Recent Gold Price Performance: Two Straight Weeks Of Losses

Table of Contents

Economic Factors Driving the Gold Price Decline

Several significant economic factors have contributed to the recent decline in gold prices. These factors are interconnected and influence investor sentiment and market behavior.

Rising Interest Rates

Increased interest rates are a primary driver of the gold price drop. Higher rates make non-yielding assets like gold less attractive compared to interest-bearing instruments. Investors can earn returns on bonds and other fixed-income investments, reducing the need to hold gold as a store of value.

- The Federal Reserve's recent decisions to raise interest rates have significantly impacted gold prices. The 0.25% increase in March, followed by another 0.25% hike in May, put upward pressure on the US dollar and decreased the appeal of gold.

- Higher interest rates also lead to increased bond yields, making bonds a more competitive investment against gold. The yield curve steepening often signals a stronger dollar and less demand for gold as a safe haven.

Strong US Dollar

The US dollar's strength has a significant inverse correlation with gold prices. Gold is priced in US dollars, so a stronger dollar makes gold more expensive for buyers using other currencies. This reduces international demand and puts downward pressure on the gold price.

- Recent data shows the US dollar strengthening against major currencies like the Euro and the Yen. This strength has directly contributed to the recent gold price decline.

- This inverse relationship between the USD and gold is a well-established market dynamic, and understanding this is crucial for gold price predictions.

Inflation Concerns Easing (Slightly)

While inflation remains a concern globally, recent data suggests a slight easing of inflationary pressures in some key economies. This reduction in inflationary fears can decrease the safe-haven appeal of gold.

- Lower-than-expected inflation numbers can reduce investor anxiety, leading them to shift investments from safe-haven assets like gold to riskier assets with potentially higher returns.

- A shift in investor sentiment regarding future inflation expectations can significantly impact gold's price performance, as gold is often seen as a hedge against inflation.

Geopolitical Events and Their Influence

Geopolitical events play a significant role in influencing gold prices. While the impact may be less pronounced in certain periods, it is always a crucial factor to consider when analyzing gold price movements.

Ukraine Conflict Developments

The ongoing conflict in Ukraine has had a notable impact on gold prices in the past. However, the gold market seems less sensitive to the conflict's developments recently. While geopolitical uncertainty generally boosts gold's safe-haven appeal, this effect seems to have lessened in the current market environment.

- Market participants seem to be focusing more on economic factors, such as interest rates and the US dollar’s performance, than on geopolitical risks.

- The relationship between geopolitical uncertainty and gold's safe-haven status is not always linear and depends on the overall market sentiment and economic backdrop.

Other Geopolitical Factors

Other global events can also influence investor confidence and affect gold demand. Any escalation of tensions in other regions or unexpected global developments can impact the gold market.

- For example, escalating tensions in the South China Sea or other regions could trigger a flight to safety, leading to increased demand for gold and pushing prices upwards.

- Monitoring geopolitical risks is crucial for understanding the potential impact on gold price volatility.

Market Sentiment and Technical Analysis

Understanding market sentiment and conducting a technical analysis of gold charts is crucial for predicting future price movements.

Investor Sentiment

Recent reports indicate a shift in investor sentiment toward gold. While some investors still see gold as a safe haven, others are adopting a more cautious stance given rising interest rates and a strong dollar.

- Gold ETF flows (inflows/outflows) provide valuable insights into investor behavior and sentiment towards gold. Decreased inflows might suggest a weakening in demand for gold in the short-term.

- Surveys and market reports tracking investor sentiment towards gold offer a valuable perspective on the market's expectations.

Technical Analysis of Gold Charts

Technical analysis of gold price charts uses various indicators to identify potential support and resistance levels, trend reversals, and future price movements.

- Key indicators like moving averages, relative strength index (RSI), and other technical tools help analysts predict future gold price behavior.

- While technical analysis is not foolproof, it provides a valuable tool for interpreting market trends and formulating trading strategies.

Conclusion

The recent two-week decline in gold prices is attributable to a confluence of factors: rising interest rates, a strengthening US dollar, and a slight easing of inflation concerns. While geopolitical developments have played a role in the past, their impact seems less significant in this specific instance. Market sentiment appears to be shifting slightly away from gold in the short term. However, it’s essential to remember that the gold market is dynamic and influenced by various unpredictable factors.

Call to Action: Stay informed about the fluctuating gold price and market trends by regularly reviewing reliable financial news sources. Understanding the intricacies of gold price performance is crucial for making informed investment decisions in the precious metals market. Continue monitoring the gold price and market developments for a more complete picture of the future trajectory of gold.

