Rockwell Automation's Strong Earnings Drive Market Gains

Table of Contents

Record-Breaking Revenue and Profitability Fuel Rockwell Automation's Success

Rockwell Automation's latest earnings report showcased exceptional financial performance, exceeding expectations across key metrics. This success stems from a combination of strong revenue growth across diverse segments and impressive improvements in profit margins.

Strong Revenue Growth Across Key Segments

The company reported significant revenue growth across its major sectors, demonstrating resilience and adaptability in a dynamic market.

- Specific revenue figures: (Insert actual figures from the earnings report, e.g., "Q3 revenue reached $2.1 billion, a 15% increase year-over-year.")

- Comparison to previous quarters/years: (Insert comparative data, e.g., "This represents a significant jump from Q2's $1.8 billion and surpasses analysts' predictions by 5%.")

- Contribution of specific product lines/services: (Mention specific examples, e.g., "The strong performance was driven in part by increased demand for their intelligent motor control solutions and integrated automation platforms in the automotive and food and beverage sectors.") This could mention growth in specific sectors like automotive, food and beverage, pharmaceuticals, etc., and quantify their contributions to overall growth.

Improved Profit Margins and Operational Efficiency

Rockwell Automation's improved profit margins highlight enhanced operational efficiency and effective cost management.

- Cost-cutting measures: (Detail specific cost-saving initiatives, e.g., "Streamlined supply chain operations resulted in significant cost reductions.")

- Supply chain management improvements: (Explain how improved supply chain management contributed to profitability, e.g., "The company successfully mitigated supply chain disruptions through proactive sourcing strategies and strategic partnerships.")

- Increased efficiency in manufacturing processes: (Illustrate how manufacturing efficiency played a part, e.g., "Implementation of lean manufacturing principles led to a 10% increase in production efficiency.")

Positive Outlook for Future Growth

Rockwell Automation's positive financial performance provides a strong foundation for continued growth.

- Expected market demand: (Discuss anticipated demand in key sectors, e.g., "The ongoing trend of automation adoption across various industries, particularly in response to labor shortages and the need for increased production efficiency, ensures strong market demand.")

- New product launches/strategic initiatives: (Mention any new products or initiatives, e.g., "The recent launch of their new industrial IoT platform is expected to drive further growth in the coming quarters.")

- Potential for acquisitions/partnerships: (Discuss any potential acquisitions or partnerships, e.g., "Rockwell Automation's strategic focus on acquisitions and partnerships will further expand their market reach and technological capabilities.")

Investor Confidence and Stock Market Reaction to Rockwell Automation's Earnings

The strong earnings report significantly boosted investor confidence in Rockwell Automation, leading to a positive market response.

Positive Market Response

The immediate market reaction to the earnings announcement was overwhelmingly positive, reflecting investor enthusiasm for the company's future prospects.

- Stock price fluctuations: (Report percentage change in stock price, e.g., "The company's stock price surged by 8% following the release of the earnings report.")

- Analyst ratings and upgrades: (Mention any upgrades in analyst ratings, e.g., "Several leading financial analysts upgraded their ratings on Rockwell Automation's stock, citing strong financial performance and positive future growth prospects.")

- Investor commentary/news articles: (Reference any relevant investor commentary or news articles, providing links where possible, e.g., "Several major financial news outlets lauded Rockwell Automation's performance, highlighting its robust revenue growth and improved profit margins.")

Long-Term Implications for Investors

The strong earnings provide a compelling case for long-term investment in Rockwell Automation.

- Potential for future dividend increases: (Discuss the possibility of future dividend increases, e.g., "The company's robust profitability strengthens the likelihood of future dividend increases, offering attractive returns to investors.")

- Long-term growth prospects: (Analyze the company's long-term growth potential, e.g., "Rockwell Automation's strategic initiatives and strong market position position the company for sustained long-term growth.")

- Comparison to competitor performance/market trends: (Compare Rockwell Automation's performance to its competitors and broader market trends, e.g., "Rockwell Automation's outperformance compared to its main competitors underscores its strong competitive advantage and market leadership.")

Industry Implications: Rockwell Automation's Success Reflects Broader Trends in Industrial Automation

Rockwell Automation's exceptional performance is indicative of broader positive trends within the industrial automation sector.

Increased Demand for Automation Solutions

The increasing demand for automation solutions reflects several critical factors shaping the modern industrial landscape.

- Impact of Industry 4.0 initiatives: (Explain how Industry 4.0 initiatives are driving demand, e.g., "The adoption of Industry 4.0 technologies and digital transformation initiatives is fueling significant demand for advanced automation solutions.")

- Growth of specific automation technologies (e.g., robotics, AI): (Detail the growth of specific technologies, e.g., "The rising adoption of robotics, artificial intelligence, and machine learning in manufacturing processes is driving significant growth in the industrial automation market.")

- Government regulations/incentives: (Mention any relevant government regulations or incentives, e.g., "Government initiatives aimed at promoting automation and digitalization are further stimulating demand for automation solutions.")

