Private Credit Jobs: 5 Key Do's And Don'ts For Success

Table of Contents

Do's for Securing Private Credit Jobs

1. Network Strategically (Keyword: Private Credit Networking)

Building a strong network is paramount in the private credit industry. It's not just about who you know, but the quality of those relationships. Effective private credit networking opens doors to unadvertised opportunities and provides invaluable insights.

- Build relationships with professionals in private credit firms: Attend industry events, connect on LinkedIn, and reach out to individuals for informational interviews.

- Attend industry conferences and events: SuperReturn, PEI, and other similar conferences offer excellent networking opportunities to connect with key players in the private credit space. Actively participate in discussions and workshops.

- Leverage LinkedIn effectively: Optimize your profile to highlight your private credit skills and experience. Connect with recruiters specializing in finance and private credit, and engage with industry thought leaders.

- Join relevant professional organizations: The CFA Institute, for example, provides access to networking events and resources beneficial for private credit professionals.

- Informational interviews: These provide invaluable insights into specific firms and roles, allowing you to learn about the day-to-day realities of a private credit career and build relationships with potential mentors.

2. Master the Relevant Skills (Keyword: Private Credit Skills)

Possessing the right private credit skills is essential for securing a role. This involves both technical expertise and a deep understanding of the industry.

- Develop strong financial modeling skills: Proficiency in Excel, discounted cash flow (DCF) analysis, and leveraged buyout (LBO) modeling is crucial for evaluating investment opportunities.

- Gain expertise in credit analysis and underwriting: Learn to assess credit risk, understand financial statements, and construct credit models.

- Understand private credit structures: Become familiar with various financing structures, including unitranche, senior secured, and mezzanine debt.

- Familiarize yourself with legal and regulatory aspects of private credit: A basic understanding of legal and compliance issues is essential for working in this highly regulated industry.

- Enhance your knowledge of industry trends and market dynamics: Stay updated on current market conditions, interest rates, and evolving investment strategies.

3. Craft a Compelling Resume and Cover Letter (Keyword: Private Credit Resume)

Your resume and cover letter are your first impression. They must effectively communicate your qualifications and demonstrate your understanding of private credit.

- Highlight relevant experience and quantify your achievements: Use metrics to showcase the impact of your work, such as increased efficiency or improved financial performance.

- Tailor your resume and cover letter to each specific job description: Generic applications rarely succeed. Each application should reflect a deep understanding of the firm and the specific role.

- Showcase your understanding of private credit investment strategies: Demonstrate your knowledge of different investment approaches and their implications.

- Emphasize your analytical and problem-solving abilities: Private credit professionals need strong analytical skills to assess complex financial situations.

- Use action verbs to describe your accomplishments and contributions: Strong action verbs make your accomplishments stand out and demonstrate your capabilities.

4. Ace the Interview (Keyword: Private Credit Interview)

The interview process is critical. Preparation, confidence, and genuine interest will significantly improve your chances.

- Prepare for behavioral, technical, and case study questions: Practice answering common interview questions and prepare for technical questions related to financial modeling and credit analysis.

- Research the firm thoroughly and demonstrate your understanding of their investment strategy: Show that you've done your homework and are genuinely interested in the firm's specific area of focus.

- Practice your answers and articulate your thought process clearly: Clearly communicate your reasoning behind your answers, showing a structured and logical approach to problem-solving.

- Ask insightful questions to show your genuine interest: Prepare questions that demonstrate your understanding of the firm and the industry.

- Follow up with a thank-you note after each interview: A timely thank-you note reinforces your interest and keeps you top-of-mind.

5. Show Your Passion (Keyword: Private Credit Career)

Enthusiasm for the private credit industry is infectious. Demonstrating genuine passion sets you apart from other candidates.

- Demonstrate a genuine enthusiasm for the private credit industry: Let your passion shine through during interviews and networking events.

- Stay up-to-date on market trends and news: Show that you are actively engaged in the industry and are aware of the latest developments.

- Engage in industry discussions and contribute to relevant online forums: This demonstrates your commitment to continuous learning and industry engagement.

- Show your commitment to continuous learning and professional development: Highlight any relevant certifications or courses you've completed, demonstrating a proactive approach to career development.

Don'ts for Securing Private Credit Jobs

1. Neglect Networking (Keyword: Private Equity Networking)

Networking is not optional; it's essential. Don't underestimate its power in securing a private credit role.

