RTL Group: On Track For Streaming Profitability? A Detailed Analysis

Table of Contents

RTL Group's Streaming Strategy and Investments

RTL Group's streaming strategy centers around its flagship platform, RTL+. This service offers a diverse range of content, encompassing both acquired and original programming, aiming to cater to a broad audience across multiple demographics. Significant investments have been made in bolstering RTL+'s offerings and expanding its reach. These investments span several key areas:

-

Content Creation: RTL Group has commissioned numerous original series and films exclusively for RTL+, including both scripted and unscripted formats. Examples include [insert specific examples of RTL+ original programming here, linking to relevant pages if possible]. This focus on original content aims to differentiate RTL+ from competitors and attract subscribers seeking unique viewing experiences.

-

Technological Advancements: The company has invested heavily in improving the technological infrastructure of RTL+, enhancing user experience through features like personalized recommendations, improved streaming quality, and seamless cross-device compatibility. Partnerships with leading technology providers may also be mentioned here.

-

Marketing and Subscriber Acquisition: RTL Group employs a multi-pronged marketing strategy to attract new subscribers, leveraging traditional and digital channels. This includes targeted advertising campaigns, social media engagement, and promotional offers. Success in subscriber acquisition is crucial for achieving RTL Group streaming profitability.

The effectiveness of these investments can be assessed by tracking key metrics such as subscriber growth, churn rate, and ARPU (Average Revenue Per User). A thorough analysis of these metrics will reveal the extent to which RTL Group’s streaming strategy and content investment are contributing to its financial success.

Analyzing RTL Group's Subscriber Growth and Engagement

Analyzing subscriber growth is paramount to understanding RTL Group's streaming performance. While precise figures are often proprietary information, publicly available data, financial reports, and press releases can shed light on trends. [Insert data on subscriber growth here, citing sources whenever possible. For example: "According to RTL Group’s Q[Quarter] [Year] report, RTL+ subscriber numbers increased by X% compared to the same period last year."]

Beyond raw numbers, analyzing key performance indicators (KPIs) provides a more nuanced understanding:

-

ARPU (Average Revenue Per User): This metric indicates the average revenue generated per subscriber. A rising ARPU suggests improved monetization strategies.

-

Churn Rate: This represents the percentage of subscribers who cancel their subscriptions within a given period. A low churn rate signifies high user satisfaction and loyalty.

-

User Engagement: Analyzing average viewing time, content consumption patterns, and user interactions within the app will reveal how effectively RTL+ is retaining its audience. A high level of engagement suggests successful content curation and platform usability.

A geographical breakdown of the subscriber base reveals areas of strength and potential for future growth. Comparing these metrics with those of competitors like Netflix, Disney+, and Amazon Prime Video in the European market provides valuable context for assessing RTL Group’s performance in relation to the wider European streaming market.

Revenue Generation and Profitability Metrics

RTL Group generates revenue from its streaming services through a mix of subscription fees and, potentially, advertising revenue. Analyzing the contribution of each revenue stream is vital for assessing overall revenue generation and streaming revenue. [Insert data on revenue streams here, citing sources whenever possible].

Understanding profitability requires examining:

-

Operating Income: This reflects the profitability of RTL+'s operations after deducting operating expenses.

-

Margins: Profit margins indicate the percentage of revenue remaining after deducting costs. Higher margins suggest greater efficiency in managing operations.

The challenge in achieving profitability in the streaming landscape lies in the high cost of producing original content, acquiring licensing rights, and investing in technology. Therefore, understanding RTL Group's cost management strategies—including content licensing deals, efficient technology deployments, and subscriber acquisition cost optimization—is crucial in evaluating their path to profitability. Comparing the streaming segment's profitability with other business segments within RTL Group provides a clearer picture of its overall financial health.

Competitive Landscape and Future Outlook

RTL Group operates in a fiercely competitive European streaming market. Key competitors include established global players like Netflix and Disney+, as well as regional players with strong local content libraries. [Identify and briefly analyze key competitors here, comparing their strengths and weaknesses to those of RTL Group].

Looking to the future, RTL Group has several growth opportunities:

- Strategic partnerships and collaborations can broaden content offerings and reduce production costs.

- Acquisitions of smaller streaming services could expand its market share and audience reach.

- Focus on niche content and targeted marketing can help it reach specific demographics effectively.

However, significant challenges remain, including rising content costs, increasing competition, and securing strong, loyal subscribers. Forecasting future subscriber growth and profitability requires careful consideration of these factors.

