Principal Financial Group (PFG) Stock: 13 Analyst Ratings Analyzed

Table of Contents

Overview of Principal Financial Group (PFG)

Principal Financial Group (PFG) is a leading global financial services company offering a wide range of retirement, insurance, and asset management solutions. Their business model focuses on providing comprehensive financial planning and investment products to individuals and institutions. PFG holds a significant market position, competing with other large financial services providers for a share of the global market.

- Market Capitalization: (Insert Current Market Cap - Requires real-time data)

- Key Competitors: Companies like MetLife, Prudential Financial, and Ameriprise Financial are among PFG's main competitors in the financial services sector.

- Recent Financial Performance: (Insert recent financial highlights, such as revenue growth percentage and EPS - Requires real-time data). These figures should be sourced from reputable financial news sites or PFG's investor relations page.

Analyzing the 13 Analyst Ratings: A Breakdown

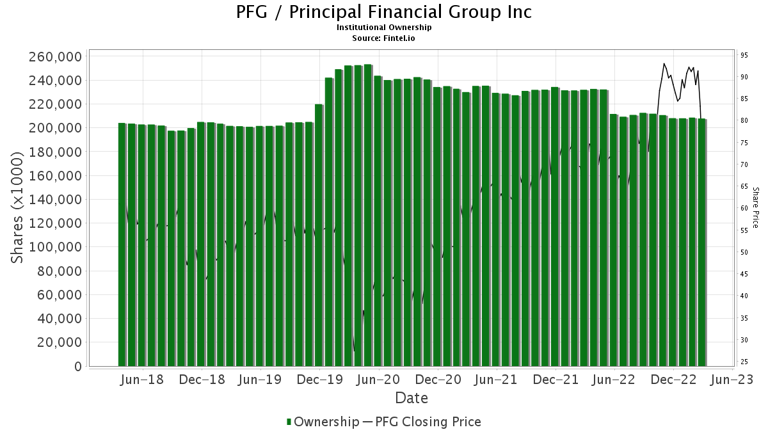

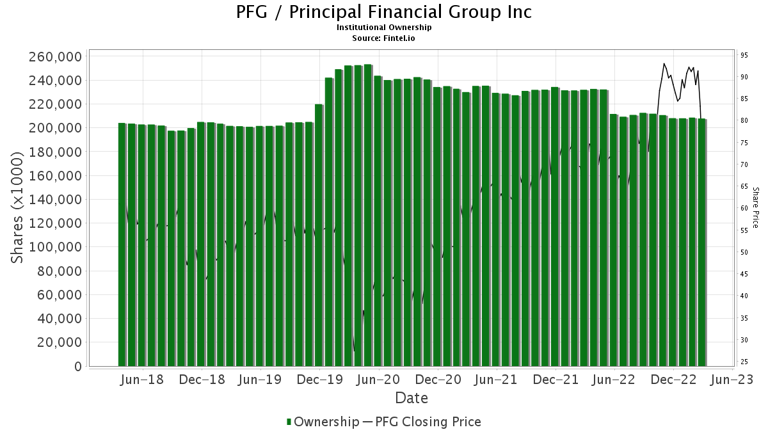

To gain a comprehensive understanding of current market sentiment towards PFG stock, we've analyzed 13 recent analyst ratings. These ratings are categorized as Buy, Hold, or Sell, providing a snapshot of analyst opinions. (Insert a visual representation here, such as a pie chart or bar graph showing the distribution of Buy, Hold, and Sell ratings. Source data from reliable financial news sources).

- Average Rating: (Calculate and state the average rating – e.g., a weighted average considering the number of each rating type). This average provides a summary measure of analyst sentiment towards PFG stock.

- Price Target Range: Analyst price targets for PFG stock range from (Insert lowest price target) to (Insert highest price target). This range reflects the diversity of opinions regarding the future price potential of PFG stock.

- Buy Ratings: (Number) analysts issued Buy ratings, citing (summarize reasons, e.g., strong growth prospects, attractive valuation, positive industry outlook).

- Hold Ratings: (Number) analysts recommended a Hold rating, primarily due to (summarize reasons, e.g., market uncertainty, moderate growth expectations, current valuation).

- Sell Ratings: (Number) analysts issued Sell ratings, expressing concerns regarding (summarize reasons, e.g., competitive pressures, regulatory headwinds, potential for lower-than-expected earnings).

- Significant Discrepancies: Any substantial differences in ratings and their justifications should be noted and discussed.

Key Factors Influencing Analyst Ratings of PFG Stock

Several macroeconomic, industry-specific, and company-specific factors influence analyst ratings of PFG stock. Understanding these factors is crucial for interpreting the ratings and making informed investment decisions.

- Macroeconomic Factors: Interest rate changes significantly impact PFG's profitability, as they affect investment returns and borrowing costs. Inflation and overall economic growth also influence consumer spending and demand for financial services.

- Industry-Specific Factors: Increased competition within the financial services sector and regulatory changes can significantly impact PFG’s operations and profitability. Changes in insurance regulations, for example, can affect the underwriting process and profitability of PFG's insurance products.

- Company Performance: PFG's recent earnings reports, dividend payouts, and strategic initiatives directly influence analyst assessments of its financial health and future prospects. A strong earnings report, for instance, would likely lead to more positive ratings.

- Dividend Policy: PFG's dividend policy and its attractiveness to income-seeking investors is another factor that contributes to analyst ratings. A consistent and growing dividend can attract investors.

Risks and Opportunities Associated with Investing in PFG Stock

Investing in PFG stock, like any investment, involves both risks and opportunities. A thorough understanding of these elements is essential for responsible investing.

- Potential Risks:

- Market Volatility: Overall market downturns can negatively impact the stock price of PFG, regardless of the company's performance.

