Nine African Countries Lose PwC: Implications For Senegal, Gabon, And Madagascar

Table of Contents

The Scope of PwC's Withdrawal and its Immediate Consequences

PwC's decision to exit nine African countries—the exact number and names should be inserted here, citing the original source—has far-reaching consequences. While the precise reasons behind this strategic move remain somewhat opaque, factors like evolving regulatory landscapes, increasing operational complexities, and perhaps even shifting business priorities likely played significant roles. The immediate impact is felt most acutely by businesses reliant on PwC's extensive suite of services, including auditing, consulting, and taxation.

- Loss of auditing expertise and credibility: The withdrawal represents a loss of established expertise and international credibility in auditing, potentially impacting the perceived financial health and stability of businesses.

- Disruption to financial reporting processes: Businesses face disruptions in their established financial reporting processes, needing to find and onboard new auditing firms, potentially leading to delays.

- Increased costs for businesses seeking alternative services: The transition to alternative service providers will likely result in increased costs for businesses, particularly smaller companies with fewer resources.

- Potential impact on foreign investment: The departure of a globally recognized firm like PwC could negatively affect investor confidence, potentially deterring foreign direct investment (FDI).

Implications for Senegal

Senegal, a relatively stable and growing economy in West Africa, has relied significantly on PwC’s services for its larger corporations. The departure creates both challenges and opportunities. Local firms now have a chance to expand their services and gain valuable experience. However, they may face capacity constraints and need support in meeting international auditing standards. The Senegalese government's response will be critical, potentially involving regulatory adjustments to attract new international auditing firms and support the growth of local players.

- Impact on Senegalese businesses, especially large corporations: Larger businesses will need to navigate the transition carefully, incurring potential costs and delays.

- Opportunities for growth for local accounting firms: This presents an opportunity for Senegalese accounting firms to grow their client base and enhance their capabilities.

- Potential regulatory changes to attract new auditing firms: The government may need to implement policy changes to incentivize other international auditing firms to enter the market.

Implications for Gabon

Gabon, heavily reliant on its oil and gas sector, faces unique challenges. PwC’s presence in this sector was crucial for maintaining transparency and accountability in the government's financial dealings. The withdrawal raises concerns about the potential for increased opacity in this critical industry. Attracting a replacement firm with similar expertise and international recognition will be difficult and may necessitate a concerted effort by the Gabonese government.

- Impact on the oil and gas sector's financial reporting: The absence of PwC could impact the quality and credibility of financial reporting in this vital sector.

- Potential implications for transparency and governance: The withdrawal could hinder transparency and accountability in government financial dealings related to the oil and gas sector.

- Challenges in attracting replacement auditing firms: Finding a firm with the necessary expertise and experience in the oil and gas sector might prove challenging.

Implications for Madagascar

Madagascar, a nation with a more vulnerable economy, relies heavily on international auditing firms like PwC for credibility and access to foreign aid and development projects. The consequences of PwC’s withdrawal are potentially severe, especially for smaller and medium-sized enterprises (SMEs) lacking the resources to engage alternative, possibly more expensive firms. Building local capacity in auditing and accounting is paramount to mitigating the long-term impact.

- Impact on foreign aid and development projects: The lack of a well-established auditing firm could impact the flow of foreign aid and the implementation of development projects.

- Challenges for small and medium-sized enterprises (SMEs): SMEs might struggle to find suitable and affordable auditing services, impacting their access to finance and growth opportunities.

- Limited capacity within local accounting firms: The capacity of local accounting firms may be insufficient to fill the gap left by PwC's departure.

The Broader African Context and Future Outlook

The implications of Nine African Countries Lose PwC extend beyond these three nations. The withdrawal highlights broader concerns about the business environment in Africa and its attractiveness to foreign investors. Regional collaborations between African nations to develop auditing capacity and attract new firms are crucial. Strengthening regulatory frameworks and investing in training and development for African accounting professionals are essential steps to mitigate the long-term consequences of PwC's departure.

- Increased competition among remaining auditing firms: The remaining auditing firms will likely face increased competition and pressure to meet the rising demand.

- Opportunities for African accounting professionals to develop expertise: The situation presents opportunities for growth and specialization within the African accounting profession.

- Need for regulatory reforms to foster a robust auditing environment: Regulatory reforms are needed to create a stable and attractive environment for both local and international auditing firms.

