Nicolai Tangen And The Economic Fallout Of Trump's Tariffs

Table of Contents

Nicolai Tangen's Role and the GPFG's Exposure

Nicolai Tangen, appointed CEO of the GPFG in 2020, inherited a fund with massive global investments. The GPFG, one of the world's largest sovereign wealth funds, holds a diverse portfolio spanning numerous countries and sectors. This extensive global reach made it inherently vulnerable to the disruptions caused by the Trump administration's trade war. The tariffs weren't a localized problem; they created a global economic uncertainty impacting returns worldwide.

- GPFG's significant holdings in US companies affected by tariffs: The fund's considerable investments in US equities meant a direct exposure to the negative consequences of tariffs on American businesses. Reduced profitability in these companies directly translated into lower returns for the GPFG.

- Potential impact on returns due to decreased profitability of US companies: Tariffs increased input costs for American companies, squeezing profit margins. This downturn affected the GPFG's overall investment returns, forcing adjustments to its portfolio strategy.

- Tangen's statements and actions regarding the tariffs: While specific public statements directly addressing the Trump tariffs may be limited, Tangen's overall strategy reflects a need for careful navigation in an unpredictable global trade environment. This likely includes diversifying investments and focusing on companies less vulnerable to trade disputes.

- Analysis of the GPFG's investment strategy in light of the tariff implications: The tariffs likely prompted a review of the GPFG's investment strategy, leading to a greater focus on risk management and diversification across geographical regions and sectors to mitigate future exposure to similar trade conflicts.

The Impact of Trump's Tariffs on the Norwegian Economy

Norway, while not directly involved in the US-China trade conflict, experienced indirect economic repercussions. The nation's strong economic ties with both the US and other countries affected by the tariffs, particularly within the EU, made it susceptible to the global economic slowdown.

- Decrease in Norwegian exports to the US and other tariff-affected markets: Norwegian businesses, particularly in sectors like seafood and oil and gas, saw a decrease in exports due to reduced demand and increased competition from tariff-protected industries in other countries.

- Rise in import costs for Norwegian businesses: Tariffs on imported goods increased the cost of production for many Norwegian businesses, impacting competitiveness and profitability.

- Impact on Norwegian employment and GDP growth: The slowdown in exports and increased import costs contributed to a slowdown in GDP growth and potentially affected employment in export-oriented sectors of the Norwegian economy.

- Government response to mitigate the economic consequences: The Norwegian government likely implemented fiscal and monetary policies to cushion the blow, including measures to support affected industries and stimulate economic growth.

The Oil and Gas Sector's Vulnerability

Norway's oil and gas sector, a crucial component of its economy, faced unique challenges. The global economic slowdown fueled by the trade war dampened demand for energy, impacting prices and investment.

- Changes in demand due to global economic slowdown: Reduced global economic activity led to decreased energy consumption, affecting the price of oil and gas and impacting Norwegian exports.

- Impact on investment in new oil and gas projects: Uncertainty created by the trade war and subsequent economic slowdown discouraged investment in new oil and gas exploration and production projects in Norway.

- Geopolitical implications and shifts in energy partnerships: The trade war highlighted the interconnectedness of global energy markets and potentially influenced Norway's energy partnerships and export strategies.

Long-Term Consequences and Future Implications

The long-term effects of Trump's tariffs on Norway are still unfolding. The GPFG's investment strategy is likely to continue adapting to an increasingly volatile global economic climate.

- Potential for structural changes in the Norwegian economy: The economic fallout may push Norway towards greater economic diversification, reducing reliance on sectors heavily impacted by global trade disputes.

- Adjustments to the GPFG's investment strategy to mitigate future trade risks: The GPFG will likely refine its investment strategy, incorporating more sophisticated risk assessment models and a greater focus on geographical diversification.

- Lessons learned for future trade negotiations and economic diversification: The experience underscored the importance of international cooperation and the need for robust economic strategies to mitigate the impact of global trade disruptions.

Conclusion

The Trump tariffs presented a significant challenge for both the GPFG, under Nicolai Tangen's leadership, and the Norwegian economy. The effects, ranging from reduced investment returns to slower GDP growth, highlighted the interconnectedness of the global economy and the far-reaching consequences of protectionist trade policies. Understanding the effects of global trade disputes is crucial for investors and policymakers. Further research into the long-term implications of these trade wars, and the strategies employed by figures like Nicolai Tangen to mitigate risk, is essential to navigating the complexities of the global economy. Continue exploring the complex relationship between Nicolai Tangen and the economic fallout of Trump's tariffs to gain a deeper understanding of the global economic landscape.

