Profiting From Market Swings: A Contrarian Investment Approach

Table of Contents

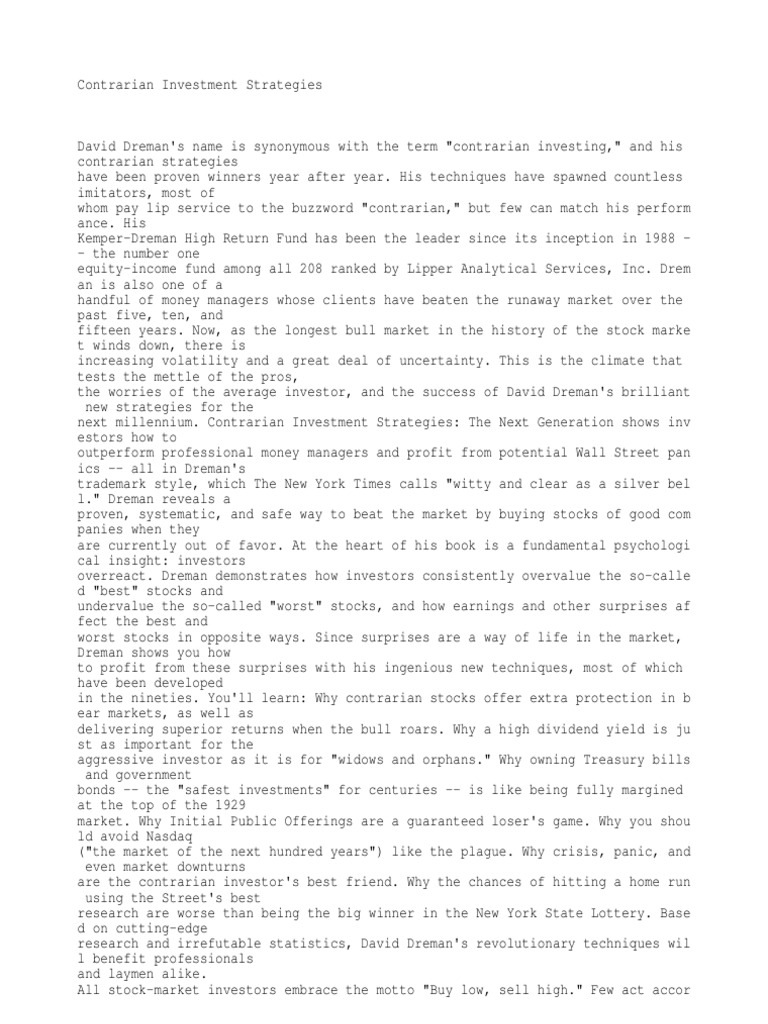

Understanding Contrarian Investing

Contrarian investing is all about swimming against the current. It's about buying when others are selling and selling when others are buying, a strategy that often involves identifying assets mispriced due to widespread fear or irrational exuberance. Mastering this approach requires a shift in mindset and a commitment to a long-term perspective.

Defining the Contrarian Approach

Contrarian investing is fundamentally different from following market trends. It prioritizes in-depth analysis and the identification of undervalued opportunities created by market inefficiencies.

- Key Principle: Fundamental analysis takes center stage. Rather than blindly following market trends, contrarian investors delve into a company's financials, assessing its intrinsic value and comparing it to its market price.

- Risk Mitigation: Diversification is a cornerstone of any successful contrarian strategy. Spreading investments across different asset classes and sectors helps cushion against potential losses in any single investment.

- Patience is Key: Contrarian investments often require patience. It may take time for the market to recognize the true value of an undervalued asset, demanding a long-term investment horizon.

Identifying Market Sentiment

Gauging overall investor emotion is crucial for successful contrarian investing. This involves analyzing various data points to understand the prevailing market mood.

- News Analysis: Scrutinize financial news for signs of excessive optimism or pessimism. Overly positive or negative news can often signal an overreaction, creating contrarian investment opportunities.

- Market Indicators: Technical analysis tools such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can help identify overbought or oversold conditions, signaling potential reversal points.

- Social Sentiment: Analyzing social media and online forums can provide insights into public opinion on specific stocks or sectors. Strong positive or negative sentiment can often precede market corrections.