- Don't underestimate the importance of building relationships: Networking is crucial for uncovering hidden opportunities and gaining valuable insights.

- Don't rely solely on online job applications: Online applications are a starting point, but networking significantly increases your chances of success.

2. Lack Relevant Skills (Keyword: Investment Banking Skills)

Possessing the right skill set is non-negotiable. Don't underestimate the technical expertise required.

- Don't underestimate the importance of financial modeling and credit analysis: These are fundamental skills for any private credit professional.

- Don't overlook the need for understanding different private credit structures: Familiarity with various debt structures is vital for evaluating investment opportunities.

3. Submit Generic Applications (Keyword: Private Equity Job Search)

Each application should be tailored to the specific firm and role. Don't waste your time with generic submissions.

- Don't send the same resume and cover letter to every firm: Each application should be customized to highlight relevant experience and skills for the specific role.

- Don't ignore the specific requirements mentioned in each job description: Pay close attention to the job description and tailor your application accordingly.

4. Underprepare for Interviews (Keyword: Finance Interview)

Thorough preparation is key. Don't go into an interview unprepared; it shows a lack of professionalism.

- Don't go into an interview unprepared: Practice answering common interview questions and research the firm thoroughly.

- Don't fail to research the firm and the interviewers: Demonstrating knowledge of the firm's investment strategy and the interviewers' backgrounds shows genuine interest.

5. Appear Unenthusiastic (Keyword: Finance Career)

Passion is contagious. Don't let a lack of enthusiasm hinder your chances.

- Don't show disinterest in the industry or the specific firm: Your enthusiasm should be evident throughout the entire process.

- Don't come across as unprepared or unpassionate: Your energy and genuine interest will make a positive impression.

Conclusion

Securing a position in the competitive world of private credit jobs requires a strategic and proactive approach. By following these do's and don'ts—mastering relevant private credit skills, networking effectively, and presenting yourself professionally—you can significantly increase your chances of success. Don't delay; start building your private credit career today by actively implementing these strategies. Remember, a focused approach and dedication to honing your private credit skills will set you apart.

Featured Posts

-

Tariff Price Hikes Retailers Predict A Return To Higher Costs

May 01, 2025

Tariff Price Hikes Retailers Predict A Return To Higher Costs

May 01, 2025 -

Bartlett Texas Fire Leaves Two Structures As Total Losses During Red Flag Conditions

May 01, 2025

Bartlett Texas Fire Leaves Two Structures As Total Losses During Red Flag Conditions

