Riot Platforms (RIOT) Stock Dips: Analyzing The 52-Week Low

Table of Contents

Bitcoin Price Volatility and its Impact on RIOT Stock

The Correlation between Bitcoin Price and RIOT Stock Performance

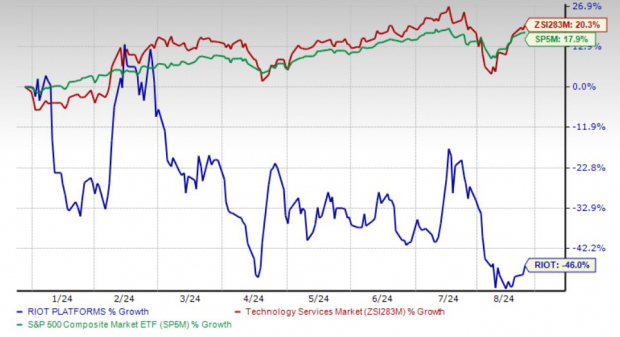

Riot Platforms, like other Bitcoin mining companies, is directly exposed to the volatility of the cryptocurrency market. The price of Bitcoin is intrinsically linked to the profitability of Bitcoin mining operations. The Riot Platforms (RIOT) 52-week low is a direct consequence of this correlation.

- Lower Bitcoin prices directly reduce the value of Riot's mining operations. When the price of Bitcoin falls, the revenue generated from mining decreases proportionally, impacting the company's bottom line.

- Decreased profitability leads to lower stock valuations. Reduced profitability translates into lower earnings per share, which in turn negatively affects investor confidence and subsequently the stock price.

- Historical examples abound showcasing this correlation. Examining past periods of Bitcoin price drops reveals a consistent downward trend in RIOT stock price, confirming the strong relationship between the two.

- (Include relevant charts and graphs here showing the correlation between Bitcoin price and RIOT stock price. Ideally, these would be dynamically generated and updated regularly.)

Keyword integration: Bitcoin price, RIOT stock price correlation, cryptocurrency market volatility, Bitcoin mining revenue.

Increased Energy Costs and Their Effect on Mining Profitability

Rising Energy Costs Squeeze Margins for Crypto Miners

Energy costs represent a significant portion of the operational expenses for Bitcoin mining companies like Riot Platforms. The recent surge in energy prices globally has placed immense pressure on the profitability of their mining operations, contributing significantly to the Riot Platforms (RIOT) 52-week low.

- Energy costs are a paramount factor in Bitcoin mining. The process is energy-intensive, meaning that fluctuations in energy prices directly affect the overall cost of mining each Bitcoin.

- Increased energy costs reduce profit margins for Riot Platforms. Higher energy expenses eat into the already slim margins of Bitcoin mining, potentially leading to losses if Bitcoin prices remain low.

- Riot Platforms' energy procurement strategies are crucial. Their ability to secure cost-effective and reliable energy sources is paramount to their long-term profitability and survival. Analyzing their energy sourcing strategy and any recent changes is key to understanding their current situation.

- (Mention any recent announcements or reports from Riot concerning energy costs. Link to official press releases or SEC filings.)

Keyword integration: Energy costs, Bitcoin mining profitability, Riot Platforms energy strategy, energy price volatility.

Market Sentiment and Investor Confidence in the Crypto Mining Sector

Negative Market Sentiment and its Impact on RIOT Stock

The overall market sentiment toward the cryptocurrency industry significantly influences investor confidence in crypto mining companies like Riot Platforms. The Riot Platforms (RIOT) 52-week low reflects a broader negative sentiment within the sector.

- Regulatory uncertainty impacts investor confidence. Varying and evolving regulations across different jurisdictions create uncertainty, making investors hesitant to invest heavily in the crypto mining sector.

- Overall market trends influence RIOT stock. Bearish market trends in the broader cryptocurrency market tend to spill over into the stocks of crypto mining companies.

- (Mention any negative news or events affecting investor confidence recently. Examples might include regulatory crackdowns, major hacks, or negative press.)

