PwC Exits Nine African Nations: Impact And Analysis

Table of Contents

Reasons Behind PwC's Withdrawal from Nine African Nations

The PwC Africa withdrawal wasn't a spontaneous decision; it's the result of a confluence of factors impacting PwC's African operations.

Operational Challenges and Profitability Concerns

PwC faced significant operational challenges in these specific markets. These included navigating complex regulatory hurdles, contending with infrastructural limitations, and facing intense competition from both established local firms and burgeoning international players. The financial performance of PwC's operations in these countries likely played a crucial role. Reports suggest low profitability and perhaps even losses, making these markets unsustainable in the long term.

- High operational costs: Maintaining offices and staffing in challenging environments comes with significant expenses.

- Intense competition from local firms: Established local firms, often with a deeper understanding of the local market, provided stiff competition.

- Difficulty attracting and retaining skilled talent: The struggle to attract and retain highly skilled professionals in these markets added to operational difficulties. Competitive salaries and challenging working conditions likely contributed to this.

Strategic Restructuring and Global Realignment

PwC's withdrawal fits into a broader global strategy of restructuring and realignment. The firm is likely focusing on consolidating its presence in more profitable and strategically important markets worldwide. This strategic decision prioritizes resource allocation towards regions offering higher returns on investment and aligning with its overall growth objectives.

- Focus on key growth markets: This withdrawal allows PwC to concentrate resources on high-growth markets with greater potential for profitability.

- Optimization of global resources: Streamlining operations and focusing on key markets allows for more efficient allocation of resources.

- Enhanced focus on digital transformation services: PwC may be shifting its focus towards high-demand digital transformation services, potentially requiring a different operational structure.

Impact on Affected African Nations and Businesses

The PwC Africa withdrawal has significant ramifications for both individual businesses and the broader economic landscape of the affected nations.

Loss of Auditing and Consulting Expertise

The departure of PwC represents a considerable loss of auditing and consulting expertise for businesses in these nine nations. Companies that relied on PwC for auditing, tax advisory, and other professional services now face challenges in finding suitable replacements.

- Reduced access to high-quality audit services: The absence of PwC may lead to a reduction in the availability of high-quality, internationally recognized audit services.

- Potential increase in audit costs: The reduced competition could potentially lead to an increase in the cost of auditing and consulting services.

- Difficulty in attracting foreign investment: The withdrawal could negatively impact investor confidence, making it harder to attract foreign investment.

Implications for Economic Development

The long-term implications for economic development in the affected countries are significant. PwC played a role in promoting good corporate governance and transparency. Its absence could lead to increased regulatory risk and potentially increased opportunities for corruption.

- Negative impact on foreign direct investment: The reduced availability of high-quality professional services may deter foreign investors.

- Increased regulatory risk: The departure of a major player could increase regulatory risk and instability.

- Potential for increased corruption: The absence of a strong auditing presence could potentially increase vulnerabilities to corruption.

The Future of Professional Services in Africa

While the PwC Africa withdrawal presents challenges, it simultaneously creates opportunities for other players within the African professional services landscape.

Opportunities for Local and Regional Firms

This withdrawal creates a significant opportunity for smaller local and regional accounting and consulting firms to expand their market share. It could lead to mergers, acquisitions, and the rise of new market leaders.

- Increased market share for local firms: Local firms are well-positioned to capture the market share left vacant by PwC.

- Opportunities for mergers and acquisitions: This could lead to consolidation within the African professional services sector.

- Growth potential in niche areas: Local firms may find opportunities to specialize in niche areas where PwC previously held a strong presence.

Response from Regulators and Governments

African governments and regulatory bodies are likely to respond to PwC's withdrawal with policy changes aimed at supporting local firms and maintaining the stability of the professional services sector. This could involve regulatory adjustments, incentives, and strengthened oversight.

- Enhanced regulatory oversight: Governments may enhance regulatory oversight to ensure the quality of services provided by remaining firms.

- Incentives for local firms: Governments may introduce incentives to support and encourage the growth of local firms.

- Development of professional accounting standards: The withdrawal could stimulate improvements in professional accounting standards and training.

Conclusion

PwC's departure from nine African nations represents a significant turning point for the continent's professional services sector. While the PwC Africa withdrawal presents challenges, it also fosters opportunities for local growth and development. Understanding the reasons behind this decision and its cascading effects is essential for navigating this new landscape. Further research and analysis are needed to comprehend the long-term impact of the PwC Africa withdrawal and to formulate effective strategies for leveraging emerging opportunities while mitigating potential negative consequences. Staying informed on the ongoing developments related to PwC exit Africa is crucial for all stakeholders.

