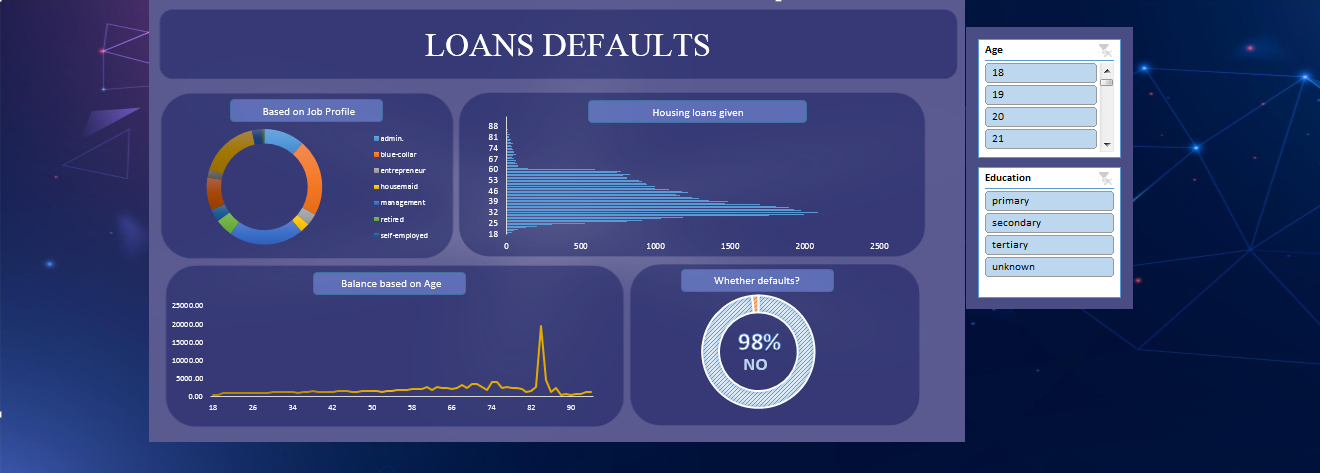

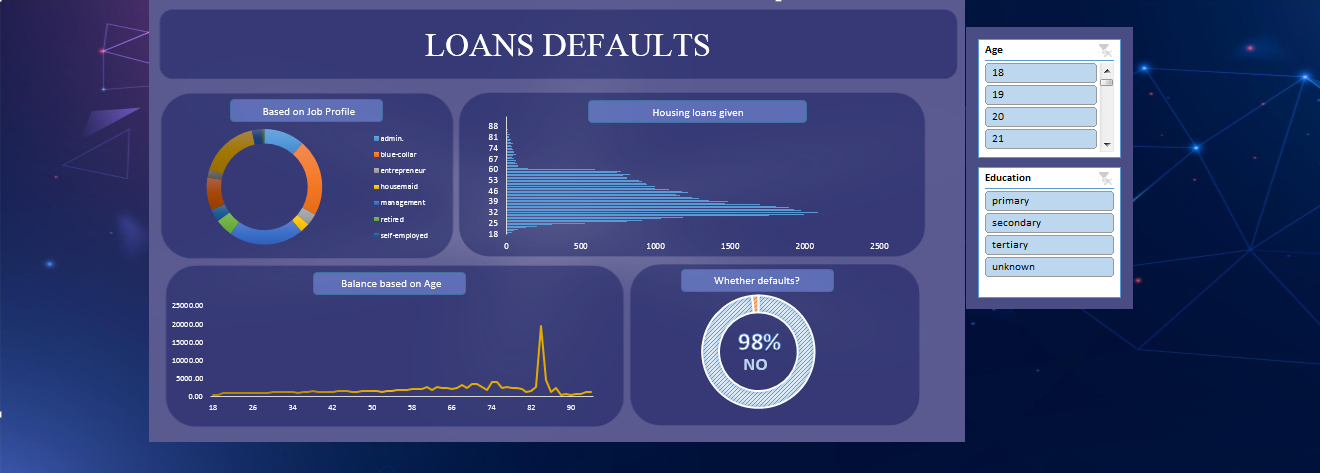

RBC Prepares For Increased Loan Defaults, Impacts Earnings

Table of Contents

Rising Interest Rates and Economic Slowdown Fueling Default Concerns

The confluence of rising interest rates and a potential economic slowdown is creating a perfect storm for increased loan defaults. These factors significantly increase the risk for both RBC and the wider Canadian financial system. Several key elements contribute to this heightened risk:

-

Soaring Interest Rates: The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, have dramatically increased borrowing costs. This makes it increasingly difficult for individuals and businesses to service their debts, leading to a higher likelihood of defaults across various loan types, including mortgages, personal loans, and business credit.