Featured Posts

-

Kentucky Derby 2024 Final Preparations At Churchill Downs

May 05, 2025

Kentucky Derby 2024 Final Preparations At Churchill Downs

May 05, 2025 -

Tioga Downs Announces Plans For The 2025 Racing Season

May 05, 2025

Tioga Downs Announces Plans For The 2025 Racing Season

May 05, 2025 -

Sheins Stalled London Ipo Us Tariffs Take Their Toll

May 05, 2025

Sheins Stalled London Ipo Us Tariffs Take Their Toll

May 05, 2025 -

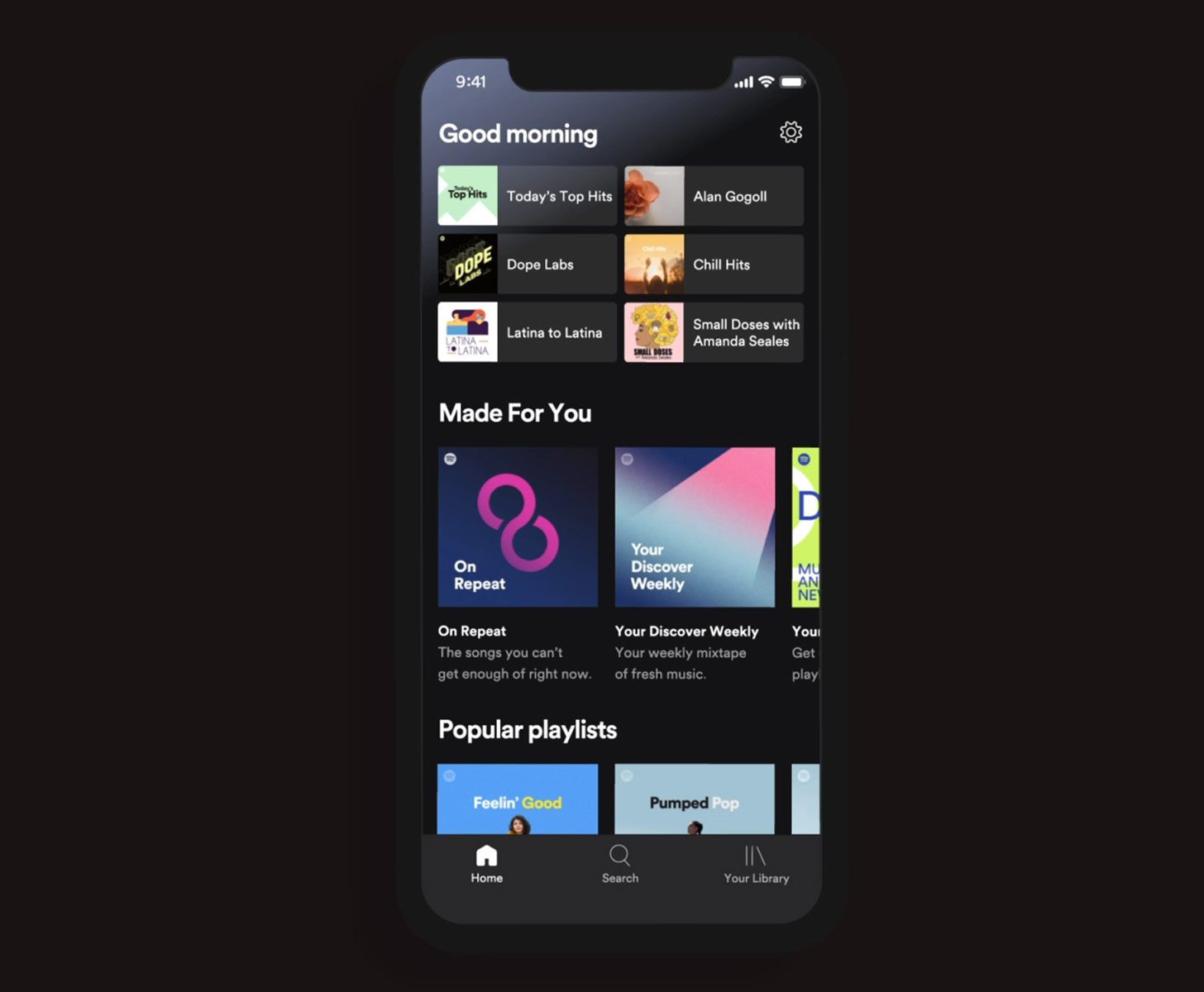

Spotify I Phone App More Payment Options For Users

May 05, 2025

Spotify I Phone App More Payment Options For Users

May 05, 2025 -

The Horner Quip Analyzing Christian Horners Words On Verstappens New Role

May 05, 2025

The Horner Quip Analyzing Christian Horners Words On Verstappens New Role

May 05, 2025

Latest Posts

-

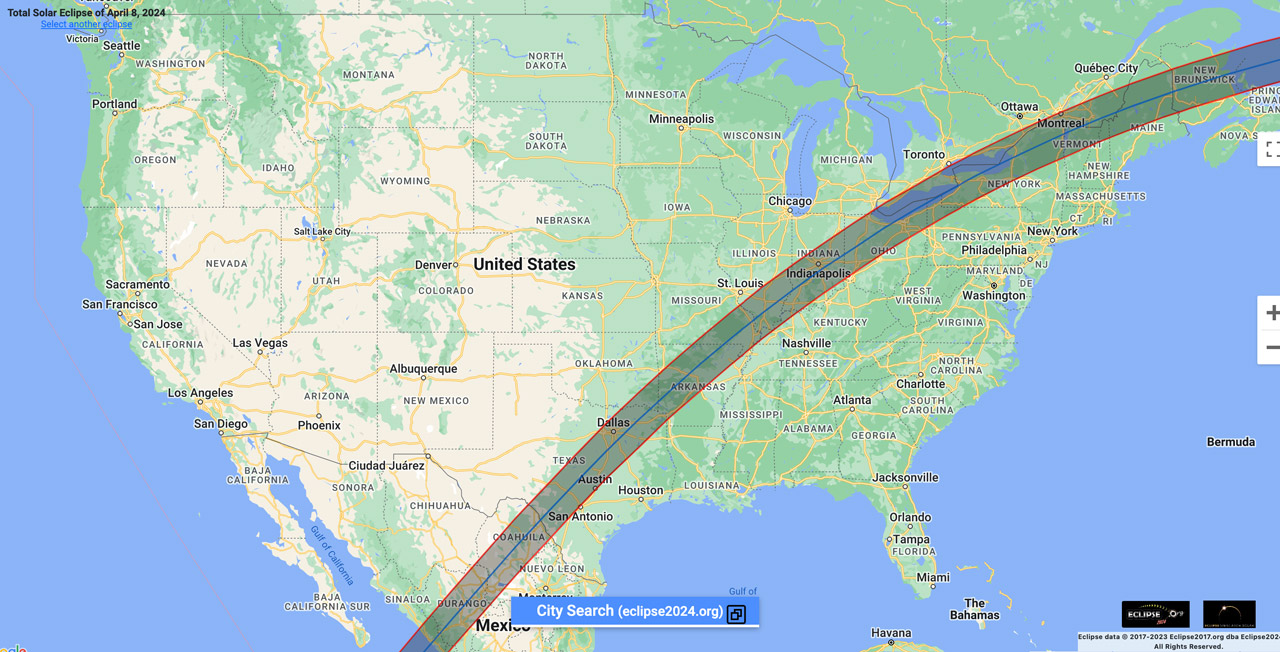

Nyc Partial Solar Eclipse Saturday Timing Viewing And Safety

May 05, 2025

Nyc Partial Solar Eclipse Saturday Timing Viewing And Safety

May 05, 2025 -

Pimblett Vs Chandler Ufc 314 Referee Intervention Requested Due To Concerns

May 05, 2025

Pimblett Vs Chandler Ufc 314 Referee Intervention Requested Due To Concerns

May 05, 2025 -

Partial Solar Eclipse Over Nyc This Saturday When And How To Watch

May 05, 2025

Partial Solar Eclipse Over Nyc This Saturday When And How To Watch

May 05, 2025 -

Witnessing The Partial Solar Eclipse In Nyc A Complete Guide

May 05, 2025

Witnessing The Partial Solar Eclipse In Nyc A Complete Guide

May 05, 2025 -

Ufc 314 Pimbletts Pre Fight Concerns About Chandlers Fighting Style

May 05, 2025

Ufc 314 Pimbletts Pre Fight Concerns About Chandlers Fighting Style

May 05, 2025