May 01, 2025 -

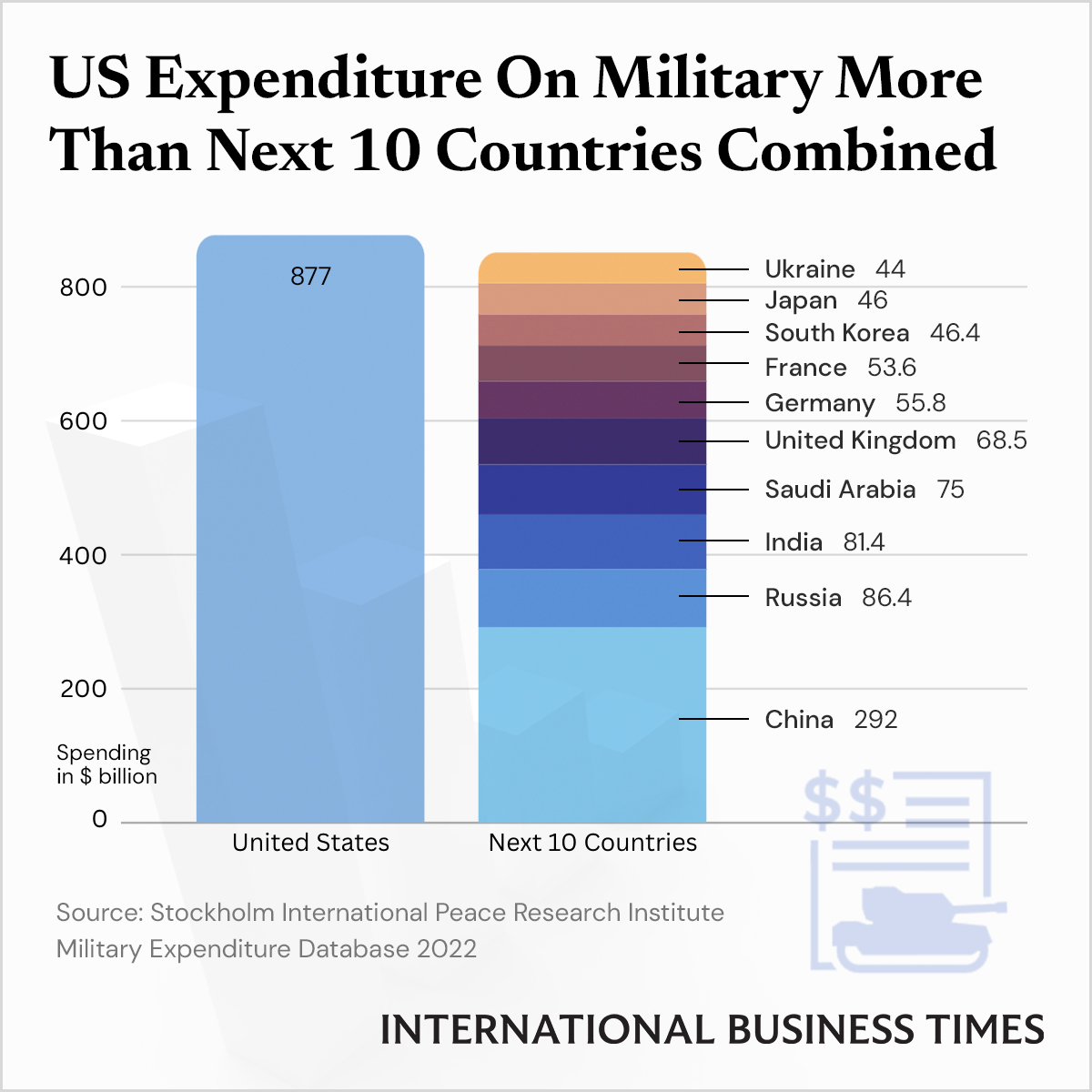

Military Spending Surge A European Reaction To Russias Actions

May 01, 2025

Military Spending Surge A European Reaction To Russias Actions

May 01, 2025 -

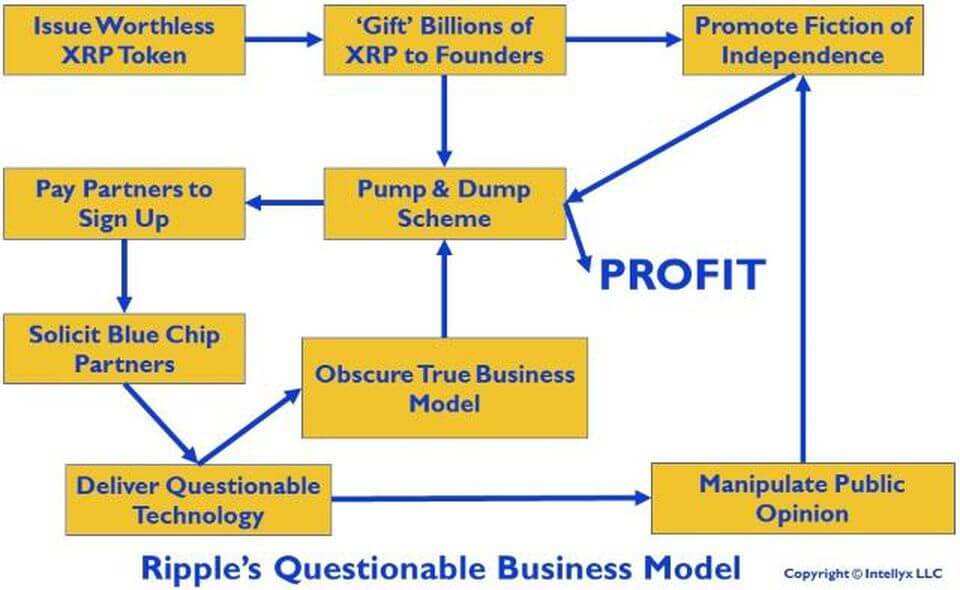

Ripple Settlement And The Potential Commodity Classification Of Xrp

May 01, 2025

Ripple Settlement And The Potential Commodity Classification Of Xrp

May 01, 2025 -

Claudia Sheinbaum Y Julio Cesar Clase Nacional De Boxeo 2025

May 01, 2025

Claudia Sheinbaum Y Julio Cesar Clase Nacional De Boxeo 2025

May 01, 2025