Conclusion: RTL Group's Path to Streaming Success

Our analysis reveals that RTL Group's journey towards RTL Group streaming profitability is a complex and ongoing process. While the company has made significant investments in content, technology, and marketing, achieving profitability requires sustained subscriber growth, efficient cost management, and successful navigation of the competitive landscape. The success of its original content strategy, the effectiveness of its subscriber acquisition efforts, and the evolution of the European streaming market will all play a crucial role in determining RTL Group’s ultimate success. Challenges remain, but the potential for growth is evident. Stay tuned for further updates on RTL Group streaming profitability and the evolving European streaming landscape. Learn more about RTL Group’s streaming strategy and its impact on the media industry by visiting [insert relevant link here].

Featured Posts

-

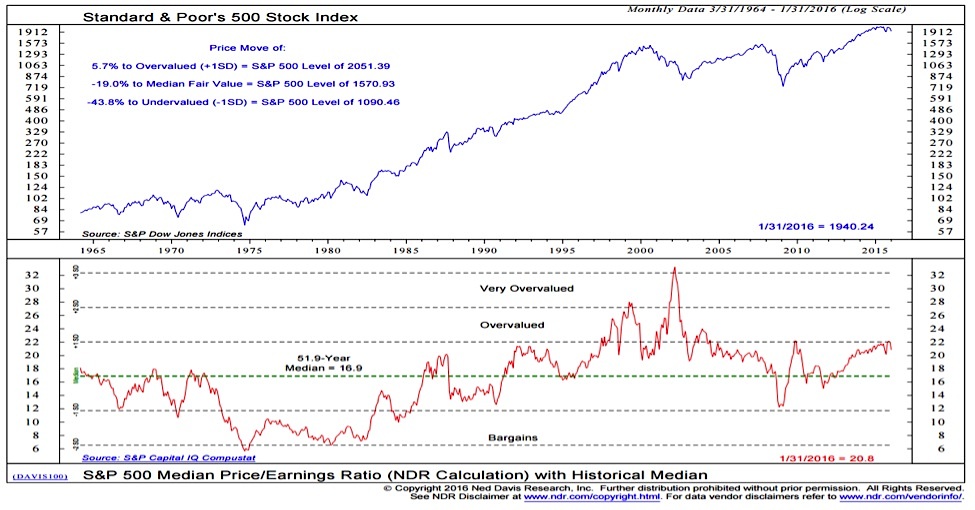

Understanding High Stock Market Valuations Bof As View For Investors

May 20, 2025

Understanding High Stock Market Valuations Bof As View For Investors

May 20, 2025 -

Abidjan Accueille Le President Mahama Une Visite Pour Consolider La Cooperation Bilaterale

May 20, 2025

Abidjan Accueille Le President Mahama Une Visite Pour Consolider La Cooperation Bilaterale

May 20, 2025 -

Cadillac F1 Seat Support Grows For Mick Schumacher

May 20, 2025

Cadillac F1 Seat Support Grows For Mick Schumacher

May 20, 2025 -

Investigating The Reasons Behind D Wave Quantum Qbts Stocks Friday Gain

May 20, 2025

Investigating The Reasons Behind D Wave Quantum Qbts Stocks Friday Gain

May 20, 2025 -

Nyt Mini Crossword Answers For March 27

May 20, 2025

Nyt Mini Crossword Answers For March 27

May 20, 2025

Latest Posts

-

Reddit Post To Become Feature Film Sydney Sweeney Lands Lead Role Warner Bros

May 21, 2025

Reddit Post To Become Feature Film Sydney Sweeney Lands Lead Role Warner Bros

May 21, 2025 -

Warner Bros Developing Film Based On Popular Reddit Post Starring Sydney Sweeney

May 21, 2025

Warner Bros Developing Film Based On Popular Reddit Post Starring Sydney Sweeney

May 21, 2025 -

Sydney Sweeney To Star In Warner Bros Movie Based On Viral Reddit Thread

May 21, 2025

Sydney Sweeney To Star In Warner Bros Movie Based On Viral Reddit Thread

May 21, 2025 -

Javier Baez Un Regreso A La Productividad

May 21, 2025

Javier Baez Un Regreso A La Productividad

May 21, 2025 -

Od Reddita Do Velikog Platna Sydney Sweeney U Novoj Filmskoj Adaptaciji

May 21, 2025

Od Reddita Do Velikog Platna Sydney Sweeney U Novoj Filmskoj Adaptaciji

May 21, 2025