- Competition: Intense competition from other financial services companies could pressure PFG's profitability and market share.

- Regulatory Risks: Changes in regulations could increase compliance costs and limit business opportunities for PFG.

- Potential Opportunities:

- Growth Prospects: PFG's expansion into new markets and development of innovative financial products offer potential growth opportunities.

- Dividend Yield: PFG's dividend yield can offer a steady income stream for investors.

- Market Share Gains: PFG could gain market share by strategically expanding its products and acquiring competitors.

- Long-Term Outlook: (Provide a balanced view, considering the factors above)

How to Interpret Analyst Ratings and Make Informed Decisions

While analyst ratings provide valuable insights, they are only one piece of the puzzle. It’s crucial to conduct thorough independent research before making any investment decisions.

- Steps Before Investing:

- Analyze PFG's financial statements (income statement, balance sheet, cash flow statement).

- Read PFG's investor presentations and SEC filings.

- Evaluate PFG's competitive landscape and industry outlook.

- Consider macroeconomic factors impacting the financial services industry.

- Research Resources: Use reputable financial news websites, PFG's investor relations page, and financial databases for in-depth research.

- Financial Advisor: Consulting a qualified financial advisor is highly recommended.

Conclusion

This analysis of 13 analyst ratings on Principal Financial Group (PFG) stock reveals a range of opinions, from Buy to Sell. While these ratings offer insights into market sentiment, independent research is crucial. Understanding the macroeconomic environment, industry trends, and PFG's specific performance is essential for making informed investment decisions regarding Principal Financial Group (PFG) stock. Remember to diversify your portfolio and consider consulting with a financial advisor before investing. Always invest responsibly.

Featured Posts

-

Tam Krwz Ks Ke Sath Rshth Myn Hyn

May 17, 2025

Tam Krwz Ks Ke Sath Rshth Myn Hyn

May 17, 2025 -

Exclusive Josh Alexander On Joining Aew His Relationship With Don Callis And Whats Next

May 17, 2025

Exclusive Josh Alexander On Joining Aew His Relationship With Don Callis And Whats Next

May 17, 2025 -

Jalen Brunson Out Knicks Lose To Lakers After Ot Injury

May 17, 2025

Jalen Brunson Out Knicks Lose To Lakers After Ot Injury

May 17, 2025 -

Palmeiras Vs Bolivar Cronica Del Partido 2 0

May 17, 2025

Palmeiras Vs Bolivar Cronica Del Partido 2 0

May 17, 2025 -

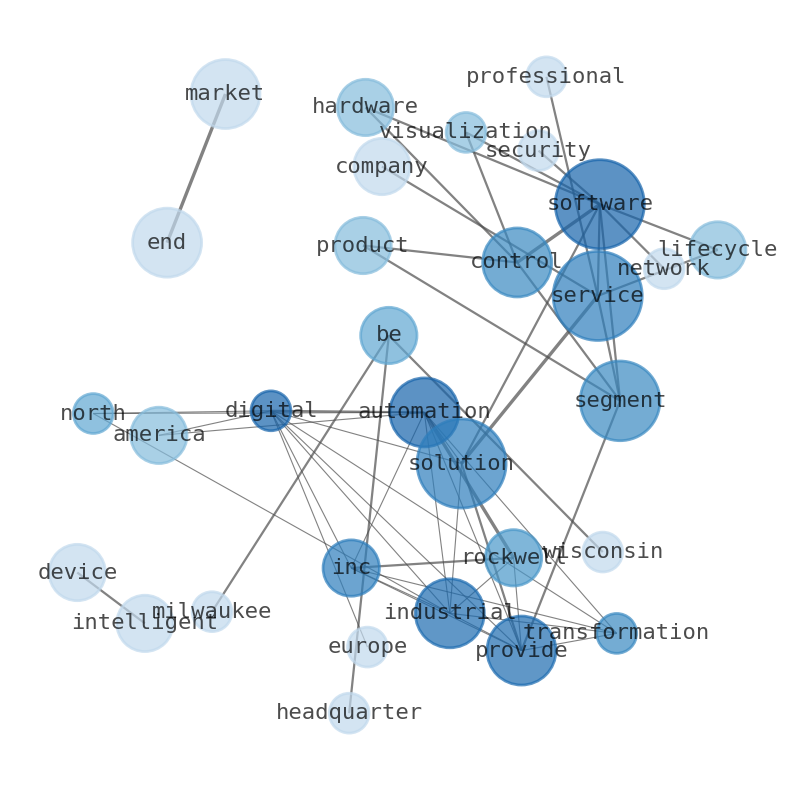

Rockwell Automations Strong Earnings Drive Market Gains

May 17, 2025

Rockwell Automations Strong Earnings Drive Market Gains

May 17, 2025

Latest Posts

-

Celtics Vs Pistons Game Prediction Can Boston Extend Winning Streak

May 17, 2025

Celtics Vs Pistons Game Prediction Can Boston Extend Winning Streak

May 17, 2025 -

Philadelphia 76ers Vs Boston Celtics Predicting The Winner

May 17, 2025

Philadelphia 76ers Vs Boston Celtics Predicting The Winner

May 17, 2025 -

Trump Family Tree Exploring The Extensive Family Of The Former Us President

May 17, 2025

Trump Family Tree Exploring The Extensive Family Of The Former Us President

May 17, 2025 -

Celtics Vs Pistons Prediction Will Boston Win Again In Detroit

May 17, 2025

Celtics Vs Pistons Prediction Will Boston Win Again In Detroit

May 17, 2025 -

Whats Preventing The Top 10 Nba Teams From Winning

May 17, 2025

Whats Preventing The Top 10 Nba Teams From Winning

May 17, 2025