College Tuition And Student Loans: A Survey Exploring Parental Perspectives

Table of Contents

The Financial Burden of College Tuition

The sheer cost of college tuition is a major source of stress for many parents. Planning and saving for a child's higher education requires careful consideration of various factors and strategies.

Parental Savings and Investment Strategies

Many parents employ various strategies to save for their children's college education. These strategies often involve a mix of:

- 529 Plans: State-sponsored savings plans offering tax advantages for college savings.

- Educational Savings Accounts (ESAs): Tax-advantaged accounts allowing for investment growth specifically for educational expenses.

- Investment Portfolios: Diversified investments aiming for long-term growth to cover college costs.

- Budgeting Strategies: Careful financial planning and budgeting to allocate funds for college savings.

- Impact of Inflation: The crucial consideration of inflation's effect on college costs over time.

The effectiveness of these strategies varies greatly depending on factors like the starting savings amount, investment returns, and the ultimate cost of the chosen college. Statistics show that many parents struggle to accumulate sufficient funds, often falling short of the actual cost of tuition, fees, room, and board. For example, the average cost of a four-year public college education has been reported to exceed [Insert Statistic on Average Cost Here], while private colleges often cost significantly more. This financial gap often necessitates the use of student loans.

The Role of Student Loans in Parental Planning

Student loans often play a crucial role in financing higher education, but they come with associated risks and rewards. Parents frequently consider the following aspects:

- Parental Co-signing: The significant responsibility of co-signing loans, incurring personal liability for the debt.

- Understanding Loan Terms and Repayment Options: Navigating the complexities of loan terms, interest rates, and repayment plans.

- The Impact of Loan Debt on Family Finances: Assessing the long-term impact of student loan debt on family budgets and financial stability.

- Exploring Federal vs. Private Loans: Comparing the benefits and drawbacks of federal and private student loan options.

The average student loan debt for graduates continues to rise, creating long-term financial burdens. Understanding the different types of loans and their implications is vital for both students and parents to make informed decisions.

Parental Perceptions of the College Application Process

The college application and financial aid process is often viewed as a complex and stressful experience by parents.

Navigating the Application and Financial Aid Process

Parents face numerous challenges while navigating the application and financial aid process, including:

- Understanding FAFSA (Free Application for Federal Student Aid): Completing the FAFSA accurately and efficiently.

- Navigating Merit-Based vs. Need-Based Aid: Understanding the different types of financial aid and eligibility requirements.

- Dealing with College Admissions Officers: Effectively communicating with college admissions staff regarding financial aid.

- The Application Fee Burden: Managing the numerous application fees associated with applying to multiple colleges.

The sheer amount of paperwork, deadlines, and potential for errors can lead to significant stress and frustration for parents.

The Influence of College Rankings and Prestige

College rankings and prestige heavily influence parental decision-making, often leading to:

- The Impact of Perceived Value on Parental Choices: Parents often prioritize perceived value, sometimes at the expense of affordability.

- The Pressure to Attend Prestigious Universities: Societal pressure to attend high-ranking institutions can drive up the cost of college.

- The Financial Implications of Choosing High-Ranked Institutions: High-ranking colleges often come with significantly higher tuition fees.

The pursuit of prestige can create conflict between parental aspirations and financial realities, forcing families to make difficult choices.

The Impact of College Tuition and Student Loans on Family Wellbeing

The financial burden of college significantly impacts the emotional and mental wellbeing of families.

Stress and Anxiety Related to College Finances

Financing a college education can lead to:

- Financial Stress: The constant worry about managing college expenses and debt.

- Family Conflict: Disagreements about college choices and financial burdens can strain family relationships.

- Impact on Retirement Planning: Saving for retirement may be compromised due to significant college expenses.

- Mental Health Implications: Financial stress can negatively impact mental health and overall wellbeing.

Parents often report significant stress and anxiety related to college finances, affecting their overall quality of life.

Long-Term Financial Planning and Intergenerational Wealth

The cost of higher education has long-term implications for families, including:

- Saving for Retirement: Reduced retirement savings due to significant college expenses.

- Inheritance Planning: The impact of student loan debt on the ability to leave an inheritance.