Conclusion: Navigating the Aftermath of Nine African Countries Losing PwC

The withdrawal of PwC from nine African countries, including Senegal, Gabon, and Madagascar, presents significant challenges and opportunities. While the immediate impact involves disruptions to financial reporting and potential decreases in investor confidence, it also necessitates a focus on building local capacity, strengthening regulatory frameworks, and fostering regional collaboration. The impact of PwC withdrawal will require careful navigation, demanding proactive responses from governments and businesses alike. To stay informed about the unfolding developments, follow the news closely and stay updated on the evolving landscape of auditing and accounting in Africa following PwC's departure from Africa. Understanding these implications is key to ensuring a stable and prosperous future for the continent's business environment.

Featured Posts

-

D C Blackhawk Passenger Jet Crash The Reports Grim Findings

Apr 29, 2025

D C Blackhawk Passenger Jet Crash The Reports Grim Findings

Apr 29, 2025 -

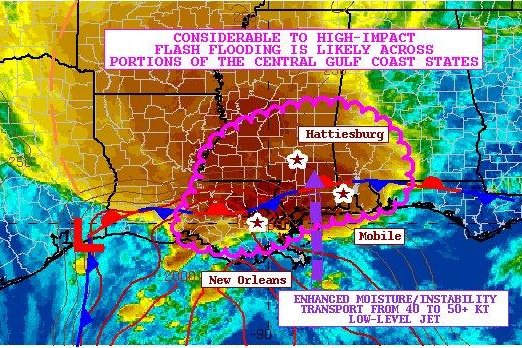

Severe Weather Pummels Louisville Unprecedented Snow Tornadoes And Flooding In 2025

Apr 29, 2025

Severe Weather Pummels Louisville Unprecedented Snow Tornadoes And Flooding In 2025

Apr 29, 2025 -

Yukon Legislature Contempt Threat Over Mine Managers Testimony

Apr 29, 2025

Yukon Legislature Contempt Threat Over Mine Managers Testimony

Apr 29, 2025 -

Nyt Strands March 3 2025 Complete Answers And Hints

Apr 29, 2025

Nyt Strands March 3 2025 Complete Answers And Hints

Apr 29, 2025 -

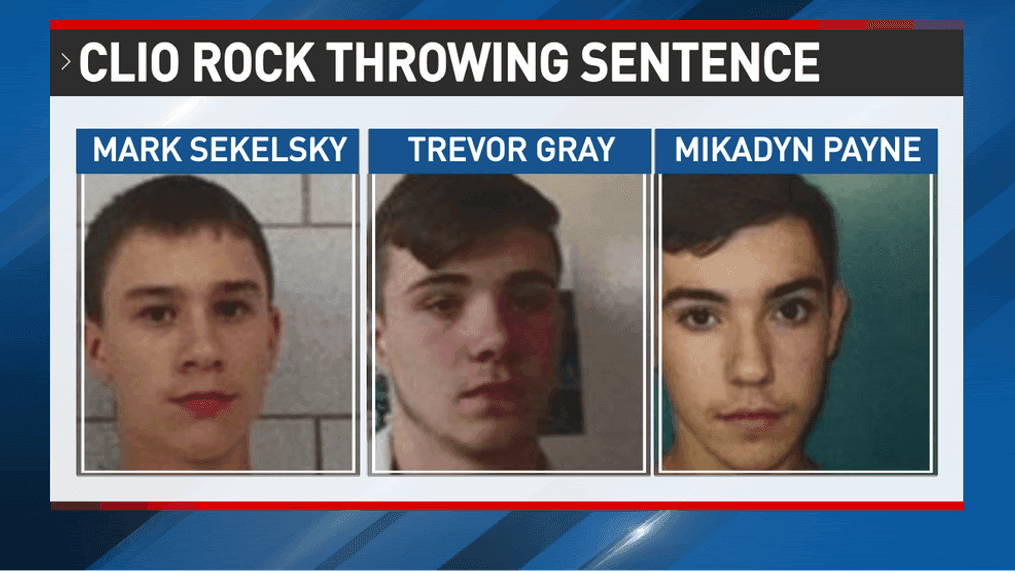

Murder Conviction After Deadly Teen Rock Throwing Game

Apr 29, 2025

Murder Conviction After Deadly Teen Rock Throwing Game

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni