BigBear.ai (BBAI): Penny Stock Potential And Investment Risks.

Table of Contents

Understanding BigBear.ai (BBAI) and its Business Model

BigBear.ai is a technology company specializing in providing AI-powered solutions and data analytics services. Its primary target markets are government agencies and commercial enterprises. BBAI's revenue model centers around delivering sophisticated technology services, including:

- AI-powered solutions for national security and defense: This involves developing cutting-edge AI systems for various defense applications.

- Data analytics and mission support services: BBAI leverages AI and machine learning to analyze large datasets, offering valuable insights to clients.

- Partnerships with leading technology firms: Collaborations with other tech companies expand BBAI's reach and capabilities.

The company secures significant revenue through government contracts, making it vulnerable to changes in government spending and procurement policies. Understanding this reliance on government contracts is crucial when assessing BBAI's financial stability and future growth potential.

The Allure of BBAI as a Penny Stock: Potential for High Returns

The allure of BBAI as a penny stock lies in its potential for high returns. The stock's low price point offers the possibility of significant capital appreciation if the company experiences substantial growth. This is a classic high-risk/high-reward scenario. Investing in BBAI presents several potential benefits:

- Potential for substantial capital appreciation: The growing demand for AI solutions could drive significant growth for BBAI, leading to substantial increases in its stock price.

- Lower initial investment: Compared to investing in established, high-priced companies, BBAI requires a lower initial investment, making it accessible to a broader range of investors.

- Increased market interest: Increased interest and speculative buying can fuel rapid price increases, particularly within the volatile penny stock market.

However, it's vital to remember that these potential gains come with significant risks, as discussed below.

Navigating the Risks: Why BBAI is a High-Risk Investment

Investing in BBAI, like any penny stock, carries substantial risks. The potential for significant losses is a real and present danger. Several factors contribute to this high-risk profile:

- High volatility: Penny stocks are inherently volatile, meaning the price can fluctuate dramatically in short periods, leading to unpredictable losses.

- Financial uncertainty: BBAI's financial performance can be unpredictable, influenced by factors like securing government contracts and intense competition. Fluctuating market conditions further increase this financial risk.

- Competition from larger, more established AI companies: BBAI faces stiff competition from larger, more established players in the AI market, potentially limiting its growth potential.

- Dependence on large government contracts: BBAI's heavy reliance on government contracts exposes it to the risks associated with government budget cuts and changes in procurement policies.

Analyzing BBAI’s Financial Performance and Future Outlook

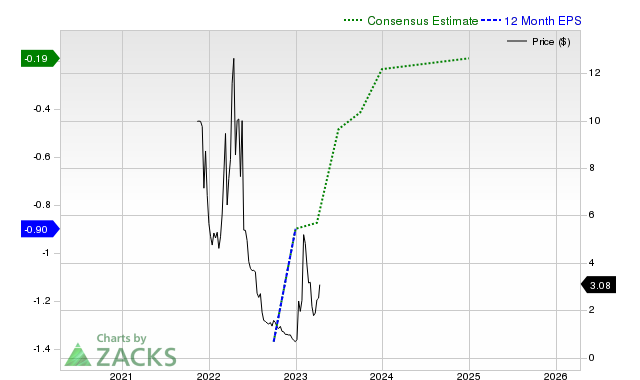

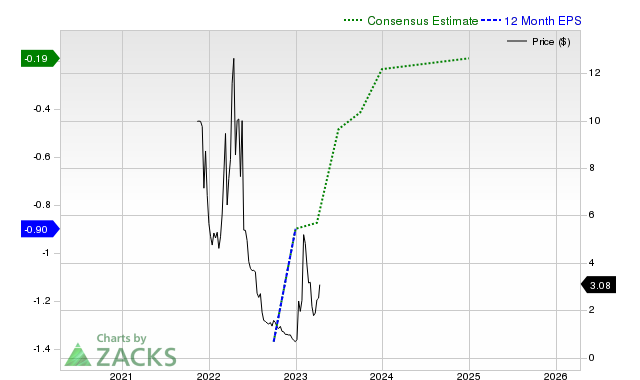

A comprehensive financial analysis of BBAI, including a review of its financial statements, revenue growth, profitability, and overall financial health, is crucial before making any investment decision. Analyzing recent financial reports, comparing key financial metrics to industry averages, and reviewing independent financial analyses can provide valuable insights. Moreover, researching market predictions and future projections for the AI sector can help you assess BBAI's potential for long-term growth and profitability. Graphs and charts illustrating key financial data can provide a clearer picture of BBAI's past performance and future prospects.

Conclusion

Investing in BigBear.ai (BBAI) as a penny stock presents a high-risk/high-reward opportunity. While the potential for substantial returns exists due to the expanding AI market, the significant risks associated with BBAI's volatility, financial uncertainty, and competitive landscape cannot be ignored. Before investing in BigBear.ai (BBAI) or any other penny stock, carefully assess your risk tolerance and conduct thorough research, including a deep dive into the company’s financials and the overall market conditions. Remember, only invest what you can afford to lose.

