BigBear.ai: Should Investors Buy, Sell, Or Hold?

Table of Contents

BigBear.ai's Business Model and Competitive Landscape

Core Services and Technologies

BigBear.ai offers a suite of AI-powered solutions targeting the defense, intelligence, and commercial sectors. Their technology leverages advanced analytics, machine learning, and artificial intelligence to provide critical insights and decision support.

- BigBear.ai AI solutions include predictive analytics for risk mitigation, geospatial intelligence analysis, and advanced modeling and simulation capabilities.

- Specific technologies deployed include natural language processing (NLP), computer vision, and advanced data fusion techniques.

- A key differentiator is BigBear.ai's focus on integrating its AI solutions within existing workflows, maximizing usability and minimizing disruption for clients. This provides a significant BigBear.ai technology advantage.

The BigBear.ai competitive edge lies in its ability to tailor solutions to highly specific client needs, a capability less readily available from larger, more generalized AI firms.

Market Analysis and Competition

The market for AI-powered data analytics is highly competitive. BigBear.ai faces established players with extensive resources and a wider range of offerings.

- BigBear.ai competitors include companies like Palantir Technologies, Booz Allen Hamilton, and Leidos, all vying for contracts in the defense and intelligence sectors. These companies possess considerable experience and market share.

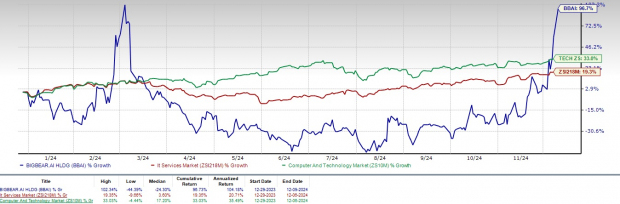

- Analyzing BigBear.ai market share requires assessing its growth in specific niches, as broader market dominance is currently held by the larger players. The BigBear.ai market growth potential rests on its ability to capture specialized market segments and secure larger government contracts.

Financial Performance and Valuation

Revenue Growth and Profitability

Analyzing BigBear.ai's financial performance reveals a company in a growth phase. While revenue has shown positive trends, profitability remains a key focus area.

- BigBear.ai revenue growth has experienced fluctuations but displays an overall upward trajectory, indicating expanding market reach and increasing contract wins.

- Examining BigBear.ai profitability reveals margins that are still under development. Net income and EPS figures require careful scrutiny, as they reflect the costs associated with growth and innovation.

- A review of BigBear.ai's financial statements underscores the importance of assessing the company's debt levels and cash flow to understand its financial health and sustainability.

Valuation Metrics

Assessing BigBear.ai's valuation necessitates a comparative analysis with industry peers. While a high P/E ratio might suggest overvaluation, it's crucial to consider the growth potential and stage of development.

- Key BigBear.ai valuation metrics like the P/E ratio and Price-to-Sales ratio need to be interpreted within the context of its competitive landscape and future growth expectations.

- A comparative study of the BigBear.ai stock valuation relative to similar companies in the AI and data analytics space provides crucial context for assessing whether the stock is currently overvalued or undervalued.

Future Outlook and Growth Potential

Growth Drivers and Opportunities

Several factors could significantly drive future BigBear.ai growth.

- BigBear.ai growth prospects are tied to the continued expansion into new commercial markets, leveraging its expertise beyond its traditional defense and intelligence clientele.

- New product launches and technological advancements represent crucial BigBear.ai growth drivers. Further development of its existing AI solutions, and the introduction of new offerings, are essential for long-term market success.

- Strategic partnerships and joint ventures can significantly enhance BigBear.ai's market reach and technological capabilities, leading to significant future growth.

Risks and Challenges

Several challenges could impact BigBear.ai's growth trajectory.

- BigBear.ai risks include intense competition from established players with deeper pockets and broader market reach.

- Regulatory changes affecting the technology sector could impact BigBear.ai's ability to operate and secure new contracts.

- An economic downturn could significantly affect the demand for AI solutions, particularly in the government and defense sectors, representing another key BigBear.ai challenge.

Conclusion

BigBear.ai's performance reflects a company navigating a complex but potentially lucrative market. Its strengths lie in its specialized AI solutions and adaptability. However, significant competition and financial stability concerns warrant careful consideration. Based on this analysis, while the future growth potential is considerable, the risks necessitate a cautious approach. Therefore, our recommendation is to Hold BigBear.ai stock. This is contingent on continued positive revenue growth and improvements in profitability.

Consider your personal risk tolerance and investment goals before deciding whether to buy, sell, or hold BigBear.ai. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions concerning BigBear.ai stock.

Featured Posts

-

Services Juridiques Atkinsrealis Droit Inc Conseils Et Representation

May 20, 2025

Services Juridiques Atkinsrealis Droit Inc Conseils Et Representation

May 20, 2025 -

Big Bear Ai Holdings Nyse Bbai Q1 Results Send Shares Down

May 20, 2025

Big Bear Ai Holdings Nyse Bbai Q1 Results Send Shares Down

May 20, 2025 -

D Wave Quantum Qbts Explaining The Recent Stock Market Rally

May 20, 2025

D Wave Quantum Qbts Explaining The Recent Stock Market Rally

May 20, 2025 -

Esperida Megalis Tessarakostis Stin Patriarxiki Akadimia Kritis

May 20, 2025

Esperida Megalis Tessarakostis Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Patra Breite Ton Efimereyonta Iatro Sas Savvatokyriako

May 20, 2025

Patra Breite Ton Efimereyonta Iatro Sas Savvatokyriako

May 20, 2025

Latest Posts

-

Javier Baez Recuperacion Y Productividad En El 2024

May 21, 2025

Javier Baez Recuperacion Y Productividad En El 2024

May 21, 2025 -

Sydney Sweeney And Julianne Moore In Echo Valley New Images Offer A Glimpse Of The Thriller

May 21, 2025

Sydney Sweeney And Julianne Moore In Echo Valley New Images Offer A Glimpse Of The Thriller

May 21, 2025 -

Barry Ward An Interview With The Irish Actor

May 21, 2025

Barry Ward An Interview With The Irish Actor

May 21, 2025 -

Echo Valley Images A First Look At The Sydney Sweeney And Julianne Moore Thriller

May 21, 2025

Echo Valley Images A First Look At The Sydney Sweeney And Julianne Moore Thriller

May 21, 2025 -

Irish Actor Barry Ward A Conversation On Casting And Character

May 21, 2025

Irish Actor Barry Ward A Conversation On Casting And Character

May 21, 2025