Featured Posts

-

The China Factor Why Foreign Auto Brands Face Headwinds In The Chinese Market

Apr 29, 2025

The China Factor Why Foreign Auto Brands Face Headwinds In The Chinese Market

Apr 29, 2025 -

Nine African Countries Lose Pw C Implications For Senegal Gabon And Madagascar

Apr 29, 2025

Nine African Countries Lose Pw C Implications For Senegal Gabon And Madagascar

Apr 29, 2025 -

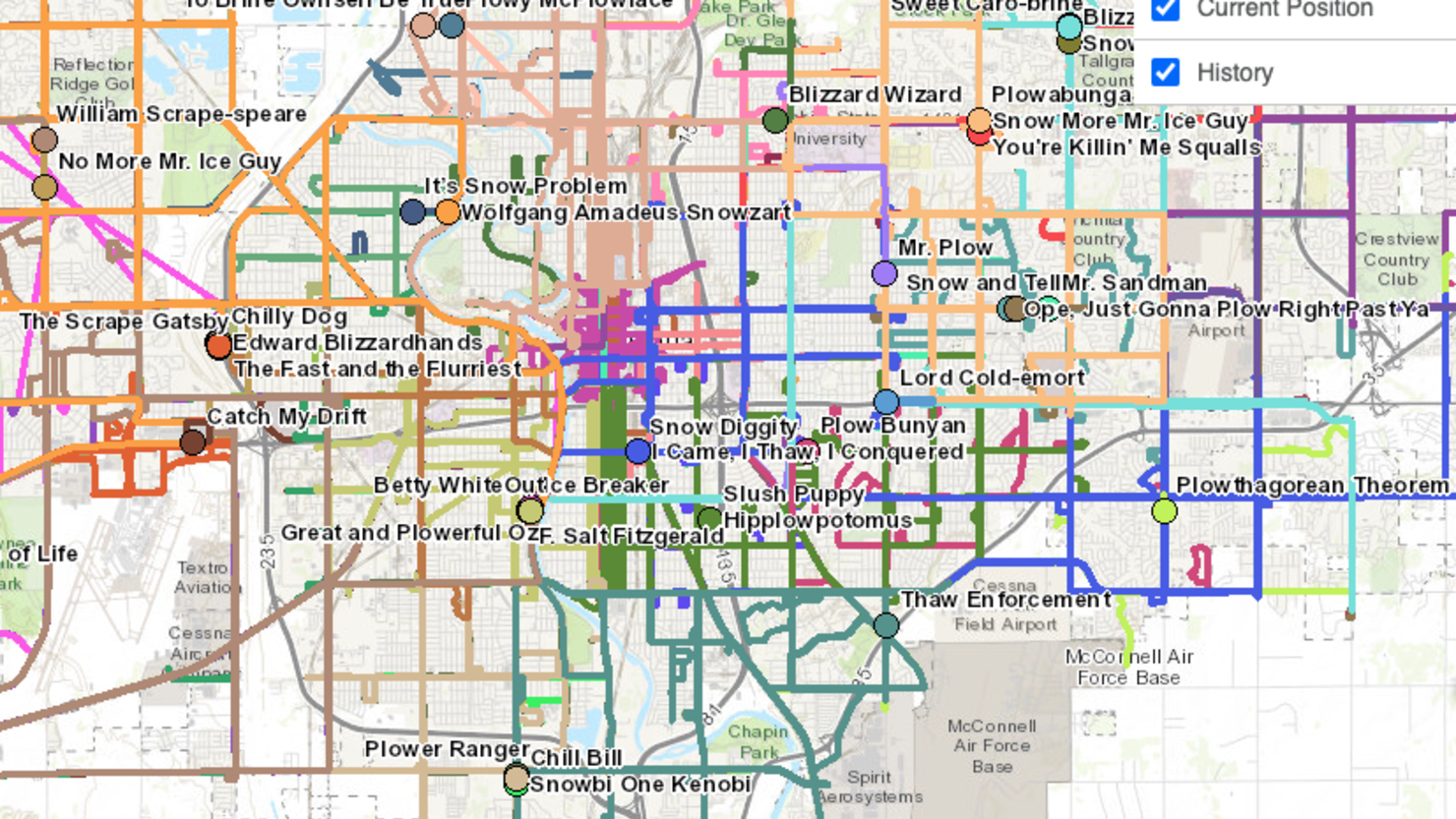

2024 Minnesota Snow Plow Names The Winners Are

Apr 29, 2025

2024 Minnesota Snow Plow Names The Winners Are

Apr 29, 2025 -

Fyrsta 100 Rafmagnsutgafa Porsche Macan Yfirlit Og Eiginleikar

Apr 29, 2025

Fyrsta 100 Rafmagnsutgafa Porsche Macan Yfirlit Og Eiginleikar

Apr 29, 2025 -

Pabrik Zuffenhausen Dan Sejarah Legendaris Porsche 356

Apr 29, 2025

Pabrik Zuffenhausen Dan Sejarah Legendaris Porsche 356

Apr 29, 2025

