Ripple Settlement And The Potential Commodity Classification Of XRP

Table of Contents

Main Points:

2.1 The Ripple SEC Lawsuit and its Outcome:

H3: Key Allegations of the SEC Lawsuit:

The Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs in December 2020, alleging the sale of unregistered securities. The core of the SEC's argument centered on the claim that XRP, despite its decentralized nature, functioned as an unregistered security under the Howey Test.

- The SEC argued that Ripple conducted unregistered offers and sales of XRP.

- They claimed XRP sales constituted investment contracts, implying investors anticipated profits based on Ripple's efforts.

- Ripple countered that XRP is a decentralized digital asset, functioning more like a currency or a commodity than a security.

H3: The Partial Summary Judgment and its Implications:

The court's partial summary judgment delivered a mixed verdict. While the judge ruled that programmatic sales of XRP did not constitute the sale of unregistered securities, institutional sales were deemed to be unregistered securities offerings.

- The ruling created a significant legal grey area regarding XRP’s status.

- The distinction between institutional sales and programmatic sales is crucial for understanding the court's decision.

- This partial victory for Ripple, however, left significant ambiguity concerning the overall classification of XRP.

H3: The Ongoing Legal Uncertainty:

Despite the partial summary judgment, considerable legal uncertainty remains. Appeals are possible, and further litigation could significantly alter XRP's status.

- The ongoing debate surrounding XRP's classification continues to impact its market price and investor sentiment.

- The lack of definitive legal clarity creates a challenging environment for businesses operating within the XRP ecosystem.

- Regulatory clarity is needed to provide a stable framework for the future of XRP and similar cryptocurrencies.

2.2 Arguments for XRP as a Commodity:

H3: Decentralization and Network Effects:

Proponents of XRP's commodity classification point to its decentralized nature and its use within the RippleNet network. A commodity is typically defined by its fungibility, interchangeable nature, and its use as a medium of exchange. XRP arguably meets these criteria.

- XRP's decentralized ledger and consensus mechanism are key arguments in its favor.

- The RippleNet network facilitates cross-border payments, showcasing XRP's practical utility as a medium of exchange.

- The network effect – the increasing value of the network as more users join – further supports this classification.

H3: Functional Analysis of XRP:

Beyond RippleNet, XRP functions within the broader cryptocurrency ecosystem. Its use in decentralized exchanges and its role in facilitating faster and cheaper cross-border payments suggest a commodity-like functionality.

- XRP’s use cases extend beyond the RippleNet, showing broader utility.

- Its adoption by various decentralized exchanges demonstrates utility outside Ripple’s direct control.

- This functional analysis lends weight to the arguments in favor of commodity classification.

H3: Comparison with Other Cryptocurrencies:

Comparing XRP to other cryptocurrencies like Bitcoin and Ethereum reveals similarities and differences in their functionalities and legal battles. Both Bitcoin and Ethereum have faced regulatory scrutiny, highlighting the complexities involved in classifying digital assets.

- Bitcoin is largely considered a decentralized currency, bolstering the argument for XRP's potential classification as a commodity.

- Ethereum's functionality as a platform for decentralized applications (dApps) presents a different legal landscape.

- However, all these assets highlight the need for clear regulatory frameworks for cryptocurrencies.

2.3 Arguments Against XRP as a Commodity (and for it being a Security):

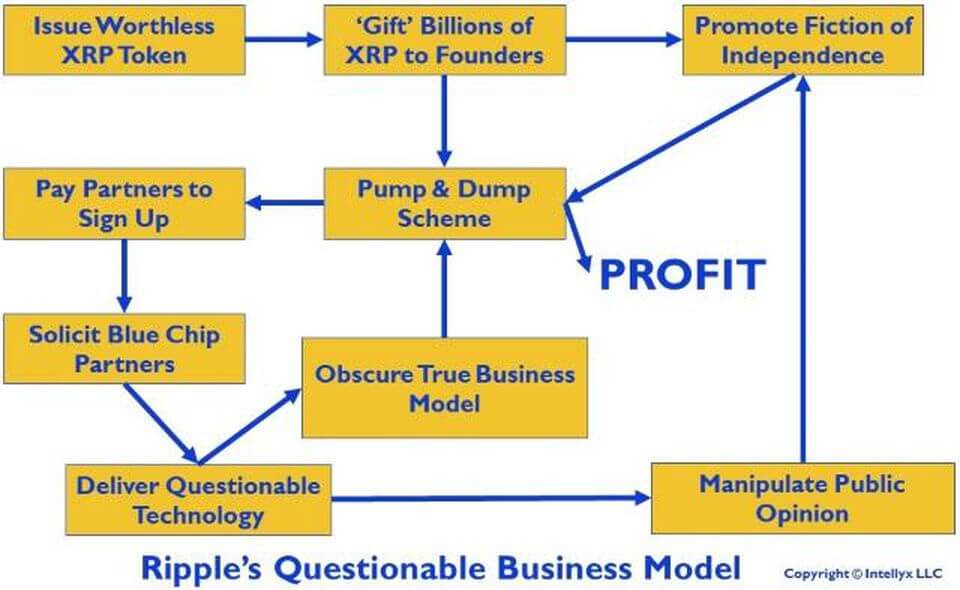

H3: Ripple's Control and Influence:

The SEC argued that Ripple's initial control and influence over XRP distribution suggest a security classification. This control includes the initial allocation and subsequent distribution of XRP tokens.

- The SEC pointed to Ripple's ability to influence XRP’s market price through its actions.

- The Howey Test, a key criterion for determining whether an investment constitutes a security, is central to this argument.

- Ripple's actions, the SEC argued, created a reasonable expectation of profit for investors, fulfilling a key element of the Howey Test.

H3: The Investment Contract Argument:

The SEC's core argument rests on the claim that XRP sales constituted investment contracts, thereby meeting the definition of a security under the Howey Test. The Howey Test involves four elements: an investment of money, in a common enterprise, with an expectation of profits primarily derived from the efforts of others.

- The SEC argued that purchasers of XRP expected profits stemming from Ripple’s efforts to develop the XRP ecosystem.

- This argument centered on the expectation of profit derived from Ripple's promotional activities and network development.

- The court's consideration of these elements is key to understanding the ongoing uncertainty.

H3: Potential Future Regulatory Scrutiny:

The Ripple case sets a precedent for the regulation of other cryptocurrencies. Regulatory bodies worldwide are closely monitoring the case and its potential implications.

- The outcome will likely influence how other cryptocurrencies are classified and regulated.

- International regulatory bodies are actively shaping their approaches to digital asset regulation based on this case.

- The future regulatory landscape for XRP and other cryptocurrencies remains highly uncertain.

2.4 The Impact on the Market and Investors:

H3: Price Volatility and Investor Sentiment:

The legal uncertainty surrounding XRP has caused significant price volatility and impacted investor sentiment. Court rulings and news related to the case have directly influenced XRP's market value.

- The partial summary judgment led to initial price increases, reflecting market optimism.

- However, ongoing legal challenges and uncertainties continue to create price volatility.

- Investor confidence in XRP remains fragile pending final legal resolution.

H3: Regulatory Implications for Crypto Market:

The Ripple case has significant implications for the entire cryptocurrency market, setting a precedent for the regulation of other digital assets and future Initial Coin Offerings (ICOs).

- The case highlights the need for greater clarity and consistency in the regulation of digital assets.

- Future ICOs and token sales will be impacted by the legal interpretations emerging from the Ripple case.

- This case could significantly shape the future regulatory landscape of the cryptocurrency market.

3. Conclusion: Navigating the Ripple Settlement and the Future of XRP Classification

The Ripple settlement and the ongoing debate surrounding XRP’s classification as a security or a commodity underscore the complexities of regulating the cryptocurrency market. While the partial summary judgment offered some clarity, significant uncertainty remains. The arguments for and against commodity classification highlight the crucial role of decentralization, network effects, and the degree of control exerted by the issuer. The Ripple case’s impact extends far beyond XRP, influencing the regulatory approach to numerous digital assets and shaping the future of the crypto market. To fully understand the implications, it is imperative to follow the developments in the Ripple settlement and stay updated on XRP's classification. Learn more about the impact of commodity classification on cryptocurrencies and prepare for the evolving regulatory landscape.

Featured Posts

-

Cty Tam Hop Chien Thang Thuyet Phuc Truoc 6 Doi Thu Trong Goi Thau Cap Nuoc Gia Dinh

May 01, 2025

Cty Tam Hop Chien Thang Thuyet Phuc Truoc 6 Doi Thu Trong Goi Thau Cap Nuoc Gia Dinh

