Pound Climbs On Inflation Data: Reduced Expectations For BOE Interest Rate Cuts

Table of Contents

Inflation Data and its Impact on the Pound

The latest UK inflation figures revealed a Consumer Price Index (CPI) of [Insert actual CPI figure here] and a Retail Price Index (RPI) of [Insert actual RPI figure here]. These numbers came in lower than most market analysts had predicted, surprising many who anticipated higher inflation figures. This unexpected drop in inflation significantly altered investor sentiment, leading to a renewed confidence in the Pound Sterling. The market reacted positively to the lower-than-expected inflation, interpreting it as a sign of cooling price pressures.

- Specific inflation figures: CPI: [Insert actual CPI figure here], RPI: [Insert actual RPI figure here].

- Comparison with previous months/years: [Compare the current figures to previous months and years, highlighting the change and its significance].

- Impact on consumer spending and business confidence: Lower inflation generally boosts consumer spending power, leading to increased demand and potentially improved business confidence. Conversely, high inflation can erode purchasing power and decrease economic activity.

These positive signals, reflected in the lower inflation rates, directly impacted the currency exchange market, leading to the Pound's climb against other major currencies. The reduced inflationary pressures significantly contributed to the strengthening of the Pound Sterling.

Reduced Expectations for BOE Interest Rate Cuts

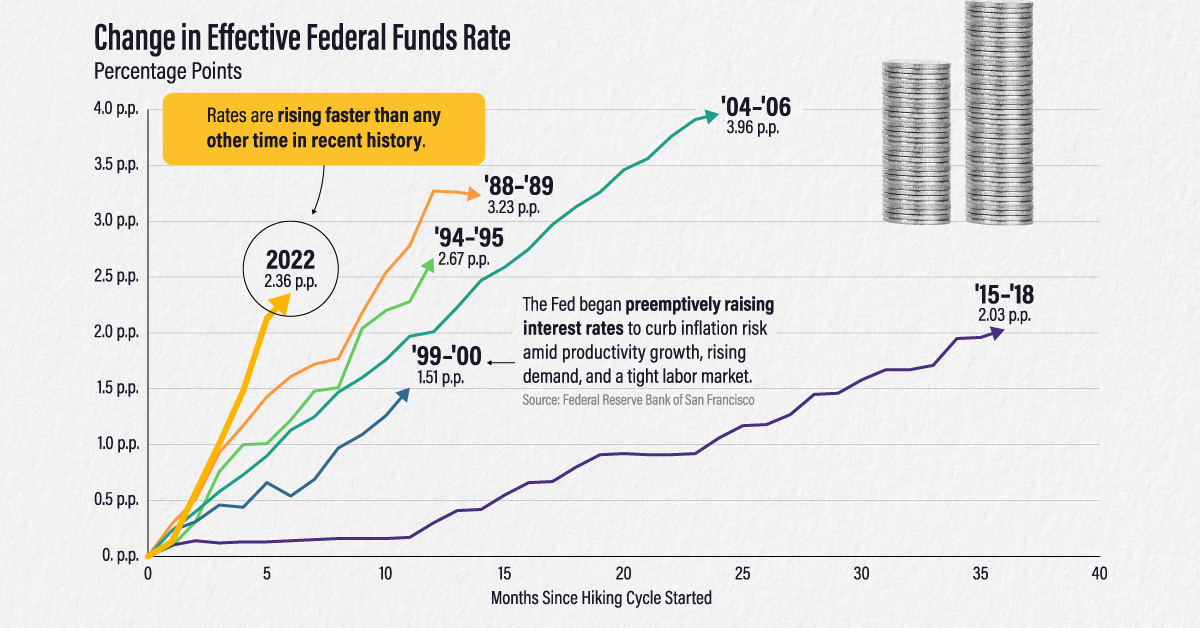

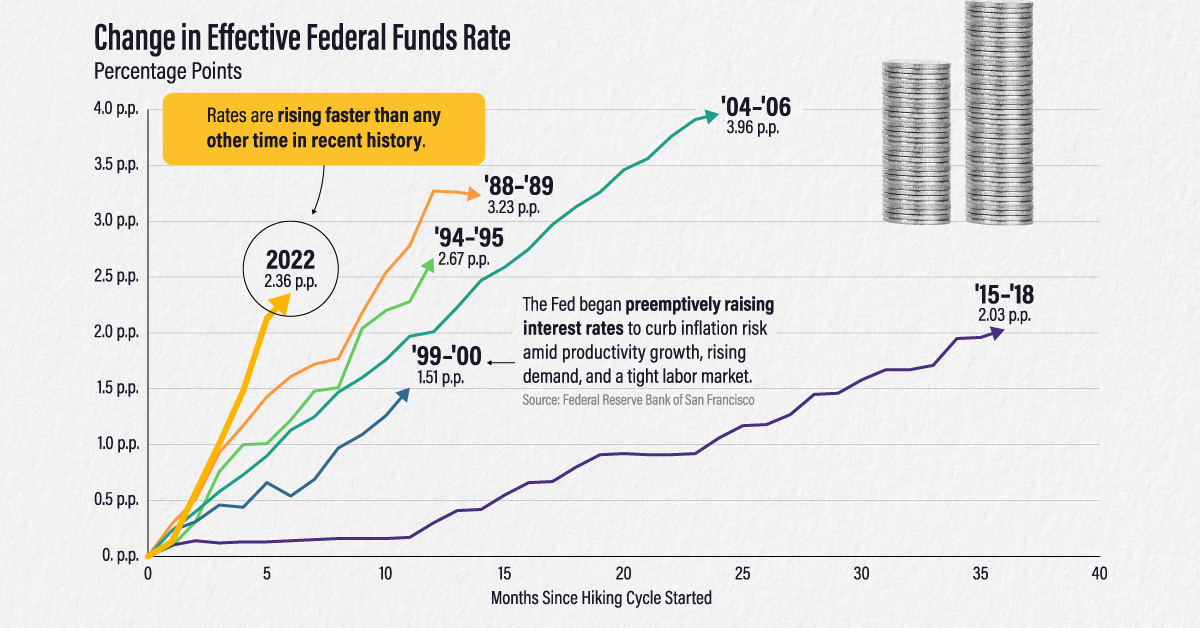

Lower-than-anticipated inflation significantly reduces the pressure on the Bank of England to implement further interest rate cuts. The BOE's primary mandate is to maintain price stability, and with inflation cooling, the urgency for rate reductions diminishes. Maintaining or even slightly increasing interest rates now becomes a more plausible scenario.

The BOE's recent statements [cite specific sources and quotes] hint at a more cautious approach to future monetary policy. This cautious stance, in light of the improved inflation figures, directly supports the Pound's appreciation.

- Current BOE base rate: [Insert current BOE base rate].

- Market predictions for future rate changes: [Summarize market predictions, citing sources, about future rate changes].

- Potential economic consequences of different BOE actions: [Discuss the potential consequences of different BOE actions (e.g., rate cuts, rate hikes, maintaining the status quo) on the UK economy].

The prospect of the BOE holding or slightly increasing interest rates has boosted investor confidence and further fueled the Pound's climb. This contrasts sharply with predictions of quantitative easing or further rate cuts just weeks ago.