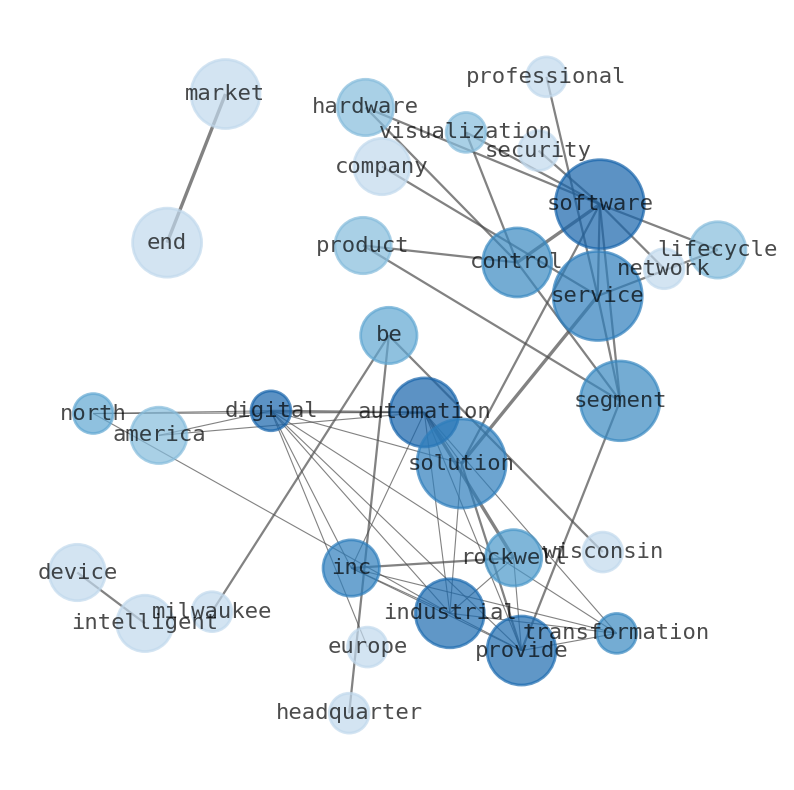

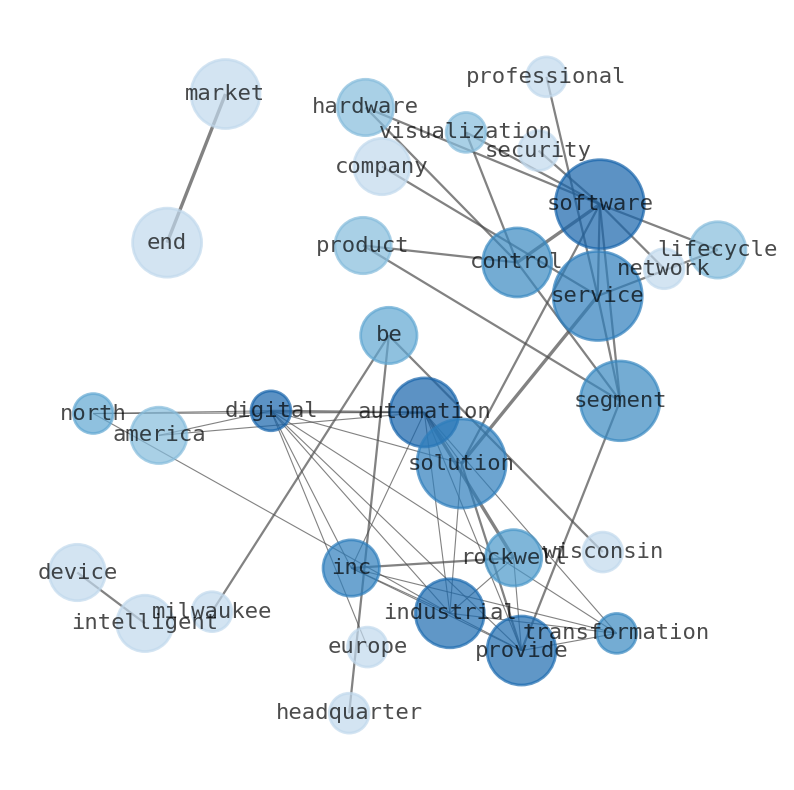

Rockwell Automation's Competitive Advantage

Rockwell Automation's success stems from its strong competitive advantage in the industrial automation market.

- Key technological advantages: (Highlight Rockwell Automation's technological strengths, e.g., "Rockwell Automation's technological leadership, particularly in the areas of industrial control systems and industrial IoT, provides a significant competitive advantage.")

- Strong customer relationships: (Explain the importance of their customer relationships, e.g., "The company's strong customer relationships and extensive service network provide a robust foundation for continued growth.")

- Effective marketing/sales strategies: (Mention their marketing effectiveness, e.g., "Rockwell Automation's effective marketing and sales strategies ensure strong market penetration and customer acquisition.")

