Could Tariffs Jeopardize The Fed's Objectives? Powell Weighs In

Table of Contents

Inflationary Pressures from Tariffs

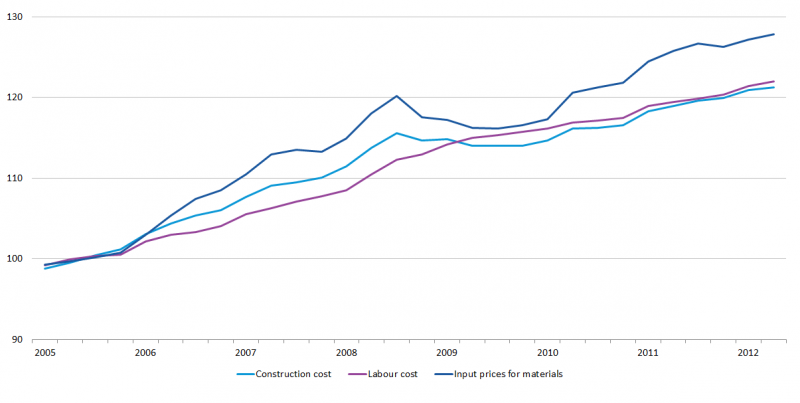

Tariffs, essentially taxes on imported goods, directly increase the cost of these goods. This increase is rarely absorbed by importers; instead, it's typically passed onto consumers, leading to higher prices across various sectors. This mechanism creates significant inflationary pressures.

- Increased import costs passed onto consumers: The added tariff cost becomes part of the final price consumers pay.

- Reduced competition leading to higher prices: Tariffs can shield domestic producers from foreign competition, reducing the incentive to lower prices.

- Potential for a wage-price spiral: Higher prices can lead to demands for higher wages, further fueling inflation in a vicious cycle.

- Impact on the Consumer Price Index (CPI) and Producer Price Index (PPI): The CPI and PPI, key inflation indicators, directly reflect the impact of tariffs on consumer and producer prices, respectively. A sharp increase in these indices can be a direct consequence of trade war inflation.

The Fed's mandate includes controlling inflation. Tariff-induced price hikes directly challenge this mandate, forcing the central bank to consider countermeasures to manage CPI impact and maintain price stability.

Impact on Economic Growth and Investment

Tariffs also pose a significant threat to economic growth. The uncertainty generated by trade wars significantly impacts business confidence, leading to decreased investment. Businesses become hesitant to expand or make long-term commitments in an unpredictable trade environment.

- Uncertainty caused by trade wars decreases business confidence: Uncertainties about future trade relations lead businesses to postpone investments and hiring.

- Reduced exports due to retaliatory tariffs: When one country imposes tariffs, others often retaliate, reducing export opportunities for all parties involved.

- Impact on supply chains and global trade: Tariffs disrupt established global supply chains, increasing costs and complexities for businesses.

- Potential for decreased GDP growth: The combined effects of reduced investment, decreased exports, and supply chain disruptions can significantly reduce GDP impact, hindering overall economic expansion.

The Fed's dual mandate includes achieving full employment. However, trade war consequences, including tariff-related economic slowdowns and job losses, make achieving this objective significantly more challenging. The negative impact on business investment directly affects job creation and overall economic prosperity.

The Fed's Response and Policy Adjustments

The Fed must carefully consider its monetary policy response to the economic fallout from tariffs. This requires a delicate balancing act, as monetary policy tools often have limitations in addressing trade-related issues.

- Potential for interest rate cuts to stimulate growth: The Fed might lower interest rates to encourage borrowing and investment, thereby stimulating economic activity.

- Challenges of using monetary policy to offset fiscal policy (tariffs): Monetary policy aims to control inflation and stimulate growth, but it struggles to directly offset the effects of fiscal policies like tariffs.

- Limitations of monetary policy in addressing trade-related issues: Monetary policy tools, like interest rate adjustments or quantitative easing, are blunt instruments compared to the targeted nature of trade policy. They may not effectively address the specific problems caused by tariffs.

- Powell's comments on the Fed's response strategy: Chairman Powell's public statements provide valuable insights into the Fed's approach to navigating this complex situation. [Link to relevant Federal Reserve statement or speech].

Powell's Statements and Public Commentary

In several public appearances, Chairman Powell has expressed concern about the impact of tariffs on the US economy. He has highlighted the potential for inflationary pressures and the challenges posed to the Fed's dual mandate. [Insert direct quote or paraphrase of Powell's statements, citing sources]. His remarks consistently emphasize the uncertainty introduced by tariffs and the difficulty in predicting their long-term economic consequences. The tone is cautious, reflecting the complexities involved in balancing monetary policy with the effects of trade policy.

Conclusion

Tariffs present a significant challenge to the Fed's ability to achieve both price stability and full employment. The inflationary pressures, negative impacts on economic growth, and complexities of coordinating monetary policy with trade policy create a difficult environment for the Fed. Powell's acknowledgement of these challenges highlights the intertwined nature of monetary and trade policies. Understanding the interplay between tariffs and Fed objectives is crucial for investors, policymakers, and the general public. Stay informed about the latest developments in trade policy and monetary policy to effectively navigate this complex economic landscape. Further research into the long-term effects of tariffs on the US economy is necessary to better understand the implications for the Federal Reserve and its ability to achieve its stated goals.

