Regulatory Reform Sought By Indian Insurers For Bond Forwards

Table of Contents

Current Restrictions on Bond Forwards for Indian Insurers

The existing regulatory framework governing bond forwards for insurance companies in India presents several challenges. These limitations significantly restrict the ability of insurers to effectively manage risk and optimize their investment portfolios.

- Limitations on investment in specific types of bond forwards: Insurers face restrictions on investing in certain types of bond forwards, limiting their access to a diverse range of fixed-income instruments. This restricts diversification opportunities and potentially limits returns.

- Restrictions on leverage and hedging strategies using bond forwards: The current regulatory environment places constraints on the leverage insurers can employ when using bond forwards for hedging purposes. This hinders their ability to effectively manage interest rate risk and other financial risks.

- Compliance burdens and reporting requirements for bond forward transactions: The compliance burden associated with bond forward transactions is substantial, requiring insurers to navigate complex regulatory requirements and maintain meticulous records. This adds to operational costs and administrative complexity.

- Comparison with regulations in other major insurance markets: Compared to major insurance markets globally, India's regulations on bond forwards are significantly more restrictive. This puts Indian insurers at a competitive disadvantage, limiting their ability to participate in global investment strategies and potentially affecting their profitability.

The Insurance Regulatory and Development Authority of India (IRDAI) currently governs these aspects, with specific regulations detailed in various circulars and guidelines. For example, limitations on leverage often necessitate the use of conservative hedging strategies, potentially leading to missed opportunities for enhanced returns. Specific transactions involving complex derivatives, frequently used in developed markets, are often prohibited under the current framework.

Arguments for Regulatory Reform – Benefits for Insurers

Regulatory reform offering greater flexibility in the use of bond forwards would provide numerous benefits for Indian insurers. These benefits directly translate into improved financial performance and enhanced competitiveness.

- Improved risk management capabilities through sophisticated hedging strategies using bond forwards: Relaxing restrictions would allow insurers to employ more sophisticated hedging strategies, effectively mitigating interest rate risk, inflation risk, and other financial risks inherent in their investment portfolios. This leads to reduced volatility and potentially lower losses during market downturns.

- Enhanced investment returns by accessing a wider range of fixed-income instruments: Increased access to a broader range of bond forwards opens doors to higher-yielding fixed-income securities, leading to potentially improved investment returns and increased profitability for insurance companies.

- Increased competitiveness with global insurance players: Easing regulations would bring Indian insurers in line with their global counterparts, fostering greater competitiveness on the international stage. This is crucial for attracting foreign investment and expansion into global markets.

- Potential for lower overall investment costs: By optimizing their investment strategies through the effective use of bond forwards, insurers can potentially reduce their overall investment costs and improve profitability.

For example, better hedging could reduce losses by a significant percentage during periods of high interest rate volatility, as demonstrated by case studies in other markets. The ability to diversify investments more effectively can lead to a measurable improvement in overall portfolio returns.

Arguments for Regulatory Reform – Benefits for the Indian Economy

Relaxing restrictions on bond forwards would not only benefit insurers but also have a positive ripple effect throughout the Indian economy.

- Increased liquidity and efficiency in the Indian bond market: Greater participation by insurance companies in the bond forward market would lead to increased liquidity and efficiency, making the market more attractive to both domestic and international investors.

- Deeper and more robust capital markets: A more active bond forward market would contribute to the development of deeper and more robust Indian capital markets, supporting overall economic growth.

- Potential for attracting foreign investment into Indian bonds: Improved market liquidity and efficiency, combined with greater opportunities for sophisticated risk management, could attract substantial foreign investment into Indian bonds, benefiting the overall economy.

- Enhanced financial stability and reduced systemic risk: A more robust and efficient bond market can lead to improved financial stability and reduced systemic risk, fostering confidence in the Indian financial system.

Economic models suggest that increased market liquidity can reduce borrowing costs for companies, thereby boosting investment and economic growth. The inflow of foreign investment can contribute significantly to capital formation and development.

Potential Challenges and Concerns Regarding Reform

While the benefits of regulatory reform are significant, it's crucial to acknowledge potential challenges and concerns. A balanced approach is essential to maximize benefits while mitigating risks.

- Systemic risk associated with increased leverage in bond forward trading: Increased leverage can amplify both gains and losses, potentially leading to heightened systemic risk. Robust regulatory oversight is necessary to mitigate this risk.