- The Financial Legacy Left to Future Generations: The potential for intergenerational wealth transfer to be affected.

The long-term financial consequences of college tuition and student loans extend beyond the immediate cost, influencing family financial planning for years to come.

Conclusion

This survey reveals a complex interplay of financial anxieties, strategic planning, and emotional considerations surrounding college tuition and student loans from a parental perspective. The challenges are significant, emphasizing the need for increased transparency, streamlined financial aid processes, and potentially alternative funding models. Understanding these parental perspectives is critical for creating more accessible and affordable higher education opportunities. Learn more about managing the costs of college tuition and student loans and finding effective financial strategies by exploring resources dedicated to college planning and financial aid.

Featured Posts

-

Fountain City Classic Scholarship Interview Strategies For Success At Midday

May 17, 2025

Fountain City Classic Scholarship Interview Strategies For Success At Midday

May 17, 2025 -

Class Action Lawsuit Alleges Fortnites Epic Games Engaged In Deceptive Practices

May 17, 2025

Class Action Lawsuit Alleges Fortnites Epic Games Engaged In Deceptive Practices

May 17, 2025 -

Josh Harts Wife On Jaylen Browns Crucial Game 5 Moments

May 17, 2025

Josh Harts Wife On Jaylen Browns Crucial Game 5 Moments

May 17, 2025 -

Trump And Arab Leaders An Analysis Of Their Close Relationships

May 17, 2025

Trump And Arab Leaders An Analysis Of Their Close Relationships

May 17, 2025 -

Red Carpet Rule Breakers Understanding Guest Misconduct

May 17, 2025

Red Carpet Rule Breakers Understanding Guest Misconduct

May 17, 2025

Latest Posts

-

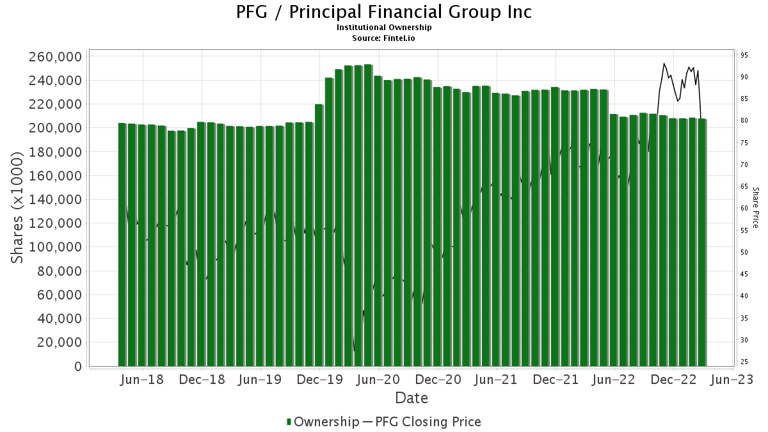

Principal Financial Group Pfg Stock 13 Analyst Ratings Analyzed

May 17, 2025

Principal Financial Group Pfg Stock 13 Analyst Ratings Analyzed

May 17, 2025 -

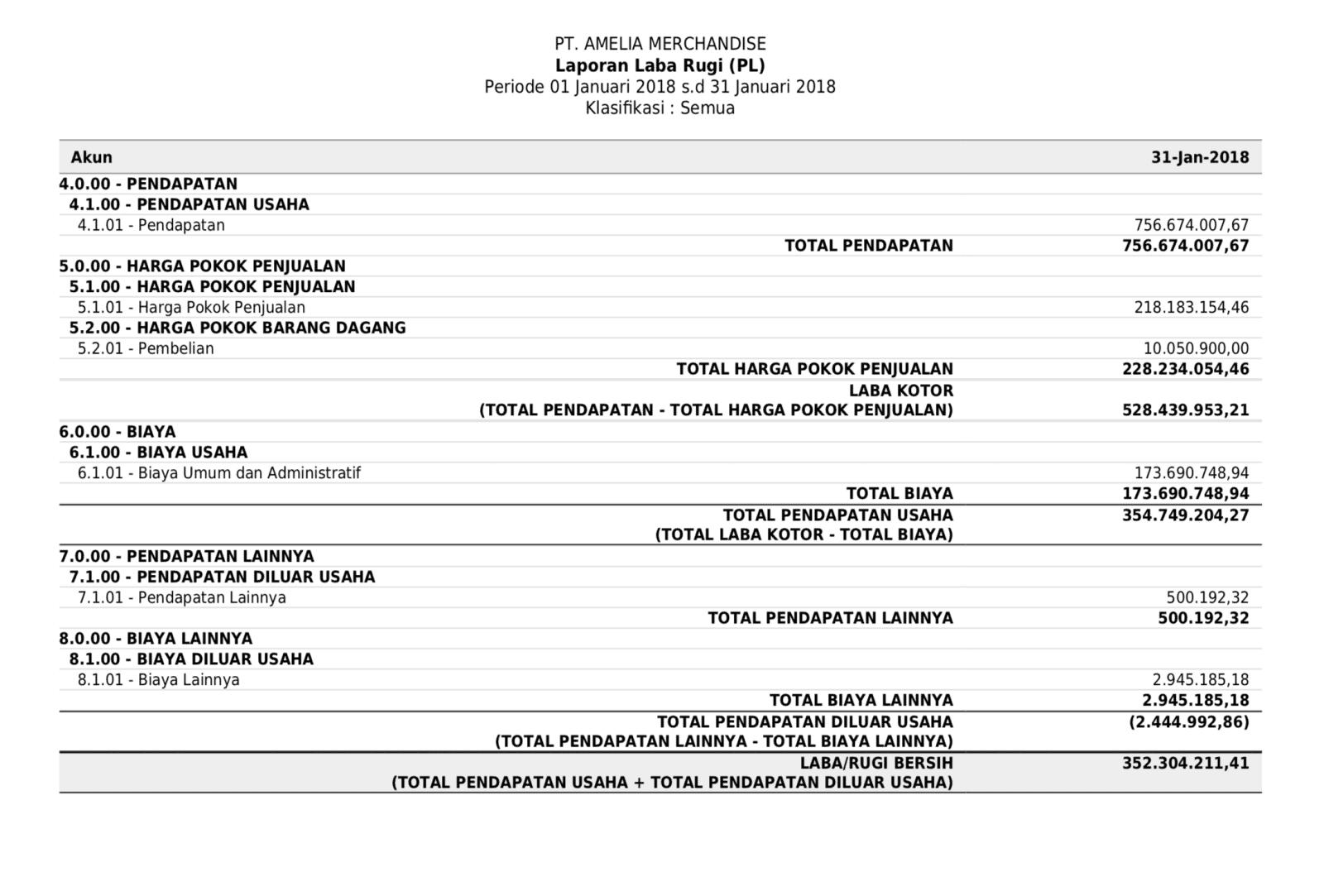

Laporan Keuangan Jenis Pentingnya Dan Aplikasinya Untuk Bisnis Anda

May 17, 2025

Laporan Keuangan Jenis Pentingnya Dan Aplikasinya Untuk Bisnis Anda

May 17, 2025 -

The Fifteenth Doctor And His New Companion Face Killer Cartoons In Doctor Who Season 2

May 17, 2025

The Fifteenth Doctor And His New Companion Face Killer Cartoons In Doctor Who Season 2

May 17, 2025 -

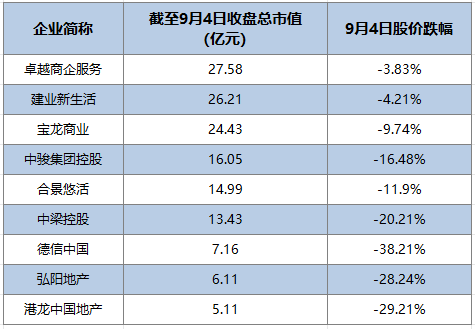

1 4 112

May 17, 2025

1 4 112

May 17, 2025 -

Doctor Who Season 2 Trailer The Fifteenth Doctors New Companion And Killer Cartoons

May 17, 2025

Doctor Who Season 2 Trailer The Fifteenth Doctors New Companion And Killer Cartoons

May 17, 2025