Reaching Profitability: An Examination Of RTL Group's Streaming Performance

Table of Contents

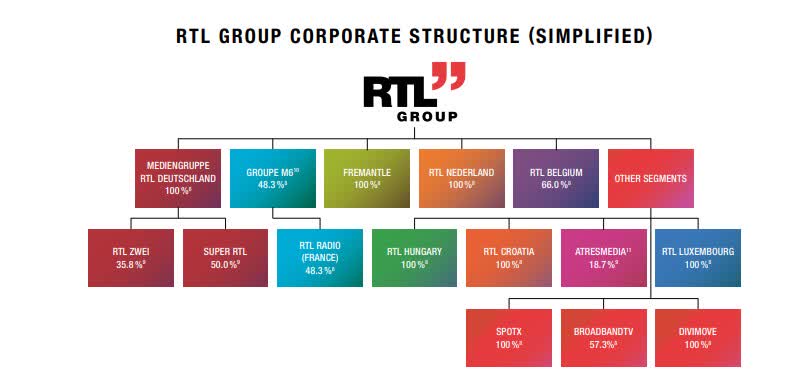

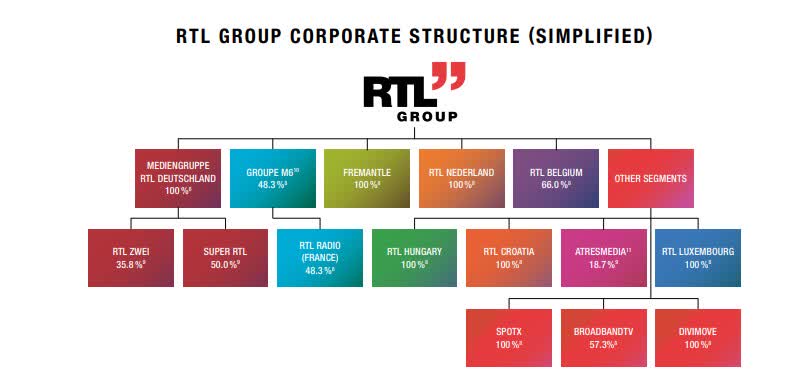

RTL Group's Streaming Strategy and Portfolio

RTL Group employs a multi-platform streaming strategy, catering to diverse audiences across different geographic regions. Understanding this portfolio is key to analyzing RTL Group streaming profitability.

-

Overview of key streaming services: RTL Group operates several prominent streaming platforms, including RTL+ (primarily in Germany, Austria, and Switzerland) and Videoland (in the Netherlands). Each platform offers a tailored content library to resonate with its specific target audience. The diversity itself contributes significantly to mitigating risk and boosting overall RTL Group streaming profitability.

-

Target demographics and geographic reach: RTL+ focuses on a broad German-speaking audience, offering a mix of local and international content. Videoland, on the other hand, targets the Dutch market with a heavier emphasis on local programming. This targeted approach maximizes audience engagement and influences RTL Group streaming profitability.

-

Content licensing strategies and original programming investments: RTL Group utilizes a mixed strategy, licensing popular international shows while simultaneously investing heavily in original programming. This blend is crucial for attracting subscribers and differentiating its services, thereby impacting RTL Group streaming profitability positively. The success of original content significantly impacts the overall strategy.

-

Diverse streaming portfolio for risk mitigation: The presence of multiple platforms across different markets reduces the risk associated with reliance on a single service. Should one platform underperform, others can compensate, ensuring more stable RTL Group streaming profitability.

Analyzing Key Performance Indicators (KPIs): Subscriber Growth and Revenue

Analyzing key performance indicators is essential for evaluating RTL Group's streaming success and its path to profitability.

-

Subscriber Acquisition Cost (CAC) and churn rates: Lowering CAC while simultaneously reducing churn is paramount for RTL Group streaming profitability. Effective marketing campaigns and engaging content directly impact these metrics.

-

Average Revenue Per User (ARPU) and its trends: Increasing ARPU through higher subscription tiers or additional revenue streams (e.g., advertising) is a crucial element of RTL Group streaming profitability.

-

Comparison with European competitors: Benchmarking RTL Group's KPIs against competitors like Sky, Viaplay, and local players provides valuable insights into its market positioning and its potential for future growth and improved RTL Group streaming profitability.

-

Impact of advertising revenue: While subscription revenue is key, advertising revenue plays a significant role, especially in the early stages of a streaming service's life cycle, contributing towards achieving RTL Group streaming profitability.

The Role of Original Content in Driving Subscriptions

Original content plays a pivotal role in attracting and retaining subscribers, directly impacting RTL Group streaming profitability.