-

Recessionary Fears: The persistent inflation and rising interest rates are fueling concerns about a potential recession in Canada. A recession would likely lead to increased unemployment, reduced consumer spending, and a further weakening of borrowers' ability to repay their loans. This would amplify the impact of higher interest rates.

-

Strain on Household Budgets: The rising cost of living, encompassing everything from groceries to housing, is putting immense pressure on household budgets. This leaves many Canadians with less disposable income, increasing their vulnerability to financial hardship and loan defaults.

-

Vulnerable Sectors: Certain sectors of the economy are particularly susceptible to rising default rates. The real estate market, already facing cooling conditions, and consumer credit, which often carries higher interest rates, are particularly vulnerable.

RBC's Proactive Measures to Mitigate Loan Default Risks

RBC, aware of the escalating risks, is implementing proactive strategies to mitigate the potential impact of increased loan defaults. These measures demonstrate a commitment to responsible risk management and financial stability:

-

Increased Loan Loss Provisions: RBC is likely significantly increasing its loan loss provisions—essentially setting aside funds to cover anticipated losses from loan defaults. This is a standard practice during periods of economic uncertainty and helps to cushion the financial blow of rising defaults.

-

Enhanced Credit Underwriting: The bank is likely strengthening its credit underwriting processes, employing more stringent criteria for approving loans. This involves more rigorous assessments of borrowers' creditworthiness and risk profiles to minimize the acceptance of high-risk borrowers.

-

Stress Testing and Scenario Planning: RBC is almost certainly conducting extensive stress testing and scenario planning exercises to evaluate its resilience to various economic downturns. These simulations help assess the potential impact of different scenarios, allowing the bank to prepare and adapt its strategies accordingly.

-

Tightening Lending Standards: To further limit its exposure to risk, RBC might be tightening its lending standards, making it more difficult for some borrowers to secure loans. This proactive measure aims to reduce the overall portfolio's risk profile.

Impact on RBC's Earnings and Shareholder Value

The anticipated rise in loan defaults will inevitably impact RBC's financial performance, affecting key metrics and potentially investor sentiment:

-

Reduced Net Income and EPS: Increased defaults will directly translate into a reduction in RBC's net income and earnings per share (EPS). The magnitude of this decline will depend on the scale and duration of the increase in loan defaults.

-

Profitability Under Pressure: RBC's profitability will face significant pressure as the costs associated with managing increased loan defaults, including legal fees and collection efforts, increase.

-

Investor Sentiment: Increased loan defaults could negatively impact investor sentiment, potentially leading to a decline in RBC's stock price. Investors will closely monitor the bank's ability to manage these risks.

-

Potential Dividend Adjustments: Depending on the severity of the situation, RBC might consider adjusting its dividend payouts to shareholders to preserve capital and maintain financial stability.

Broader Implications for the Canadian Banking Sector

The potential surge in loan defaults at RBC carries broader implications for the Canadian banking sector and the overall economic stability of the country:

-

Systemic Risk Concerns: Increased defaults at a major institution like RBC could signal broader vulnerabilities within the Canadian banking sector, raising concerns about systemic risk – the risk of a widespread collapse of the financial system.

-

Bank of Canada's Response: The Bank of Canada's response to the economic situation will play a crucial role in mitigating systemic risk. Monetary policy decisions will influence interest rates and the overall health of the economy.

-

Regulatory Oversight: Government regulations and policies will play a significant role in influencing the ability of the banking sector to navigate the challenges posed by increased loan defaults.

-

Economic Stability at Stake: The stability of the Canadian economy is intrinsically linked to the health of its banking sector. A significant downturn in the banking sector could have wide-ranging economic consequences.

Conclusion

The anticipated rise in loan defaults presents a considerable challenge for RBC and the Canadian banking sector as a whole. While RBC is demonstrably taking proactive steps to mitigate these risks through enhanced risk management and proactive financial planning, the impact on its earnings and shareholder value is expected to be substantial. The ultimate impact will hinge on the severity and duration of the economic slowdown and the efficacy of the bank's risk management strategies. Staying informed about RBC's response to these challenges and the broader economic outlook is crucial. Monitor news and financial analysis for updates on RBC's financial performance and its strategies for navigating this complex economic climate. Understanding RBC's approach to managing increased loan defaults is vital for anyone invested in the Canadian banking sector or concerned about the wider economic outlook.