- The need for robust regulatory oversight and monitoring: Easing restrictions necessitates the implementation of a robust regulatory framework and ongoing monitoring to prevent market manipulation and ensure fair practices.

- Potential for market manipulation and fraud: Greater participation in the bond forward market increases the potential for manipulation and fraudulent activities. Stronger surveillance and enforcement mechanisms are essential.

- Protecting policyholder interests: Any regulatory changes must prioritize the protection of policyholder interests, ensuring the financial stability and solvency of insurance companies.

Mitigating these concerns requires a multi-pronged approach. This could involve implementing stricter capital adequacy requirements, enhancing surveillance technologies, and strengthening enforcement mechanisms to deter fraud. Independent audits and regular stress tests could also help to identify and address potential vulnerabilities.

Conclusion

The arguments for regulatory reform concerning bond forwards in India are compelling. Relaxing the current restrictions offers significant benefits for Indian insurers, enhancing their risk management capabilities, improving investment returns, and boosting their global competitiveness. Moreover, a more active bond forward market would contribute to a deeper, more efficient, and robust Indian financial system, attracting foreign investment and promoting overall economic growth. However, a balanced approach is crucial. Careful consideration of potential risks, coupled with the implementation of robust regulatory oversight and monitoring mechanisms, is essential to ensure the stability and integrity of the market and protect policyholder interests. Further discussions and collaboration between the IRDAI, insurers, and other stakeholders are vital to achieving optimal regulatory changes concerning bond forwards in India, fostering a thriving and stable financial ecosystem.

Featured Posts

-

White Houses Unexpected Choice Maha Influencer Replaces Withdrawn Surgeon General Nominee

May 10, 2025

White Houses Unexpected Choice Maha Influencer Replaces Withdrawn Surgeon General Nominee

May 10, 2025 -

Family Support For Dakota Johnson At Materialist Film Screening

May 10, 2025

Family Support For Dakota Johnson At Materialist Film Screening

May 10, 2025 -

Harry Styles Honest Feelings About His Terrible Snl Impression

May 10, 2025

Harry Styles Honest Feelings About His Terrible Snl Impression

May 10, 2025 -

Uk Visa Restrictions New Rules For Certain Nationalities

May 10, 2025

Uk Visa Restrictions New Rules For Certain Nationalities

May 10, 2025 -

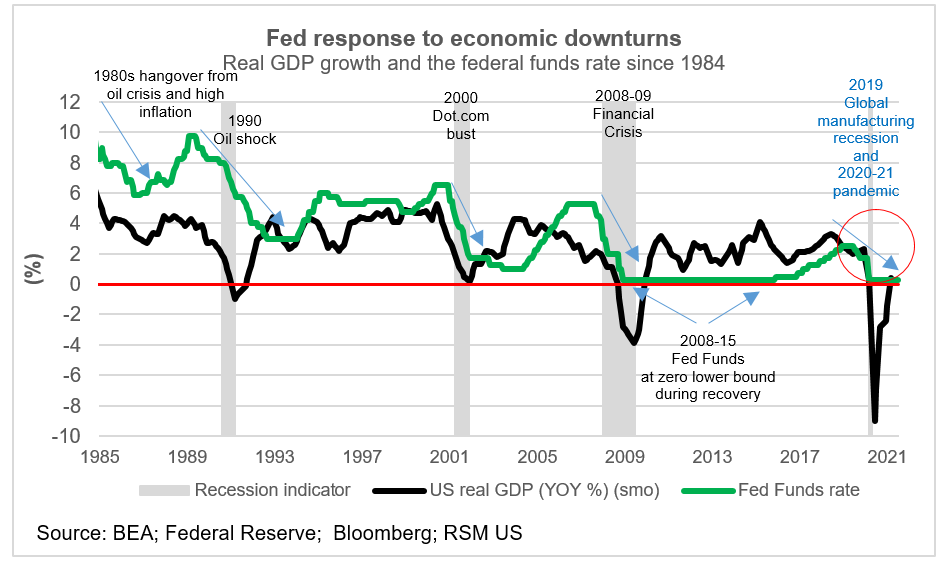

U S Federal Reserves Rate Decision Implications For The Economy

May 10, 2025

U S Federal Reserves Rate Decision Implications For The Economy

May 10, 2025