Impact on GBP/USD and other Currency Pairs

Following the release of the inflation data, the Pound experienced significant appreciation against major currencies. The GBP/USD exchange rate [Insert current GBP/USD exchange rate and mention recent fluctuations], reflecting the increased demand for the Pound. Similarly, the GBP/EUR exchange rate [Insert current GBP/EUR exchange rate and mention recent fluctuations], indicating a strengthening Pound against the Euro.

- GBP/USD exchange rate fluctuations: [Detail recent GBP/USD fluctuations and explain the reasons behind these changes].

- GBP/EUR exchange rate fluctuations: [Detail recent GBP/EUR fluctuations and explain the reasons behind these changes].

- Impact on import/export costs: A stronger Pound makes imports cheaper for UK consumers but can make UK exports more expensive in international markets.

These fluctuations in currency exchange rates have significant implications for UK businesses engaged in international trade, impacting import and export costs and profitability.

Potential Risks and Uncertainties

While the current situation is positive for the Pound, several factors could reverse its recent gains. Geopolitical risks, a potential global economic slowdown, and unexpected surges in inflation remain significant uncertainties.

- Geopolitical risks: [Discuss potential geopolitical risks that could impact the Pound, such as Brexit-related uncertainties or global conflicts].

- Global economic slowdown: [Discuss the possibility of a global economic slowdown and its potential impact on the UK economy and the Pound].

- Unexpected changes in inflation: A sudden resurgence in inflation could quickly undermine the current positive outlook and pressure the BOE to act.

These uncertainties highlight the dynamic nature of the forex market and the need for continuous monitoring of economic indicators.

Conclusion

The Pound's climb is undeniably linked to lower-than-expected inflation data, significantly reducing the anticipated need for BOE interest rate cuts. This "Pound's climb" is a direct result of market confidence in the UK's economic outlook. The impact of this "Pound Sterling appreciation" on various sectors of the UK economy and the international markets cannot be understated.

To stay ahead of future movements in the Pound, it's crucial to stay informed about upcoming economic data releases and BOE announcements. Further reading on BOE monetary policy and UK economic forecasts will provide a deeper understanding of this dynamic situation. Understanding the "Pound Climbs on Inflation Data" phenomenon is paramount for investors and businesses alike, influencing investment strategies and international trade decisions.