Featured Posts

-

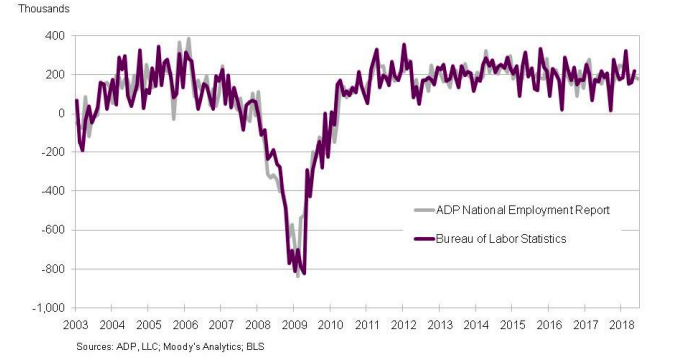

Aprils Employment Numbers 177 000 New Jobs Unemployment Holds At 4 2

May 05, 2025

Aprils Employment Numbers 177 000 New Jobs Unemployment Holds At 4 2

May 05, 2025 -

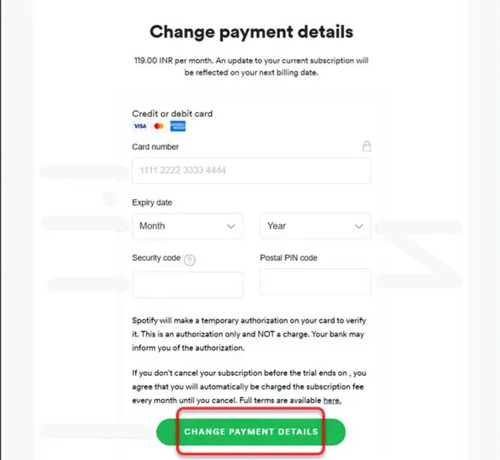

New Spotify Payment Methods On I Phone

May 05, 2025

New Spotify Payment Methods On I Phone

May 05, 2025 -

Nicolai Tangen And The Economic Fallout Of Trumps Tariffs

May 05, 2025

Nicolai Tangen And The Economic Fallout Of Trumps Tariffs

May 05, 2025 -

Resistance Mounts Car Dealerships Push Back On Ev Mandate

May 05, 2025

Resistance Mounts Car Dealerships Push Back On Ev Mandate

May 05, 2025 -

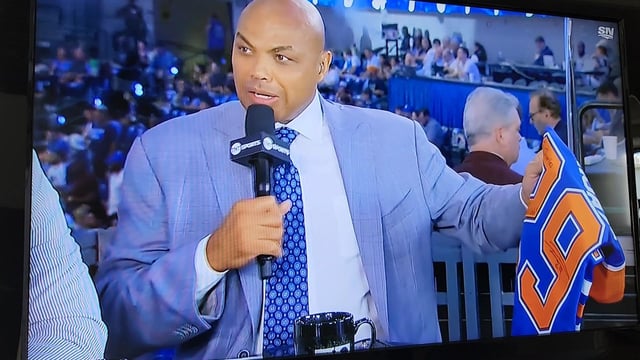

Barkley Predicts Oilers And Leafs Playoff Success

May 05, 2025

Barkley Predicts Oilers And Leafs Playoff Success

May 05, 2025

Latest Posts

-

I Emma Stooyn Mia Anatreptiki Emfanisi Poy Den Perasei Aparatiriti

May 05, 2025

I Emma Stooyn Mia Anatreptiki Emfanisi Poy Den Perasei Aparatiriti

May 05, 2025 -

I Emma Stooyn Kai I Anatreptiki Emfanisi Tis To Forema Poy Afise Afonoys

May 05, 2025

I Emma Stooyn Kai I Anatreptiki Emfanisi Tis To Forema Poy Afise Afonoys

May 05, 2025 -

Ufc 314 Volkanovski Vs Lopes Examining The Pre Fight Betting Lines

May 05, 2025

Ufc 314 Volkanovski Vs Lopes Examining The Pre Fight Betting Lines

May 05, 2025 -

Emma Stones Red Carpet Choice Analyzing The Popcorn Butt Dress Design

May 05, 2025

Emma Stones Red Carpet Choice Analyzing The Popcorn Butt Dress Design

May 05, 2025 -

Betting On Ufc 314 Volkanovski Vs Lopes Main Event Opening Odds

May 05, 2025

Betting On Ufc 314 Volkanovski Vs Lopes Main Event Opening Odds

May 05, 2025