-

Successful original shows: Hit shows attract new subscribers and encourage retention, thus impacting RTL Group streaming profitability positively. Analyzing the performance of these shows is key to refining future content strategies.

-

Cost-effectiveness of original content production: Balancing creative ambition with budgetary constraints is vital. Efficient production processes are essential for maximizing ROI and ensuring RTL Group streaming profitability.

-

Comparison with competitors: Analyzing the original content strategies of successful competitors in the European market provides valuable insights for optimizing RTL Group's approach and improving RTL Group streaming profitability.

-

Local and international appeal: Striking a balance between locally relevant and internationally appealing content is key to maximizing subscriber reach and improving RTL Group streaming profitability.

Challenges and Opportunities in the European Streaming Market

The European streaming market presents both challenges and opportunities for RTL Group.

-

Competition from global giants: Netflix, Disney+, and Amazon Prime Video pose stiff competition, requiring RTL Group to differentiate its offerings to maintain its market share and achieve RTL Group streaming profitability.

-

Regional regulations and market fragmentation: Navigating varying regulations across different European countries adds complexity to the operational landscape and impacts RTL Group streaming profitability.

-

Strategic partnerships and collaborations: Collaborations with other media companies or technology providers can unlock new opportunities and improve efficiencies, ultimately influencing RTL Group streaming profitability.

-

Expansion into new markets: Exploring expansion into new European markets or even beyond can broaden RTL Group's reach and enhance its overall RTL Group streaming profitability.

The Path to Profitability: Future Strategies and Predictions

RTL Group's future success in streaming hinges on several strategic factors.

-

Mergers, acquisitions, and partnerships: Strategic mergers, acquisitions, or partnerships could accelerate growth and expand content libraries, significantly impacting RTL Group streaming profitability.

-

Subscription price increases: Adjusting subscription pricing based on market conditions and value proposition is a potential lever for improving RTL Group streaming profitability.

-

Technological advancements: Investing in advanced streaming technologies and personalized recommendations can enhance user experience and drive subscriber growth, consequently contributing towards RTL Group streaming profitability.

-

Predictions for future performance: While predicting the future is challenging, a focus on efficient content production, strategic partnerships, and audience engagement positions RTL Group favorably for long-term success and enhanced RTL Group streaming profitability.

Conclusion

This examination of RTL Group's streaming performance reveals a complex picture. While challenges exist in the competitive European market, RTL Group's diversified portfolio, strategic content investments, and adaptability offer a pathway to profitability. By focusing on key performance indicators, optimizing content strategy, and navigating the evolving landscape, RTL Group can solidify its position as a major player in the streaming industry. To stay informed on the future of RTL Group and its pursuit of RTL Group streaming profitability, continue following industry news and analysis. Understanding the factors impacting RTL Group's streaming profitability is crucial for investors and industry observers alike.

Featured Posts

-

D Wave Quantum Qbts Stock Market Performance A Detailed Analysis Of Recent Gains

May 21, 2025

D Wave Quantum Qbts Stock Market Performance A Detailed Analysis Of Recent Gains

May 21, 2025 -

Manchester City Eye Arsenal Legend To Replace Pep Guardiola

May 21, 2025

Manchester City Eye Arsenal Legend To Replace Pep Guardiola

May 21, 2025 -

Huuhkajien Uudistettu Avauskokoonpano Kaellman Pois

May 21, 2025

Huuhkajien Uudistettu Avauskokoonpano Kaellman Pois

May 21, 2025 -

Record Breaking Run Fastest Crossing Of Australia On Foot

May 21, 2025

Record Breaking Run Fastest Crossing Of Australia On Foot

May 21, 2025 -

Ea Fc 25 Fut Birthday Ultimate Player Tier List And Best Cards

May 21, 2025

Ea Fc 25 Fut Birthday Ultimate Player Tier List And Best Cards

May 21, 2025

Latest Posts

-

Dont Miss It Movies Leaving Hulu In October 2023

May 23, 2025

Dont Miss It Movies Leaving Hulu In October 2023

May 23, 2025 -

Hulu Movies Leaving Soon What To Watch Before They Re Gone

May 23, 2025

Hulu Movies Leaving Soon What To Watch Before They Re Gone

May 23, 2025 -

Hulu Movie Departures Whats Leaving This Month

May 23, 2025

Hulu Movie Departures Whats Leaving This Month

May 23, 2025 -

Movies Leaving Hulu This Month Your Complete Guide

May 23, 2025

Movies Leaving Hulu This Month Your Complete Guide

May 23, 2025 -

M And S Midi Dress As Seen On Cat Deeley

May 23, 2025

M And S Midi Dress As Seen On Cat Deeley

May 23, 2025