs to differentiate itself from established giants to secure a significant market share.

- Netflix, Disney+, Amazon Prime Video: These players possess massive content libraries, strong brand recognition, and significant resources. Competing effectively requires a clear strategic advantage.

- Market Share Competition: RTL+ needs to actively compete for market share by offering unique and compelling content, competitive pricing, and superior user experience.

Content costs and licensing agreements

Securing high-quality content is expensive. RTL Group must manage content costs effectively to maintain profitability.

- Licensing Agreements: Licensing agreements with content providers can be complex and costly. Negotiating favorable terms is crucial for maintaining profitability.

- Risk Mitigation: Diversifying content sources and investing in original productions can help mitigate the risks associated with reliance on specific content providers.

Technological advancements and evolving consumer behavior

The streaming landscape is constantly evolving. RTL Group must adapt to technological advancements and changing consumer preferences.

- Technological Disruption: New technologies like VR/AR could disrupt the streaming industry. RTL Group needs to anticipate and adapt to these changes.

- Changing Viewing Habits: Consumer viewing habits are constantly shifting. Understanding these trends and adapting the business model accordingly is essential for long-term success.

The Future of RTL Group in the Streaming World

In summary, RTL Group's streaming success hinges on several factors. While its streaming platforms offer potential, the intense competition, high content costs, and evolving market dynamics present significant challenges. The analysis of its financial projections reveals a complex picture, with opportunities and risks intertwined. A strong content strategy, effective marketing, and a keen understanding of the competitive landscape will determine RTL Group's ultimate success. Its international expansion plans, while promising, require careful execution to navigate the unique challenges of different markets.

Final Assessment: RTL Group's prospects for streaming success are promising but not guaranteed. Success will depend on its ability to innovate, adapt, and effectively compete in a highly dynamic and competitive environment.

Call to Action: Keep a close eye on RTL Group's financial reports and news to stay informed about its progress and the ongoing evolution of its streaming strategy. The future of RTL Group streaming success is unfolding, and continued monitoring is key to understanding its trajectory.

Featured Posts

-

Jutarnji List Tko Je Sve Sjajio Na Premijeri

May 20, 2025

Jutarnji List Tko Je Sve Sjajio Na Premijeri

May 20, 2025 -

The Enduring Appeal Of Agatha Christies Poirot An Analysis

May 20, 2025

The Enduring Appeal Of Agatha Christies Poirot An Analysis

May 20, 2025 -

Ap

May 20, 2025

Ap

May 20, 2025 -

Kaellman Ja Hoskonen Palaavat Suomeen Puola Jakson Jaelkeen

May 20, 2025

Kaellman Ja Hoskonen Palaavat Suomeen Puola Jakson Jaelkeen

May 20, 2025 -

Leclerc Speaks Out The Truth About The Ferrari Strategy And Hamilton

May 20, 2025

Leclerc Speaks Out The Truth About The Ferrari Strategy And Hamilton

May 20, 2025

Find Sandylands U On Tv Your Ultimate Guide

Find Sandylands U On Tv Your Ultimate Guide