May 01, 2025 -

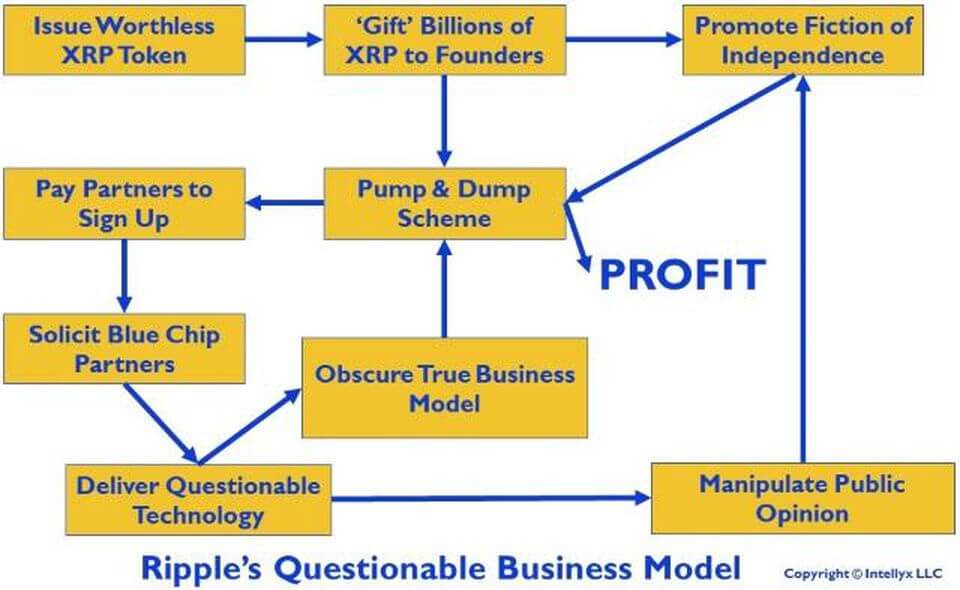

Chemicals In Household Plastics Potential Link To Higher Heart Disease Mortality Rates

May 01, 2025

Chemicals In Household Plastics Potential Link To Higher Heart Disease Mortality Rates

May 01, 2025 -

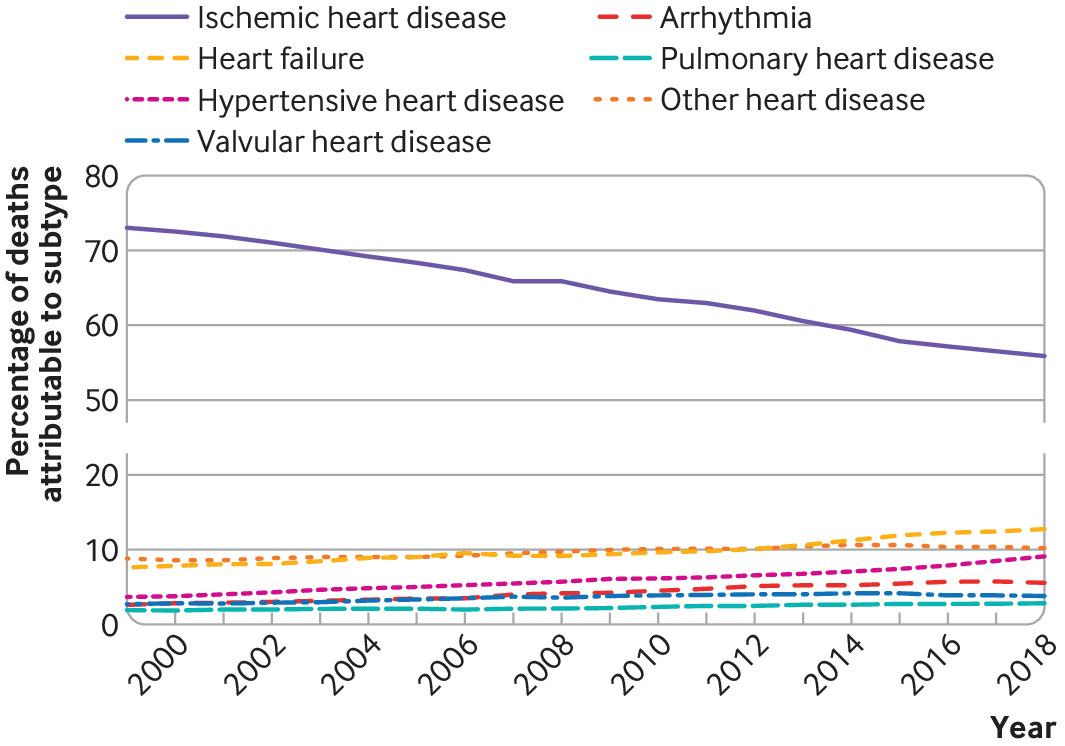

Priscilla Pointer Dies Dallas And Carrie Actress Passes Away

May 01, 2025

Priscilla Pointer Dies Dallas And Carrie Actress Passes Away

May 01, 2025 -

Cleveland Cavaliers Evaluating Week 16s Trade And Player Rest

May 01, 2025

Cleveland Cavaliers Evaluating Week 16s Trade And Player Rest

May 01, 2025 -

Lady Raiders Fall Short In 59 56 Home Loss To Cincinnati

May 01, 2025

Lady Raiders Fall Short In 59 56 Home Loss To Cincinnati

May 01, 2025