U.S. Federal Reserve's Rate Decision: Implications For The Economy

Table of Contents

Inflationary Pressures and the Fed's Response

The U.S. economy is currently grappling with persistent inflationary pressures. Inflation, the rate at which prices for goods and services rise, has been significantly higher than the Federal Reserve's target rate of 2%. This surge is driven by a complex interplay of factors, including persistent supply chain disruptions, elevated energy prices fueled by geopolitical instability, and robust consumer demand. The Federal Reserve, tasked with maintaining price stability and maximum employment, uses interest rate adjustments as a key tool to manage inflation. The rationale behind the chosen interest rate adjustment—whether it's an increase, decrease, or hold—directly reflects the Fed's assessment of the current economic landscape and its projection for future inflation.

- Current inflation figures: Compare the latest Consumer Price Index (CPI) data to the Fed's target rate, highlighting the gap and the urgency of the situation.

- Impact on spending and investment: Increased inflation erodes purchasing power, impacting consumer spending and potentially leading to reduced business investment as costs rise.

- Measures to combat inflation: The Fed might employ quantitative tightening (QT), reducing its balance sheet by allowing bonds to mature without reinvestment, to curb inflation further. This reduces the money supply and indirectly increases borrowing costs.

Impact on Borrowing Costs and Investment

The U.S. Federal Reserve's Rate Decision directly influences borrowing costs across the economy. The federal funds rate, the target rate for overnight lending between banks, serves as the benchmark for other interest rates. An increase in the federal funds rate, as often implemented to combat inflation, translates into higher borrowing costs for consumers and businesses.

- Mortgage rates: Higher interest rates lead to increased mortgage rates, making home purchases less affordable and potentially cooling down the housing market.

- Credit card and business loans: Increased rates directly impact credit card interest and business loan rates, potentially hindering consumer spending and business expansion.

- Impact on job creation: Reduced business investment due to higher borrowing costs can lead to slower job growth and potentially increased unemployment.

Implications for the Stock Market and Investment Strategies

The relationship between the U.S. Federal Reserve's Rate Decision and stock market performance is complex and often inverse. Generally, rising interest rates can negatively impact stock prices, particularly for growth stocks that rely on future earnings. Investors often shift from equities to bonds when interest rates rise, seeking safer, higher-yielding investments.

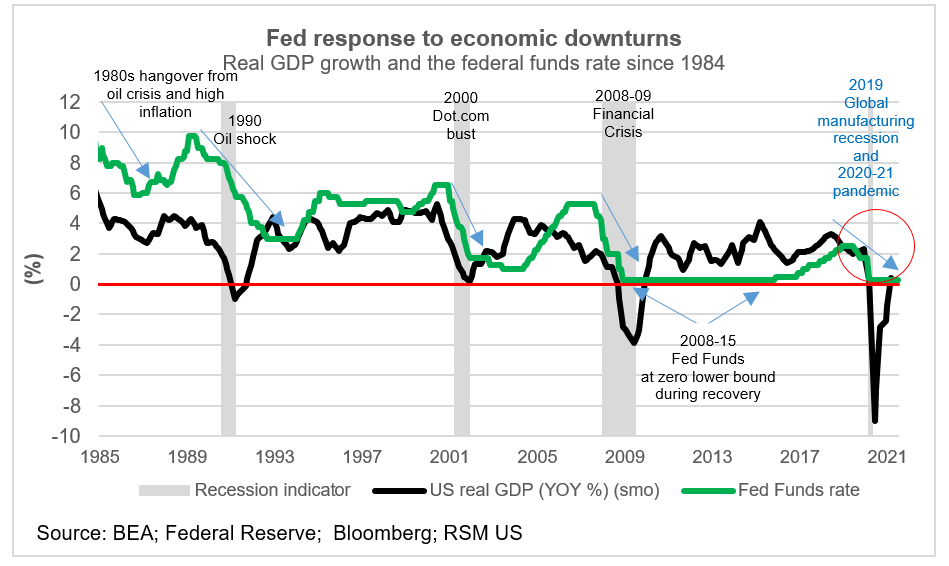

- Historical correlation: Analyze historical data to demonstrate the typical relationship between interest rate changes and subsequent stock market fluctuations.

- Risk mitigation: Investors can mitigate risk by diversifying their portfolios, incorporating defensive assets, and potentially adjusting their investment timelines.

- Investment opportunities: While rising rates can present challenges, there are often sectors that perform well in higher interest rate environments, such as the financial sector.

The Dollar's Strength and Global Economic Impacts

The U.S. Federal Reserve's Rate Decision significantly influences the value of the U.S. dollar. Higher interest rates typically attract foreign investment, increasing demand for the dollar and strengthening its value. A stronger dollar makes U.S. exports more expensive and imports cheaper, impacting U.S. trade balances and competitiveness.

- Impact on U.S. competitiveness: A stronger dollar can harm U.S. export industries, as their products become less attractive in global markets.

- Effects on emerging markets: Emerging markets with dollar-denominated debt can face increased pressure as the cost of servicing their debts rises.

- Currency volatility: Fluctuations in the dollar's value can create uncertainty and risk for businesses engaged in international trade.

Conclusion: Understanding the Long-Term Effects of the U.S. Federal Reserve's Rate Decision

The U.S. Federal Reserve's Rate Decision has far-reaching consequences, affecting inflation, borrowing costs, investment strategies, and the global economy. Understanding the implications of these decisions is crucial for businesses, investors, and policymakers alike. The ripple effects of the U.S. Federal Reserve's Rate Decision are extensive and require careful consideration. To effectively navigate this complex economic landscape, it's vital to stay informed about future Fed announcements and consult with financial advisors to manage investments accordingly. Further research into the historical impact of U.S. Federal Reserve rate decisions provides invaluable context and insight into their long-term effects. Stay informed and make sound financial decisions based on a comprehensive understanding of the U.S. Federal Reserve's actions and their implications.

Featured Posts

-

Americas First Nonbinary Person Dies Exploring The Impact On The Community

May 10, 2025

Americas First Nonbinary Person Dies Exploring The Impact On The Community

May 10, 2025 -

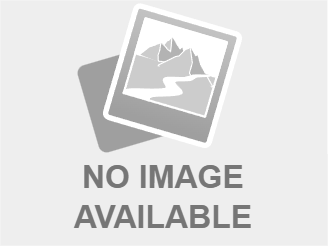

Melanie Eiffel Une Influence Determinante Sur Gustave Et Son Uvre A Dijon

May 10, 2025

Melanie Eiffel Une Influence Determinante Sur Gustave Et Son Uvre A Dijon

May 10, 2025 -

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Construction De La Tour

May 10, 2025

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Construction De La Tour

May 10, 2025 -

Fin De Serie Pour Dijon En Arkema Premiere Ligue Le Psg S Impose

May 10, 2025

Fin De Serie Pour Dijon En Arkema Premiere Ligue Le Psg S Impose

May 10, 2025 -

Epicure Et La Cite De La Gastronomie De Dijon Une Relation Tendue

May 10, 2025

Epicure Et La Cite De La Gastronomie De Dijon Une Relation Tendue

May 10, 2025