Strategies for Profiting from Market Swings

Several strategies can help you capitalize on market swings, each with its own set of advantages and risks.

Value Investing

Value investing focuses on identifying undervalued companies with strong fundamentals, often overlooked by the broader market.

- Finding Undervalued Stocks: Use discounted cash flow analysis, price-to-earnings ratios (P/E), and other valuation metrics to identify companies trading below their intrinsic value.

- Identifying Market Inefficiencies: Look for companies temporarily affected by negative news that is short-lived, but whose underlying fundamentals remain sound. These situations can create compelling buying opportunities.

- Long-Term Perspective: Value investing is a long-term strategy. Don't expect immediate gains; patience is crucial for realizing the full potential of your investments.

Short Selling

Short selling involves profiting from declining asset prices. This is a more advanced and riskier strategy requiring a thorough understanding of market dynamics.

- Understanding Short Selling Mechanics: This involves borrowing shares, selling them at the current market price, buying them back later at a lower price, and returning them to the lender, pocketing the difference.

- Identifying Stocks Suitable for Short Selling: Focus on companies with weak fundamentals, overvalued assets, or facing significant headwinds. Thorough due diligence is paramount.

- Risk Management in Short Selling: Short selling can lead to significant losses if the stock price rises instead of falls. Employing stop-loss orders and diversifying short positions are crucial risk management strategies.

Swing Trading

Swing trading aims to capitalize on short-term price fluctuations. This strategy requires a keen understanding of technical analysis and risk management.

- Technical Analysis for Swing Trading: Use chart patterns, indicators like RSI and MACD, and support/resistance levels to identify entry and exit points for your trades.

- Risk Management in Swing Trading: Stop-loss orders and careful position sizing are essential for controlling potential losses.

- Identifying Suitable Assets for Swing Trading: Stocks with high volatility and sufficient liquidity are typically preferred for swing trading.

Risk Management in Contrarian Investing

Even with the most carefully planned strategies, risk management is crucial for long-term success in contrarian investing.

Diversification

Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors helps to reduce the impact of losses in any single investment.

Stop-Loss Orders

Stop-loss orders automatically sell an asset when it reaches a predetermined price, limiting potential losses.

Position Sizing

Carefully determining the appropriate amount of capital to allocate to each investment minimizes risk and prevents significant losses from wiping out your entire portfolio.

Emotional Discipline

Maintaining emotional discipline is vital. Sticking to your investment plan, despite market volatility and short-term setbacks, is essential for long-term success.

Conclusion

Profiting from market swings requires a disciplined, informed approach. By understanding contrarian investing principles, employing effective strategies like value investing or swing trading, and implementing robust risk management techniques, you can potentially capitalize on market volatility. Remember that contrarian investing involves inherent risk; thorough research and a long-term perspective are crucial for success. Start learning more about profiting from market swings today and explore the opportunities available through a contrarian investment approach. Don't let market fluctuations dictate your investment strategy; learn to profit from them.

Featured Posts

-

Silent Divorce Understanding The Telltale Signs Of Marital Breakdown

Apr 28, 2025

Silent Divorce Understanding The Telltale Signs Of Marital Breakdown

Apr 28, 2025 -

Decoding Xs Financials Post Musk Debt Sale Analysis

Apr 28, 2025

Decoding Xs Financials Post Musk Debt Sale Analysis

Apr 28, 2025 -

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Documents

Apr 28, 2025

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Documents

Apr 28, 2025 -

Dont Miss Hudsons Bay Closing Sale With Huge Markdowns

Apr 28, 2025

Dont Miss Hudsons Bay Closing Sale With Huge Markdowns

Apr 28, 2025 -

Lapd Releases Videos Chaos Surrounds Shooting Of Weezer Bassists Wife

Apr 28, 2025

Lapd Releases Videos Chaos Surrounds Shooting Of Weezer Bassists Wife

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

Universal Tone

Apr 28, 2025

Universal Tone

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Red Sox Manager Cora Alters Lineup For Doubleheaders First Game

Apr 28, 2025

Red Sox Manager Cora Alters Lineup For Doubleheaders First Game

Apr 28, 2025 -

Coras Strategic Lineup Tweaks For Red Sox Doubleheader

Apr 28, 2025

Coras Strategic Lineup Tweaks For Red Sox Doubleheader

Apr 28, 2025