Featured Posts

-

Roc Agel La Residencia Privada De La Familia Grimaldi

May 26, 2025

Roc Agel La Residencia Privada De La Familia Grimaldi

May 26, 2025 -

A Look At Jenson And The Fw 22 Extended Version

May 26, 2025

A Look At Jenson And The Fw 22 Extended Version

May 26, 2025 -

San Franciscos Anchor Brewing Company Closes Its Doors After 127 Years

May 26, 2025

San Franciscos Anchor Brewing Company Closes Its Doors After 127 Years

May 26, 2025 -

Alcaraz And Sabalenka Triumph In Rome Italian Open Strong Start

May 26, 2025

Alcaraz And Sabalenka Triumph In Rome Italian Open Strong Start

May 26, 2025 -

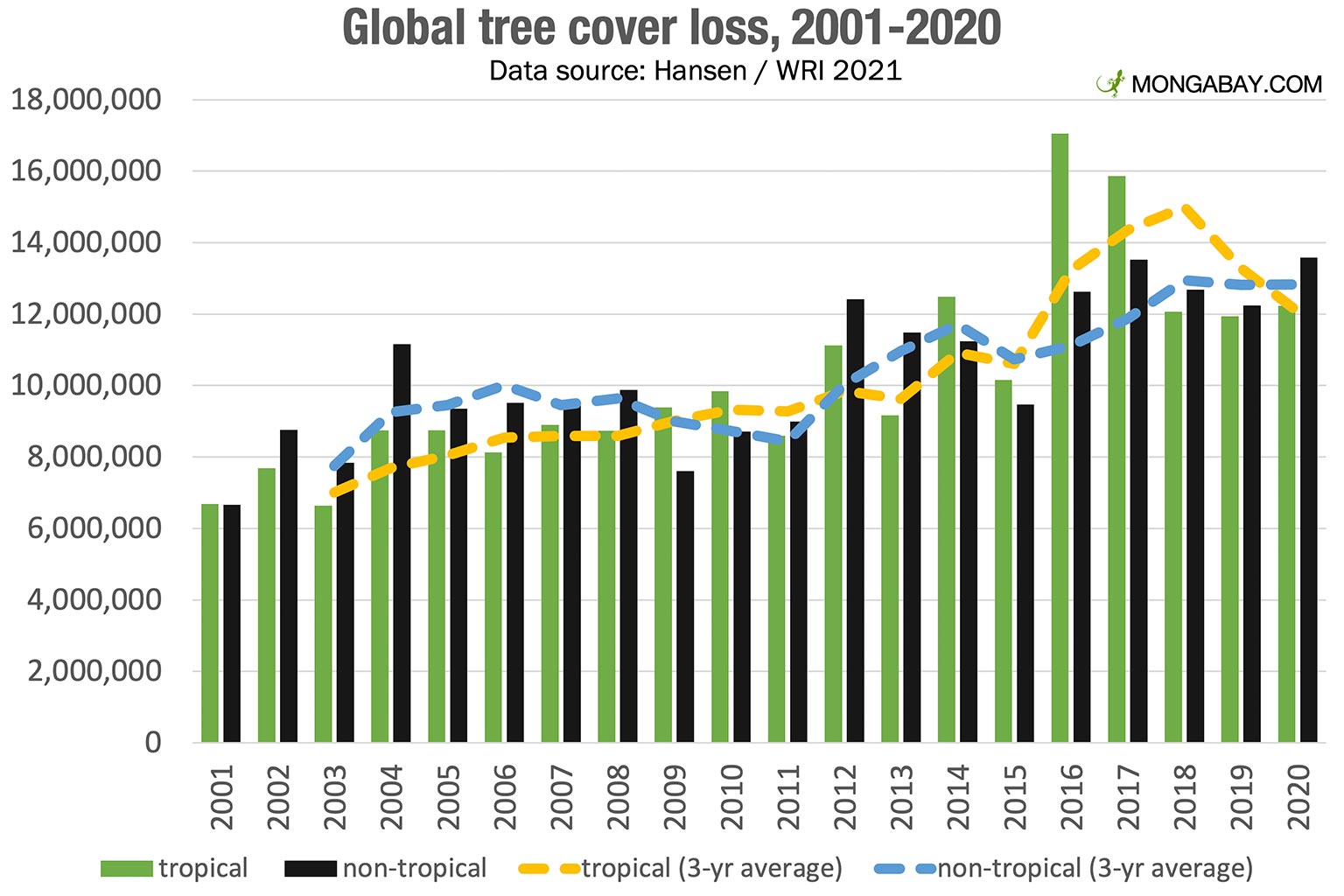

Wildfires Drive Unprecedented Global Forest Loss A Record Year

May 26, 2025

Wildfires Drive Unprecedented Global Forest Loss A Record Year

May 26, 2025