Featured Posts

-

La Conmovedora Noticia Que Recibio Michael Schumacher

May 20, 2025

La Conmovedora Noticia Que Recibio Michael Schumacher

May 20, 2025 -

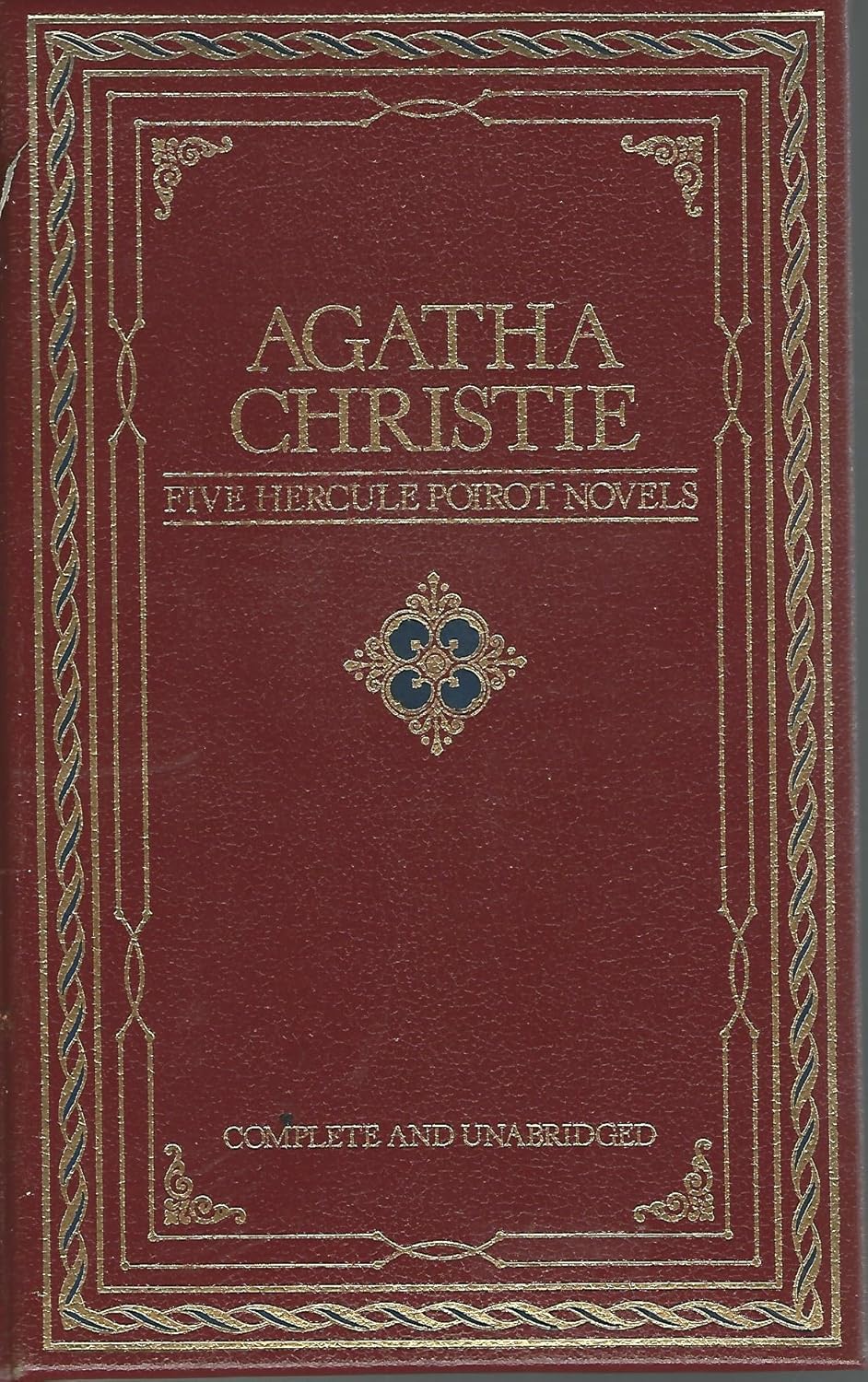

Exploring The Enduring Legacy Of Agatha Christies Hercule Poirot

May 20, 2025

Exploring The Enduring Legacy Of Agatha Christies Hercule Poirot

May 20, 2025 -

Amidst The Batman 2 Rumors Robert Pattinson And Suki Waterhouses Public Display Of Affection In New York

May 20, 2025

Amidst The Batman 2 Rumors Robert Pattinson And Suki Waterhouses Public Display Of Affection In New York

May 20, 2025 -

Man Utd Amorims Blockbuster Forward Signing

May 20, 2025

Man Utd Amorims Blockbuster Forward Signing

May 20, 2025 -

Continuing Tariff Uncertainty An Fp Video Analysis Of Domestic And International Impacts

May 20, 2025

Continuing Tariff Uncertainty An Fp Video Analysis Of Domestic And International Impacts

May 20, 2025

Latest Posts

-

Synaylia Stin Dimokratiki Kathigites Toy Dimotikoy Odeioy Rodoy

May 20, 2025

Synaylia Stin Dimokratiki Kathigites Toy Dimotikoy Odeioy Rodoy

May 20, 2025 -

Moysiki Bradia Kathigites Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 20, 2025

Moysiki Bradia Kathigites Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 20, 2025 -

Dimotiko Odeio Rodoy Synaylia Kathigiton Stin Dimokratiki

May 20, 2025

Dimotiko Odeio Rodoy Synaylia Kathigiton Stin Dimokratiki

May 20, 2025 -

Telikos Champions League I Kroyz Azoyl Kai I Epityxia Toy Giakoymaki

May 20, 2025

Telikos Champions League I Kroyz Azoyl Kai I Epityxia Toy Giakoymaki

May 20, 2025 -

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Programma And Leptomereies

May 20, 2025

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Programma And Leptomereies

May 20, 2025