- (Discuss analyst ratings and their predictions for RIOT stock. Cite sources for this data.)

Keyword integration: Investor sentiment, Cryptocurrency market outlook, RIOT stock forecast, regulatory uncertainty, crypto market sentiment.

Company-Specific Factors Contributing to the RIOT Stock Dip

Internal Factors Affecting Riot Platforms' Performance

While external factors play a significant role, internal company-specific factors can also contribute to a stock price decline. Analyzing these is crucial to a complete understanding of the Riot Platforms (RIOT) 52-week low.

- (Examine recent financial reports and identify any potential weaknesses. Link to financial statements and reports.)

- (Assess the company's expansion plans and their potential risks. Analyze the feasibility and potential returns of their expansion strategies.)

- (Discuss any operational challenges or setbacks faced by Riot Platforms. This might include hardware malfunctions, unexpected downtime, or difficulties in scaling operations.)

- (Analyze management decisions and their impact on the company's performance. Were there any questionable strategic decisions made that contributed to the decline?)

Keyword integration: Riot Platforms financial performance, RIOT operational challenges, company-specific risks, RIOT expansion plans.

Conclusion: Navigating the Future of Riot Platforms (RIOT) Stock

The Riot Platforms (RIOT) 52-week low is a result of a confluence of factors, including Bitcoin price volatility, rising energy costs, negative market sentiment, and potentially company-specific issues. Understanding the interplay between these elements is critical for investors. The correlation between Bitcoin price and RIOT stock price remains strong, highlighting the inherent risk associated with this investment.

While the outlook may seem bleak in the short term, it's important to maintain a balanced perspective. Opportunities might arise from strategic energy cost management or favorable regulatory developments.

Understanding the factors contributing to the Riot Platforms (RIOT) 52-week low is crucial for informed investment decisions. Continue your research on RIOT and other cryptocurrency mining stocks to navigate the volatile market effectively. Remember to consult with a financial advisor before making any investment decisions.

(Include relevant links to Riot Platforms' investor relations page, financial statements, and other reliable sources of information here.)

Featured Posts

-

Photoshopped Perfection Christina Aguilera Faces Backlash Over Altered Images

May 02, 2025

Photoshopped Perfection Christina Aguilera Faces Backlash Over Altered Images

May 02, 2025 -

Play Station Showcase 2024 Ps 5 Fans Two Year Wait Nearly Over

May 02, 2025

Play Station Showcase 2024 Ps 5 Fans Two Year Wait Nearly Over

May 02, 2025 -

Elon Musks Departure Exclusive Details On Teslas Ceo Search

May 02, 2025

Elon Musks Departure Exclusive Details On Teslas Ceo Search

May 02, 2025 -

Is Now The Time To Buy Xrp Ripple At Less Than 3

May 02, 2025

Is Now The Time To Buy Xrp Ripple At Less Than 3

May 02, 2025 -

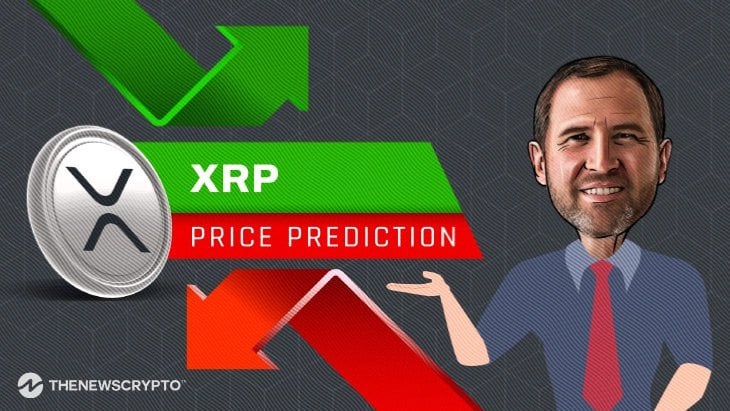

Riot Fest 2025 Lineup Revealed Green Day Weezer Lead The Charge

May 02, 2025

Riot Fest 2025 Lineup Revealed Green Day Weezer Lead The Charge

May 02, 2025