Conclusion

Rockwell Automation's strong Q[Quarter] earnings, characterized by record revenue, significantly improved profitability, and a positive market response, signal a promising future for both the company and the broader industrial automation sector. The company's success underscores the increasing demand for automation solutions and its strong competitive position within the market. This strong performance offers significant implications for investors seeking exposure to the growing industrial automation market.

Call to Action: Stay informed about Rockwell Automation's continued success and the future of industrial automation by visiting their investor relations page [insert link] and exploring industry analysis reports on the latest trends in industrial automation. Investing in the future of industrial automation means understanding key players like Rockwell Automation.

Featured Posts

-

The Studio Seth Rogen Breaks His Own Rotten Tomatoes Record

May 17, 2025

The Studio Seth Rogen Breaks His Own Rotten Tomatoes Record

May 17, 2025 -

Fortnite Cowboy Bebop Bundle Faye Valentine And Spike Spiegel Skin Price Revealed

May 17, 2025

Fortnite Cowboy Bebop Bundle Faye Valentine And Spike Spiegel Skin Price Revealed

May 17, 2025 -

City To Rename Itself In Honor Of Paige Bueckers Wnba Debut

May 17, 2025

City To Rename Itself In Honor Of Paige Bueckers Wnba Debut

May 17, 2025 -

Donald Trumps Expanding Family Welcome To Alexander Boulos

May 17, 2025

Donald Trumps Expanding Family Welcome To Alexander Boulos

May 17, 2025 -

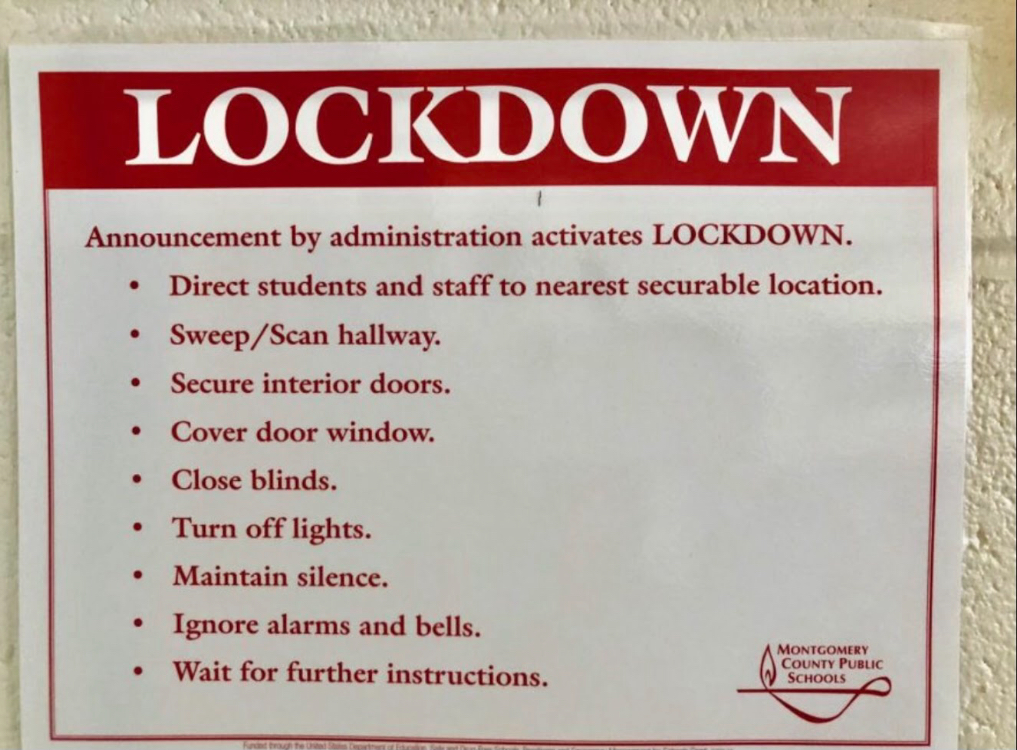

The Evolution Of Lockdown Protocols In Florida Schools A Generational Perspective

May 17, 2025

The Evolution Of Lockdown Protocols In Florida Schools A Generational Perspective

May 17, 2025

Latest Posts

-

Cdiscount Trottinette Electrique A Petit Prix Moins De 200 E

May 17, 2025

Cdiscount Trottinette Electrique A Petit Prix Moins De 200 E

May 17, 2025 -

Trottinette Electrique A Moins De 200 E Disponible Des Maintenant Sur Cdiscount

May 17, 2025

Trottinette Electrique A Moins De 200 E Disponible Des Maintenant Sur Cdiscount

May 17, 2025 -

50 000 Ultraviolette Tesseract

May 17, 2025

50 000 Ultraviolette Tesseract

May 17, 2025 -

Ultraviolette Tesseract 50 000

May 17, 2025

Ultraviolette Tesseract 50 000

May 17, 2025 -

Ultraviolette F77 50 000

May 17, 2025

Ultraviolette F77 50 000

May 17, 2025