Understanding High Stock Market Valuations: BofA's View For Investors

Table of Contents

BofA's Current Assessment of High Stock Market Valuations

BofA's current stance on high stock market valuations is generally cautious, though not necessarily bearish. While acknowledging the robust performance of the market, their analysts highlight the elevated levels of certain valuation metrics, suggesting a degree of risk. They emphasize the need for careful consideration and a strategic approach to investing in this environment. Specific data points and quotes from BofA reports would require access to their proprietary research. However, we can discuss general indicators they typically utilize.

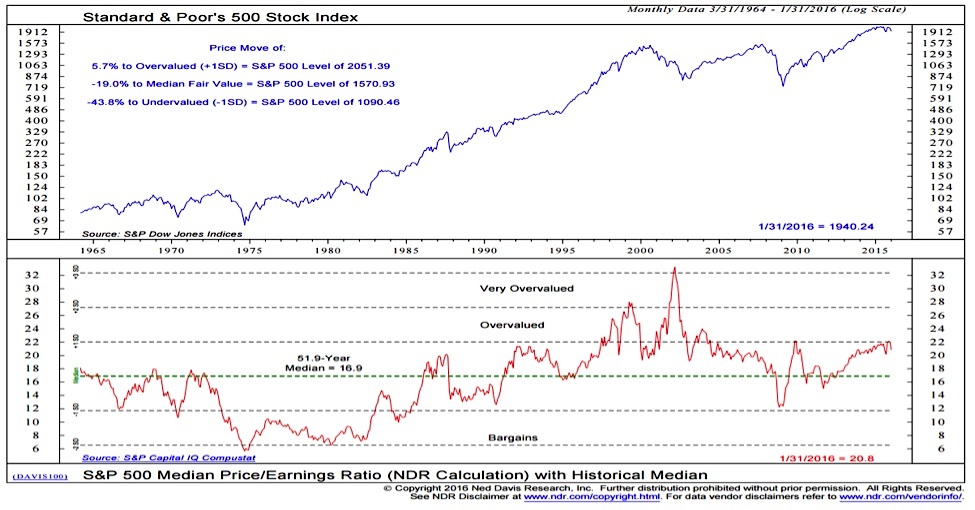

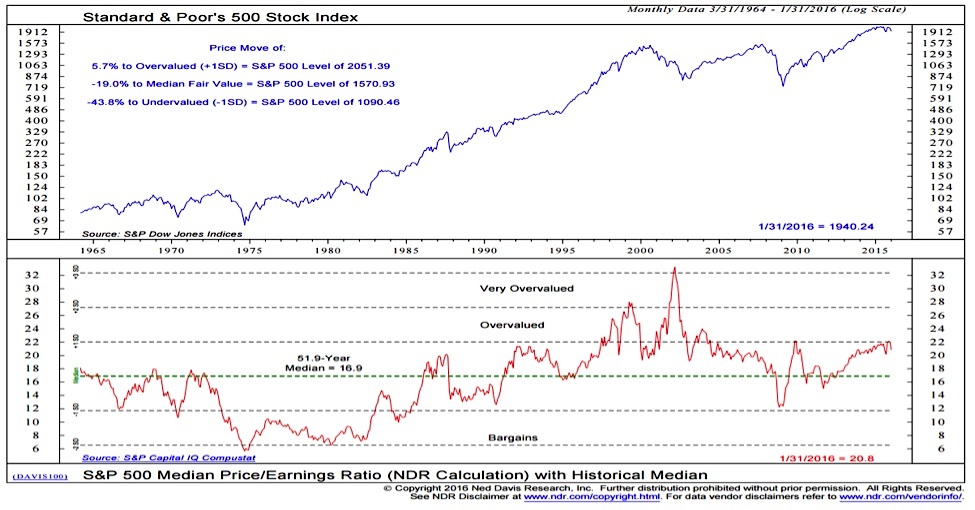

- Key Indicators: BofA's assessment of market valuations often involves analyzing multiple metrics, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various sector-specific valuation ratios. High P/E ratios, for instance, generally indicate that the market is pricing stocks at a premium relative to their earnings.

- Overvalued and Undervalued Sectors: BofA's research often identifies specific sectors or asset classes that are deemed overvalued or undervalued relative to their historical averages and future growth prospects. This analysis can vary significantly depending on the economic climate and market conditions. For example, certain technology stocks might be seen as overvalued in periods of rapid growth, while more traditional sectors may appear undervalued.

- Recent BofA Reports: To gain the most up-to-date insights, it's crucial to consult BofA's regularly published research reports and market commentaries. These reports often delve into the nuances of current valuations and provide more detailed sector-specific analyses. Access to these reports may require a subscription or professional access.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the current environment of high stock market valuations. Understanding these underlying forces is critical for investors.