Featured Posts

-

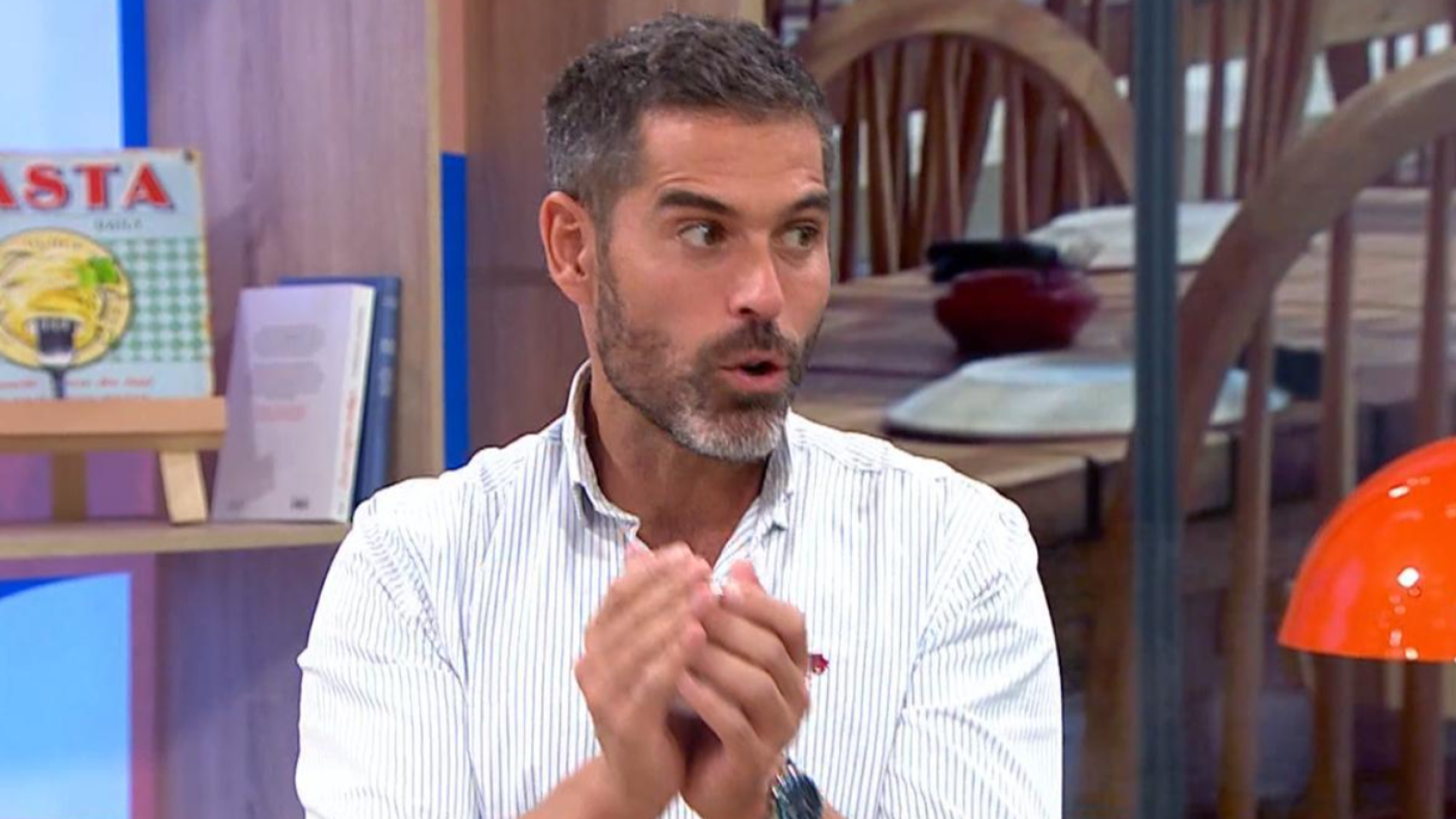

Preparacion De Lasana De Calabacin La Receta De Pablo Ojeda En Mas Vale Tarde

May 31, 2025

Preparacion De Lasana De Calabacin La Receta De Pablo Ojeda En Mas Vale Tarde

May 31, 2025 -

Critique De Soudain Seuls Que Reserve Ce Film Diffuse Ce Soir A La Tele

May 31, 2025

Critique De Soudain Seuls Que Reserve Ce Film Diffuse Ce Soir A La Tele

May 31, 2025 -

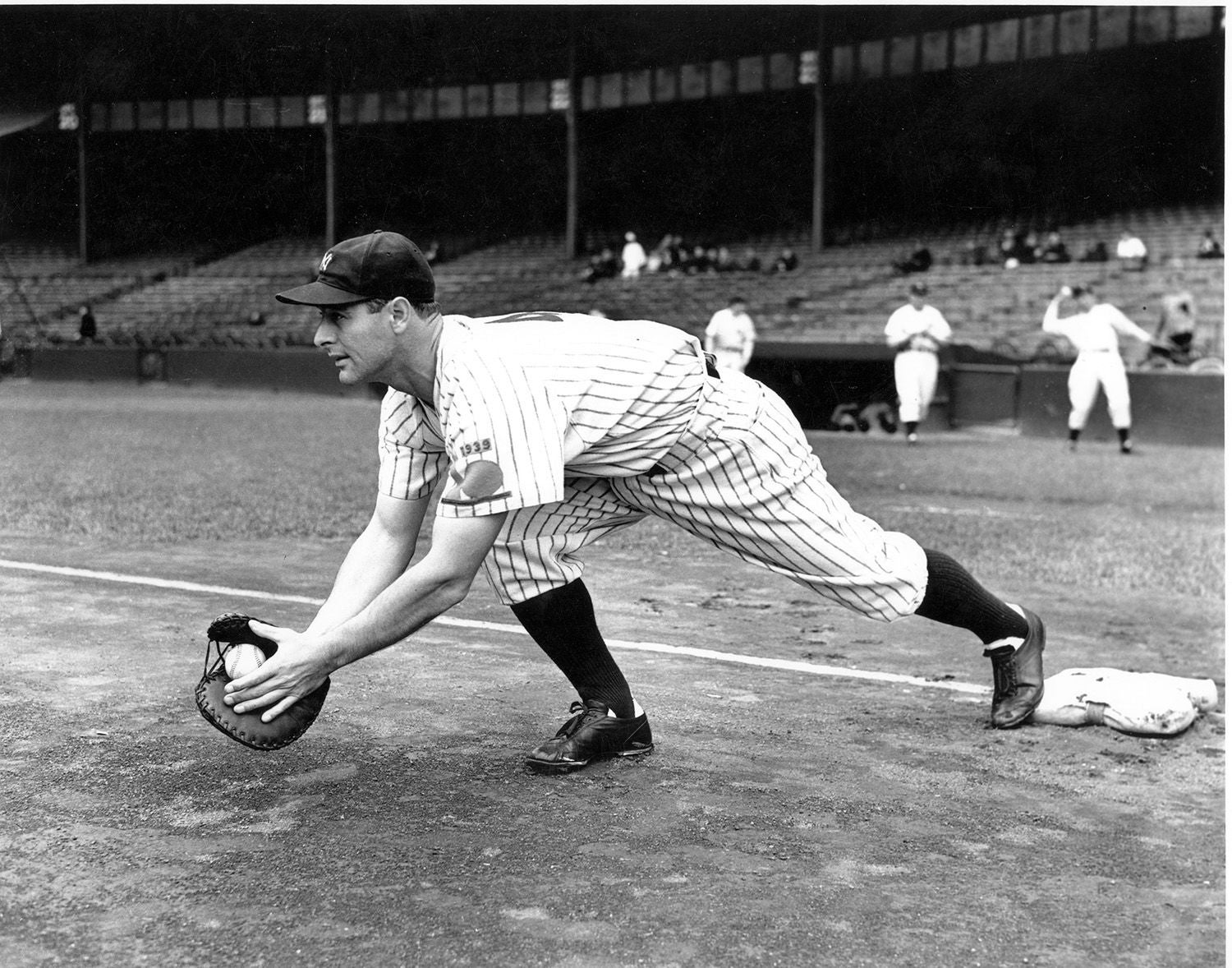

Jack Whites Detroit Tigers Broadcast Appearance Hall Of Fame Talk And Baseball Analysis

May 31, 2025

Jack Whites Detroit Tigers Broadcast Appearance Hall Of Fame Talk And Baseball Analysis

May 31, 2025 -

Birmingham Supercross Round 10 Results 2025 Official Update

May 31, 2025

Birmingham Supercross Round 10 Results 2025 Official Update

May 31, 2025 -

Padel Court Proposal For Essex Bannatyne Health Club Announced

May 31, 2025

Padel Court Proposal For Essex Bannatyne Health Club Announced

May 31, 2025