Latest Posts

-

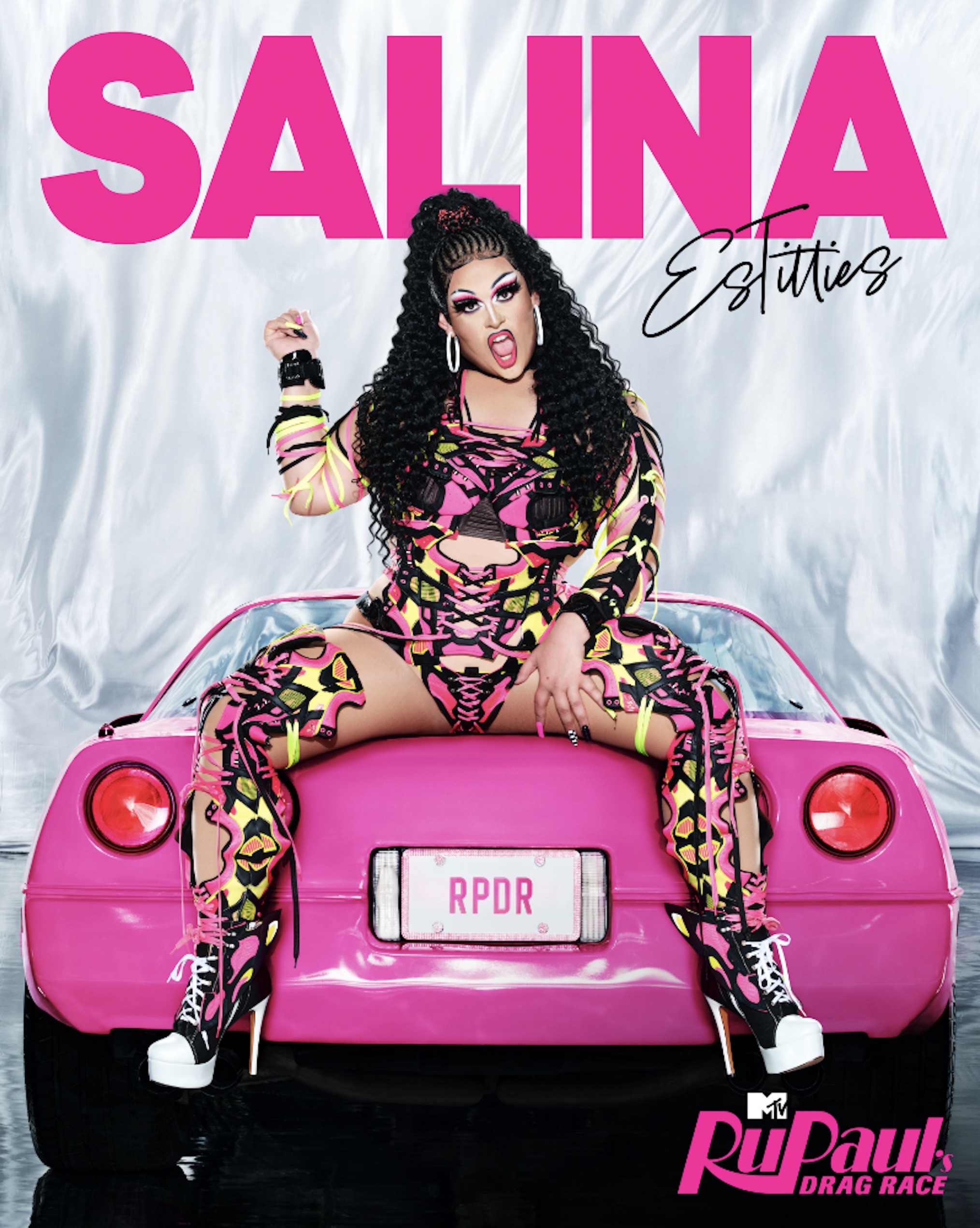

Unexpected Family Ties Nba Legend And Ru Pauls Drag Race

Apr 30, 2025

Unexpected Family Ties Nba Legend And Ru Pauls Drag Race

Apr 30, 2025 -

Surprise Nba Legend Is Godfather To Ru Pauls Drag Race Star

Apr 30, 2025

Surprise Nba Legend Is Godfather To Ru Pauls Drag Race Star

Apr 30, 2025 -

Nba Legends Unexpected Role Ru Pauls Drag Race Stars Godfather

Apr 30, 2025

Nba Legends Unexpected Role Ru Pauls Drag Race Stars Godfather

Apr 30, 2025 -

Ru Pauls Drag Race Live 1000th Show A Las Vegas Celebration Streamed Worldwide

Apr 30, 2025

Ru Pauls Drag Race Live 1000th Show A Las Vegas Celebration Streamed Worldwide

Apr 30, 2025 -

Las Vegas Ru Pauls Drag Race Live 1000th Performance Global Stream

Apr 30, 2025

Las Vegas Ru Pauls Drag Race Live 1000th Performance Global Stream

Apr 30, 2025