- Low Interest Rates: Historically low interest rates have pushed investors into higher-yielding assets, including stocks. The reduced opportunity cost of investing in stocks (compared to bonds or savings accounts) helps drive demand and inflates valuations.

- Quantitative Easing (QE) and Monetary Policy: Central bank policies, such as quantitative easing (QE), have injected significant liquidity into the market, further boosting asset prices. This injection of capital increases the money supply and can drive up demand across various asset classes.

- Strong Corporate Earnings Growth: Robust corporate earnings growth, particularly in certain sectors, can justify higher stock valuations. However, it's crucial to analyze whether this growth is sustainable or merely temporary.

- Technological Advancements and Innovation: Breakthrough innovations and technological advancements frequently attract substantial investment, leading to high valuations for companies at the forefront of these trends. These high valuations often reflect the potential for future growth and disruption.

- Investor Sentiment and Market Psychology: Positive investor sentiment and a general sense of optimism can inflate stock prices, even in the absence of strong fundamentals. Market psychology plays a powerful role in driving valuations.

Potential Risks Associated with High Stock Market Valuations

Investing in a market with high valuations inherently carries significant risks. Understanding these risks is crucial for informed decision-making.

- Increased Market Volatility: Highly valued markets are often more susceptible to sharp corrections and increased volatility. Small changes in investor sentiment or economic news can lead to significant price swings.

- Risk of Overvalued Assets: Investing in overvalued assets significantly increases the potential for losses if the market corrects. A decline in valuations could lead to substantial capital erosion.

- Impact of Inflation: Inflation erodes the purchasing power of future earnings, potentially impacting stock valuations. High inflation often prompts central banks to raise interest rates, potentially leading to a market downturn.

- Change in Monetary Policy: A shift in monetary policy from accommodative to restrictive can dramatically impact stock prices. Rising interest rates tend to decrease stock valuations.

- Geopolitical Risks: Geopolitical uncertainties and global events can significantly affect investor sentiment and trigger market corrections, regardless of underlying valuations.

BofA's Investment Strategies for High Valuation Environments

BofA's suggested investment strategies for navigating high-valuation environments often emphasize caution and diversification.

- Diversification: Diversifying across various asset classes (stocks, bonds, real estate, alternative investments) helps mitigate risk. This approach reduces the impact of potential declines in any single asset class.

- Value Investing: Focusing on value investing, identifying undervalued companies with strong fundamentals, can provide a more resilient portfolio in a high-valuation market.

- Sector-Specific Recommendations: BofA's research often provides sector-specific investment recommendations based on their valuation analysis. These recommendations can help investors identify potentially less-risky opportunities.

- Risk Management and Portfolio Rebalancing: Regular portfolio rebalancing helps maintain the desired asset allocation and manage risk. This disciplined approach can help prevent overexposure to any single sector or asset class.

- Alternative Investments: Consideration of alternative investments, such as private equity or hedge funds, may be recommended to diversify risk further.

Conclusion

BofA's perspective on high stock market valuations emphasizes caution while acknowledging the ongoing market performance. They advocate for a strategic approach, focusing on diversification, value investing, and careful risk management. Understanding these high stock market valuations is crucial for making sound investment choices. The potential for market corrections and the impact of various economic and geopolitical factors warrant a thoughtful and adaptable investment strategy. Learn more about BofA's insights and develop a robust investment plan today by consulting with a financial advisor and researching their market analysis. Remember to consult with a financial professional before making any investment decisions.

Featured Posts

-

Addressing Taiwans Energy Needs The Lng Solution

May 20, 2025

Addressing Taiwans Energy Needs The Lng Solution

May 20, 2025 -

Improved Wireless Headphones A Comprehensive Guide

May 20, 2025

Improved Wireless Headphones A Comprehensive Guide

May 20, 2025 -

Retired Admiral Robert P Burkes Bribery Conviction Key Details

May 20, 2025

Retired Admiral Robert P Burkes Bribery Conviction Key Details

May 20, 2025 -

The Truth Behind The Bbc Agatha Christie Deepfake Rumours

May 20, 2025

The Truth Behind The Bbc Agatha Christie Deepfake Rumours

May 20, 2025 -

Jennifer Lawrences Post Baby Red Carpet Return A Stunning Backless Bridal Look

May 20, 2025

Jennifer Lawrences Post Baby Red Carpet Return A Stunning Backless Bridal Look

May 20, 2025

Latest Posts

-

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025 -

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025 -

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025 -

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025 -

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025