Featured Posts

-

Uefa Real Madrid I Sorusturuyor Arda Gueler Ve Takim Arkadaslari Icin Kritik Suerec

May 25, 2025

Uefa Real Madrid I Sorusturuyor Arda Gueler Ve Takim Arkadaslari Icin Kritik Suerec

May 25, 2025 -

Dax Surge Will A Wall Street Rebound Dampen The Celebration

May 25, 2025

Dax Surge Will A Wall Street Rebound Dampen The Celebration

May 25, 2025 -

Live Euro Voorbij 1 08 Impact Van Stijgende Kapitaalmarktrentes

May 25, 2025

Live Euro Voorbij 1 08 Impact Van Stijgende Kapitaalmarktrentes

May 25, 2025 -

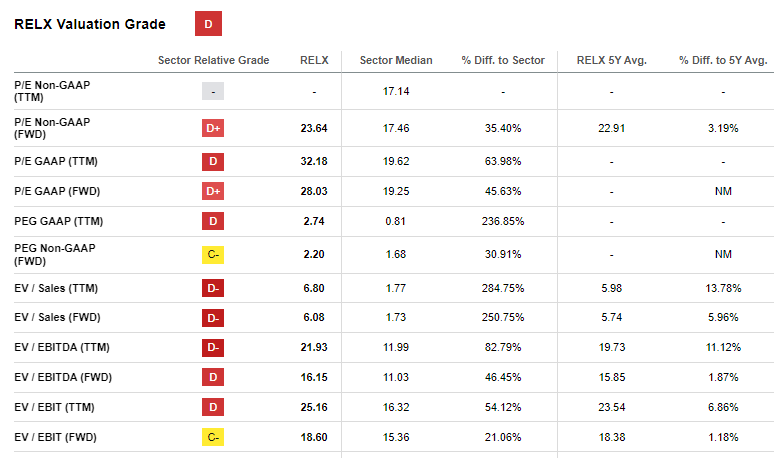

Sterke Resultaten Relx Ai Als Motor Voor Groei Tot 2025

May 25, 2025

Sterke Resultaten Relx Ai Als Motor Voor Groei Tot 2025

May 25, 2025 -

Uefa Real Madrid E Dair Sorusturma Son Gelismeler Ve Analiz

May 25, 2025

Uefa Real Madrid E Dair Sorusturma Son Gelismeler Ve Analiz

May 25, 2025

Latest Posts

-

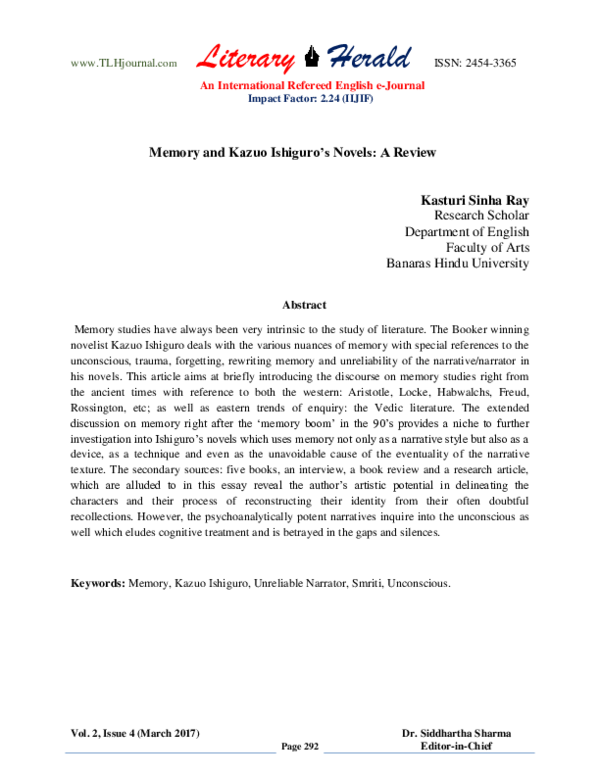

Kazuo Ishiguros Novels A Study Of Memory Forgetting And Imagined Realities

May 25, 2025

Kazuo Ishiguros Novels A Study Of Memory Forgetting And Imagined Realities

May 25, 2025 -

Kazuo Ishiguro Exploring Memory Forgetting And Imagination In His Novels

May 25, 2025

Kazuo Ishiguro Exploring Memory Forgetting And Imagination In His Novels

May 25, 2025 -

Jenson Button In The 2009 Brawn A Throwback To F1 Success

May 25, 2025

Jenson Button In The 2009 Brawn A Throwback To F1 Success

May 25, 2025 -

Oxfordshire Teenager Named After F1 Legend To Compete At Goodwood

May 25, 2025

Oxfordshire Teenager Named After F1 Legend To Compete At Goodwood

May 25, 2025 -

Jenson And The Fw 22 Extended Collection New Styles And Details

May 25, 2025

Jenson And The Fw 22 Extended Collection New Styles And Details

May 25, 2025